15++ Customer declaration for zero rated vat info

Home » money laundering idea » 15++ Customer declaration for zero rated vat infoYour Customer declaration for zero rated vat images are available in this site. Customer declaration for zero rated vat are a topic that is being searched for and liked by netizens now. You can Find and Download the Customer declaration for zero rated vat files here. Download all free vectors.

If you’re looking for customer declaration for zero rated vat pictures information connected with to the customer declaration for zero rated vat keyword, you have come to the right site. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Customer Declaration For Zero Rated Vat. A tax invoice need not be issued for zero-rated exempt and deemed supplies or to non-GST registered customer. If you need further guidance phone the VAT Disabled. Separate rules apply to goods that are moved through EU countries to other EU countries. Use this customer declaration form VAT1615A to claim VAT relief on adapted motor vehicles for disabled wheelchair or stretcher users charities and eligible bodies.

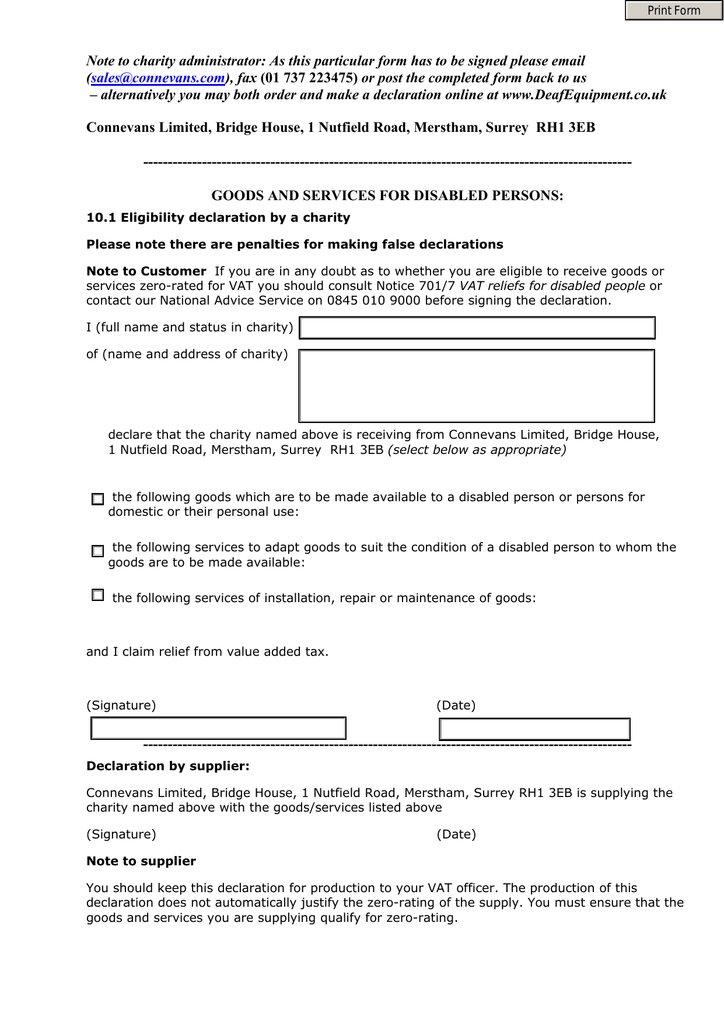

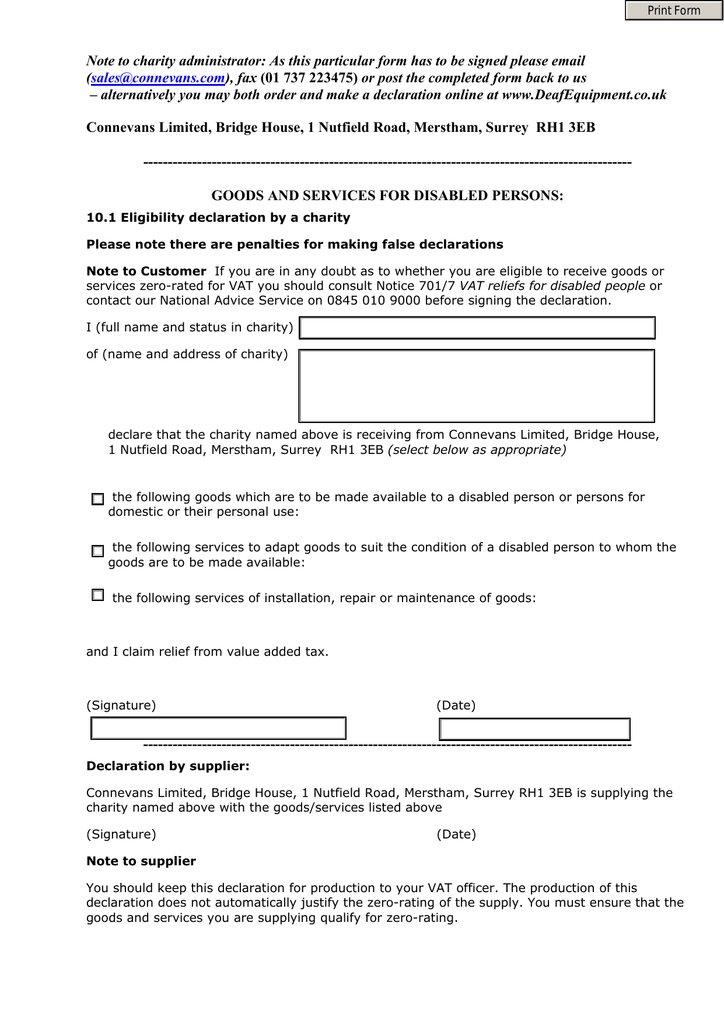

Vat Declaration Form For A Charity Manualzz From manualzz.com

Vat Declaration Form For A Charity Manualzz From manualzz.com

If your sale is zero-rated your invoice should include the customers VAT number. Find out more about importing goods and services and VAT. Zero rate of VAT on ICS of goods. HM Revenue Customs. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records. Any VAT -registered person whose sales are zero-rated or effectively zero-rated may within two 2 years after the close of the taxable quarter when the sales were made apply for the issuance of a tax credit certificate or refund of creditable input tax due or paid attributable to such sales except transitional input tax to the extent that such input tax has not been applied against output tax Emphasis supplied.

Find out more about importing goods and services and VAT.

Separate rules apply to goods that are moved through EU countries to other EU countries. Declare sales on your VAT return and complete an. HM Revenue Customs. The zero rate of Value-Added Tax VAT can apply to the ICS if the following conditions are met. The gross sales figure is included in the FRS calculations. The rules for zero-rating contained in these publications cover designated commercial exit ports documentation time periods for removing the movable goods from South Africa and time periods within which the supporting documentation must be obtained.

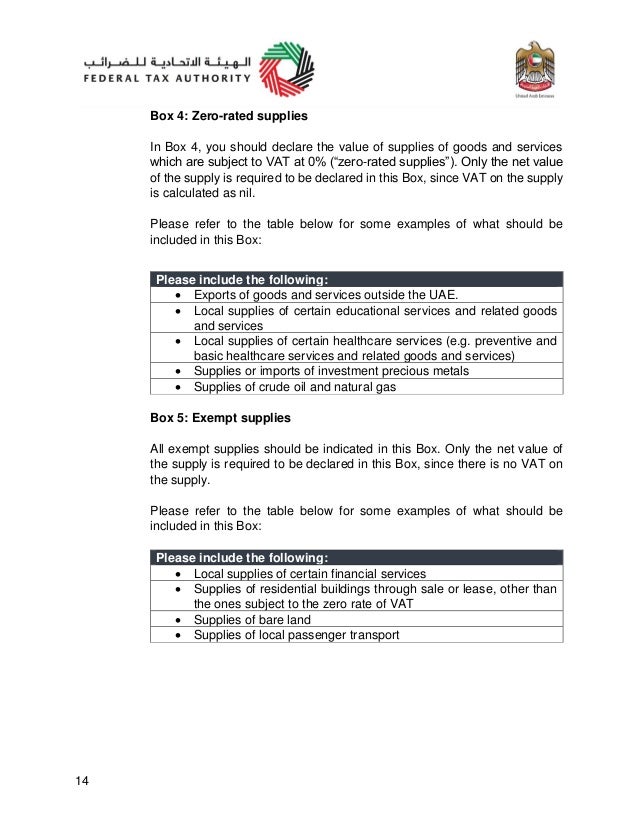

Source: docplayer.net

Source: docplayer.net

Goods exported to a customer outside the EU can also be zero-rated for VAT even if they initially travel through other EU countries. The payment of the VAT liability declared in the VAT 215 and VAT 216 records must be made on eFiling by the following persons. HM Revenue Customs. Entrust Your VAT Compliance to The Highly Qualified Specialists. This reduces the price of a good.

Source: tax-handbook.rra.gov.rw

Source: tax-handbook.rra.gov.rw

HM Revenue Customs. A tax invoice need not be issued for zero-rated exempt and deemed supplies or to non-GST registered customer. Adapted motor vehicles for disabled people and charities. Entrust Your VAT Compliance to The Highly Qualified Specialists. Declare sales on your VAT return and complete an.

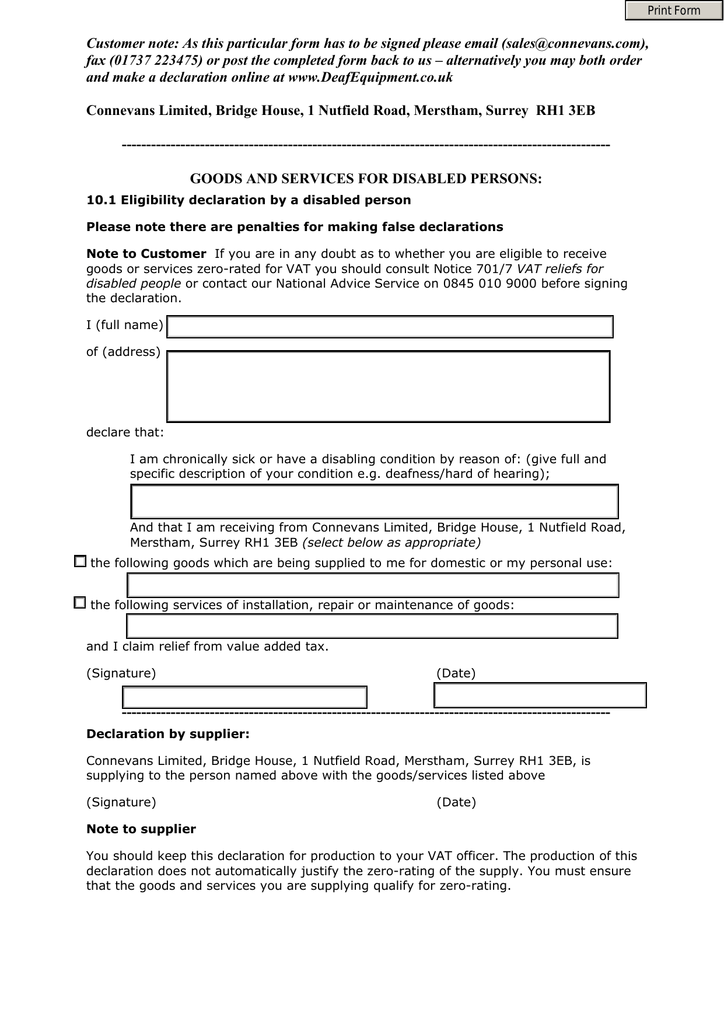

Source: cdn-customsclearance.co.uk

Source: cdn-customsclearance.co.uk

Ad Global VAT Declaration Services on One and Totally Free Platform - Register Now. The Customs Intermediarys immediate customer in this case is the UK based Freight Forwarder so their services are within the scope of UK VAT. This reduces the price of a good. You should also keep proof of goods leaving the UK. Any VAT -registered person whose sales are zero-rated or effectively zero-rated may within two 2 years after the close of the taxable quarter when the sales were made apply for the issuance of a tax credit certificate or refund of creditable input tax due or paid attributable to such sales except transitional input tax to the extent that such input tax has not been applied against output tax Emphasis supplied.

