16+ Effects of money laundering in insurance business ideas in 2021

Home » money laundering idea » 16+ Effects of money laundering in insurance business ideas in 2021Your Effects of money laundering in insurance business images are ready in this website. Effects of money laundering in insurance business are a topic that is being searched for and liked by netizens today. You can Get the Effects of money laundering in insurance business files here. Get all free vectors.

If you’re searching for effects of money laundering in insurance business pictures information related to the effects of money laundering in insurance business interest, you have pay a visit to the right blog. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

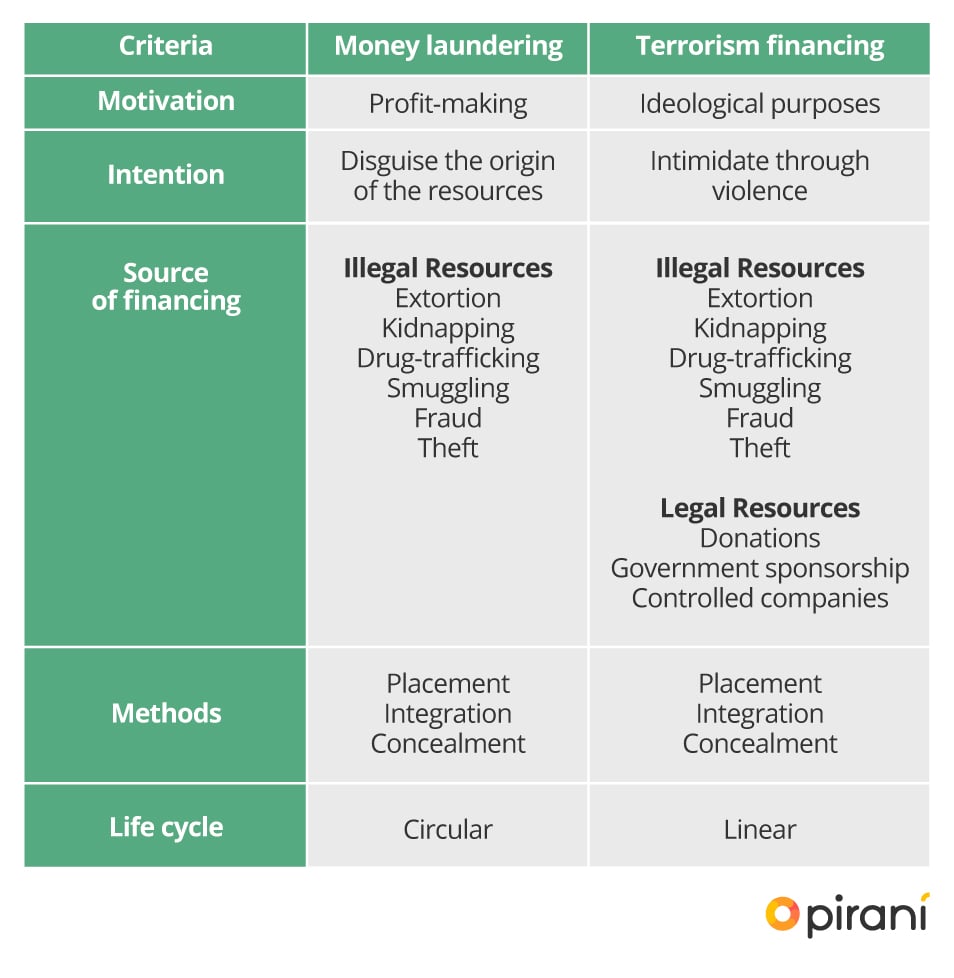

Effects Of Money Laundering In Insurance Business. Effects on the Economy. Ultimately laundered money flows into global financial systems where it can undermine national economies and currencies. The Proceeds of Crime and Anti-Money Laundering Act 2009 defines financial institutions that have FRC reporting obligations and that includes any person or entity which conducts a business. Money laundering and terrorist financing can impair the efficiency of a countrys financial sector.

What Is The Real Money Laundering Risk In Life Insurance High Risk Low Risk Or No Risk That Is The Question Acams Today From acamstoday.org

What Is The Real Money Laundering Risk In Life Insurance High Risk Low Risk Or No Risk That Is The Question Acams Today From acamstoday.org

Ultimately laundered money flows into global financial systems where it can undermine national economies and currencies. It makes an integral part of organized crime. Money Laundering in the Insurance Industry How Does It Happen. Funds appear to originate from somewhere other than their true origins. Effects on the Economy. Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates.

