15++ Define money laundering in banking info

Home » money laundering idea » 15++ Define money laundering in banking infoYour Define money laundering in banking images are available in this site. Define money laundering in banking are a topic that is being searched for and liked by netizens today. You can Download the Define money laundering in banking files here. Get all royalty-free photos.

If you’re looking for define money laundering in banking images information linked to the define money laundering in banking topic, you have visit the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

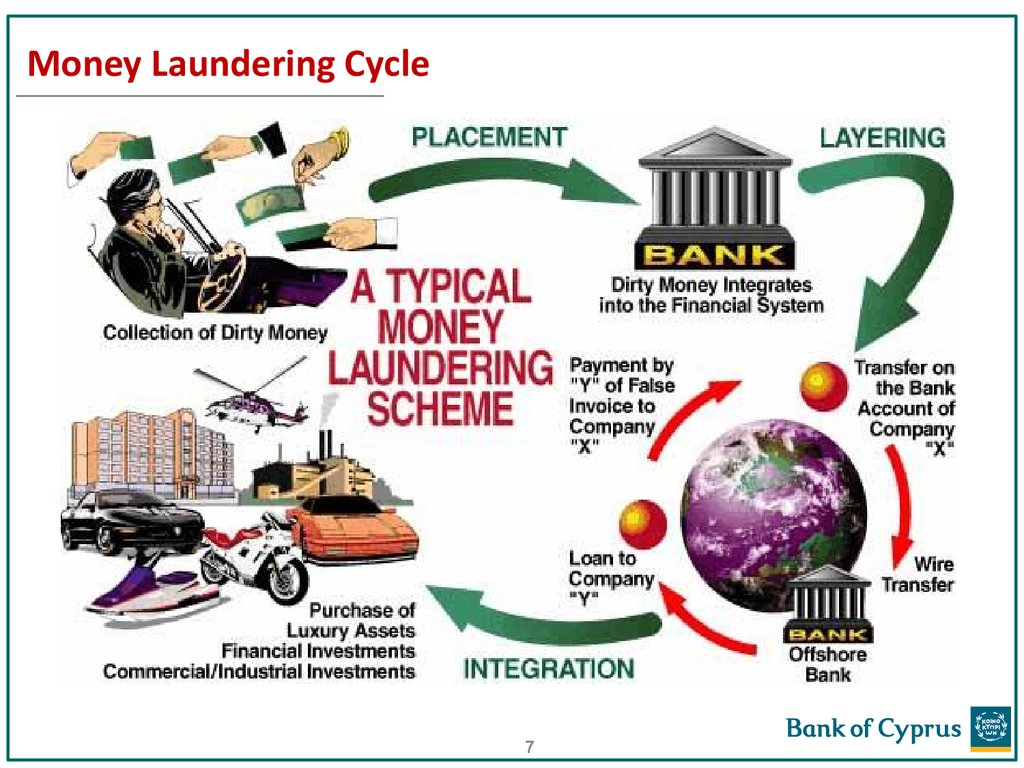

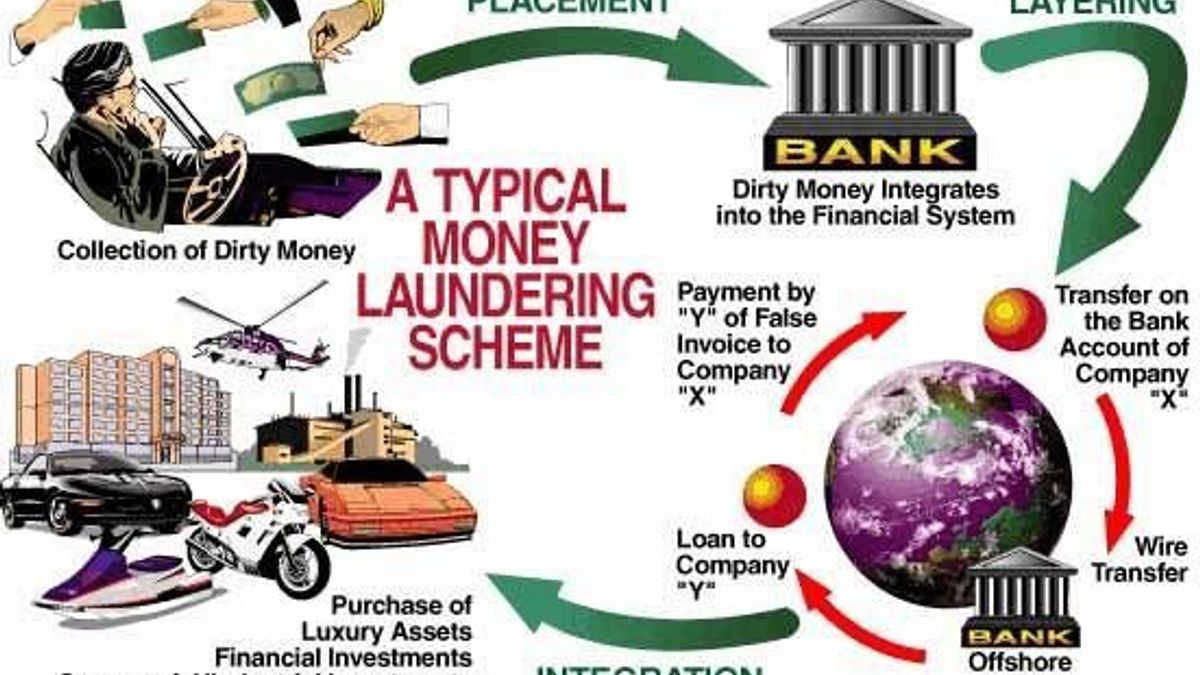

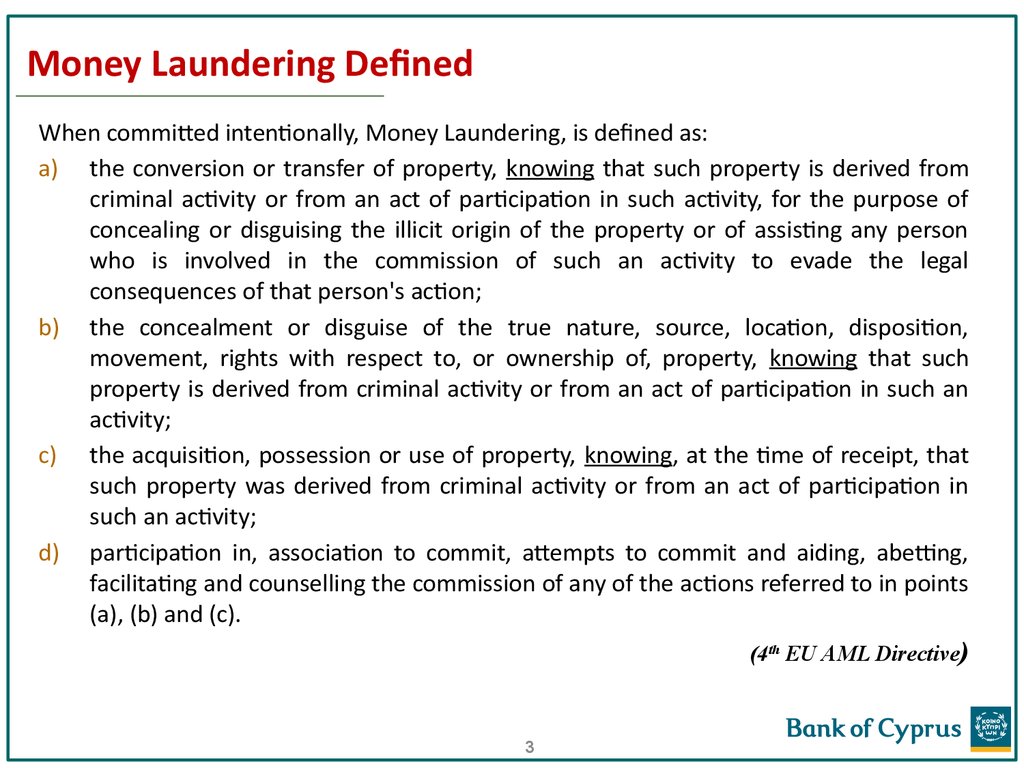

Define Money Laundering In Banking. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Lastly we can say that Money Laundering is the process whereby proceeds reasonably believed to have been derived from criminal activity are transported transferred transformed converted or intermingled with legitimate funds for the purpose of concealing or disguising the true nature source disposition movement or ownership of these proceeds. Along with some other aspects of underground economic activity rough estimates have been.

Get Our Image Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies From pinterest.com

Get Our Image Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies From pinterest.com

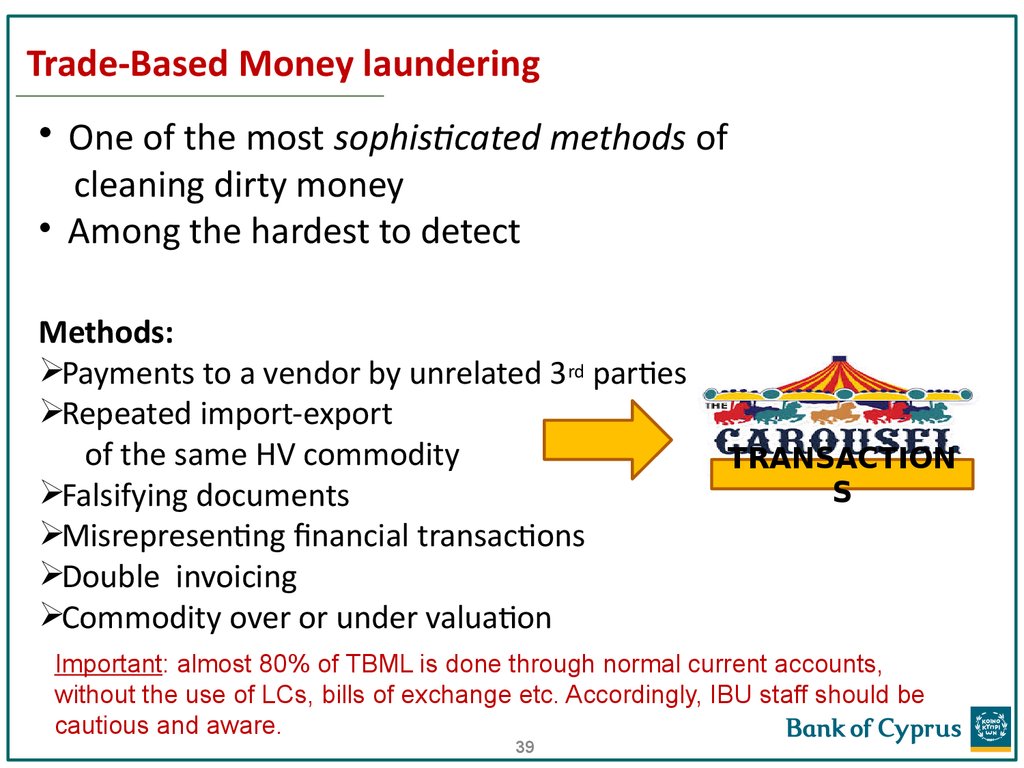

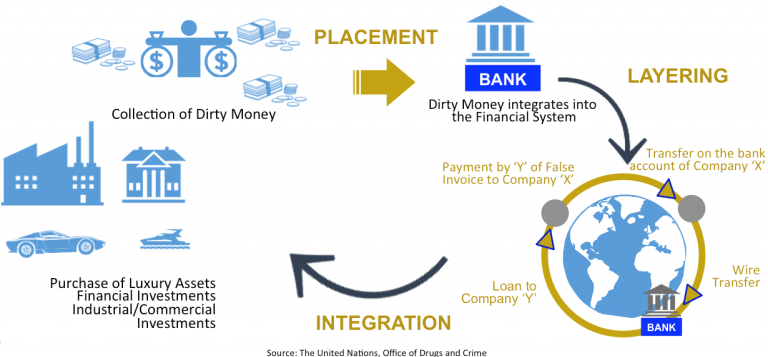

One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect. Define money laundering in banking. The illegal funds are first introduced into the legitimate financial system to hide their real source. Lastly we can say that Money Laundering is the process whereby proceeds reasonably believed to have been derived from criminal activity are transported transferred transformed converted or intermingled with legitimate funds for the purpose of concealing or disguising the true nature source disposition movement or ownership of these proceeds.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source.

How to define laundering money. One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. It is a worldwide problem with approximately 300 billion going through the. How do you define money laundering. Define Money Laundering Laws. Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money.

Source: en.ppt-online.org

Source: en.ppt-online.org

By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Define money laundering in banking. How to define laundering money. Money Laundering Control Act of 1986 and any applicable money laundering-related Laws of other jurisdictions where the Company and its Subsidiaries conduct business or own assets. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds.

Source: bi.go.id

Source: bi.go.id

It is a worldwide problem with approximately 300 billion going through the. Section 1956 a defines three types of criminal conduct. Define Money Laundering Laws. Means any Law governing financial recordkeeping and reporting requirements including the US. The global effect is.

Source: en.ppt-online.org

Source: en.ppt-online.org

Simultaneous puts and calls representing mirror-image bets on a. The process of taking the proceeds of criminal activity and making them appear legal. Define Money Laundering Laws. Define money laundering in banking. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds.

Source: in.pinterest.com

Source: in.pinterest.com

Define Money Laundering Laws. Full Definition of Money Laundering Money laundering is the practice of engaging in financial transactions in order to conceal the identity source andor destination of money and is a main operation of the underground economy. Lastly we can say that Money Laundering is the process whereby proceeds reasonably believed to have been derived from criminal activity are transported transferred transformed converted or intermingled with legitimate funds for the purpose of concealing or disguising the true nature source disposition movement or ownership of these proceeds. The process of taking the proceeds of criminal activity and making them appear legal. According to FindLaw embezzlement is defined.

Source: pinterest.com

Source: pinterest.com

According to FindLaw embezzlement is defined. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money.

Source: jagranjosh.com

Source: jagranjosh.com

Money Laundering is the process of changing the colors of the money. Authorities plan to limit cash deposits of dollars at bank counters as a measure against money laundering. Define Money Laundering Laws. The process of taking the proceeds of criminal activity and making them appear legal. Means any Law governing financial recordkeeping and reporting requirements including the US.

Source: pinterest.com

Source: pinterest.com

Section 1956 a defines three types of criminal conduct. Money Laundering Control Act of 1986 and any applicable money laundering-related Laws of other jurisdictions where the Company and its Subsidiaries conduct business or own assets. Full Definition of Money Laundering Money laundering is the practice of engaging in financial transactions in order to conceal the identity source andor destination of money and is a main operation of the underground economy. Along with some other aspects of underground economic activity rough estimates have been. The dirty money is often moved around to create confusion through wire transfers to.

Source: en.ppt-online.org

Source: en.ppt-online.org

The dirty money is often moved around to create confusion through wire transfers to. The process of taking the proceeds of criminal activity and making them appear legal. Currency and Foreign Transaction Reporting Act of 1970 the US. Section 1956 a defines three types of criminal conduct. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin.

Source: in.pinterest.com

Source: in.pinterest.com

The dirty money is often moved around to create confusion through wire transfers to. According to FindLaw embezzlement is defined. Money Laundering Control Act of 1986 and any applicable money laundering-related Laws of other jurisdictions where the Company and its Subsidiaries conduct business or own assets. Define money laundering in banking. Means any Law governing financial recordkeeping and reporting requirements including the US.

Source: bi.go.id

Define Money Laundering Laws. Authorities plan to limit cash deposits of dollars at bank counters as a measure against money laundering. The illegal funds are first introduced into the legitimate financial system to hide their real source. How do you define money laundering. Money Laundering Control Act of 1986 and any applicable money laundering-related Laws of other jurisdictions where the Company and its Subsidiaries conduct business or own assets.

Source: en.ppt-online.org

Source: en.ppt-online.org

Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds. Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. Money laundering is the process of making illegally obtained funds dirty money appear legal. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. The dirty money is often moved around to create confusion through wire transfers to.

Source: letstalkaml.com

Source: letstalkaml.com

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. How do you define money laundering. Define Money Laundering Laws. Money Laundering is the process of changing the colors of the money. Means any Law governing financial recordkeeping and reporting requirements including the US.

Source: pinterest.com

Source: pinterest.com

Along with some other aspects of underground economic activity rough estimates have been. It is a worldwide problem with approximately 300 billion going through the. Means any Law governing financial recordkeeping and reporting requirements including the US. The dirty money is often moved around to create confusion through wire transfers to. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title define money laundering in banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information