Source: bizindo.com

Source: bizindo.com

A tax invoice need not be issued for zero-rated exempt and deemed supplies or to non-GST registered customer. This reduces the price of a good. Zero-rated sales are included in the FRS turnover figure so this creates an unwelcome VAT liability for scheme users. Entrust Your VAT Compliance to The Highly Qualified Specialists. Paragraph 41 of the Notice states that the supply of transportation or related services connected with an import into or an export from the UK is zero-rated.

Source:

Governments commonly lower the tax burden on low-income households by zero rating essential goods such as food and utilities or. Zero rate of VAT on ICS of goods. 2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT. Ad Global VAT Declaration Services on One and Totally Free Platform - Register Now. You should also keep proof of goods leaving the UK.

Source: slideshare.net

Source: slideshare.net

When payment has been made to you you must issue a serially printed receipt to the payer if a tax invoice or simplified tax invoice has not been issued by you. A tax invoice need not be issued for zero-rated exempt and deemed supplies or to non-GST registered customer. HM Revenue Customs. In the case of the VAT 215 record the recipient where the recipient is not a registered vendor of. Countries designate products as zero-rated because they are leading contributors to other manufactured goods and a.

Source: manualzz.com

Source: manualzz.com

From 1 January 2021 these sales will be zero-rated for UK VAT purposes export of goods and subject to VAT and import duty when they arrive in the destination country. If you need further guidance phone the VAT Disabled. The payment of the VAT liability declared in the VAT 215 and VAT 216 records must be made on eFiling by the following persons. In the case of the VAT 215 record the recipient where the recipient is not a registered vendor of. This reduces the price of a good.

Source:

From 1 January 2021 these sales will be zero-rated for UK VAT purposes export of goods and subject to VAT and import duty when they arrive in the destination country. When payment has been made to you you must issue a serially printed receipt to the payer if a tax invoice or simplified tax invoice has not been issued by you. The zero rate of Value-Added Tax VAT can apply to the ICS if the following conditions are met. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records. Separate rules apply to goods that are moved through EU countries to other EU countries.

Source: manualzz.com

Source: manualzz.com

You must obtain and retain the customers VAT registration number including country prefix you must quote your VAT. Zero-rated goods are products that are exempt from value-added taxation VAT. Use this customer declaration form VAT1615A to claim VAT relief on adapted motor vehicles for disabled wheelchair or stretcher users charities and eligible bodies. You must obtain and retain the customers VAT registration number including country prefix you must quote your VAT. Countries designate products as zero-rated because they are leading contributors to other manufactured goods and a.

