19+ Eu money laundering risk list info

Home » money laundering Info » 19+ Eu money laundering risk list infoYour Eu money laundering risk list images are ready. Eu money laundering risk list are a topic that is being searched for and liked by netizens now. You can Download the Eu money laundering risk list files here. Get all free photos and vectors.

If you’re searching for eu money laundering risk list pictures information linked to the eu money laundering risk list keyword, you have come to the ideal site. Our site always provides you with hints for viewing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

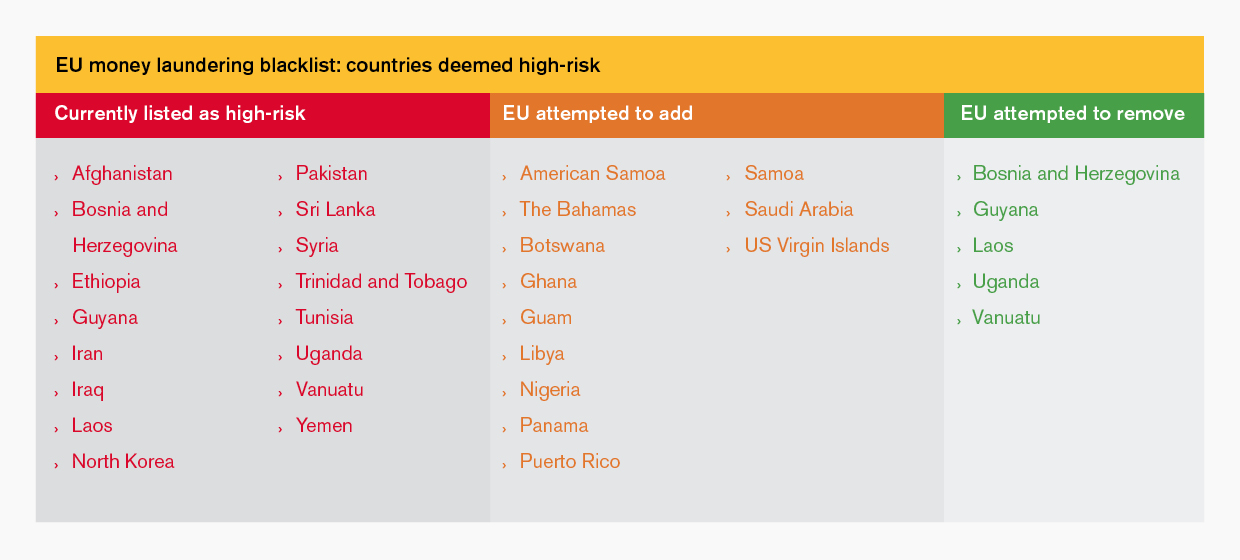

Eu Money Laundering Risk List. Why the EU anti-money laundering list is so short. And the EUs new dirty-money blacklist revealed more by its omissions than by its inclusions. The objective of the listing is to protect the EU financial system from risks of money laundering and terrorist financing coming from third countries. But the real story of the EU and money laundering.

European Flag European Commission Brussels 26 6 2017 Swd 2017 241 Final Commission Staff Working Document Accompanying The Document Report From The Commission To The European Parliament And The Council On The Assessment Of From eur-lex.europa.eu

European Flag European Commission Brussels 26 6 2017 Swd 2017 241 Final Commission Staff Working Document Accompanying The Document Report From The Commission To The European Parliament And The Council On The Assessment Of From eur-lex.europa.eu

Pursuant to Article 9 of Directive EU 2015849 the 4th Anti-Money Laundering Directive there is a legal requirement to identify third-country jurisdictions which have strategic deficiencies in their national AMLCFT regimes that pose significant threats to the financial system of the Union high-risk. Interesting its list contained three EU Member States Bulgaria Latvia Romania and twelve Financial Action Task Force FATF members Argentina Brazil China India Malaysia Russia South Africa and Turkey plus four member states of the Gulf. In 2014 in response to a Freedom of Information FOI Act request the FCA published a list of 95 countries that it assessed to be high risk. From 1 January 2021 the UK has had its own standalone list. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. But the real story of the EU and money laundering.

On the other hand EU enforcement legislation deals with investigation and prosecution in the field of money laundering.

Q and A. The Fifth Anti-Money Laundering Directive broadened the criteria for the identification of high-risk third countries including notably the availability of information on the. From 1 January 2021 the UK has had its own standalone list. With the aforementioned cases just being the top of the iceberg the European Commission recognized that there is a significant risk of money laundering in professional football and it has decided to add the sector to its watchlist of money laundering risks for the European economy in its Supranational Risk Assessment of money laundering and terrorist financing risks report in July 2019. Until the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. They include new guidance on MLTF risk assessments customer due diligence for.

Source: gtreview.com

Source: gtreview.com

The objective of the listing is to protect the EU financial system from risks of money laundering and terrorist financing coming from third countries. From 1 January 2021 the UK has had its own standalone list. The European Commission has published its list of high-risk third countries dubbed the blacklist which it says have weak anti-money laundering and terrorist financing regimes. These revised guidelines on MLTF risk factors take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs implementation reviews and in the ESAs 2019 Joint Opinion on MLTF risks. In 2014 in response to a Freedom of Information FOI Act request the FCA published a list of 95 countries that it assessed to be high risk.

Source: ec.europa.eu

Source: ec.europa.eu

European Union legislation tackles the issue of AML from two angles. The 20 countries that posed a high risk of injecting criminal or terrorist funds into the single market were named and shamed by the European Commission on 8 May. They include new guidance on MLTF risk assessments customer due diligence for. Q and A. As set in the new Anti-Money Laundering Directive banks and other gatekeepers will have to be more vigilant and carry out extra checks when carrying out transactions involving high-risk third countries identified by the Commission.

Source:

The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. From 1 January 2021 the UK has had its own standalone list. As set in the new Anti-Money Laundering Directive banks and other gatekeepers will have to be more vigilant and carry out extra checks when carrying out transactions involving high-risk third countries identified by the Commission. The European Economic and Social Committee EESC an EU advisory body made up of workers and employers organisations has heavily criticised the EUs recently published list of high-risk third countries subject to enhanced due diligence measures in relation to anti-money laundering AML The EESC says the list does not include many of the countries believed to be acting as tax havens for money laundering.

Source: globalcompliancenews.com

Source: globalcompliancenews.com

Interesting its list contained three EU Member States Bulgaria Latvia Romania and twelve Financial Action Task Force FATF members Argentina Brazil China India Malaysia Russia South Africa and Turkey plus four member states of the Gulf. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. Interesting its list contained three EU Member States Bulgaria Latvia Romania and twelve Financial Action Task Force FATF members Argentina Brazil China India Malaysia Russia South Africa and Turkey plus four member states of the Gulf. The objective of the listing is to protect the EU financial system from risks of money laundering and terrorist financing coming from third countries. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries.

Source: bankinghub.eu

Source: bankinghub.eu

These revised guidelines on MLTF risk factors take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs implementation reviews and in the ESAs 2019 Joint Opinion on MLTF risks. EU list of high-risk third countries 13 February 2019 by eub2– last modified 13 February 2019 The EU Commission adopted on 13 February its new list of 23 third countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks. While the EU list of uncooperative tax jurisdictions is a Council-led process the EU list of high-risk third countries is established by the Commission based on EU anti-money laundering rules. In 2014 in response to a Freedom of Information FOI Act request the FCA published a list of 95 countries that it assessed to be high risk. Interesting its list contained three EU Member States Bulgaria Latvia Romania and twelve Financial Action Task Force FATF members Argentina Brazil China India Malaysia Russia South Africa and Turkey plus four member states of the Gulf.

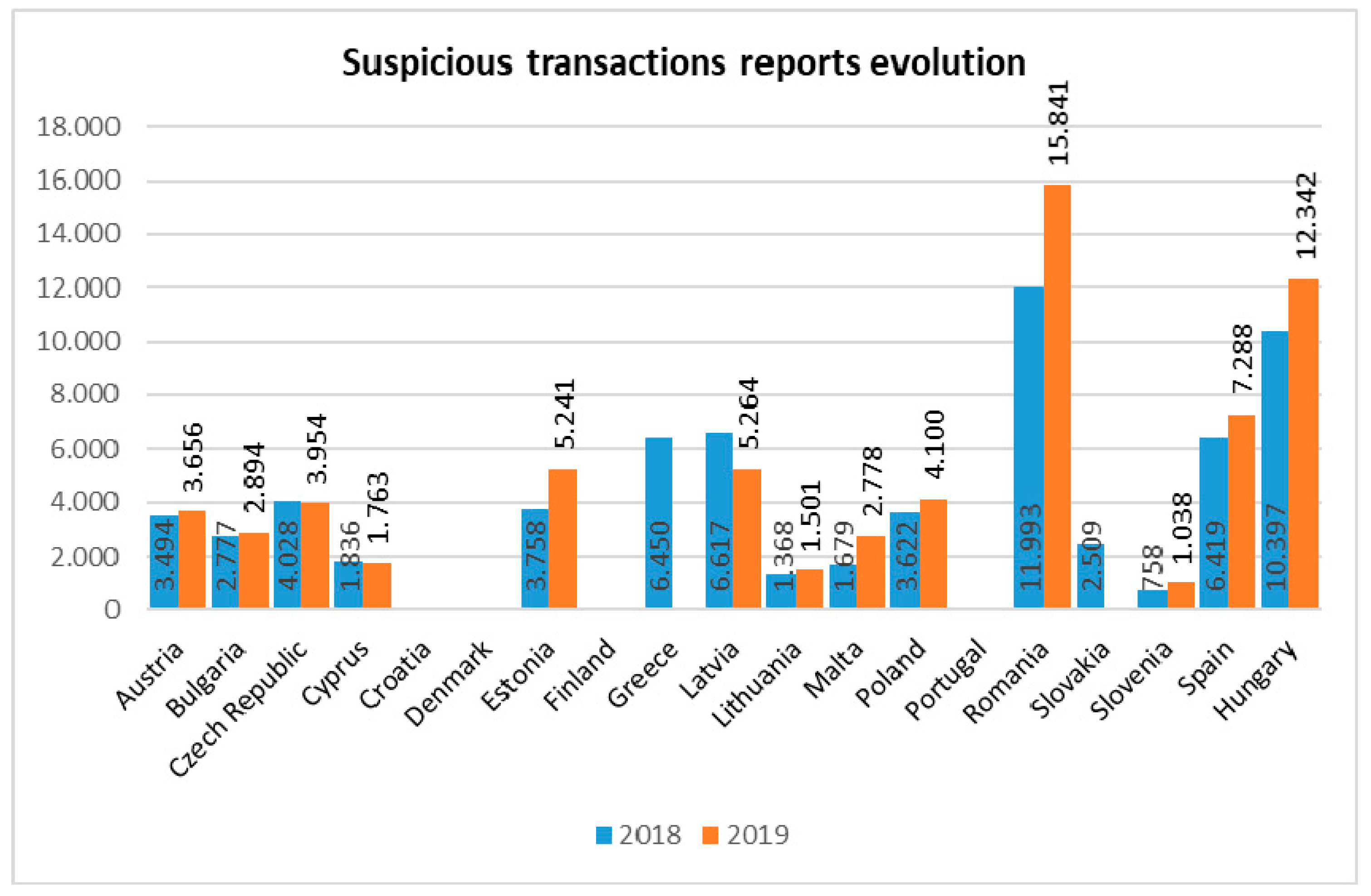

Source: mdpi.com

Source: mdpi.com

And the EUs new dirty-money blacklist revealed more by its omissions than by its inclusions. Since then any amendments to the EU list do not have effect in the UK. In 2014 in response to a Freedom of Information FOI Act request the FCA published a list of 95 countries that it assessed to be high risk. Why the EU anti-money laundering list is so short. With the aforementioned cases just being the top of the iceberg the European Commission recognized that there is a significant risk of money laundering in professional football and it has decided to add the sector to its watchlist of money laundering risks for the European economy in its Supranational Risk Assessment of money laundering and terrorist financing risks report in July 2019.

