18+ Customer declaration on turnover for fy 2020 21 ideas

Home » money laundering Info » 18+ Customer declaration on turnover for fy 2020 21 ideasYour Customer declaration on turnover for fy 2020 21 images are available in this site. Customer declaration on turnover for fy 2020 21 are a topic that is being searched for and liked by netizens now. You can Get the Customer declaration on turnover for fy 2020 21 files here. Get all royalty-free images.

If you’re looking for customer declaration on turnover for fy 2020 21 images information connected with to the customer declaration on turnover for fy 2020 21 keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Customer Declaration On Turnover For Fy 2020 21. The Financial Year end is round the corner. We Confirm that provisions of Section is on our from NTPC exceeding RS50 during FY 2021-22. If you are an employee of a company at the beginning of every financial year or while joining the company you have to submit Income Tax Declaration to your employer. Here is to confirm that Annual Audited Turnover of Ms.

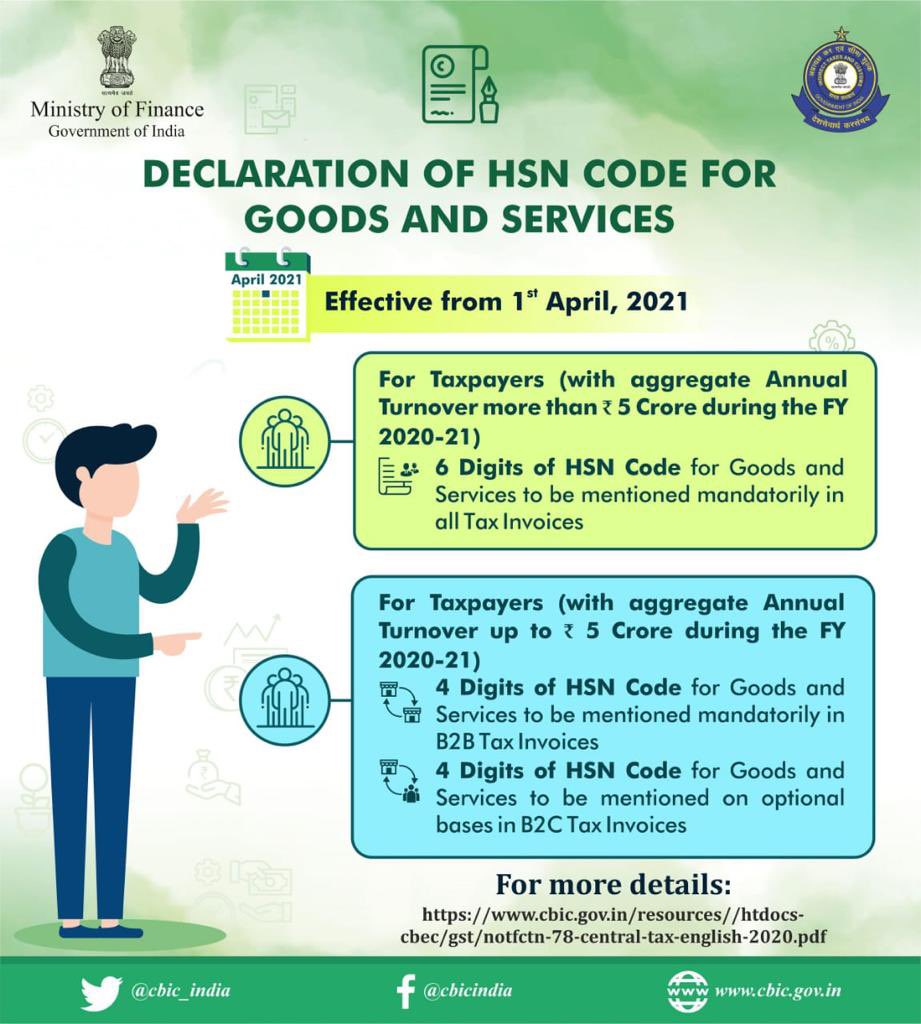

Below is the TDS rate for FY 2020-21. We name of buyer having PAN PAN of buyer hereby inform you that our total salesgross receiptsturnover from Business during FY 2020-21 has been more than Rs10 Crore. Annual charges in 2020-21. The Finance Act 2020 says All individuals HUF will be liable to deduct TDS if the turnover had cross Rs. If AGM is held on 31122020 if AGM is held before 31122020 then AGM 30 days. Here is the Sample format of the Customer Declaration for Section 194Q.

Your turnover for April 2020 to April 2021 is down by 20 compared to 2019 to 2020.

You may send to us your declaration in the enclosed draft on or before 20062021 to enable us to take note of the same and modify our accounting software accordingly. The sponsor must still make a final declaration of 0 turnover for the entry during the declaration period between 1 July and 22 July 2021. The Financial Year end is round the corner. A declaration of 0 turnover was made for the entry between 1 July and 22 July. Whether the above legal entitys total sales gross receipts or turnover from the business exceeded Rs10 crore during FY 2020-21. We Confirm that provisions of Section is on our from NTPC exceeding RS50 during FY 2021-22.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

These amendments shall take effect from 1 st April 2020. We Confirm that provisions of Section is on our from NTPC exceeding RS50 during FY 2021-22. Below is the TDS rate for FY 2020-21. For the 2020-21 fiscal. Your turnover for April 2020 to April 2021 is down by 20 compared to 2019 to 2020.

1 Crore in case of business and Rs. 50 Cr then you will be required to do TDS for FY 2021-21 not from the month in which turnover exceed Rs. We name of buyer having PAN PAN of buyer hereby inform you that our total salesgross receiptsturnover from Business during FY 2020-21 has been more than Rs10 Crore. Youll get the lower grant amount which is worth 30 of 3 months average trading profits because your. An existing entry was qualified to be exempt under the ACE scheme in 2020-21 if the entry was eligible for ACE in 2019-20.

Source: myloancare.in

Source: myloancare.in

In the below chart applicable from 14th May 2020. Deducting the applicable 01 under Section 1940 While remitting to the Of NTPC Limited. Therefore Iwe would be deducting Tax Deduction at Source TDS as per the Income Tax Act. Your turnover for April 2020 to April 2021 is down by 20 compared to 2019 to 2020. If your turnover for FY 2020-21 exceeds Rs.

Below is the TDS rate for FY 2020-21. The sales gross receipts turnover of the FY 2020-21 would be relevant in determining the applicability in the FY 2021-22. Ie Details of contributions received from employees for various funds as referred to in section 361va Most commonly reported funds under the clause are EPF and ESIC. Ltd the artist-first content creator and talent management firm has announced that its youngest vertical the four-year-old Global Creator Network GCN has clocked a turnover of over INR 100 cr. The PAN and TAN of the above legal entity.

TDS applicability would be required to be examined every year on the basis of turnover of preceding previous year. We Confirm that provisions of Section is on our from NTPC exceeding RS50 during FY 2021-22. Seller should obtain declaration information from their customer whether the customers turnover exceeds Rs 10 crore in the immediately preceding year check Turnover of FY 20-21 for applicability in FY 2021-22 a If the turnover of Customer does not exceed the said threshold limit of 10 crore the seller will be under obligation to collect tax at source on receipts in excess of Rs 50 Lakh. You may send to us your declaration in the enclosed draft on or before 20062021 to enable us to take note of the same and modify our accounting software accordingly. This is a provisional statement that has details about your proposed investments and expenses that are Income Tax.

TaxIndiaClub having PAN XXXXX 3040 X exceeds Rs. The Finance Act 2020 says All individuals HUF will be liable to deduct TDS if the turnover had cross Rs. In the below chart applicable from 14th May 2020. TaxIndiaClub having PAN XXXXX 3040 X exceeds Rs. We name of buyer having PAN PAN of buyer hereby inform you that our total salesgross receiptsturnover from Business during FY 2020-21 has been more than Rs10 Crore.

Source: alstom.com

Source: alstom.com

You will not be required to do TDS in the FY 2020-21 as your turnover in the FY 2019-20 was below Rs. Seller should obtain declaration information from their customer whether the customers turnover exceeds Rs 10 crore in the immediately preceding year check Turnover of FY 20-21 for applicability in FY 2021-22 a If the turnover of Customer does not exceed the said threshold limit of 10 crore the seller will be under obligation to collect tax at source on receipts in excess of Rs 50 Lakh. Is to that business during the FY 2020-21. TaxIndiaClub having PAN XXXXX 3040 X exceeds Rs. 50 Cr then you will be required to do TDS for FY 2021-21 not from the month in which turnover exceed Rs.

Source: twitter.com

Source: twitter.com

Particulars Current due date Extended due date Remarks Income tax 1 Filing of Income Tax Return for FY 2018-19 31 March 2020 30 June 2020 Both original and revised return 2 Declaration and payment under Vivad se. In case your declaration is not received by us by the above date we will modify our software to deduct tax at the rate of 5 percent and it would be difficult for us to take corrective action to reduce the rate during the. Your turnover for April 2020 to April 2021 is down by 20 compared to 2019 to 2020. This is a provisional statement that has details about your proposed investments and expenses that are Income Tax. The sales gross receipts turnover of the FY 2020-21 would be relevant in determining the applicability in the FY 2021-22.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

The Finance Act 2020 says All individuals HUF will be liable to deduct TDS if the turnover had cross Rs. 50 Cr then you will be required to do TDS for FY 2021-21 not from the month in which turnover exceed Rs. Query If the turnover in FY 2019-20 was more than Rs. The sales gross receipts turnover of the FY 2020-21 would be relevant in determining the applicability in the FY 2021-22. Whether the above legal entitys total sales gross receipts or turnover from the business exceeded Rs10 crore during FY 2020-21.

Source:

10 crore during Financial Year 2020-21 and liableto deduct TDS us 194Q of Income Tax Act 1961 applicable from 01072021. Relying on our declaration. Therefore Iwe would be deducting Tax Deduction at Source TDS as per the Income Tax Act. 50 Lakhs in case of profession in previous year. TDS applicability would be required to be examined every year on the basis of turnover of preceding previous year.

Source:

Seller should obtain declaration information from their customer whether the customers turnover exceeds Rs 10 crore in the immediately preceding year check Turnover of FY 20-21 for applicability in FY 2021-22 a If the turnover of Customer does not exceed the said threshold limit of 10 crore the seller will be under obligation to collect tax at source on receipts in excess of Rs 50 Lakh. If your turnover for FY 2020-21 exceeds Rs. Tax Compliances in January 2021 Important due. 50 Cr then you will be required to do TDS for FY 2021-21 not from the month in which turnover exceed Rs. WE quality purpose of Section Of the Act.

Source: a2ztaxcorp.com

Source: a2ztaxcorp.com

Here is to confirm that Annual Audited Turnover of Ms. The PAN and TAN of the above legal entity. Is to that business during the FY 2020-21. Our aggregate turnover exceeds INR 10 Crore for FY 2020-21 hence we are covered within the ambit of Section 194Q of the Income Tax Act 1961 effective from July 1 2021. In case your declaration is not received by us by the above date we will modify our software to deduct tax at the rate of 5 percent and it would be difficult for us to take corrective action to reduce the rate during the.

Source:

You may send to us your declaration in the enclosed draft on or before 20062021 to enable us to take note of the same and modify our accounting software accordingly. 10 crore during Financial Year 2020-21 and liableto deduct TDS us 194Q of Income Tax Act 1961 applicable from 01072021. The Finance Act 2020 says All individuals HUF will be liable to deduct TDS if the turnover had cross Rs. Here is to confirm that Annual Audited Turnover of Ms. If AGM is held on 31122020 if AGM is held before 31122020 then AGM 15 days.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer declaration on turnover for fy 2020 21 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas