16++ Customer risk rating categories info

Home » money laundering Info » 16++ Customer risk rating categories infoYour Customer risk rating categories images are ready. Customer risk rating categories are a topic that is being searched for and liked by netizens now. You can Get the Customer risk rating categories files here. Find and Download all royalty-free photos.

If you’re looking for customer risk rating categories images information linked to the customer risk rating categories keyword, you have come to the right blog. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Customer Risk Rating Categories. Classification of the customers is done under three risk categories viz. Include a system of risk ratings or categories of. Orange is high risk. What types of customers pose a risk.

Risk Analysis Templates 15 Free Printable Word Excel Pdf Examples Risk Analysis Free Word Document Project Risk Management From hu.pinterest.com

Risk Analysis Templates 15 Free Printable Word Excel Pdf Examples Risk Analysis Free Word Document Project Risk Management From hu.pinterest.com

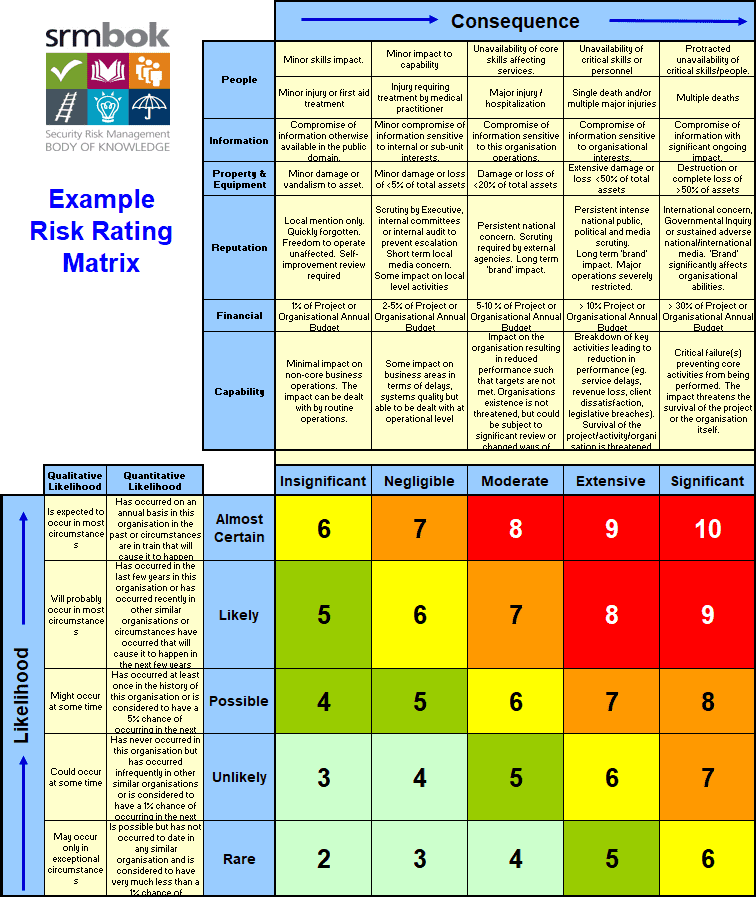

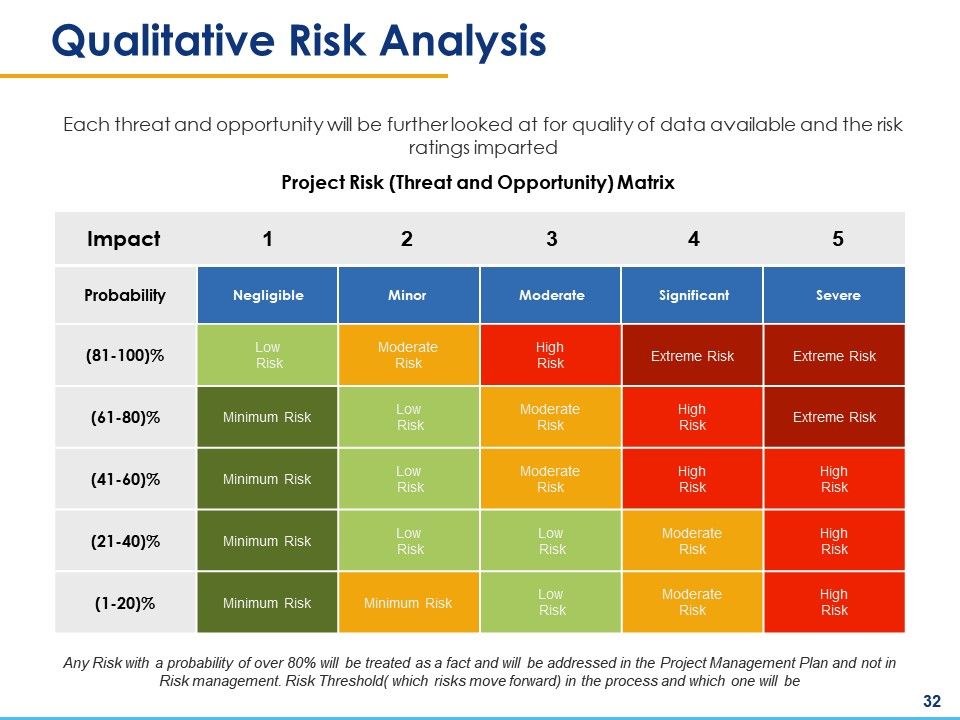

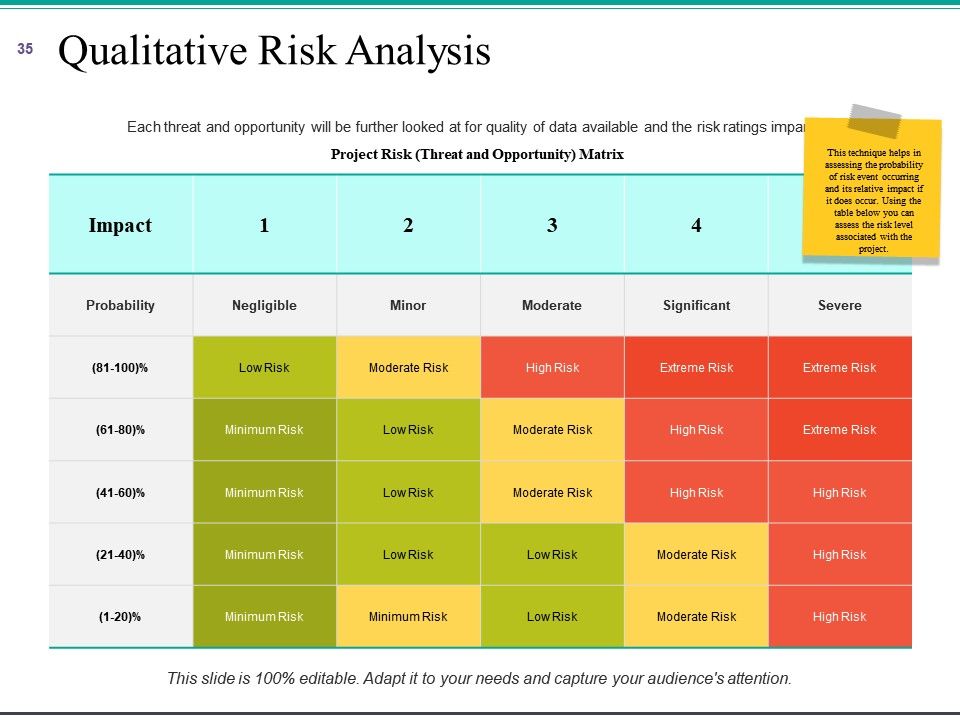

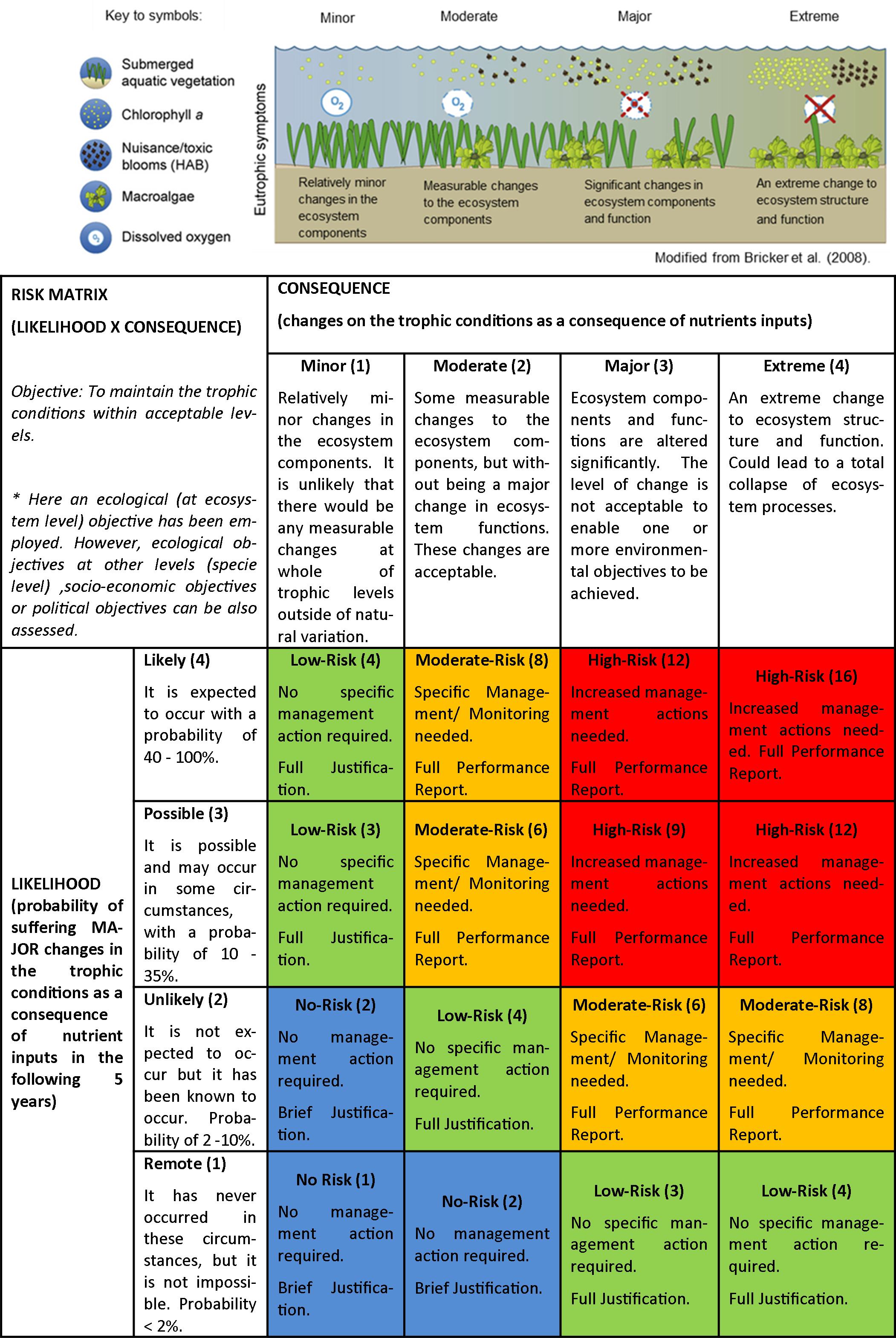

Risk category is ICT as the root cause of the risk is ICTsystems related and needs to be controlled and treated as an ICT systems issue. Product Service and Transaction Risk. Most commonly used risk classifications include strategic financial. Every risk assessment matrix has two axes. Financial Security Management and Environmental. Be easily identified and transactions in whose accounts by and large conform to the.

The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score.

Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. 1Adapted from the VMIA Guide to developing a Risk. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Orange is high risk.

Source: in.pinterest.com

Source: in.pinterest.com

Most commonly used risk classifications include strategic financial. For these purposes customer information. Functions of a Credit Risk Rating System. Include a system of risk ratings or categories of customers. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers.