Source: softelligence.net

Source: softelligence.net

But the real story of the EU and money laundering. The EU has laws in place to combat money laundering and the financing of terrorism. It says the list was established after an in-depth analysis and the that the method reflected the. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: ec.europa.eu

Source: ec.europa.eu

The 20 countries that posed a high risk of injecting criminal or terrorist funds into the single market were named and shamed by the European Commission on 8 May. The European Economic and Social Committee EESC an EU advisory body made up of workers and employers organisations has heavily criticised the EUs recently published list of high-risk third countries subject to enhanced due diligence measures in relation to anti-money laundering AML The EESC says the list does not include many of the countries believed to be acting as tax havens for money laundering. They include new guidance on MLTF risk assessments customer due diligence for. The 20 countries that posed a high risk of injecting criminal or terrorist funds into the single market were named and shamed by the European Commission on 8 May. Why the EU anti-money laundering list is so short.

Source: medium.com

Source: medium.com

The European Economic and Social Committee EESC an EU advisory body made up of workers and employers organisations has heavily criticised the EUs recently published list of high-risk third countries subject to enhanced due diligence measures in relation to anti-money laundering AML The EESC says the list does not include many of the countries believed to be acting as tax havens for money laundering. Professional football has been added to the EUs watchlist of money-laundering risks as the bloc admitted it faced a structural problem in its fight against illegal financial flows. And the EUs new dirty-money blacklist revealed more by its omissions than by its inclusions. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. The EU has laws in place to combat money laundering and the financing of terrorism.

Source: ec.europa.eu

Source: ec.europa.eu

Professional football has been added to the EUs watchlist of money-laundering risks as the bloc admitted it faced a structural problem in its fight against illegal financial flows. Since then any amendments to the EU list do not have effect in the UK. With the aforementioned cases just being the top of the iceberg the European Commission recognized that there is a significant risk of money laundering in professional football and it has decided to add the sector to its watchlist of money laundering risks for the European economy in its Supranational Risk Assessment of money laundering and terrorist financing risks report in July 2019. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. The Fifth Anti-Money Laundering Directive broadened the criteria for the identification of high-risk third countries including notably the availability of information on the.

Source:

The Fifth Anti-Money Laundering Directive broadened the criteria for the identification of high-risk third countries including notably the availability of information on the. Pursuant to Article 9 of Directive EU 2015849 the 4th Anti-Money Laundering Directive there is a legal requirement to identify third-country jurisdictions which have strategic deficiencies in their national AMLCFT regimes that pose significant threats to the financial system of the Union high-risk. From 1 January 2021 the UK has had its own standalone list. Since then any amendments to the EU list do not have effect in the UK. EU list of high-risk third countries 13 February 2019 by eub2– last modified 13 February 2019 The EU Commission adopted on 13 February its new list of 23 third countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

Pursuant to Article 9 of Directive EU 2015849 the 4th Anti-Money Laundering Directive there is a legal requirement to identify third-country jurisdictions which have strategic deficiencies in their national AMLCFT regimes that pose significant threats to the financial system of the Union high-risk. They include new guidance on MLTF risk assessments customer due diligence for. While the EU list of uncooperative tax jurisdictions is a Council-led process the EU list of high-risk third countries is established by the Commission based on EU anti-money laundering rules. The European Economic and Social Committee EESC an EU advisory body made up of workers and employers organisations has heavily criticised the EUs recently published list of high-risk third countries subject to enhanced due diligence measures in relation to anti-money laundering AML The EESC says the list does not include many of the countries believed to be acting as tax havens for money laundering. Interesting its list contained three EU Member States Bulgaria Latvia Romania and twelve Financial Action Task Force FATF members Argentina Brazil China India Malaysia Russia South Africa and Turkey plus four member states of the Gulf.

Source: ceps.eu

Source: ceps.eu

The objective of the listing is to protect the EU financial system from risks of money laundering and terrorist financing coming from third countries. These revised guidelines on MLTF risk factors take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs implementation reviews and in the ESAs 2019 Joint Opinion on MLTF risks. In 2014 in response to a Freedom of Information FOI Act request the FCA published a list of 95 countries that it assessed to be high risk. The two lists complement each other in ensuring a double protection for the Single Market from external risks. European Union legislation tackles the issue of AML from two angles.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title eu money laundering risk list by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas