11++ Example of trade based money laundering info

Home » money laundering idea » 11++ Example of trade based money laundering infoYour Example of trade based money laundering images are ready in this website. Example of trade based money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Example of trade based money laundering files here. Download all free photos.

If you’re searching for example of trade based money laundering pictures information related to the example of trade based money laundering interest, you have pay a visit to the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

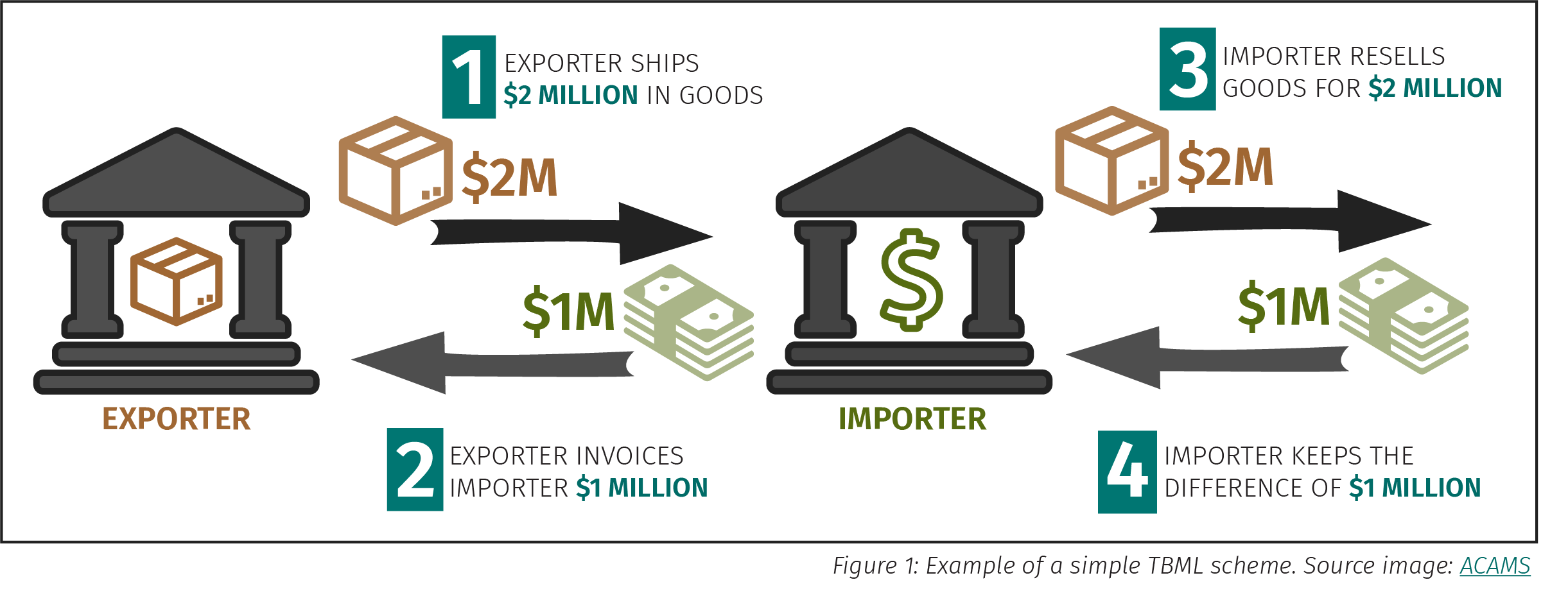

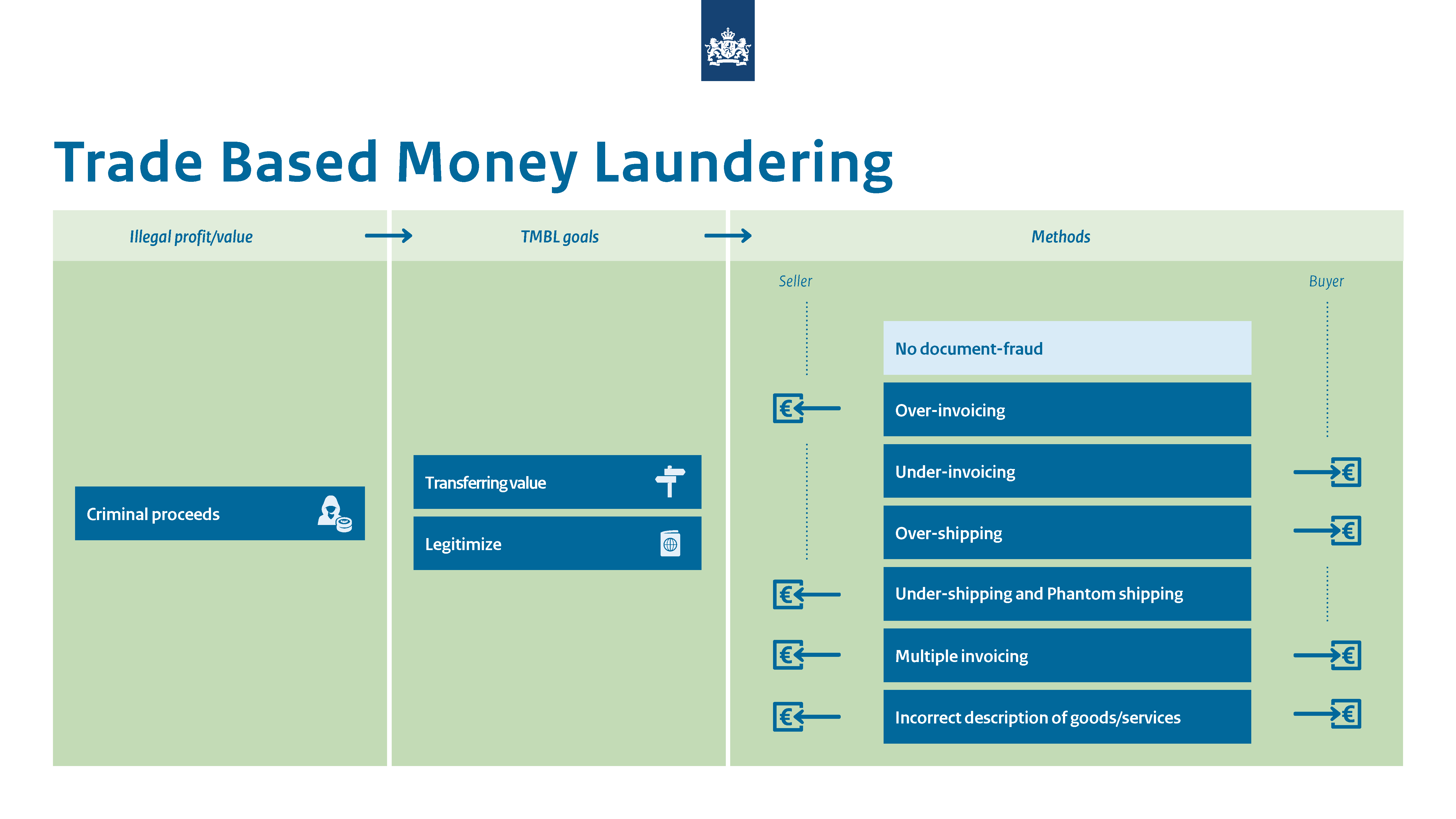

Example Of Trade Based Money Laundering. A trade entity maintains a minimal number of working staff inconsistent with. In its simplest definition trade-based money laundering is the process of disguising the proceeds of crime and moving value ie movement of money using. To apply for Tax incentives when exporting certain goods Evading capital controls by placing overpaid funds into an offshore account Money laundering by creating artificial profits. The crime involves a number of schemes in order to complicate the documentation of legitimate trade transactions.

Https Bb Org Bd Aboutus Regulationguideline Bfiu Dec112019 Guideline Tbml Pdf From

Wire 20000 to Company X including an extra 10000 of dirty money that has been laundered into clean funds. A trade entity maintains a minimal number of working staff inconsistent with. The Financial Action Task Force FATF identifies four basic techniques of Trade-Based Money Laundering in a 2006 publication. Examples of trade-based money laundering activities that should raise red flags include. International trade is huge. They presented these to their bank exporters.

The Financial Action Task Force FATF identifies four basic techniques of Trade-Based Money Laundering in a 2006 publication.

Trade-based money laundering further referred to as TBML is the process by which criminals use a legitimate trade to disguise their criminal proceeds from unscrupulous sources. Past money laundering schemes fraud tax evasion other criminal activities or ongoing or past investigations or convictions. The crime involves a number of schemes in order to complicate the documentation of legitimate trade transactions. The International Trade System The international trade system is subject to a wide range of risks and vulnerabilities which provide criminal organisations with the opportunity to launder the proceeds of crime and provide funding to terrorist organisations with a relatively low risk of detection. Unfortunately this also creates an environment thats rife for abuse trade-based money laundering TBML accounts for hundreds of billions of dollars of illegal money flows annually. Examples of how TBMLFT may be carried out.

Source: compliancealert.org

Source: compliancealert.org

A trade entity maintains a minimal number of working staff inconsistent with. Past money laundering schemes fraud tax evasion other criminal activities or ongoing or past investigations or convictions. A trade entity maintains a minimal number of working staff inconsistent with. And falsely described goods and. Trade Based Money Laundering 2 2.

Source: cassidy.senate.gov

Source: cassidy.senate.gov

A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins. To apply for Tax incentives when exporting certain goods Evading capital controls by placing overpaid funds into an offshore account Money laundering by creating artificial profits. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. 1 Financial Action Task Force FATF Trade Based Money Laundering June 23 2006.

Source: en.ppt-online.org

Source: en.ppt-online.org

Trade Based Money Laundering 2 2. A trade entity or its owners or senior managers appear in negative news eg. The crime involves a number of schemes in order to complicate the documentation of legitimate trade transactions. Wire 20000 to Company X including an extra 10000 of dirty money that has been laundered into clean funds. And falsely described goods and.

Source: worldwildlife.org

Source: worldwildlife.org

The crime involves a number of schemes in order to complicate the documentation of legitimate trade transactions. Examples of trade-based money laundering activities that should raise red flags include. In practice this can be achieved through the misrepresentation of the price quantity or quality of imports or exports. 1 Financial Action Task Force FATF Trade Based Money Laundering June 23 2006. Further investigation by the bank reveals missing and unrecognized documentation with.

Source: amlc.eu

Source: amlc.eu

In its simplest definition trade-based money laundering is the process of disguising the proceeds of crime and moving value ie movement of money using. Examples of trade-based money laundering activities that should raise red flags include. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period. These methods involve under or over valuation of invoices to disguise the movement of funds. Such actions may include moving illicit.

Over- and under-shipment ie short shipping of goods and services. Further investigation by the bank reveals missing and unrecognized documentation with. Defining trade-based money laundering and trade-based terrorist financing 11 Trade process and financing 12 Section 2. Examples of trade-based money laundering activities that should raise red flags include. The International Trade System The international trade system is subject to a wide range of risks and vulnerabilities which provide criminal organisations with the opportunity to launder the proceeds of crime and provide funding to terrorist organisations with a relatively low risk of detection.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

Defining trade-based money laundering and trade-based terrorist financing 11 Trade process and financing 12 Section 2. In practice this can be achieved through the misrepresentation of the price quantity or quality of imports or exports. Over and under invoicing of goods and services Multiple invoicing of goods and services Over and under shipments of goods and services. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period. In 2016 world merchandise exports were valued at US 1546 trillion and the growth rate is projected over two percent annually.

Source:

Further investigation by the bank reveals missing and unrecognized documentation with. A trade entity maintains a minimal number of working staff inconsistent with. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. Examples of trade-based money laundering activities that should raise red flags include. Wire 20000 to Company X including an extra 10000 of dirty money that has been laundered into clean funds.

Source: unbrick.id

Source: unbrick.id

Trade-based money laundering further referred to as TBML is the process by which criminals use a legitimate trade to disguise their criminal proceeds from unscrupulous sources. The money laundering risk in each transaction is considered and evidence of the assessment is kept AML Knowledge Trade processors must have good trade knowledge customers expected activity and sound understanding of trade based money laundering risks Independent verification of information. The International Trade System The international trade system is subject to a wide range of risks and vulnerabilities which provide criminal organisations with the opportunity to launder the proceeds of crime and provide funding to terrorist organisations with a relatively low risk of detection. According to Immigration and Customs Enforcement ICE Criminal organizations frequently exploit global trade systems to move value around the world by employing complex and. These methods involve under or over valuation of invoices to disguise the movement of funds.

Source:

Such actions may include moving illicit. The basic techniques of trade-based money laundering TBML include over- and under-invoicing of goods and services multiple-invoicing of goods and services. Unfortunately this also creates an environment thats rife for abuse trade-based money laundering TBML accounts for hundreds of billions of dollars of illegal money flows annually. For example the art market is an ideal vehicle for money laundering. Defining trade-based money laundering and trade-based terrorist financing 11 Trade process and financing 12 Section 2.

Source:

These methods involve under or over valuation of invoices to disguise the movement of funds. Over and under invoicing of goods and services Multiple invoicing of goods and services Over and under shipments of goods and services. To apply for Tax incentives when exporting certain goods Evading capital controls by placing overpaid funds into an offshore account Money laundering by creating artificial profits. For example the art market is an ideal vehicle for money laundering. They presented these to their bank exporters.

Source: complyadvantage.com

Source: complyadvantage.com

A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank. Illicit trade is becoming popular but it is far from a victimless crime. Further investigation by the bank reveals missing and unrecognized documentation with. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. Governments lose tax revenue public health risks increase and legitimate economy is in danger.

Source:

Over- and under-shipment ie short shipping of goods and services. Such actions may include moving illicit. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period. The Financial Action Task Force FATF identifies four basic techniques of Trade-Based Money Laundering in a 2006 publication. According to Immigration and Customs Enforcement ICE Criminal organizations frequently exploit global trade systems to move value around the world by employing complex and.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title example of trade based money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information