15++ Enterprise customer risk rating info

Home » money laundering idea » 15++ Enterprise customer risk rating infoYour Enterprise customer risk rating images are ready. Enterprise customer risk rating are a topic that is being searched for and liked by netizens today. You can Download the Enterprise customer risk rating files here. Find and Download all royalty-free vectors.

If you’re searching for enterprise customer risk rating pictures information related to the enterprise customer risk rating keyword, you have visit the right blog. Our website always gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

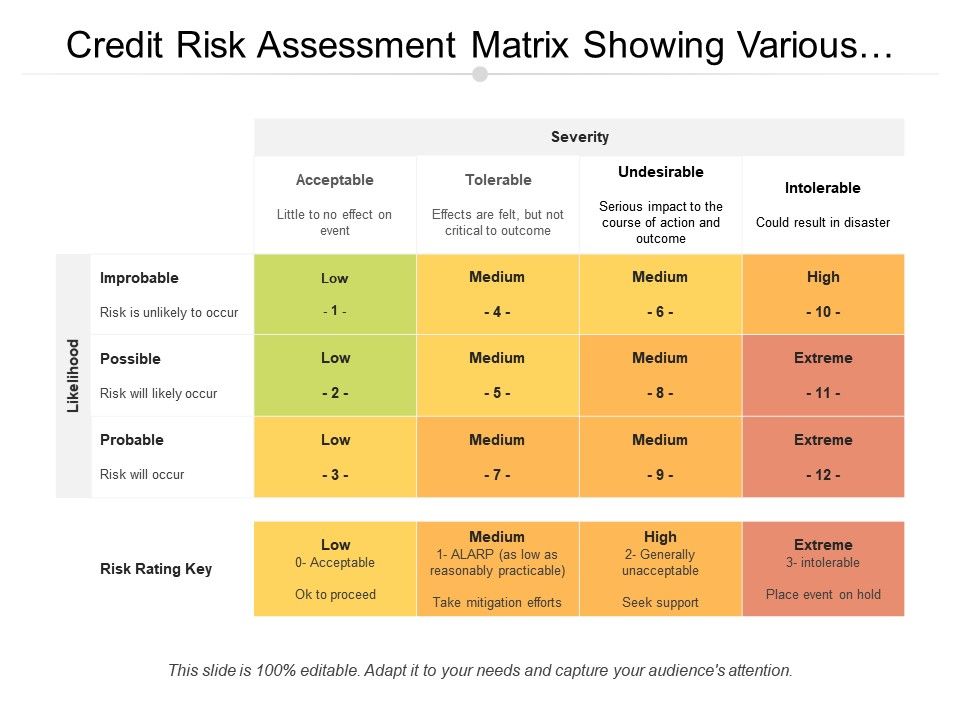

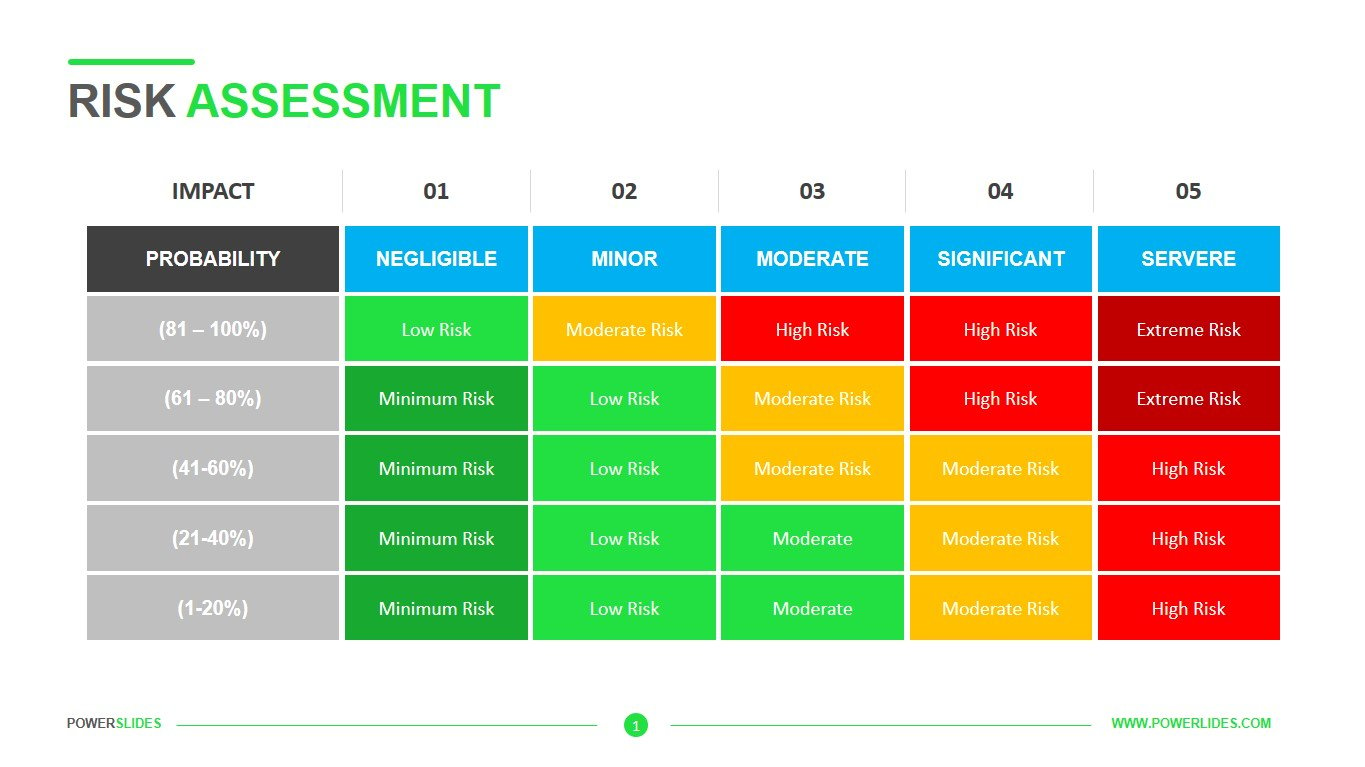

Enterprise Customer Risk Rating. Delivery Channels Risk or Interface Risk. Therefore your risk assessments must take into account the following risk categories. Risk Factor Rating Score Economic activity or business of the customer is considered high risk H 3 Economic activity or business of the customer is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. Particular customer types geographic locations products services channels and transactions generally pose a higher risk of money laundering and terrorism financing due to their vulnerability.

Risk Assessment Form Templates Risk Analysis Risk Management Project Management Templates From pinterest.com

Risk Assessment Form Templates Risk Analysis Risk Management Project Management Templates From pinterest.com

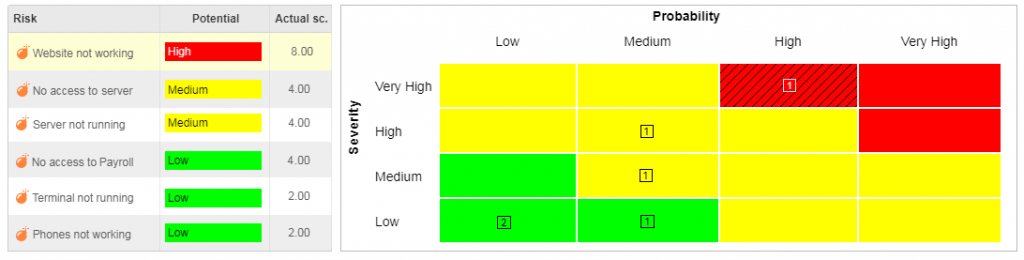

As 20 101 x 100 198 the rating for segment B 0 to 20 new clients will always be low. It assesses how risks affect not just specific siloed units but also how risks develop across units and operations of an. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Enterprise risk management ERM is a holistic top-down approach. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Customer risk rating and business.

Certain types of customers may pose heightened risk. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. This component contains a trend analysis for each of the VPR levels. Functions of a Credit Risk Rating System. Certain types of customers may pose heightened risk. This allows bank management and examiners to monitor changes and trends.

Source: slideteam.net

Source: slideteam.net

By risk category financial operational strategic compliance and sub-category market credit liquidity etc for business units corporate functions and capital projects. This component contains a trend analysis for each of the VPR levels. Through customer due diligence CDD a financial institution gains an understanding of the types of transactions in which a customer is likely to engage. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. This case study illustrates a methodology to rate the risk arising from client.

Source: pinterest.com

Source: pinterest.com

Some firms only have low and high risk classification. These ranges are beyond the maximum possible that can be computed. Customer and entity risk is extremely complex. By risk category financial operational strategic compliance and sub-category market credit liquidity etc for business units corporate functions and capital projects. Where flaws are identified in the design of the EWRA rating methodologies banks should.

Source: pinterest.com

Source: pinterest.com

This component contains a trend analysis for each of the VPR levels. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. Customer risk rating and business. Customer and entity risk is extremely complex. Geographical Risk to be tackled separately.

Source: pinterest.com

Source: pinterest.com

Some firms only have low and high risk classification. In its assessment of inherent AML risk at the enterprise level an FI should evaluate AML and OFAC risk inherent in its customers geographies products services channels and transactions. Risk Factor Rating Score Economic activity or business of the customer is considered high risk H 3 Economic activity or business of the customer is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. Particular customer types geographic locations products services channels and transactions generally pose a higher risk of money laundering and terrorism financing due to their vulnerability.

Source: id.pinterest.com

Source: id.pinterest.com

This case study illustrates a methodology to rate the risk arising from client. Risk Factor Rating Score Economic activity or business of the customer is considered high risk H 3 Economic activity or business of the customer is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. Where flaws are identified in the design of the EWRA rating methodologies banks should. While each risk captured may be important to management. In its assessment of inherent AML risk at the enterprise level an FI should evaluate AML and OFAC risk inherent in its customers geographies products services channels and transactions.

Source: pinterest.com

Source: pinterest.com

Particular customer types geographic locations products services channels and transactions generally pose a higher risk of money laundering and terrorism financing due to their vulnerability. As 20 101 x 100 198 the rating for segment B 0 to 20 new clients will always be low. An assessment helps businesses to adapt their approach of managing risks to meet the demands of the evolving financial. Risk Factor Rating Score Economic activity or business of the customer is considered high risk H 3 Economic activity or business of the customer is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. These ranges are beyond the maximum possible that can be computed.

Source: researchgate.net

Source: researchgate.net

The identification appraisal and supervision of risks of an entity. These ranges are beyond the maximum possible that can be computed. While each risk captured may be important to management. At a practical level this means that there will be more factors relevant to risk assessment. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making.

Source: pinterest.com

Source: pinterest.com

A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. The reproduction or modification is prohibited. Enterprise-Wide Risk Assessment EWRA or simply Enterprise Risk Assessment ERA or Overall Risk Assessment or Enterprise Risk Management ERM are all terms that describe the same process. Customer risk rating and business. Based on the customers risk score the KYC system determines the next review date.

Source: powerslides.com

Source: powerslides.com

Particular customer types geographic locations products services channels and transactions generally pose a higher risk of money laundering and terrorism financing due to their vulnerability. By risk category financial operational strategic compliance and sub-category market credit liquidity etc for business units corporate functions and capital projects. These ranges are beyond the maximum possible that can be computed. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. The approach to risk assessment will need to utilise a risk-based approach at the enterprise level enterprise-wide risk assessment EWRA.

Source: pinterest.com

Source: pinterest.com

As 20 101 x 100 198 the rating for segment B 0 to 20 new clients will always be low. As 20 101 x 100 198 the rating for segment B 0 to 20 new clients will always be low. The identification appraisal and supervision of risks of an entity. Geographical Risk to be tackled separately. VPR Summary - Vulnerability Trending over the last 90 days.

Source: blog.softexpert.com

Source: blog.softexpert.com

A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Enterprise risk management ERM is a holistic top-down approach. An assessment helps businesses to adapt their approach of managing risks to meet the demands of the evolving financial. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. This case study illustrates a methodology to rate the risk arising from client.

Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. Functions of a Credit Risk Rating System. Based on the customers risk score the KYC system determines the next review date. In its assessment of inherent AML risk at the enterprise level an FI should evaluate AML and OFAC risk inherent in its customers geographies products services channels and transactions.

Source: id.pinterest.com

Source: id.pinterest.com

Some firms only have low and high risk classification. Product Service and Transaction Risk. The identification appraisal and supervision of risks of an entity. Therefore your risk assessments must take into account the following risk categories. In its assessment of inherent AML risk at the enterprise level an FI should evaluate AML and OFAC risk inherent in its customers geographies products services channels and transactions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title enterprise customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information