20+ Easiest to detect money laundering activity ideas

Home » money laundering Info » 20+ Easiest to detect money laundering activity ideasYour Easiest to detect money laundering activity images are ready in this website. Easiest to detect money laundering activity are a topic that is being searched for and liked by netizens now. You can Download the Easiest to detect money laundering activity files here. Download all royalty-free vectors.

If you’re looking for easiest to detect money laundering activity images information connected with to the easiest to detect money laundering activity interest, you have pay a visit to the right blog. Our website always provides you with hints for seeing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

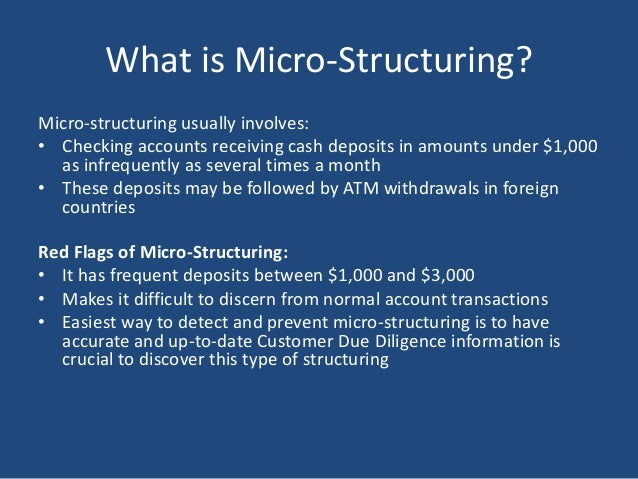

Easiest To Detect Money Laundering Activity. In monitoring and detecting any suspicious money laundering activities FIs are benefitting from data analytics technology. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. This is most critical stage for any money launderer as the criminal can effectively mask his illegal. With a reliable digital ID system it is easier to track bad actors who are trying to conduct illegal money laundering activities.

Pdf Money Laundering And Terrorist Financing Activities A Primer On Avoidance Management For Money Managers From researchgate.net

Pdf Money Laundering And Terrorist Financing Activities A Primer On Avoidance Management For Money Managers From researchgate.net

Financial institutions today utilise AI for areas such as customer service risk management fraud detection and anti-money laundering while adhering. Since 1990 money laundering itself has been a crimeand its easy to see why. Each time exploiting loopholes or discrepancies in legislation and taking advantage of delays in judicial or police cooperation. The easier it is for criminals to spend illegal money undetected the more likely they are to commit crimes in the future. Paying close attention to countries of origin Banks may be able to detect informal value transfers involving unwitting participants by paying very close attention to the country of origin of the money in question. With that in mind one of the most competent ways to find money laundering is to look at regular.

Constantly moving them to elude detection.

The sources of the money in precise are felony and the money is invested in a method that makes it seem like clean cash and hide the id of the legal part of the money earned. Money laundering involves three stages. Constantly moving them to elude detection. The second stage in the money laundering process is referred to as layering. Money laundering is relatively easy to detect. Anti-money laundering is a framework for putting best practices into action in order to detect suspicious activity.

Source: blog.neufund.org

Once the funds have been placed into the financial system the criminals make it difficult for authorities to detect laundering activity. Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods. In monitoring and detecting any suspicious money laundering activities FIs are benefitting from data analytics technology. Once the funds have been placed into the financial system the criminals make it difficult for authorities to detect laundering activity. With a reliable digital ID system it is easier to track bad actors who are trying to conduct illegal money laundering activities.

Source: quora.com

Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods. The second stage in the money laundering process is referred to as layering. View on timesmachine TimesMachine is an exclusive benefit for home delivery and digital subscribers. Placement of illegal funds in a legitimate financial institution the layering of illegal and legal funds to obfuscate the origin of the illegal proceeds and integration of funds back to the criminal. The sources of the money in precise are felony and the money is invested in a method that makes it seem like clean cash and hide the id of the legal part of the money earned.

Source: researchgate.net

Source: researchgate.net

Certain securities products have few transactions and often customers have a web of account relationships across a securities providers business units. A key driver of this deficiency is the difficulty in detecting money laundering typol ogies in securities products since the sector is most vulnerable to the integration stage of money laundering. With a reliable digital ID system it is easier to track bad actors who are trying to conduct illegal money laundering activities. Placement of illegal funds in a legitimate financial institution the layering of illegal and legal funds to obfuscate the origin of the illegal proceeds and integration of funds back to the criminal. Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods.

Source: kyc2020.com

Source: kyc2020.com

Money laundering is relatively easy to detect. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. Constantly moving them to elude detection. Anti-money laundering is a framework for putting best practices into action in order to detect suspicious activity. Since 1990 money laundering itself has been a crimeand its easy to see why.

Source: shuftipro.com

Source: shuftipro.com

Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods. The second stage in the money laundering process is referred to as layering. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. Since 1990 money laundering itself has been a crimeand its easy to see why. With a reliable digital ID system it is easier to track bad actors who are trying to conduct illegal money laundering activities.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Among the three stages of money laundering ie placement layering and integration money laundering is easiest to detect at the placement stage. Each time exploiting loopholes or discrepancies in legislation and taking advantage of delays in judicial or police cooperation. Blockpass provides a solution which is. This is a complex web of transactions to move money into the financial system usually via offshore techniques. Paying close attention to countries of origin Banks may be able to detect informal value transfers involving unwitting participants by paying very close attention to the country of origin of the money in question.

Source: researchgate.net

Source: researchgate.net

Among the three stages of money laundering ie placement layering and integration money laundering is easiest to detect at the placement stage. With that in mind one of the most competent ways to find money laundering is to look at regular. The second stage in the money laundering process is referred to as layering. Money laundering involves three stages. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often.

Source: calert.info

Source: calert.info

Since 1990 money laundering itself has been a crimeand its easy to see why. View on timesmachine TimesMachine is an exclusive benefit for home delivery and digital subscribers. During this stage for example the money launderers may begin by moving funds electronically from one country to another then divide them into investments placed in advanced financial options or overseas markets. Money laundering is relatively easy to detect. With that in mind one of the most competent ways to find money laundering is to look at regular.

Source: linkurio.us

Source: linkurio.us

With that in mind one of the most competent ways to find money laundering is to look at regular. Money laundering involves three stages. The easier it is for criminals to spend illegal money undetected the more likely they are to commit crimes in the future. This is a complex web of transactions to move money into the financial system usually via offshore techniques. Once the funds have been placed into the financial system the criminals make it difficult for authorities to detect laundering activity.

Source: calert.info

Source: calert.info

Paying close attention to countries of origin Banks may be able to detect informal value transfers involving unwitting participants by paying very close attention to the country of origin of the money in question. Constantly moving them to elude detection. Blockpass provides a solution which is. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. With that in mind one of the most competent ways to find money laundering is to look at regular.

Source: slideshare.net

Source: slideshare.net

Money laundering is relatively easy to detect. Constantly moving them to elude detection. Money laundering is relatively easy to detect. This is most critical stage for any money launderer as the criminal can effectively mask his illegal. Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods.

Source: shuftipro.com

Source: shuftipro.com

Paying close attention to countries of origin Banks may be able to detect informal value transfers involving unwitting participants by paying very close attention to the country of origin of the money in question. A key driver of this deficiency is the difficulty in detecting money laundering typol ogies in securities products since the sector is most vulnerable to the integration stage of money laundering. Anti-money laundering is a framework for putting best practices into action in order to detect suspicious activity. Financial institutions today utilise AI for areas such as customer service risk management fraud detection and anti-money laundering while adhering. Each time exploiting loopholes or discrepancies in legislation and taking advantage of delays in judicial or police cooperation.

Source: bobsguide.com

Source: bobsguide.com

Constantly moving them to elude detection. View on timesmachine TimesMachine is an exclusive benefit for home delivery and digital subscribers. With a reliable digital ID system it is easier to track bad actors who are trying to conduct illegal money laundering activities. The sources of the money in precise are felony and the money is invested in a method that makes it seem like clean cash and hide the id of the legal part of the money earned. Blockpass provides a solution which is.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title easiest to detect money laundering activity by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas