15+ Efcc anti money laundering certificate ideas in 2021

Home » money laundering Info » 15+ Efcc anti money laundering certificate ideas in 2021Your Efcc anti money laundering certificate images are ready. Efcc anti money laundering certificate are a topic that is being searched for and liked by netizens today. You can Find and Download the Efcc anti money laundering certificate files here. Get all royalty-free images.

If you’re looking for efcc anti money laundering certificate pictures information related to the efcc anti money laundering certificate interest, you have come to the ideal site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

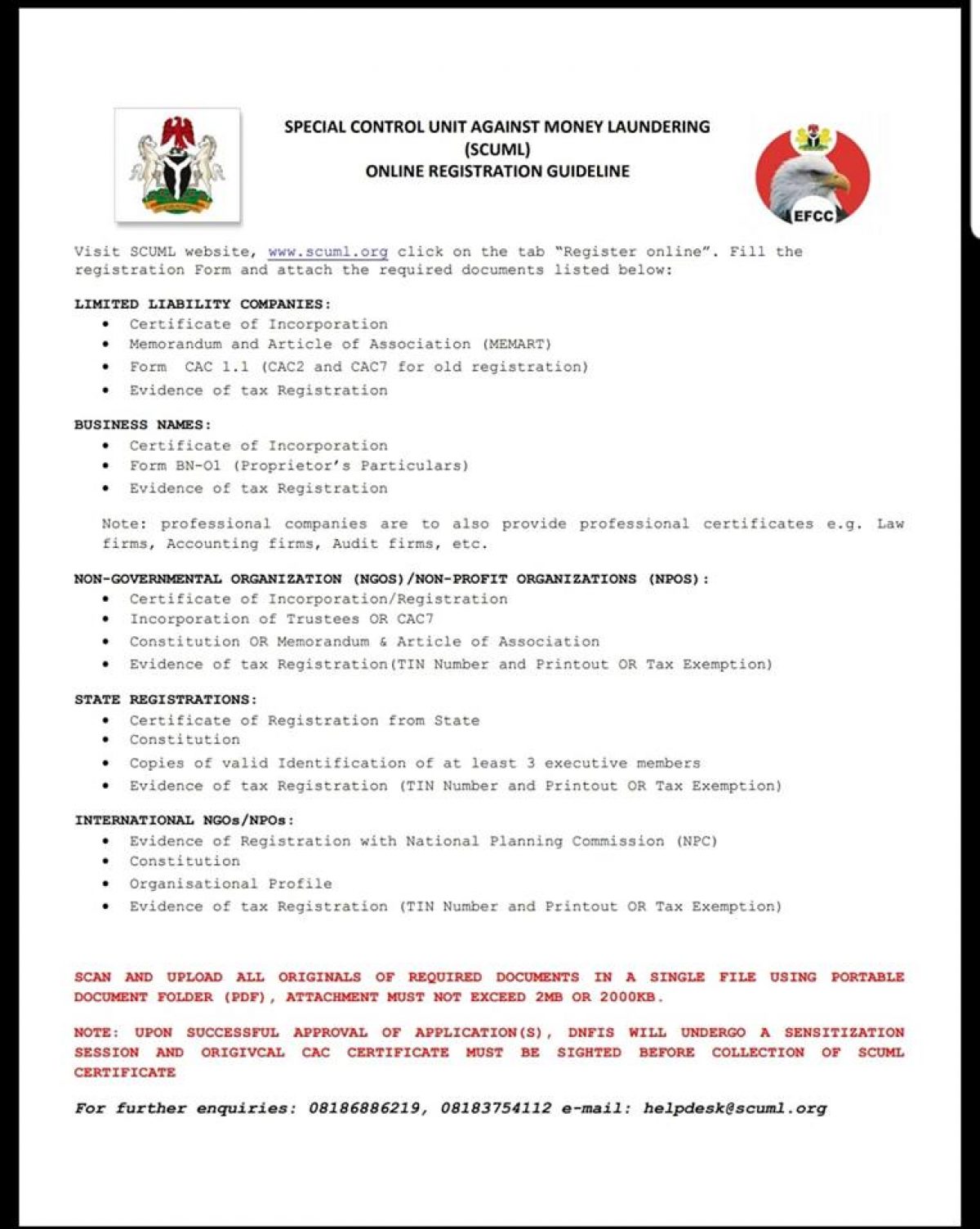

Efcc Anti Money Laundering Certificate. Financial Institutions should remain compliant with guidelines laid down by Financial Action. Certified AML Experts help financial institutions to oversee anti money laundering policies. CAMS Certified Anti-Money Laundering Specialist is the global gold standard in AML certifications with more than 40000 CAMS graduates worldwide. In SCUMLs efforts to serve as a structure for curtailing Money Laundering and Terrorist Financing in the DNFI sector and sanitizing the sector to create an enabling environment for promotion of commerce and investment it ensures effective supervision of DNFIs which includes amongst others registration inspection on a risk based-approach ensuring rendition of statutory reports cash-based transaction.

Sibshaa Sibshaac Twitter From twitter.com

Sibshaa Sibshaac Twitter From twitter.com

In SCUMLs efforts to serve as a structure for curtailing Money Laundering and Terrorist Financing in the DNFI sector and sanitizing the sector to create an enabling environment for promotion of commerce and investment it ensures effective supervision of DNFIs which includes amongst others registration inspection on a risk based-approach ensuring rendition of statutory reports cash-based transaction. While many banks and bankers may not worry or warn a customer when accepting deposits they sure will warn and demand for an Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before allowing withdrawals and operation of bank accounts. Our professional certification courses include 15 modules over a period of 15 weeks covering all the key elements of anti-money laundering countering the financing of terrorism and financial crimes prevention. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts. Certified AML Experts help financial institutions to oversee anti money laundering policies. Each class is 2h30.

This is handled by several law enforcement agencies regulators and stakeholders including the Economic and Financial Crimes Commission EFCC.

Often whenever there is a. Financial Institutions should remain compliant with guidelines laid down by Financial Action. This is handled by several law enforcement agencies regulators and stakeholders including the Economic and Financial Crimes Commission EFCC. They are trained on the topics like Trade Based Money Laundering KYC CTF etc. SCUML was created as part of measures for the implementation of the Financial Action Task. AMLFC Institute Professional Certifications.

Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. The primary aim of every business organization is to maximize shareholders value through an increase in profitability. SCUML was created as part of measures for the implementation of the Financial Action Task. Each class is 2h30.

This is handled by several law enforcement agencies regulators and stakeholders including the Economic and Financial Crimes Commission EFCC. SCUML was created as part of measures for the implementation of the Financial Action Task. Our professional certification courses include 15 modules over a period of 15 weeks covering all the key elements of anti-money laundering countering the financing of terrorism and financial crimes prevention. SCUML was established by the Federal Government in September 2005 in compliance with the provisions of the Money Laundering Prohibition Act 2004 which was subsequently repealed and amended to Money Laundering Prohibition Act 2011 as amended. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts.

Source: twitter.com

Source: twitter.com

So Special Control Unit against Money Laundering SCUML Certificate is a vital tool for opening and operating a bank account for many businesses and professionals in Nigeria. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. Banks EFCC and Anti-money Laundering Law. CAMS is currently available in 12 languages including Spanish. While many banks and bankers may not worry or warn a customer when accepting deposits they sure will warn and demand for an Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before allowing withdrawals and operation of bank accounts.

Source: twitter.com

Source: twitter.com

So Special Control Unit against Money Laundering SCUML Certificate is a vital tool for opening and operating a bank account for many businesses and professionals in Nigeria. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts. So Special Control Unit against Money Laundering SCUML Certificate is a vital tool for opening and operating a bank account for many businesses and professionals in Nigeria. This core business objective is often in conflict with the need to ensure compliance with applicable rules and regulations that govern business operations. Our professional certification courses include 15 modules over a period of 15 weeks covering all the key elements of anti-money laundering countering the financing of terrorism and financial crimes prevention.

Source: blog.jovago.com

Source: blog.jovago.com

Certified AML Experts help financial institutions to oversee anti money laundering policies. Financial Institutions should remain compliant with guidelines laid down by Financial Action. This core business objective is often in conflict with the need to ensure compliance with applicable rules and regulations that govern business operations. Our professional certification courses include 15 modules over a period of 15 weeks covering all the key elements of anti-money laundering countering the financing of terrorism and financial crimes prevention. CAMS Certified Anti-Money Laundering Specialist is the global gold standard in AML certifications with more than 40000 CAMS graduates worldwide.

Source: businesspost.ng

Source: businesspost.ng

The Commander of the Lagos Zonal Command of the Economic and Financial Crimes Commission EFCC Ahmed Ghali has urged Designated Non-Financial Institutions DNFIs to conduct their dealings in line with the Anti-money LaunderingCounter Terrorism Financing AMLCFT Laws. SCUML was established by the Federal Government in September 2005 in compliance with the provisions of the Money Laundering Prohibition Act 2004 which was subsequently repealed and amended to Money Laundering Prohibition Act 2011 as amended. The requirements candidates should have to take the CAM exam includes Firstly the aspirants need to earn at least 40 credits of college coursework. SCUML was created as part of measures for the implementation of the Financial Action Task. Certified Anti-Money Laundering Specialist Requirments.

The primary aim of every business organization is to maximize shareholders value through an increase in profitability. AMLFC Institute Professional Certifications. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. The requirements candidates should have to take the CAM exam includes Firstly the aspirants need to earn at least 40 credits of college coursework. This core business objective is often in conflict with the need to ensure compliance with applicable rules and regulations that govern business operations.

Source: learnnigerianlaws.com

Source: learnnigerianlaws.com

Anti Money Laundering Certificate holders play a crucial role in compliance. CAMS is currently available in 12 languages including Spanish. In SCUMLs efforts to serve as a structure for curtailing Money Laundering and Terrorist Financing in the DNFI sector and sanitizing the sector to create an enabling environment for promotion of commerce and investment it ensures effective supervision of DNFIs which includes amongst others registration inspection on a risk based-approach ensuring rendition of statutory reports cash-based transaction. So Special Control Unit against Money Laundering SCUML Certificate is a vital tool for opening and operating a bank account for many businesses and professionals in Nigeria. So Special Control Unit against Money Laundering SCUML Certificate is a vital tool for opening and operating a bank account for many businesses and professionals in Nigeria.

Source: twitter.com

Source: twitter.com

While many banks and bankers may not worry or warn a customer when accepting deposits they sure will warn and demand for an Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before allowing withdrawals and operation of bank accounts. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts. The Commander of the Lagos Zonal Command of the Economic and Financial Crimes Commission EFCC Ahmed Ghali has urged Designated Non-Financial Institutions DNFIs to conduct their dealings in line with the Anti-money LaunderingCounter Terrorism Financing AMLCFT Laws. Each class is 2h30. CAMS is currently available in 12 languages including Spanish.

Source: sothawaca.blogspot.com

Source: sothawaca.blogspot.com

EFCC Charges DNFIs on Anti-money Laundering Terrorism Financing The Commander of the Lagos Zonal Command of the Economic and Financial Crimes Commission EFCC Ahmed Ghali has urged Designated Non-Financial Institutions DNFIs to conduct their dealings in line with the Anti-money LaunderingCounter Terrorism Financing AMLCFT Laws. EFCC Charges DNFIs on Anti-money Laundering Terrorism Financing The Commander of the Lagos Zonal Command of the Economic and Financial Crimes Commission EFCC Ahmed Ghali has urged Designated Non-Financial Institutions DNFIs to conduct their dealings in line with the Anti-money LaunderingCounter Terrorism Financing AMLCFT Laws. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts. The Commander of the Lagos Zonal Command of the Economic and Financial Crimes Commission EFCC Ahmed Ghali has urged Designated Non-Financial Institutions DNFIs to conduct their dealings in line with the Anti-money LaunderingCounter Terrorism Financing AMLCFT Laws. This is handled by several law enforcement agencies regulators and stakeholders including the Economic and Financial Crimes Commission EFCC.

Source: naijabusiness.com.ng

Source: naijabusiness.com.ng

They are trained on the topics like Trade Based Money Laundering KYC CTF etc. Certified Anti-Money Laundering Specialist Requirments. Each class is 2h30. The primary aim of every business organization is to maximize shareholders value through an increase in profitability. Certified AML Experts help financial institutions to oversee anti money laundering policies.

EFCC Academy Court Jails Man for SCUML Certificate Forgery The anti money laundering agency Special Control Unit Against Money Laundering SCUML domiciled in the Economic and Financial Crimes Commission has secured the conviction of one Ebenezer Joshua before Justice Abbas Ahman of the Kebbi State High Court. Banks EFCC and Anti-money Laundering Law. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts. EFCC Academy Court Jails Man for SCUML Certificate Forgery The anti money laundering agency Special Control Unit Against Money Laundering SCUML domiciled in the Economic and Financial Crimes Commission has secured the conviction of one Ebenezer Joshua before Justice Abbas Ahman of the Kebbi State High Court. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits.

Source: banknaija.com

Source: banknaija.com

CAMS Certified Anti-Money Laundering Specialist is the global gold standard in AML certifications with more than 40000 CAMS graduates worldwide. We offer self-study and enhanced learning packages to get you qualified in as little as three months. So Special Control Unit against Money Laundering SCUML Certificate is a vital tool for opening and operating a bank account for many businesses and professionals in Nigeria. This core business objective is often in conflict with the need to ensure compliance with applicable rules and regulations that govern business operations. There are several professionals and businesses that must obtain Anti-Money Laundering certificate often referred to as SCUML CertificateEFCC Clearance before they can operate bank accounts.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title efcc anti money laundering certificate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas