20+ Customer risk rating aids in determining ideas in 2021

Home » money laundering Info » 20+ Customer risk rating aids in determining ideas in 2021Your Customer risk rating aids in determining images are ready in this website. Customer risk rating aids in determining are a topic that is being searched for and liked by netizens now. You can Get the Customer risk rating aids in determining files here. Download all royalty-free photos and vectors.

If you’re looking for customer risk rating aids in determining images information related to the customer risk rating aids in determining topic, you have come to the right blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and find more informative video content and images that match your interests.

Customer Risk Rating Aids In Determining. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. If the risk rating is high that client will be consistently and closely monitored. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. The number to be allocated is set out in the table below.

5s Radar Chart Radar Chart Lean Six Sigma Change Management From pinterest.com

5s Radar Chart Radar Chart Lean Six Sigma Change Management From pinterest.com

A risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield. This is the common pattern of risk across businesses. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. Garvey 2 provides an extensive set of rating scales for making these multicriteria assessments as well as ways to combine them into an overall measure of impact or consequence.

This report illustrates a businesss ability to pay invoices based on its payment history and public records.

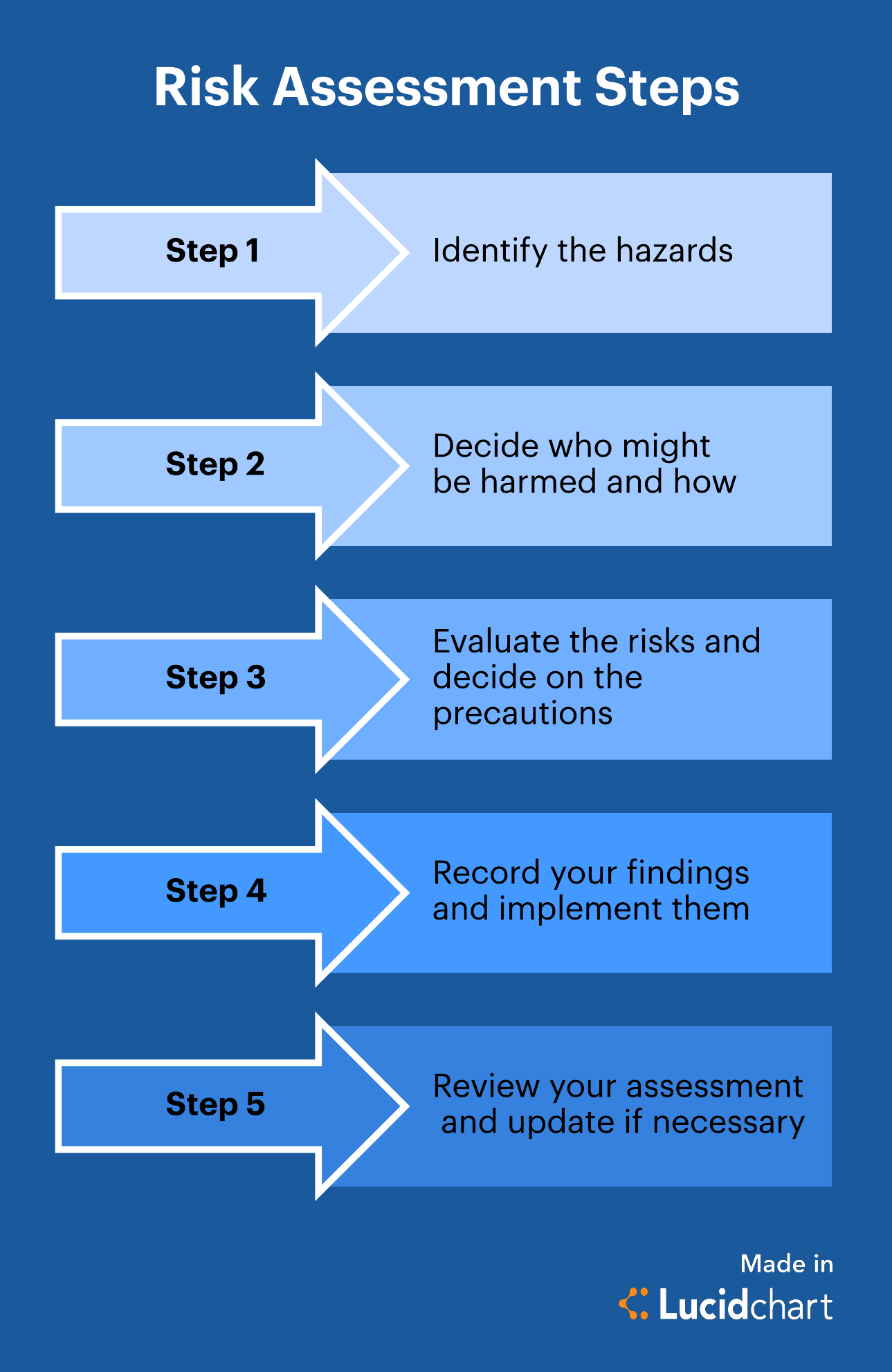

Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. Most organizations define scales for rating risks in terms of impact likelihood and other dimensions. Determining Risk and the Risk Pyramid. These scales provide a consistent basis for determining risk impact levels across cost schedule performance and other criteria considered important to the project. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. Categories of Risk Rating.

Source: researchgate.net

Source: researchgate.net

A low rated event is one with little no impact on the business activities and the reputation of the firm. A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any safety measures called Control Measures that you already have in place to reduce the hazard and any safety measure which you say you will put into place. Based on the customers risk score the KYC system determines the next review date. If the risk rating is high that client will be consistently and closely monitored. Determining Risk and the Risk Pyramid.

Source: pinterest.com

Source: pinterest.com

The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. Garvey 2 provides an extensive set of rating scales for making these multicriteria assessments as well as ways to combine them into an overall measure of impact or consequence. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Source: scholarsofficial.com

Source: scholarsofficial.com

The number to be allocated is set out in the table below. If the risk rating is low the client. These scales provide a consistent basis for determining risk impact levels across cost schedule performance and other criteria considered important to the project. Garvey 2 provides an extensive set of rating scales for making these multicriteria assessments as well as ways to combine them into an overall measure of impact or consequence. These scales comprise rating levels and definitions that foster consistent interpretation and application by different constituencies.

Source: lucidchart.com

Source: lucidchart.com

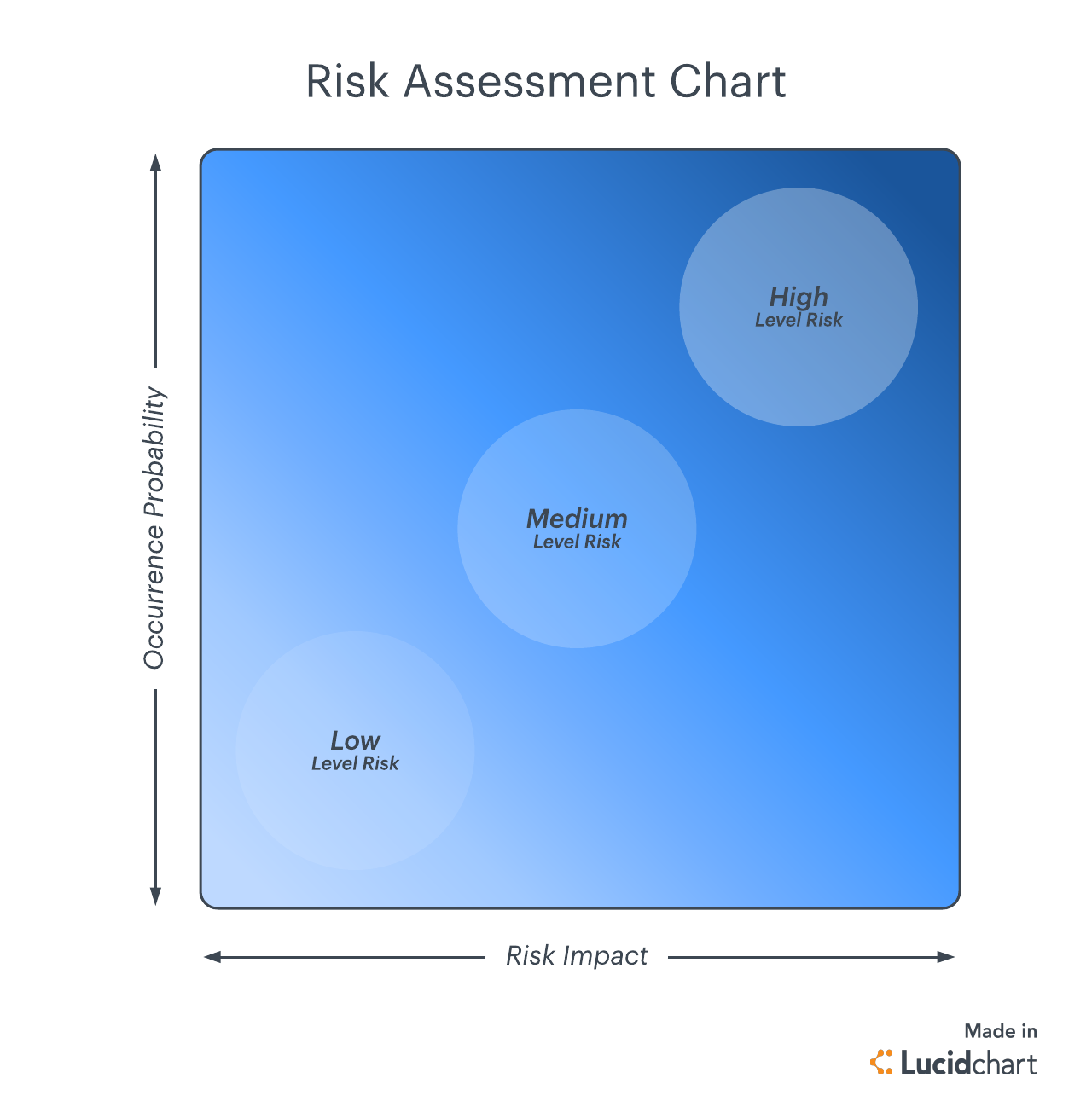

Risk Rating RR Probability of Occurrence OV x Severity of Consequences Value CV As the formula indicates the higher the assessed probability of occurrence and severity of. Risk is rated on the impact on the business which can be economic or reputational and its likelihood of occurring in the near future. Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. The scorecard is then used to forecast retention probabilities from which a risk-adjusted customer lifetime value is calculated.

Source: researchgate.net

Source: researchgate.net

What are the risk factors that are considered in determining the customer risk rating. Most organizations also conduct internal audit risk assessments to aid in the development of the internal audit plan. To determine a customers overall risk rating a. If the risk rating is low the client. Risk Rating RR Probability of Occurrence OV x Severity of Consequences Value CV As the formula indicates the higher the assessed probability of occurrence and severity of.

Source: lucidchart.com

Source: lucidchart.com

A risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Risk assessment process is focused on the identification of bet the company risks those that could impact the organizations ability to achieve its strategic objectives. Risk Rating RR Probability of Occurrence OV x Severity of Consequences Value CV As the formula indicates the higher the assessed probability of occurrence and severity of. Determining Risk and the Risk Pyramid.

Source: pinterest.com

Source: pinterest.com

The risk tolerance of the organization what products are used what data is available and the weighting of each risk factor are just some of the variables that need to be considered to determine whether the overall aggregate score is considered high- medium- or low- risk. What are the risk factors that are considered in determining the customer risk rating. Risk Rating RR Probability of Occurrence OV x Severity of Consequences Value CV As the formula indicates the higher the assessed probability of occurrence and severity of. If the risk rating is low the client. The more descriptive the scales the more consistent their.

Source:

