19++ Customer risk rating definition info

Home » money laundering Info » 19++ Customer risk rating definition infoYour Customer risk rating definition images are ready in this website. Customer risk rating definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Customer risk rating definition files here. Download all royalty-free vectors.

If you’re looking for customer risk rating definition pictures information linked to the customer risk rating definition interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeking the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

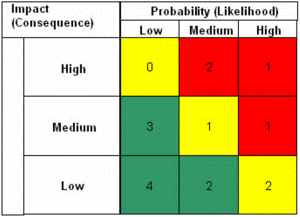

Customer Risk Rating Definition. Compliance Examination Composite Ratings. Classification of the customers is done under three risk categories viz. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. When a credit is 7rated or worse the loan officer - should evaluate the loans accrual status and prepare an Impairment Analysis consistent with FAS 114 and bank policy.

Financial Risk Assessment Template New Risk Register Template Risk Templates Risk Management From pinterest.com

Financial Risk Assessment Template New Risk Register Template Risk Templates Risk Management From pinterest.com

Loans to new customers will not be approved with this loan rating. This allows bank management and examiners to monitor changes and trends. Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. When a credit is 7rated or worse the loan officer - should evaluate the loans accrual status and prepare an Impairment Analysis consistent with FAS 114 and bank policy. Consumer compliance risk in the institutions products and services andor at preventing violations of law and consumer harm. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio.

Functions of a Credit Risk Rating System.

Any customer account may be used for illicit purposes including money laundering or terrorist financing. Your client feels the solution will change company culture in ways that will make the work place less secure friendly cooperative or. Functions of a Credit Risk Rating System. Two 2 An institution in this category maintains a CMS that is satisfactory at managing consumer compliance risk in. Medium Risk - Rating of 6 or 8. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Source: pinterest.com

Source: pinterest.com

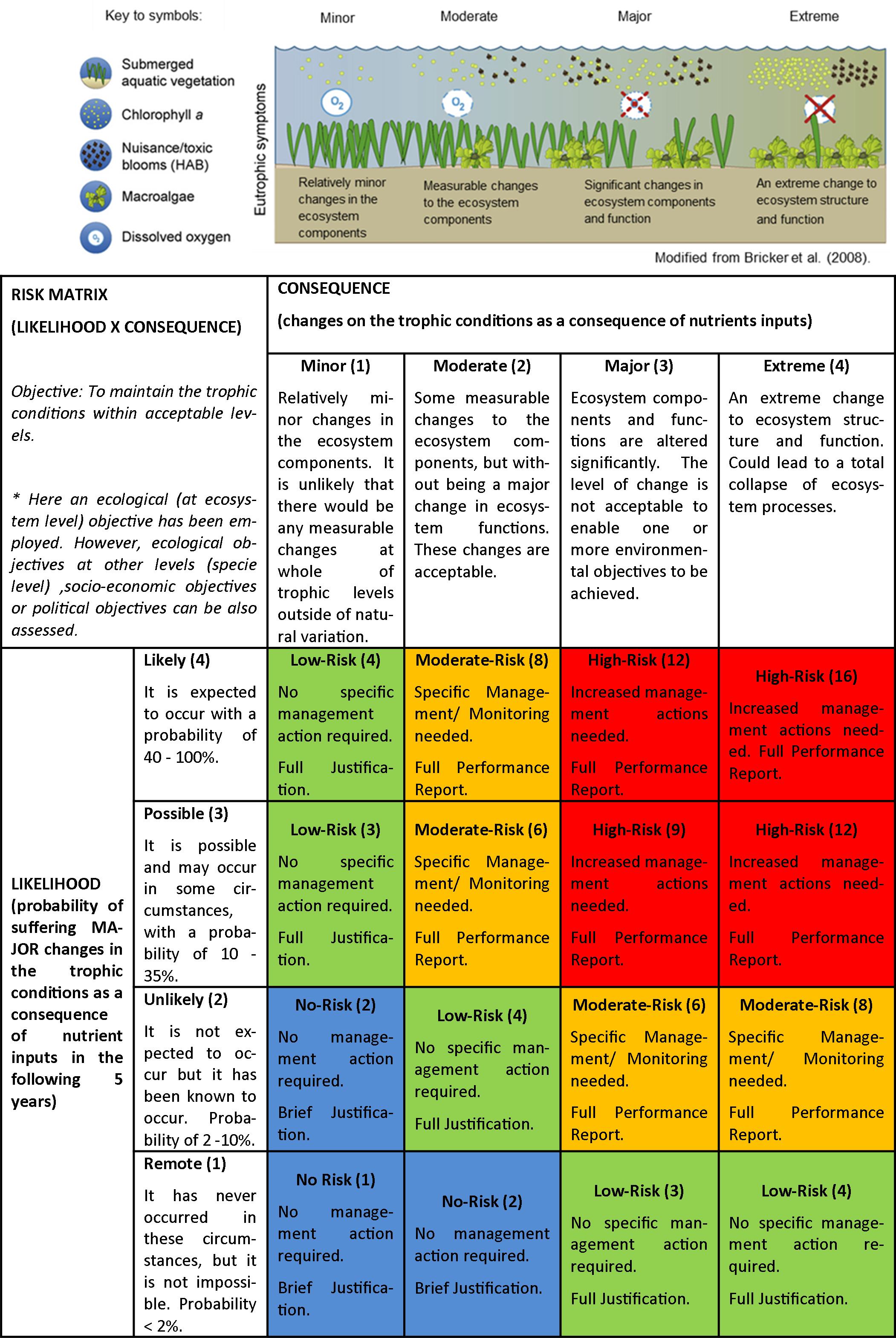

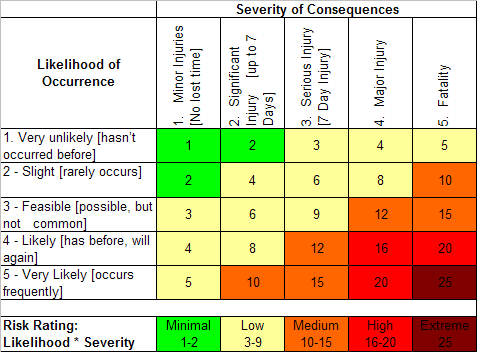

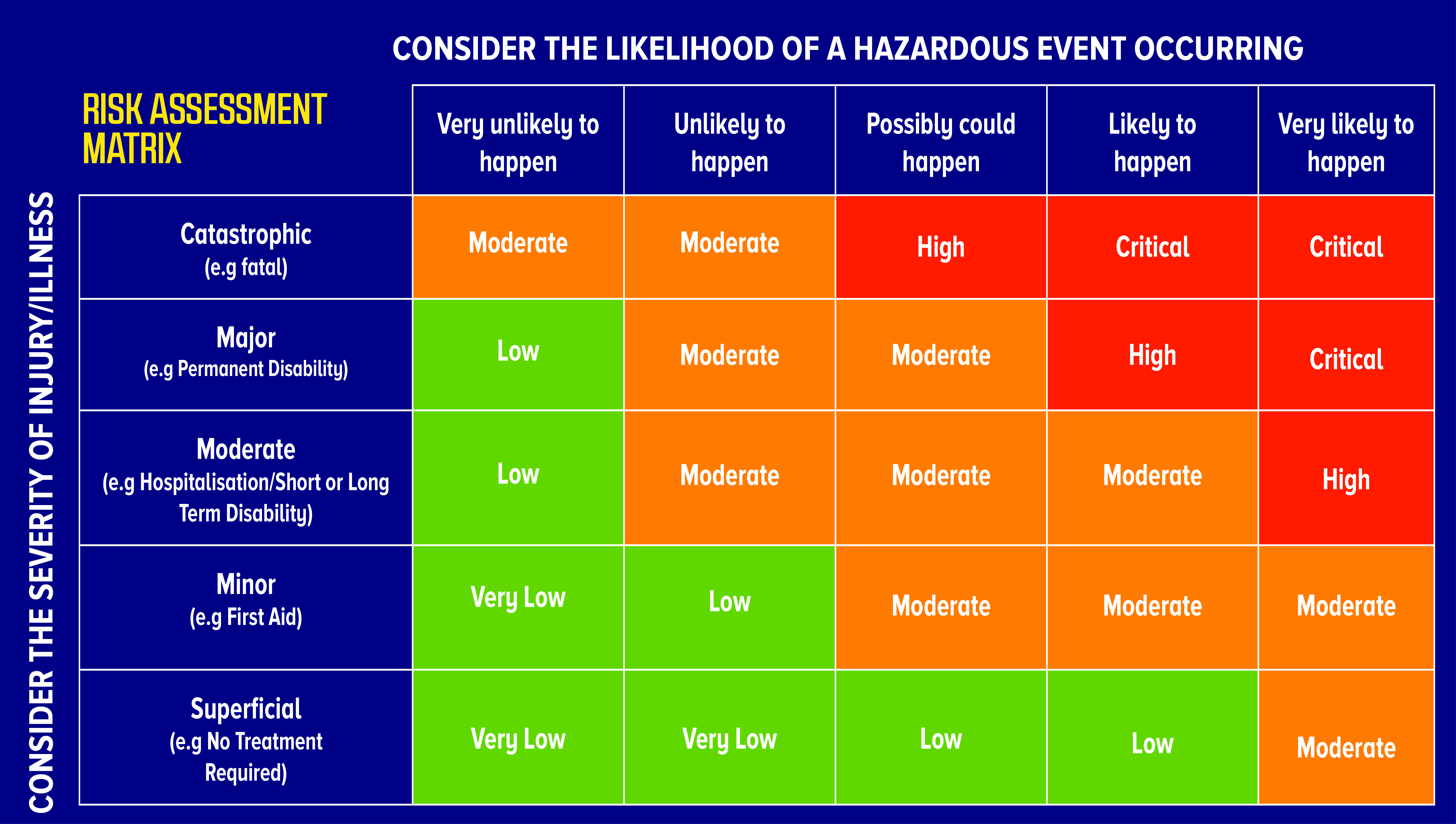

A KYC risk rating is simply a calculation of risk. If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. Consumer compliance risk in the institutions products and services andor at preventing violations of law and consumer harm. Compliance Examination Composite Ratings. Classification of the customers is done under three risk categories viz.

Source: proxsisgroup.com

Source: proxsisgroup.com

If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. Further a spectrum of risks may be identifiable even within the same category of customers. Critically deficient indicates an absence of crucial CMS elements and a demonstrated lack of willingness or capability to take the appropriate steps necessary to operate. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making.

Source: perseus-net.eu

Source: perseus-net.eu

The number to be allocated is set out in the table below. Low medium and high. Functions of a Credit Risk Rating System. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Understand your potential customer base and their industry and figure out what factors would cause a customer not to pay.

Source: pinterest.com

Source: pinterest.com

High Risk - Rating. Understand your potential customer base and their industry and figure out what factors would cause a customer not to pay. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Two 2 An institution in this category maintains a CMS that is satisfactory at managing consumer compliance risk in. Customer Risk Categorization Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective.

Source: thehealthandsafetyconsultancy.co.uk

Source: thehealthandsafetyconsultancy.co.uk

Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Based on the customers risk score the KYC system determines the next review date. High Risk - Rating. Your client feels the solution will change company culture in ways that will make the work place less secure friendly cooperative or. One 1 An institution in this category maintains a strong CMS and takes action to prevent violations of law and consumer harm.

Source: pinterest.com

Source: pinterest.com

Understand your potential customer base and their industry and figure out what factors would cause a customer not to pay. Your client feels the solution will change company culture in ways that will make the work place less secure friendly cooperative or. Two 2 An institution in this category maintains a CMS that is satisfactory at managing consumer compliance risk in. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Source: sitesafe.org.nz

Source: sitesafe.org.nz

When a credit is 7rated or worse the loan officer - should evaluate the loans accrual status and prepare an Impairment Analysis consistent with FAS 114 and bank policy. Compliance Examination Composite Ratings. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. When a credit is 7rated or worse the loan officer - should evaluate the loans accrual status and prepare an Impairment Analysis consistent with FAS 114 and bank policy. Critically deficient indicates an absence of crucial CMS elements and a demonstrated lack of willingness or capability to take the appropriate steps necessary to operate.

Source: pinterest.com

Source: pinterest.com

Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Customer risk rating models play a crucial role in complying with the Know Your Customer KYC and Customer Due Diligence CDD requirements which are designed to assess customer risk and prevent fraud. Understand your potential customer base and their industry and figure out what factors would cause a customer not to pay. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him.

Source: analyticsindiamag.com

Source: analyticsindiamag.com

Two 2 An institution in this category maintains a CMS that is satisfactory at managing consumer compliance risk in. Low medium and high. Risk rating involves the categorization of individual credit facilities based on credit analysis and local market conditions into a series of graduating categories based on risk. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. Loans to new customers will not be approved with this loan rating.

Source: acs.org

Source: acs.org

Customer risk rating models play a crucial role in complying with the Know Your Customer KYC and Customer Due Diligence CDD requirements which are designed to assess customer risk and prevent fraud. Most institutions calculate both of these risk ratings as each of them is equally important. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. Low medium and high.

Source: pinterest.com

Source: pinterest.com

This allows bank management and examiners to monitor changes and trends. Commonly referred to as the customer risk rating. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This allows bank management and examiners to monitor changes and trends. Customer Risk means any change with respect to any of the customers of the Companies or the relationship between any of such customers and all or any of the Companies for any reason including without limitation the announcement of the execution and delivery hereof but excluding any changes arising from i any material failure of any Company to comply with the material terms.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

Risk classification is an important parameter of the risk based kyc approach. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. Loans to new customers will not be approved with this loan rating.

Source: pinterest.com

Source: pinterest.com

A KYC risk rating is simply a calculation of risk. Low medium and high. If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. Risk rating involves the categorization of individual credit facilities based on credit analysis and local market conditions into a series of graduating categories based on risk. A KYC risk rating is simply a calculation of risk.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer risk rating definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas