18++ Customer risk rating system info

Home » money laundering idea » 18++ Customer risk rating system infoYour Customer risk rating system images are ready. Customer risk rating system are a topic that is being searched for and liked by netizens today. You can Download the Customer risk rating system files here. Get all royalty-free photos and vectors.

If you’re searching for customer risk rating system images information connected with to the customer risk rating system keyword, you have pay a visit to the ideal site. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Customer Risk Rating System. Most institutions calculate both of these risk ratings as each of them is equally important. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Medium Risk - Rating of 6 or 8. In practice a RR System allows a CDFI to quantify the risk in its small business loan portfolio by segmenting the loans into risk grades2 A RR System.

Psychometric Risk Analysis Online Risk Profile Risk Anaysis Advanced Risk Assessment Risk Vs Reward Risk Analysis Risk Management Risk From pinterest.com

Psychometric Risk Analysis Online Risk Profile Risk Anaysis Advanced Risk Assessment Risk Vs Reward Risk Analysis Risk Management Risk From pinterest.com

Risk Factor Rating Score Customer funds transfer activity does not include high risk international jurisdictions HIDTAs HIFCAs or other areas classified by the bank as high risk L 0 Customer funds transfer activity includes high risk international jurisdictions HIDTAs HIFCAs or other areas classified by the bank as high risk H 3. Most institutions calculate both of these risk ratings as each of them is equally important. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. What Is a Risk Rating System. Customer health scoring is the key to providing that stellar serviceOnce youve set up your system and collected the necessary data youll have the insights you need to address each customers unique pain pointsIn return youll enjoy less churn greater retention accelerated acquisition and more success overall.

The CC Rating System does not consider a banks CRA performance as CRA performance is evaluated separately and assigned its own component rating.

Financial Security Management and Environmental. The risk rating model uses an Excel spreadsheet. This rating should determine the level of due diligence required simple or enhanced the levels of approvals required for entering into the relationship with the customer the higher the risk the higher the level of approval required and the frequency at which the customer record has to be mandatorily reviewed. Customer health scoring is the key to providing that stellar serviceOnce youve set up your system and collected the necessary data youll have the insights you need to address each customers unique pain pointsIn return youll enjoy less churn greater retention accelerated acquisition and more success overall. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be.

Source: researchgate.net

Source: researchgate.net

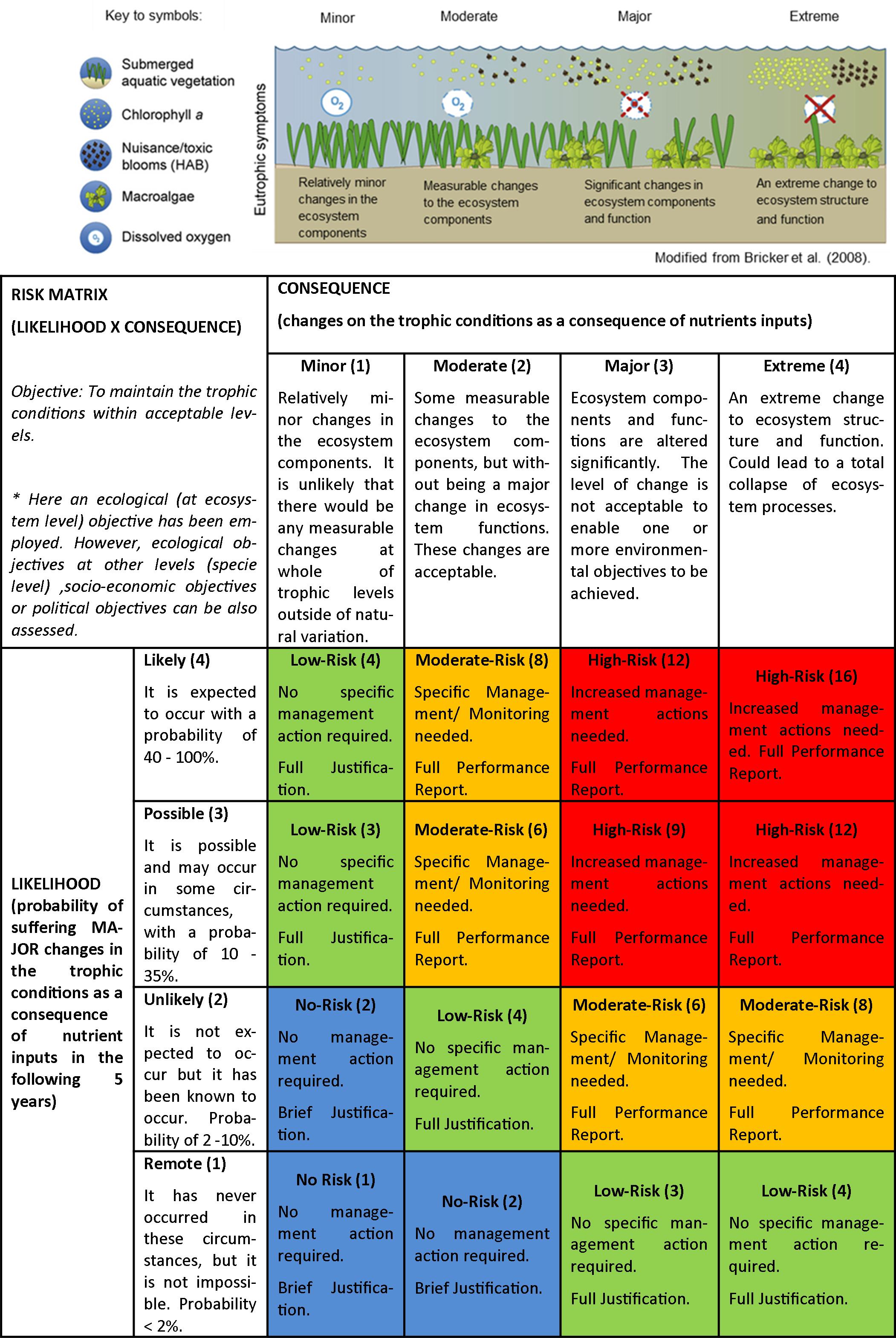

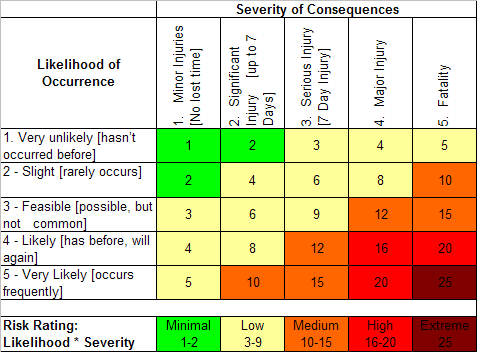

If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. A RR System is the primary summary indicator of the individual loan risk within a CDFIs small business loan portfolio. A KYC risk rating is simply a calculation of risk. Most institutions calculate both of these risk ratings as each of them is equally important. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor.

Source: perseus-net.eu

Source: perseus-net.eu

Once a final risk score is generated the customer is categorised as high medium or low risk. What Is a Risk Rating System. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Based on the customers risk score the KYC system determines the next review date. Most institutions calculate both of these risk ratings as each of them is equally important.

Source: pinterest.com

Source: pinterest.com

Risk Factor Rating Score Customer funds transfer activity does not include high risk international jurisdictions HIDTAs HIFCAs or other areas classified by the bank as high risk L 0 Customer funds transfer activity includes high risk international jurisdictions HIDTAs HIFCAs or other areas classified by the bank as high risk H 3. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. The goal of a risk rating system should be to assess a borrowers potential future payment volatility by reviewing several characteristics. The CC Rating System provides a general framework for assessing risks during the supervisory process using certain compliance factors and assigning an overall consumer compliance rating to each federally regulated financial institution3 The primary purpose of the CC Rating System is to ensure that regulated financial institutions are evaluated in a. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose.

Source: thehealthandsafetyconsultancy.co.uk

Source: thehealthandsafetyconsultancy.co.uk

How KYC Risk Rating Works. This allows bank management and examiners to monitor changes and trends. The maximum individual component score and overall score are outlined below. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score.

Source: pinterest.com

Source: pinterest.com

The CC Rating System provides a general framework for assessing risks during the supervisory process using certain compliance factors and assigning an overall consumer compliance rating to each federally regulated financial institution3 The primary purpose of the CC Rating System is to ensure that regulated financial institutions are evaluated in a. Examiners should consult with appropriate Compliance Supervision Management Compliance Risk Policy or Legal representatives when considering CRA programmatic or risk management deficiencies in the. In practice a RR System allows a CDFI to quantify the risk in its small business loan portfolio by segmenting the loans into risk grades2 A RR System. Most institutions calculate both of these risk ratings as each of them is equally important. High Risk - Rating.

Source: pinterest.com

Source: pinterest.com

This rating should determine the level of due diligence required simple or enhanced the levels of approvals required for entering into the relationship with the customer the higher the risk the higher the level of approval required and the frequency at which the customer record has to be mandatorily reviewed. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. Based on the customers risk score the KYC system determines the next review date. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. The maximum individual component score and overall score are outlined below.

Source: pinterest.com

Source: pinterest.com

For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be. High Risk - Rating. A Most Unlikely Event 1 x Trivial Injuries if event occurs 1 Risk Rating of 1 Minimal Risk 1x11 A Likely Event 3 x Major Injuries if event occurs 4 Risk Rating of 12 High Risk 3x412 When you allocate the Rating you do so after taking into consideration any. Medium Risk - Rating of 6 or 8. This rating should determine the level of due diligence required simple or enhanced the levels of approvals required for entering into the relationship with the customer the higher the risk the higher the level of approval required and the frequency at which the customer record has to be mandatorily reviewed.

Source: in.pinterest.com

Source: in.pinterest.com

Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Functions of a Credit Risk Rating System. Either that posed by a specific customer or that which an institution faces based on its entire client portfolio. The CC Rating System does not consider a banks CRA performance as CRA performance is evaluated separately and assigned its own component rating.

Source: pinterest.com

Source: pinterest.com

Financial Security Management and Environmental. The CC Rating System does not consider a banks CRA performance as CRA performance is evaluated separately and assigned its own component rating. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. Financial Security Management and Environmental. What Is a Risk Rating System.

Source: researchgate.net

Source: researchgate.net

Most institutions calculate both of these risk ratings as each of them is equally important. The risk rating model uses an Excel spreadsheet. Functions of a Credit Risk Rating System. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. The number to be allocated is set out in the table below.

Source: fi.pinterest.com

Source: fi.pinterest.com

If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This allows bank management and examiners to monitor changes and trends. The maximum individual component score and overall score are outlined below. A RR System is the primary summary indicator of the individual loan risk within a CDFIs small business loan portfolio.

Source: pinterest.com

Source: pinterest.com

For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be. The goal of a risk rating system should be to assess a borrowers potential future payment volatility by reviewing several characteristics. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. High Risk - Rating. Each loan is evaluated under four risk components.

Source: pinterest.com

Source: pinterest.com

The maximum individual component score and overall score are outlined below. For instance when assessing the current financial health of the borrowers business global cash flow global debt service coverage global debt to equity financial statement strength and loan to value and collateral value for the loan should be. What Is a Risk Rating System. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. High Risk - Rating.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer risk rating system by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information