We develop a customer relationship scorecard which proves an innovative tool for managers to use in determining the risks in their customer relationships and developing risk mitigation strategies. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Further a spectrum of risks may be identifiable even within the same category of customers. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. Most organizations also conduct internal audit risk assessments to aid in the development of the internal audit plan.

Source: qualityassurancemag.com

Source: qualityassurancemag.com

Further a spectrum of risks may be identifiable even within the same category of customers. Garvey 2 provides an extensive set of rating scales for making these multicriteria assessments as well as ways to combine them into an overall measure of impact or consequence. A risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any.

If the risk rating is high that client will be consistently and closely monitored. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. A risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield. Determining Risk and the Risk Pyramid. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any.

Source: pinterest.com

Source: pinterest.com

A risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield. Impact of Risk Rating. Commonly referred to as the customer risk rating. If the risk rating is low the client. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk.

Source: pinterest.com

Source: pinterest.com

These scales provide a consistent basis for determining risk impact levels across cost schedule performance and other criteria considered important to the project. The more descriptive the scales the more consistent their. Most organizations define scales for rating risks in terms of impact likelihood and other dimensions. We develop a customer relationship scorecard which proves an innovative tool for managers to use in determining the risks in their customer relationships and developing risk mitigation strategies. Another useful way to determine the creditworthiness of a customer is with a business credit report to get their credit rating.

Source: johnsonlambert.com

Source: johnsonlambert.com

FACEBOOK TWITTER LINKEDIN By. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. To determine a customers overall risk rating a. Determining Risk and the Risk Pyramid. A risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer risk rating aids in determining by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas