17++ Customer risk rating parameters information

Home » money laundering idea » 17++ Customer risk rating parameters informationYour Customer risk rating parameters images are available. Customer risk rating parameters are a topic that is being searched for and liked by netizens today. You can Get the Customer risk rating parameters files here. Find and Download all free vectors.

If you’re looking for customer risk rating parameters images information connected with to the customer risk rating parameters topic, you have visit the ideal site. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Customer Risk Rating Parameters. When new deposit accounts are open the new account person will input a risk rating of M-Medium in the risk field unless its an existing customer at which point the account is rated L-Low. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. This allows KYC to capture the right amount of risk a customer is posing to the bank or FI.

Pin On About Internal Audit From pinterest.com

Pin On About Internal Audit From pinterest.com

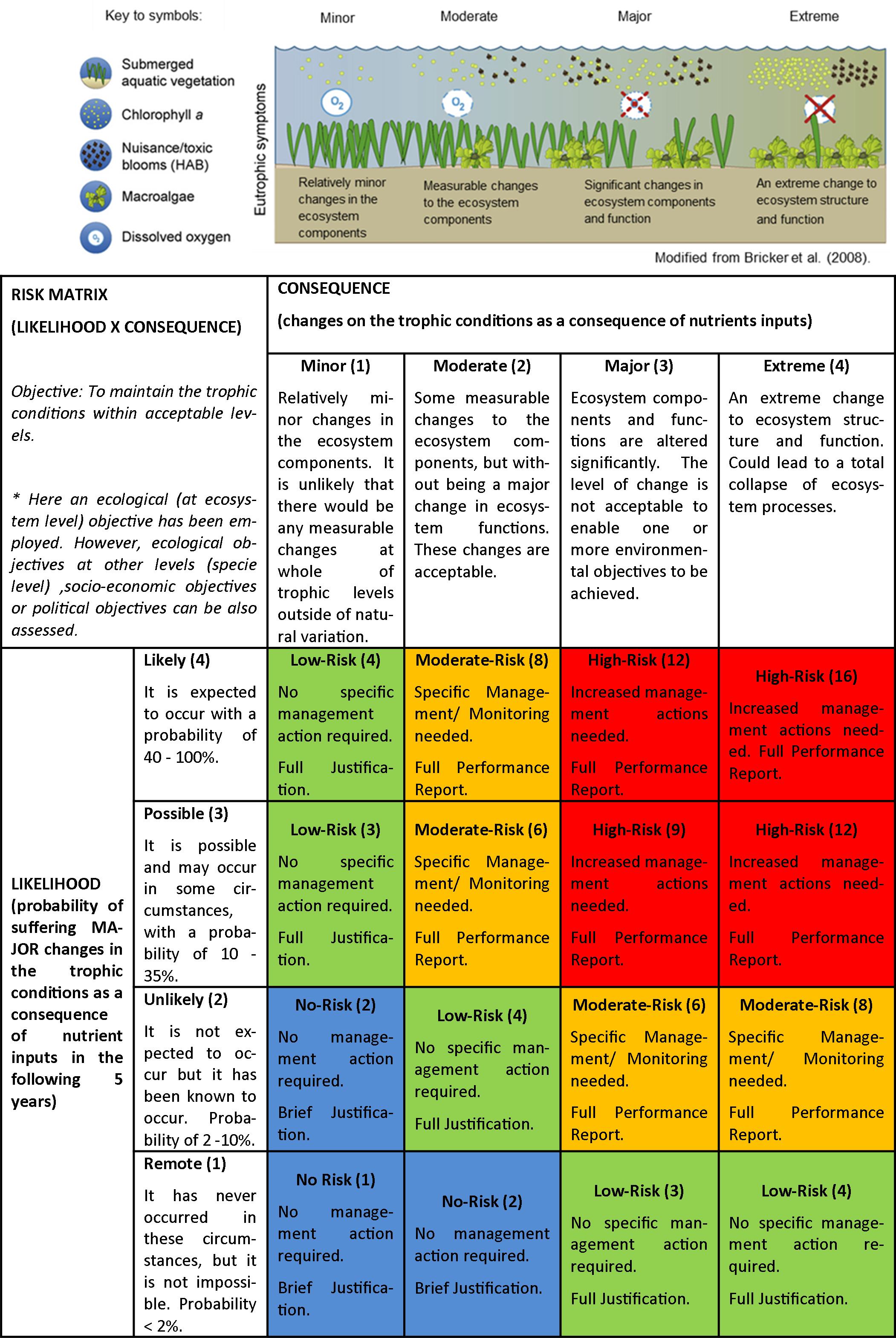

What is KYC Risk Rating. Risk likelihood ie probability of risk occurrence Risk consequence ie impact and severity of risk occurrence Thresholds to trigger management activities. The goal of a risk rating system should be to assess a borrowers potential future payment volatility by reviewing several characteristics. Most institutions calculate both of these risk ratings as each of them is equally important. Customers identity Socialfinancial status Nature of business activity Information about the clients business and their location etc. The Risk assessments after creation is further analyzed to check which is to be promoted to case and closed by the system.

This allows KYC to capture the right amount of risk a customer is posing to the bank or FI.

For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Describes the actual risk scores and risk level attributed to the customer based on the answers in the profile. The number to be allocated is set out in the table below. The Risk assessments after creation is further analyzed to check which is to be promoted to case and closed by the system. A KYC risk rating is simply a calculation of risk. Even if a customer is risk scored by two models then the customer will have one risk assessment with both the scores available.

Source: pinterest.com

Source: pinterest.com

Risk assessment parameters vary based on the customer type. 43 - 61 M oderate 4. For every customer identified and risk scored a risk assessment is created. 62 - 81 Low 3. Are some of the parameters in the risk assessment strategy of the financial institutions.

Source: perseus-net.eu

Source: perseus-net.eu

The different status which a risk assessment can hold are described as follows. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating. Most institutions calculate both of these risk ratings as each of them is equally important. Which will allow the bank to determine what the customers anticipated risk rating should be. When new deposit accounts are open the new account person will input a risk rating of M-Medium in the risk field unless its an existing customer at which point the account is rated L-Low.

Source: in.pinterest.com

Source: in.pinterest.com

The BSA Department looks at all new deposit accounts after 30 days and determines if the account can be moved to L or needs to. What is KYC Risk Rating. Even if a customer is risk scored by two models then the customer will have one risk assessment with both the scores available. Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. The specifics of what contributes to the risk total are documented.

Source: pinterest.com

Source: pinterest.com

How KYC Risk Rating Works. Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. The number to be allocated is set out in the table below. Describes the anticipated risk rating of the customer. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers.

Source: pinterest.com

Source: pinterest.com

Even if a customer is risk scored by two models then the customer will have one risk assessment with both the scores available. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. Describes the anticipated risk rating of the customer. Describes the actual risk scores and risk level attributed to the customer based on the answers in the profile. Even if a customer is risk scored by two models then the customer will have one risk assessment with both the scores available.

Source: pinterest.com

Source: pinterest.com

Most institutions calculate both of these risk ratings as each of them is equally important. When new deposit accounts are open the new account person will input a risk rating of M-Medium in the risk field unless its an existing customer at which point the account is rated L-Low. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. Verafin is the way to go. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any.

Source: pinterest.com

Source: pinterest.com

A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. Even if a customer is risk scored by two models then the customer will have one risk assessment with both the scores available. 82 - 100 U ndoubted 2. For every customer identified and risk scored a risk assessment is created. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating.

Source: in.pinterest.com

Source: in.pinterest.com

Risk likelihood ie probability of risk occurrence Risk consequence ie impact and severity of risk occurrence Thresholds to trigger management activities. For more information about the different types of risk model refer to the section Risk Assessment Model on page 9. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. 82 - 100 U ndoubted 2. The goal of a risk rating system should be to assess a borrowers potential future payment volatility by reviewing several characteristics.

Source: pinterest.com

Source: pinterest.com

Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be considered. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Define the parameters used to analyze and categorize risks and the parameters used to control the risk management effort.

Source: pinterest.com

Source: pinterest.com

Risk parameters are used to provide common and consistent criteria for comparing the various risks. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be considered. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement.

Source: pinterest.com

Source: pinterest.com

Risk likelihood ie probability of risk occurrence Risk consequence ie impact and severity of risk occurrence Thresholds to trigger management activities. 62 - 81 Low 3. Parameters for evaluating categorizing and prioritizing risks include. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Risk assessment parameters vary based on the customer type.

Source: pinterest.com

Source: pinterest.com

Risk parameters are used to provide common and consistent criteria for comparing the various risks. The BSA Department looks at all new deposit accounts after 30 days and determines if the account can be moved to L or needs to. Define the parameters used to analyze and categorize risks and the parameters used to control the risk management effort. For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be considered. Which will allow the bank to determine what the customers anticipated risk rating should be.

Source: researchgate.net

Source: researchgate.net

The BSA Department looks at all new deposit accounts after 30 days and determines if the account can be moved to L or needs to. Customer risk rating is an integral part of the customer due diligence process yet it can be a difficult tool to implement. Classification of the customers is done under three risk categories viz. Risk likelihood ie probability of risk occurrence Risk consequence ie impact and severity of risk occurrence Thresholds to trigger management activities. Describes the actual risk scores and risk level attributed to the customer based on the answers in the profile.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer risk rating parameters by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information