Source: pinterest.com

Source: pinterest.com

Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. Every risk assessment matrix has two axes. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating. Participating in the design of the solution. Accepting solution at face value vs.

Source: sectara.com

Source: sectara.com

The risk to the customer shall be assigned on the following basis. Unfamiliar VSfamiliar If people are dealing with risky matters that are familiar to them they tend to view them as. Classification of the customers is done under three risk categories viz. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making.

Source: pinterest.com

Source: pinterest.com

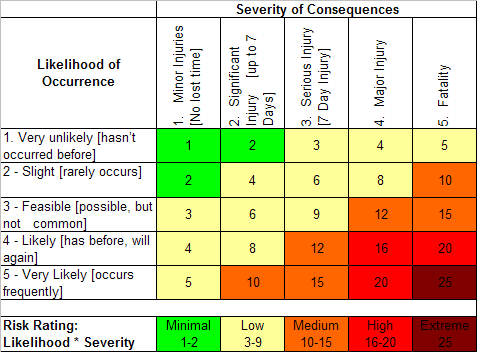

1Adapted from the VMIA Guide to developing a Risk. Yellow is medium risk. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. As with the risk assessment the bank may determine that some factors should be weighted more heavily than others. One that measures the consequence impact and the other measures likelihood.

Source: slideteam.net

Source: slideteam.net

The Enterprise Risk Management Process outlines Risk Categories and Sub Categories used by the department. Based on the customers risk score the KYC system determines the next review date. SAP system decides the action that should be taken when the customer reaches the credit limit. Are some of the parameters in the risk assessment strategy of the financial institutions. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk.

Source: safety.unimelb.edu.au

Source: safety.unimelb.edu.au

Further a spectrum of risks may be identifiable even within the same category of customers. Are some of the parameters in the risk assessment strategy of the financial institutions. Some firms only have low and high risk classification. Therefore your risk assessments must take into account the following risk categories. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of.

Source: pinterest.com

Source: pinterest.com

In addition customer due diligence also includes conducting ongoing monitoring to identify and report suspicious transactions and on a risk basis to maintain and update customer information. Product Service and Transaction Risk. To use a risk matrix extract the data from the risk assessment form and plug it into the matrix accordingly. One that measures the consequence impact and the other measures likelihood. Are some of the parameters in the risk assessment strategy of the financial institutions.

As with the risk assessment the bank may determine that some factors should be weighted more heavily than others. To use a risk matrix extract the data from the risk assessment form and plug it into the matrix accordingly. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Classification of the customers is done under three risk categories viz. Delivery Channels Risk or Interface Risk.

Source: pinterest.com

Source: pinterest.com

The risk to the customer shall be assigned on the following basis. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. With the help of risk category you can divide the customers in to various categories like low risk customers medium risk customer high risk customers etc. What types of customers pose a risk. Include a system of risk ratings or categories of.

Source: hu.pinterest.com

Source: hu.pinterest.com

Geographical Risk to be tackled separately. For these purposes customer information. The Enterprise Risk Management Process outlines Risk Categories and Sub Categories used by the department. One that measures the consequence impact and the other measures likelihood. Every risk assessment matrix has two axes.

Source: slideteam.net

Source: slideteam.net

Therefore your risk assessments must take into account the following risk categories. One that measures the consequence impact and the other measures likelihood. Commonly referred to as the customer risk rating. Product Service and Transaction Risk. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score.

Source: perseus-net.eu

Source: perseus-net.eu

SAP system decides the action that should be taken when the customer reaches the credit limit. Based on the customers risk score the KYC system determines the next review date. Risk categories can be defined as the classification of risks as per the business activities of the organization and provides a structured overview of the underlying and potential risks faced by them. Further a spectrum of risks may be identifiable even within the same category of customers. Be easily identified and transactions in whose accounts by and large conform to the.

Source: thehealthandsafetyconsultancy.co.uk

Source: thehealthandsafetyconsultancy.co.uk

Are some of the parameters in the risk assessment strategy of the financial institutions. As with the risk assessment the bank may determine that some factors should be weighted more heavily than others. The maximum individual component score and overall score are outlined below. Accepting solution at face value vs. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer risk rating categories by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas