20++ Efcc money laundering act info

Home » money laundering idea » 20++ Efcc money laundering act infoYour Efcc money laundering act images are ready in this website. Efcc money laundering act are a topic that is being searched for and liked by netizens now. You can Get the Efcc money laundering act files here. Get all free photos.

If you’re looking for efcc money laundering act images information connected with to the efcc money laundering act topic, you have come to the ideal blog. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Efcc Money Laundering Act. Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime. Nigeria being a cash-based economy vested the supervisory. The Commission is empowered to prevent investigate prosecute and penalise economic and financial crimes and is charged with the responsibility of enforcing the provisions of other laws and regulations relating to economic and financial crimes including. The banking institutions like other business entities often pay lip service to the issue of compliance with anti-money laundering AML regulations.

8 Things Nigerians Should Know About The Money Laundering Act 2011 Lawpadi From lawpadi.com

8 Things Nigerians Should Know About The Money Laundering Act 2011 Lawpadi From lawpadi.com

B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. The EFCC Act is an Act mandates the EFCC to combat financial and economic crimes. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. The Money Laundering Act 1995 The Money Laundering Prohibition act 2004. The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. One of the Federal laws is the Money Laundering Prohibition Act 2011 which among other things prohibits cash transactions and mandates Suspicious Transaction Reports to be reported to the Economic and Financial Crimes Commission EFCC.

The Commission is empowered to prevent investigate prosecute and penalise economic and financial crimes and is charged with the responsibility of enforcing the provisions of other laws and regulations relating to economic and financial crimes including.

According to the charge EFCC alleges that the defendants accepted cash payments above the threshold set by the Money Laundering Act without going through a financial institution. Such cases include infractions that are contrary to the provisions of the Commissions enabling law. Some of the laws include the Money. The commission accused the defendants of conspiring to commit an illegal act of accepting cash payments in the aggregate sum of N3388 million from the House of Assembly without going through a financial. Money Laundering Allegation. The commission is empowered to prevent investigate prosecute penalize economic and financial crimes and is charged with the responsibility of enforcing the praising of other laws regulating relating to economic financial crimes including.

Source: slidetodoc.com

Source: slidetodoc.com

ESTABLISHMENT ACT 2004 EXPLANATORY MEMORANDUM This Act provides for the establishment of the Economic and Financial Crimes Commission charged with the responsibility for the enforcement of all economic and financial crimes laws among other things. While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts. The commission is empowered to prevent investigate prosecute penalize economic and financial crimes and is charged with the responsibility of enforcing the praising of other laws regulating relating to economic financial crimes including. MONEY LAUNDERING PROHIBITION ACT 2011 EXPLANATORY MEMORANDUM This Act- a provides for the repeal of the Money Laundering Act 2004 and enactment of Money Laundering Prohibition Act 2011. The Establishment Act The Act mandates the EFCC to combat financial and economic crimes.

Source: lawpadi.com

Source: lawpadi.com

The EFCC was established on April 13 2003. The EFCC Act 2004 as well as a posse of other laws which the Commission has direct responsibility for their enforcement. Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. EFCCs non-service of charge stalls arraignment of Oduah others.

B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. The EFCC is ready to deal with the individuals groups and organisations that conspire with some bad eggs among us to perpetrate the act of money laundering and terrorist financing he said He further call on them to encourage their Designated Non- Financial Institutions DNFIs customers to register their businesses with the Special. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme.

The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. Money Laundering Allegation. Of the Money Laundering Prohibition Act. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. ESTABLISHMENT ACT 2004 EXPLANATORY MEMORANDUM This Act provides for the establishment of the Economic and Financial Crimes Commission charged with the responsibility for the enforcement of all economic and financial crimes laws among other things.

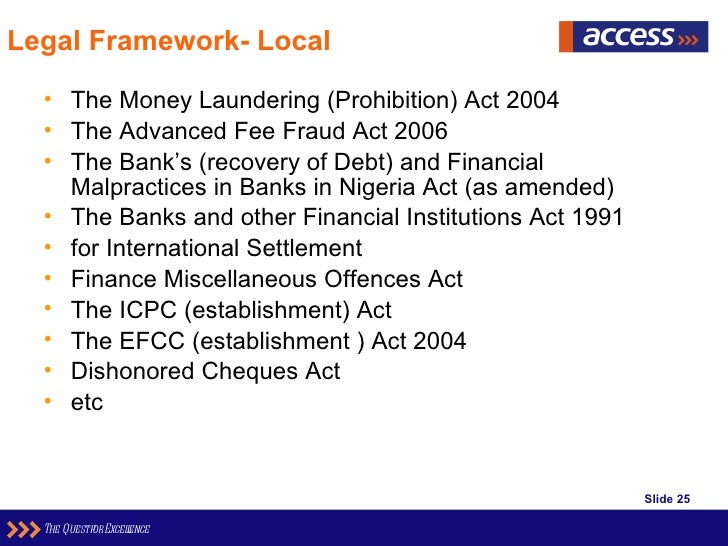

Source: slideshare.net

Source: slideshare.net

The EFCC Act is an Act mandates the EFCC to combat financial and economic crimes. One of the Federal laws is the Money Laundering Prohibition Act 2011 which among other things prohibits cash transactions and mandates Suspicious Transaction Reports to be reported to the Economic and Financial Crimes Commission EFCC. The EFCC was established on April 13 2003. EFCCs non-service of charge stalls arraignment of Oduah others. While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts.

Source:

Source:

The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011. Money Laundering Allegation. With this rate of scans in Nigeria financial sector the law enforcement decided to come up with legislative act called the money laundering prohibition Act 2004 this was followed by the Central Bank of Nigeria CBN Anti-money laundering compliance manual guidelines from Economic and Financial Crimes Commission EFCC 2003 Independent. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme.

Source: slidetodoc.com

Source: slidetodoc.com

The EFCC is ready to deal with the individuals groups and organisations that conspire with some bad eggs among us to perpetrate the act of money laundering and terrorist financing he said He further call on them to encourage their Designated Non- Financial Institutions DNFIs customers to register their businesses with the Special. EFCCs non-service of charge stalls arraignment of Oduah others. The banking institutions like other business entities often pay lip service to the issue of compliance with anti-money laundering AML regulations. With this rate of scans in Nigeria financial sector the law enforcement decided to come up with legislative act called the money laundering prohibition Act 2004 this was followed by the Central Bank of Nigeria CBN Anti-money laundering compliance manual guidelines from Economic and Financial Crimes Commission EFCC 2003 Independent. Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime.

The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. The EFCC was established on April 13 2003. The Commission is empowered to prevent investigate prosecute and penalise economic and financial crimes and is charged with the responsibility of enforcing the provisions of other laws and regulations relating to economic and financial crimes including. The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act.

Source: stephenlegal.ng

Source: stephenlegal.ng

While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts. When was the EFCC established. The Economic and Financial Crimes Commission EFCC is a Nigerian law enforcement agency that is accountable for the investigation of economic and financial crimes such as advance fee fraud also known as 419 fraud money laundering and embezzlements. B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. The commission is empowered to prevent investigate prosecute penalize economic and financial crimes and is charged with the responsibility of enforcing the praising of other laws regulating relating to economic financial crimes including.

The banking institutions like other business entities often pay lip service to the issue of compliance with anti-money laundering AML regulations. With this rate of scans in Nigeria financial sector the law enforcement decided to come up with legislative act called the money laundering prohibition Act 2004 this was followed by the Central Bank of Nigeria CBN Anti-money laundering compliance manual guidelines from Economic and Financial Crimes Commission EFCC 2003 Independent. B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. The Establishment Act The Act mandates the EFCC to combat financial and economic crimes. The Money Laundering Act 1995 The Money Laundering Prohibition act 2004.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

Some of the laws include the Money. The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. Some of the laws include the Money. The commission is empowered to prevent investigate prosecute penalize economic and financial crimes and is charged with the responsibility of enforcing the praising of other laws regulating relating to economic financial crimes including.

The Economic and Financial Crimes Commission EFCC is a Nigerian law enforcement agency that is accountable for the investigation of economic and financial crimes such as advance fee fraud also known as 419 fraud money laundering and embezzlements. There are several notable money laundering cases in Nigeria. According to the charge EFCC alleges that the defendants accepted cash payments above the threshold set by the Money Laundering Act without going through a financial institution. The EFCC was established on April 13 2003. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme.

Source: learnnigerianlaws.com

Source: learnnigerianlaws.com

With this rate of scans in Nigeria financial sector the law enforcement decided to come up with legislative act called the money laundering prohibition Act 2004 this was followed by the Central Bank of Nigeria CBN Anti-money laundering compliance manual guidelines from Economic and Financial Crimes Commission EFCC 2003 Independent. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. The Economic and Financial Crimes Commission EFCC Lagos Zonal office on April 10 2019 arraigned one Saheed Hammed Hussain alongside his companies SH Concept Limited and America House Hold Limited before Justice Mohammed Liman of the Federal High Court sitting in Ikoyi Lagos on a three-count charge bordering on money laundering. With this rate of scans in Nigeria financial sector the law enforcement decided to come up with legislative act called the money laundering prohibition Act 2004 this was followed by the Central Bank of Nigeria CBN Anti-money laundering compliance manual guidelines from Economic and Financial Crimes Commission EFCC 2003 Independent. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title efcc money laundering act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information