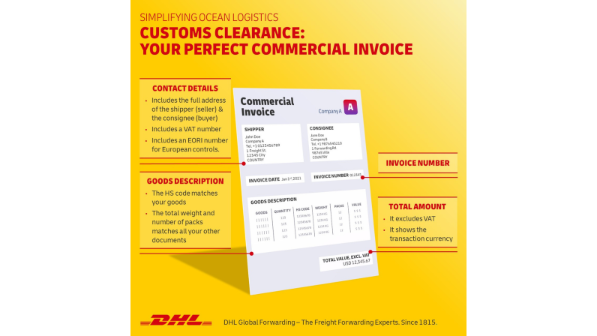

Source: dhl.com

Source: dhl.com

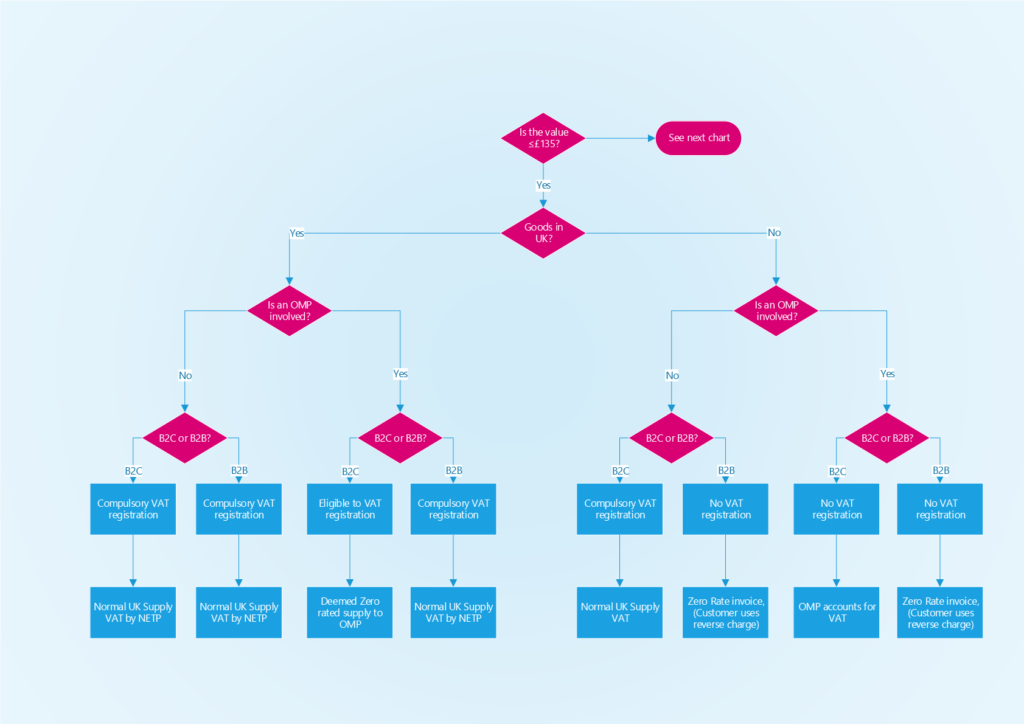

Then complete the standard checkout process purchasing the product with zero rated VAT. Almost all countries apply preferential rates to some goods and services making them either zero rated or exempt For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. Zero-rated goods are products that are exempt from value-added taxation VAT. Zero rate of VAT on ICS of goods. Then complete a standard declaration form with their details which is then sent to me for record tax purposes 3.

Source: accountsco.it

Source: accountsco.it

Declare sales on your VAT return and complete an. Then complete a standard declaration form with their details which is then sent to me for record tax purposes 3. Use this customer declaration form VAT1615A to claim VAT relief on adapted motor vehicles for disabled wheelchair or stretcher users charities and eligible bodies. The rules for zero-rating contained in these publications cover designated commercial exit ports documentation time periods for removing the movable goods from South Africa and time periods within which the supporting documentation must be obtained. From 1 January 2021 these sales will be zero-rated for UK VAT purposes export of goods and subject to VAT and import duty when they arrive in the destination country.

Source:

2550M and of the Quarterly VAT Return on or before the 25th day following the end of the taxable quarter using BIR Form No. The Customs Intermediarys immediate customer in this case is the UK based Freight Forwarder so their services are within the scope of UK VAT. Provide the customer with a VAT invoice and keep copies of these invoices. We Are Ready to Help. See the updated Guide for completing the Value Added Tax VAT201 Declaration.

Source: docs.microsoft.com

Source: docs.microsoft.com

The place of an intra-Community supply ICS of goods is the place where the transport begins. Then complete a standard declaration form with their details which is then sent to me for record tax purposes 3. Tick a box saying they are eligible for zero rated VAT relief on the product which removes the 20 VAT from the price 2. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records. 2550M and of the Quarterly VAT Return on or before the 25th day following the end of the taxable quarter using BIR Form No.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer declaration for zero rated vat by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information