The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract.

Money launderers ultimately make businesses much less productive leading to lower levels of money and tax revenue for the country. Money launderers ultimately make businesses much less productive leading to lower levels of money and tax revenue for the country. The negative effects of money laundering on economic development are difficult to measure but it is obvious that such activity seriously damages. In short money laundering aims to disguise money made illegally by working it into a legitimate financial system such as a bank Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks in the USA as of February 2014. According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. They can adversely affect the stability of banks or other financial institutions individually such as securities companies and insurance companies.

Source:

Instead the victims money fell into the hands of a thief who cares about no one but himself and his interests. Effects on the Economy. Money launderers ultimately make businesses much less productive leading to lower levels of money and tax revenue for the country. The Proceeds of Crime and Anti-Money Laundering Act 2009 defines financial institutions that have FRC reporting obligations and that includes any person or entity which conducts a business. Money Laundering in the Insurance Industry How Does It Happen.

Source: cl.pinterest.com

Source: cl.pinterest.com

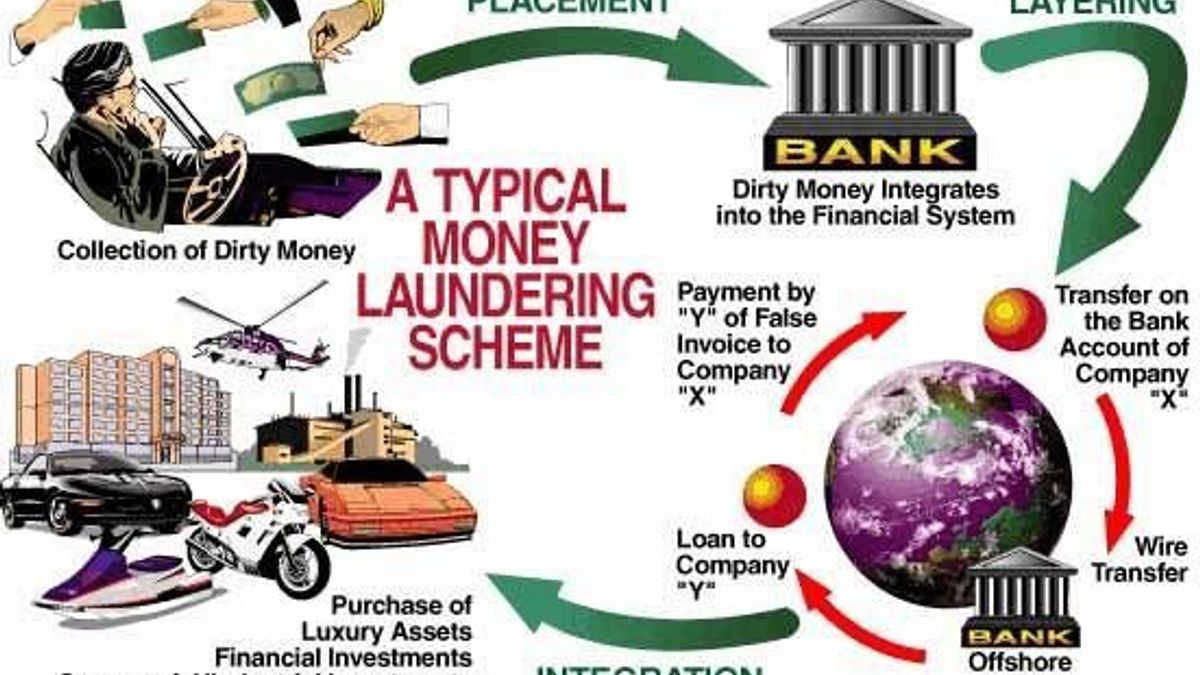

How Money Laundering Works. Unchecked money laundering can erode the integrity of a nations financial institutions. Effects on the Economy. Funds appear to originate from somewhere other than their true origins. Individuals may turn enterprises which were initially productive into sterile ones just to launder money.

Source: pinterest.com

Source: pinterest.com

Funds appear to originate from somewhere other than their true origins. In short money laundering aims to disguise money made illegally by working it into a legitimate financial system such as a bank Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks in the USA as of February 2014. The negative effects of money laundering on economic development are difficult to measure but it is obvious that such activity seriously damages. According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses.

Source: piranirisk.com

Source: piranirisk.com

In short money laundering aims to disguise money made illegally by working it into a legitimate financial system such as a bank Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks in the USA as of February 2014. Apart from this insurance intermediaries like agents and brokers who are an important direct distribution channel for the sector are easily subject to exploitation by money launderers The practical implication of this paper is to stress the importance of detecting signs of money laundering activities as early prevention is the best alternative for insurance companies in countering money laundering in the industry The formal reporting measures put in place by the AntiMoney. Ultimately laundered money flows into global financial systems where it can undermine national economies and currencies. Effects on the Economy. Justice will prevail and hopefully restore some trust back to the victims.

Source:

Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently. The Proceeds of Crime and Anti-Money Laundering Act 2009 defines financial institutions that have FRC reporting obligations and that includes any person or entity which conducts a business. Funds appear to originate from somewhere other than their true origins. Within the insurance system money launderers can structure transactions force employees to collaborate and enforce appropriate reports or set up apparently legitimate front insurance organizations to launder money. Some of the red flags which may indicate money laundering include.

Source: bi.go.id

Source: bi.go.id

Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently. In short money laundering aims to disguise money made illegally by working it into a legitimate financial system such as a bank Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks in the USA as of February 2014. Paying a large top-up into an existing life insurance policy Purchasing a general insurance policy then making a claim soon after. The negative effects of money laundering on economic development are difficult to measure but it is obvious that such activity seriously damages. Some of the red flags which may indicate money laundering include.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

Effects on the Economy. Money Laundering in the Insurance Industry How Does It Happen. The Proceeds of Crime and Anti-Money Laundering Act 2009 defines financial institutions that have FRC reporting obligations and that includes any person or entity which conducts a business. The coronavirus pandemic can have some impact on the anti-money laundering process of financial institutions throughout the world. Instead the victims money fell into the hands of a thief who cares about no one but himself and his interests.

Source: acamstoday.org

Source: acamstoday.org

Ultimately laundered money flows into global financial systems where it can undermine national economies and currencies. Effects on the Economy. How Money Laundering Works. Money Laundering in the Insurance Industry How Does It Happen. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently.

It makes an integral part of organized crime. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. This process is used by criminals terrorist other organizations to legitimize funds andor obscure origin. Money laundering and terrorist financing can impair the efficiency of a countrys financial sector. The Proceeds of Crime and Anti-Money Laundering Act 2009 defines financial institutions that have FRC reporting obligations and that includes any person or entity which conducts a business.

Source: jagranjosh.com

Source: jagranjosh.com

Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Unchecked money laundering can erode the integrity of a nations financial institutions. Instead the victims money fell into the hands of a thief who cares about no one but himself and his interests. Money Laundering in the Insurance Industry How Does It Happen. This process is used by criminals terrorist other organizations to legitimize funds andor obscure origin.

Source: pinterest.com

Source: pinterest.com

Unchecked money laundering can erode the integrity of a nations financial institutions. Money launderers ultimately make businesses much less productive leading to lower levels of money and tax revenue for the country. EFFECTS OF MONEY LAUNDERING IN KENYA 10 INTRODUCTION Money is laundered whenever ownership is concealed. They can adversely affect the stability of banks or other financial institutions individually such as securities companies and insurance companies. Some of the red flags which may indicate money laundering include.

Source: bi.go.id

EFFECTS OF MONEY LAUNDERING IN KENYA 10 INTRODUCTION Money is laundered whenever ownership is concealed. Unchecked money laundering can erode the integrity of a nations financial institutions. Furthermore organisations laundering money have a fundamental unfair businesses advantage. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Money laundering and terrorist financing can impair the efficiency of a countrys financial sector.

Source: pinterest.com

Source: pinterest.com

Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Money laundering and terrorist financing can impair the efficiency of a countrys financial sector. The negative effects of money laundering on economic development are difficult to measure but it is obvious that such activity seriously damages. Within the insurance system money launderers can structure transactions force employees to collaborate and enforce appropriate reports or set up apparently legitimate front insurance organizations to launder money. This process is used by criminals terrorist other organizations to legitimize funds andor obscure origin.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title effects of money laundering in insurance business by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information