18+ Define layering in banking information

Home » money laundering idea » 18+ Define layering in banking informationYour Define layering in banking images are available in this site. Define layering in banking are a topic that is being searched for and liked by netizens now. You can Get the Define layering in banking files here. Find and Download all royalty-free photos and vectors.

If you’re looking for define layering in banking pictures information connected with to the define layering in banking keyword, you have visit the right site. Our website frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

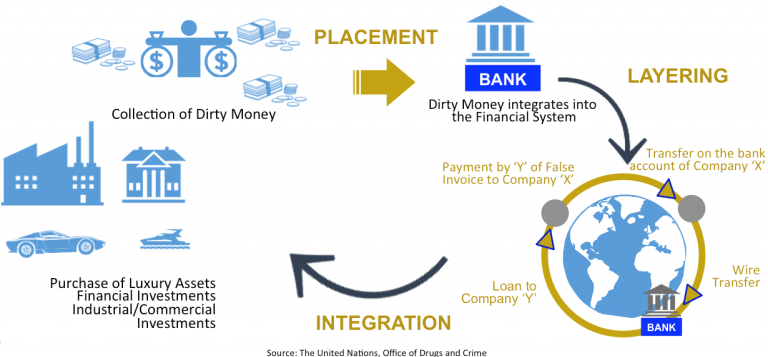

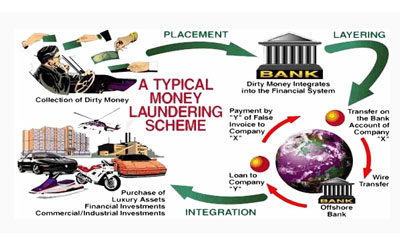

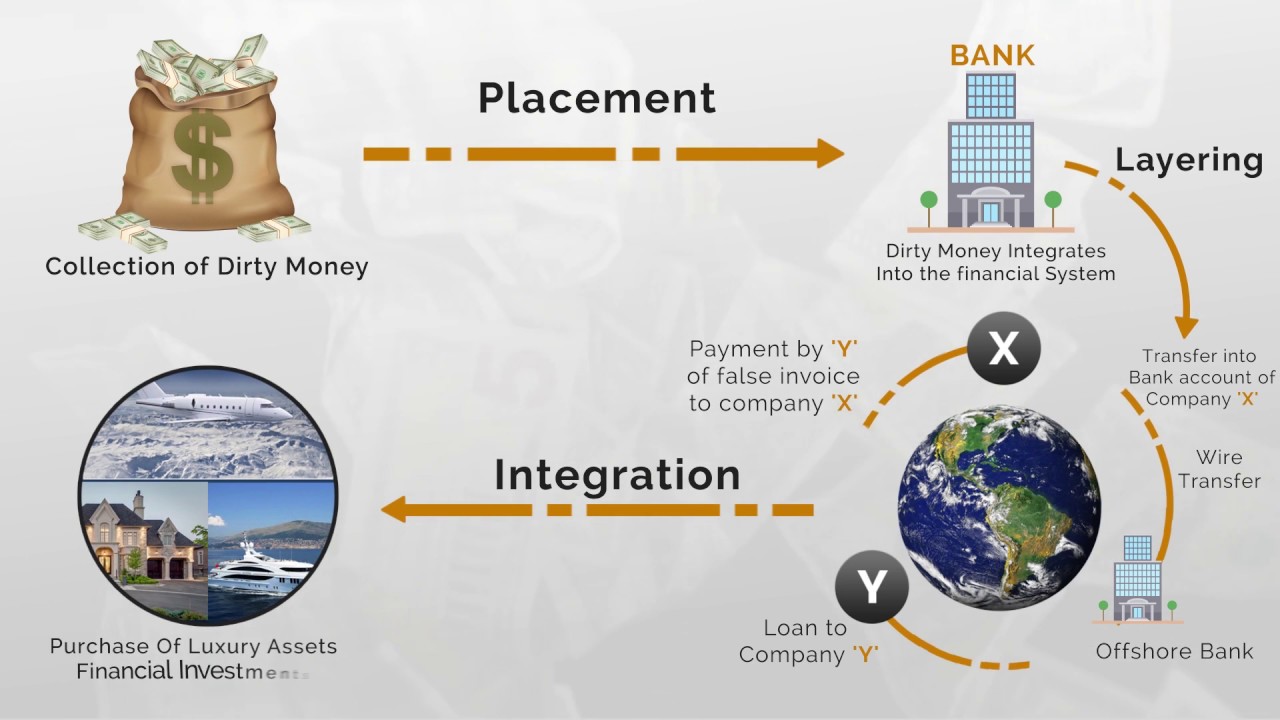

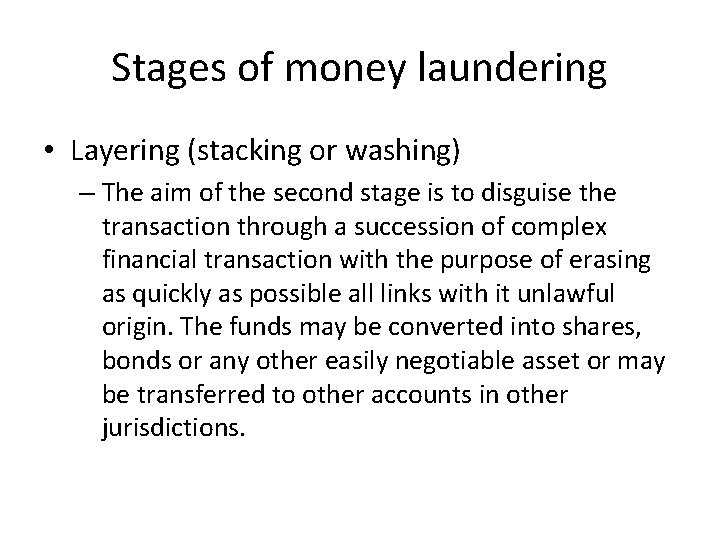

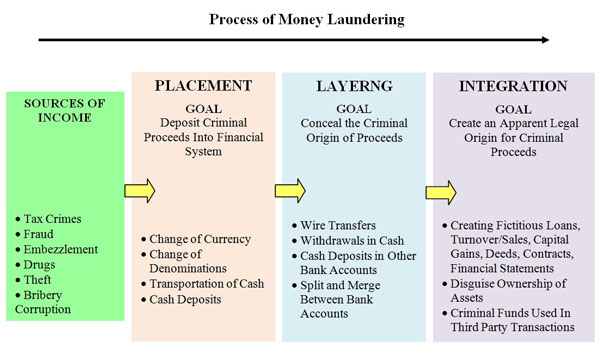

Define Layering In Banking. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure. The 7 layers are labeled starting with layer 1 at the bottom 1 -Physical 2-Data Link 3-Network 4-Transport 5. After placement comes the layering stage sometimes referred to as structuring. Once cash has been successfully placed into the financial system launderers can engage in an infinite number of complex transactions and transfers designed to disguise the audit trail and thus the source of the property and provide anonymity.

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Compliance Jobs From in.pinterest.com

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Compliance Jobs From in.pinterest.com

For example a drug dealer in another country depositing cash from his illegal trade into a local bank. Placement layering and integration-aka hide move and invest Placement. Or participating in or assisting the movement of funds to make the proceeds appear legitimate. The final stage is getting the money out so it can be used without attracting attention from law enforcement or. Layering involves sending the money through various financial transactions to change its form and make it difficult to follow. The primary purpose of this stage is to separate the illicit money from its source.

The final stage is getting the money out so it can be used without attracting attention from law enforcement or.

The acquisition possession or use of property knowing that these are derived from criminal activity. Integration This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure. Refers to the initial point of entry for funds derived from criminal activities into the financial system. The Layering Stage Camouflage. Here the illicit money is separated from its source.

Source: in.pinterest.com

Source: in.pinterest.com

Money laundering is the process used to disguise the source of money or assets derived from criminal activity. Layering involves the separation of proceeds from illegal source using complex transactions designed to obscure the audit trail and hide the proceeds. Money laundering is the conversion or transfer of property. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. Layering is essentially the use of placement and extraction over and over again using varying amounts each time to make tracing transactions as hard as possible.

Source: letstalkaml.com

Source: letstalkaml.com

Or participating in or assisting the movement of funds to make the proceeds appear legitimate. So although Fannie or Freddie are not asking for conditions some banks add more at times bizarre conditions to the approval and insiders call it risk layering. A bank overlay structure consists of two layers. The concealment or disguising of the nature of the proceeds. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure.

Source: calert.info

Source: calert.info

Money laundering is the process used to disguise the source of money or assets derived from criminal activity. The final stage is getting the money out so it can be used without attracting attention from law enforcement or. Sometimes this is negotiated down to either giving the original bank a right to play in any new deal but not a guarantee of payment or giving the original bank an amount of fees equal to what the alternative bank. Profit-motivated crimes span a variety of illegal activities from drug trafficking and smuggling to fraud extortion and corruption. Refers to the initial point of entry for funds derived from criminal activities into the financial system.

Source: pinterest.com

Source: pinterest.com

Borrowers have 30000 in a bank account that can be liquidated anytime. Here the illicit money is separated from its source. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure. The acquisition possession or use of property knowing that these are derived from criminal activity. Layering is essentially the use of placement and extraction over and over again using varying amounts each time to make tracing transactions as hard as possible.

Source: youtube.com

Source: youtube.com

Layering usually involves a complex system of transactions designed to hide the source and ownership of the funds. Refers to the initial point of entry for funds derived from criminal activities into the financial system. The higher layer is a group of networked regional banks or even a single global bank that maintains a separate bank account for each country or legal entity of the corporate structure. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. Layering usually involves a complex system of transactions designed to hide the source and ownership of the funds.

Source: bitquery.io

Source: bitquery.io

For example a drug dealer in another country depositing cash from his illegal trade into a local bank. Placement layering and integration-aka hide move and invest Placement. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. The layering stage is the most complex and often entails the international movement of the funds. This is dissimilar to layering for in the integration process detection and identification of laundered funds is provided through informants.

Source: vskills.in

Source: vskills.in

The primary purpose of this stage is to separate the illicit money from its source. After placement comes the layering stage sometimes referred to as structuring. The purpose of a layered security approach is to make sure that every individual defense component has a backup to counter any flaws or gaps in other defenses of security. The higher layer is a group of networked regional banks or even a single global bank that maintains a separate bank account for each country or legal entity of the corporate structure. Here the illicit money is separated from its source.

Source: pinterest.com

Source: pinterest.com

A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. This borrower has compensating factors to offset the isolated period of bad credit and low credit scores. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. The layering stage is the most complex and often entails the international movement of the funds. Layering involves the separation of proceeds from illegal source using complex transactions designed to obscure the audit trail and hide the proceeds.

Source: professional.dowjones.com

Source: professional.dowjones.com

Sometimes this is negotiated down to either giving the original bank a right to play in any new deal but not a guarantee of payment or giving the original bank an amount of fees equal to what the alternative bank. Borrowers have 30000 in a bank account that can be liquidated anytime. For example a drug dealer in another country depositing cash from his illegal trade into a local bank. Refers to the initial point of entry for funds derived from criminal activities into the financial system. The concealment or disguising of the nature of the proceeds.

Source: complyadvantage.com

Source: complyadvantage.com

The scope of criminal proceeds is significant - estimated at some 590 billion to 15 trillion US. Refers to the initial point of entry for funds derived from criminal activities into the financial system. Profit-motivated crimes span a variety of illegal activities from drug trafficking and smuggling to fraud extortion and corruption. The primary purpose of this stage is to separate the illicit money from its source. The higher layer is a group of networked regional banks or even a single global bank that maintains a separate bank account for each country or legal entity of the corporate structure.

Source: slidetodoc.com

Source: slidetodoc.com

Layering usually involves a complex system of transactions designed to hide the source and ownership of the funds. The scope of criminal proceeds is significant - estimated at some 590 billion to 15 trillion US. So this borrower will be a good candidate for manual underwriting approval. Money laundering is often described as occurring in three stages. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure.

Source: allbankingalerts.com

Source: allbankingalerts.com

The purpose of a layered security approach is to make sure that every individual defense component has a backup to counter any flaws or gaps in other defenses of security. The layering stage is the most complex and often entails the international movement of the funds. Layering involves the separation of proceeds from illegal source using complex transactions designed to obscure the audit trail and hide the proceeds. Here the illicit money is separated from its source. The 7 layers are labeled starting with layer 1 at the bottom 1 -Physical 2-Data Link 3-Network 4-Transport 5.

Source: calert.info

Source: calert.info

Placement layering and integration-aka hide move and invest Placement. The higher layer is a group of networked regional banks or even a single global bank that maintains a separate bank account for each country or legal entity of the corporate structure. The acquisition possession or use of property knowing that these are derived from criminal activity. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. Layering usually involves a complex system of transactions designed to hide the source and ownership of the funds.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title define layering in banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information