11+ Eu blacklist of countries at risk of money laundering ideas

Home » money laundering idea » 11+ Eu blacklist of countries at risk of money laundering ideasYour Eu blacklist of countries at risk of money laundering images are available in this site. Eu blacklist of countries at risk of money laundering are a topic that is being searched for and liked by netizens now. You can Download the Eu blacklist of countries at risk of money laundering files here. Get all free photos and vectors.

If you’re searching for eu blacklist of countries at risk of money laundering pictures information linked to the eu blacklist of countries at risk of money laundering interest, you have come to the ideal site. Our website always gives you hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

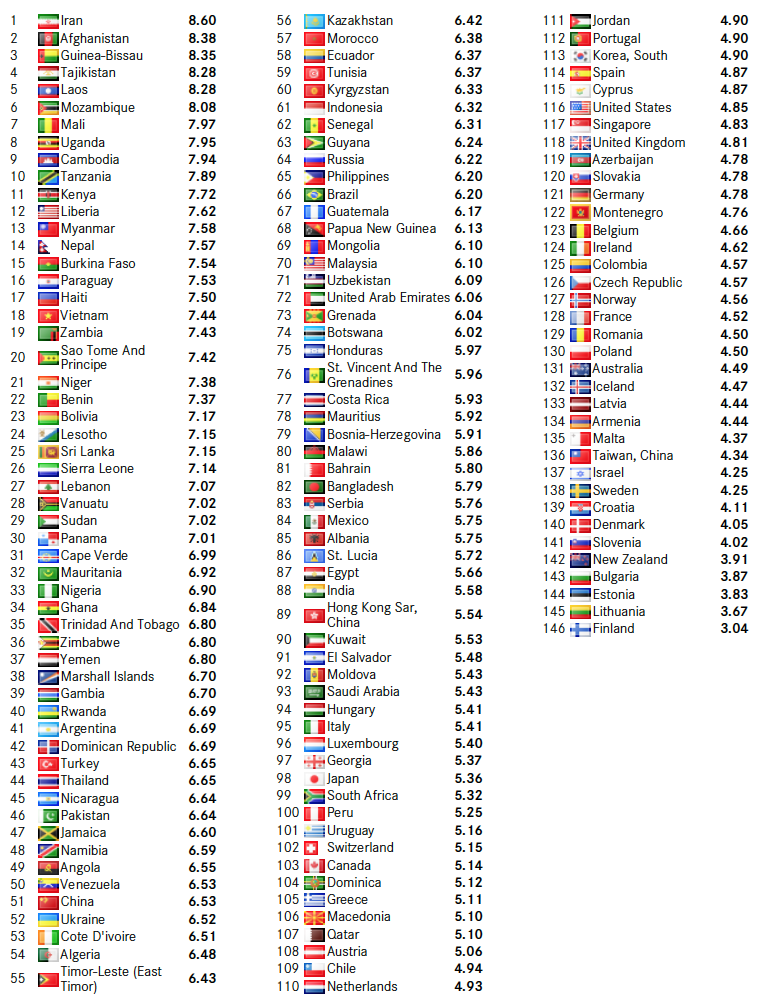

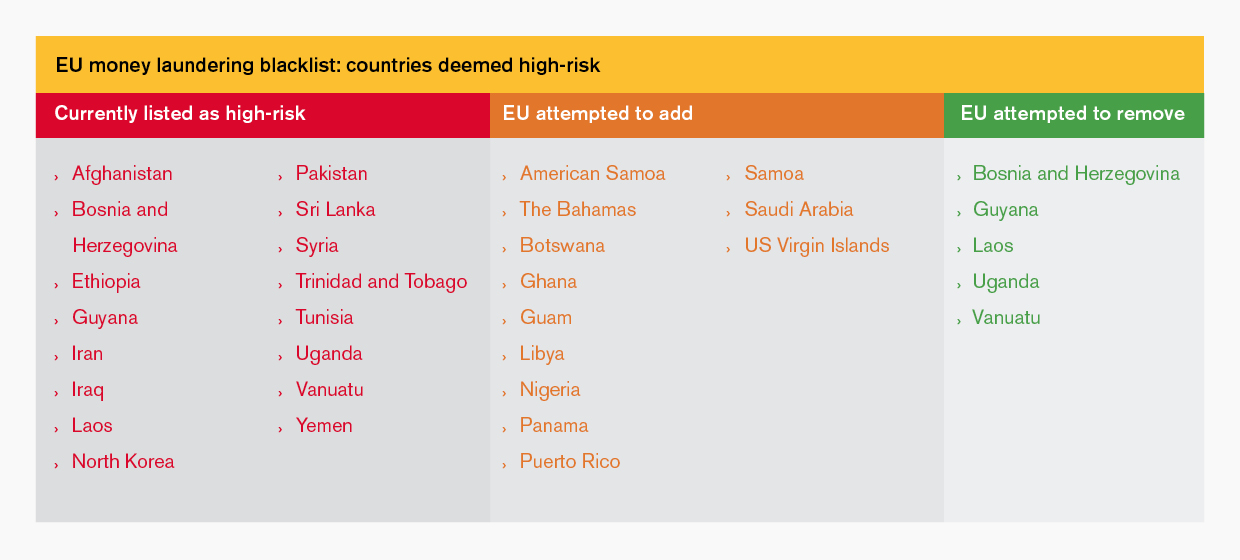

Eu Blacklist Of Countries At Risk Of Money Laundering. Included on the list are Botswana Ghana Zimbabwe and Mauritius. Tunisia Sri Lanka and Trinidad and Tobago added to money laundering blacklist List is part of EUs toolkit to protect itself against money laundering terrorist financing Long record of disagreement between Parliament and Commission over compilation. EU names four US territories on money-laundering blacklist. This second update makes a minor change to the previous list by dropping Guyana and adding Ethiopia.

Anti Money Laundering In Indonesia What You Need To Know From complyadvantage.com

Anti Money Laundering In Indonesia What You Need To Know From complyadvantage.com

Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism. The EU should have an autonomous process for judging whether countries are at high-risk of money laundering say committee MEPs after rejecting for a second time by 61 votes to 7 with 32 abstentions a blacklist of countries drawn up by the EU Commission. The Commission currently identifies eleven countries including Afghanistan Iraq Bosnia and Herzegovina and Syria which it judges to be deficient in countering money laundering and terrorist financing. After Wednesdays decision Parliament may meet to discuss the EU. This second update makes a minor change to the previous list by dropping Guyana and adding Ethiopia. The EU is revising its list of countries at high risk of money laundering as part of a renewed drive to tackle corruption and CFOs will soon be required to adhere to enhanced due-diligence requirements when conducting transactions with these countries.

The Commission says that they are guided by the criteria listed in the 4th Anti-Money Laundering Directive which does not explicitly mention the issue.

EU list of high-risk third countries. MEPs in plenary rejected a previous European Commission blacklist because it failed to include countries which were suspected of being involved in tax crimes. Sri Lanka and Trinidad and Tobago were also added to the blacklist. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The 23 jurisdictions are. Last Friday European Union member states unanimously rejected a blacklist of countries identified as posing a high risk of money laundering or terrorist financing.

Source: wikiwand.com

Source: wikiwand.com

New delegated act on high-risk third countries. Methodology for identifying high-risk third countries. The Commission is responsible for producing. EUs anti-money laundering country blacklist raises US ire. Panama was the only other country from Latin America to join the list.

Source: bnreport.com

Source: bnreport.com

The four countries are Botswana Ghana Mauritius and Zimbabwe. This second update makes a minor change to the previous list by dropping Guyana and adding Ethiopia. New delegated act on high-risk third countries. Been named on the EUs blacklist of territories at high risk of money laundering. Fifth Anti-Money Laundering Directive.

Source: ctmfile.com

Source: ctmfile.com

On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. EU list of high-risk third countries. The Commission currently identifies eleven countries including Afghanistan Iraq Bosnia and Herzegovina and Syria which it judges to be deficient in countering money laundering and terrorist financing. EU names four US territories on money-laundering blacklist. The European Commission has published its list of high-risk third countries dubbed the blacklist which it says have weak anti-money laundering and terrorist financing regimes.

Source: wikiwand.com

Source: wikiwand.com

The revised blacklist was originally published by the European Commission in February. EUs anti-money laundering country blacklist raises US ire. New delegated act on high-risk third countries. After Wednesdays decision Parliament may meet to discuss the EU. The European Union EU is poised to add 12 countries to its list of jurisdictions whose lax or inadequate regulation continue to pose significant threats to the financial system of the Union.

Source: gtreview.com

Source: gtreview.com

This second update makes a minor change to the previous list by dropping Guyana and adding Ethiopia. EUs anti-money laundering country blacklist raises US ire. The Commission is responsible for producing. EU poised to blacklist Bahamas Mauritius and Panama for money-laundering. EU list on high risk third countries.

Source: cgdev.org

Source: cgdev.org

After Wednesdays decision Parliament may meet to discuss the EU. The list which was published earlier this year came into effect on the 1st of October. The 23 jurisdictions are. The Commission currently identifies eleven countries including Afghanistan Iraq Bosnia and Herzegovina and Syria which it judges to be deficient in countering money laundering and terrorist financing. Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism.

Source: complyadvantage.com

Source: complyadvantage.com

The list which was published earlier this year came into effect on the 1st of October. Fifth Anti-Money Laundering Directive. Sri Lanka and Trinidad and Tobago were also added to the blacklist. In early May the EU published its list of countries that have failed to properly address the threats of money laundering and terrorism financing including the Bahamas Barbados Jamaica and Trinidad and Tobago. Methodology for identifying high-risk third countries.

Source: ec.europa.eu

Source: ec.europa.eu

In early May the EU published its list of countries that have failed to properly address the threats of money laundering and terrorism financing including the Bahamas Barbados Jamaica and Trinidad and Tobago. While its previous list included 16 countries and. The Commission currently identifies eleven countries including Afghanistan Iraq Bosnia and Herzegovina and Syria which it judges to be deficient in countering money laundering and terrorist financing. Been named on the EUs blacklist of territories at high risk of money laundering. Last Friday European Union member states unanimously rejected a blacklist of countries identified as posing a high risk of money laundering or terrorist financing.

Source: lki.lk

Source: lki.lk

The four countries are Botswana Ghana Mauritius and Zimbabwe. Sri Lanka and Trinidad and Tobago were also added to the blacklist. The EU is revising its list of countries at high risk of money laundering as part of a renewed drive to tackle corruption and CFOs will soon be required to adhere to enhanced due-diligence requirements when conducting transactions with these countries. The Commission currently identifies eleven countries including Afghanistan Iraq Bosnia and Herzegovina and Syria which it judges to be deficient in countering money laundering and terrorist financing. This second update makes a minor change to the previous list by dropping Guyana and adding Ethiopia.

Source: ec.europa.eu

Source: ec.europa.eu

The US has reacted with fury at the European Commissions publication of a blacklist of 23 countries including four overseas US territories which it says have strategic deficiencies in their anti-money laundering and counter-terrorist financing AMLCTF frameworks. While its previous list included 16 countries and. After Wednesdays decision Parliament may meet to discuss the EU. The four countries are Botswana Ghana Mauritius and Zimbabwe. EUs anti-money laundering country blacklist raises US ire.

Source: amlcft.xyz

Source: amlcft.xyz

The revised blacklist was originally published by the European Commission in February. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Included on the list are Botswana Ghana Zimbabwe and Mauritius. New delegated act on high-risk third countries. Sri Lanka and Trinidad and Tobago were also added to the blacklist.

Source: amleurope.com

Source: amleurope.com

The 23 jurisdictions are. The Commission currently identifies eleven countries including Afghanistan Iraq Bosnia and Herzegovina and Syria which it judges to be deficient in countering money laundering and terrorist financing. With any of the named countries. European Union lawmakers on Wednesday voted in favour of including Tunisia onto the blocs list of third countries considered at high risk of money laundering and terrorism financing. Tunisia Sri Lanka and Trinidad and Tobago added to money laundering blacklist List is part of EUs toolkit to protect itself against money laundering terrorist financing Long record of disagreement between Parliament and Commission over compilation.

Source: cgdev.org

Source: cgdev.org

The EU should have an autonomous process for judging whether countries are at high-risk of money laundering say committee MEPs after rejecting for a second time by 61 votes to 7 with 32 abstentions a blacklist of countries drawn up by the EU Commission. The aim is to protect the integrity of the EU financial system. Been named on the EUs blacklist of territories at high risk of money laundering. These jurisdictions fall under the category of high-risk countries thats show strategic deficiencies in their anti-money laundering and. MEPs in plenary rejected a previous European Commission blacklist because it failed to include countries which were suspected of being involved in tax crimes.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title eu blacklist of countries at risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information