11++ Examples of money laundering in australia ideas

Home » money laundering idea » 11++ Examples of money laundering in australia ideasYour Examples of money laundering in australia images are available in this site. Examples of money laundering in australia are a topic that is being searched for and liked by netizens today. You can Find and Download the Examples of money laundering in australia files here. Get all royalty-free vectors.

If you’re looking for examples of money laundering in australia pictures information related to the examples of money laundering in australia topic, you have visit the ideal site. Our site frequently gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Examples Of Money Laundering In Australia. What kinds of money laundering are being detected by AUSTRAC in Australia. Criminals buy high-value goods such as real estate as a way of laundering or concealing illicit funds. AUSTRAC has identified high-value goods including real estate to be a significant money laundering channel in Australia 2. For example a foreign person may commit a money laundering offence under the Criminal Code if the predicate offence is a foreign crime but the dealing with the proceeds of the foreign crime occurs in Australia.

Money Laundering Activities In Australia An Examination Of The Push And Pull Factors Driving Money Flows Sciencedirect From sciencedirect.com

Money Laundering Activities In Australia An Examination Of The Push And Pull Factors Driving Money Flows Sciencedirect From sciencedirect.com

The examples below highlight the complexity of money laundering cases where new cyber technologies such as digital currencies are being used to facilitate money laundering as well as professional facilitators. By 2005 Nauru had passed anti-money laundering AML and tax haven laws with help from the Financial Action Task Force FATF. What kinds of money laundering are being detected by AUSTRAC in Australia. The sources of the money in actual are criminal and the money is invested in a method that makes it look like clear cash and conceal the. CBA was fully publicly owned until April 1991 when it began going through the steps of privatization. A 2005 mutual evaluation of Australias anti-money launderingcounter-terrorism financing regime by FATF cautioned against the potential inefficiency of the current regulatory system and the lack of additional measures Australia had introduced to further safeguard the non-profit sector from misuse.

How are virtual currencies used for money laundering.

For example a foreign person may commit a money laundering offence under the Criminal Code if the predicate offence is a foreign crime but the dealing with the proceeds of the foreign crime occurs in Australia. Theoretically someone could purchase a piece of real estate property with cash and quickly sell it. The examples below highlight the complexity of money laundering cases where new cyber technologies such as digital currencies are being used to facilitate money laundering as well as professional facilitators. Money laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate. CBA was fully publicly owned until April 1991 when it began going through the steps of privatization. Sending smaller value wire transfers to overseas-based beneficiaries over a short period of time.

Source: id.pinterest.com

Source: id.pinterest.com

AUSTRAC has identified high-value goods including real estate to be a significant money laundering channel in Australia 2. It is a process by which dirty cash is transformed into clear money. The examples below highlight the complexity of money laundering cases where new cyber technologies such as digital currencies are being used to facilitate money laundering as well as professional facilitators. What kinds of money laundering are being detected by AUSTRAC in Australia. How are virtual currencies used for money laundering.

Source:

By July 1996 CBA was completely privatized 2. In a number of legal and regulatory systems however the term money laundering has been extended to other forms of financial and business crimes and is sometimes used more generally to include the misuse of the financial system involving things such as securities digital currencies credit cards and traditional currency including terrorism financing and evasion of international sanctions. Criminals buy high-value goods such as real estate as a way of laundering or concealing illicit funds. Investigations by the ACC-led Task Force Gordian which was established in March 2005 to combat money laundering and tax fraud revealed that the pilot had engaged in numerous money laundering activities between July 2005 and June 2006 where a total of 65 million was smuggled from Australia. The sources of the money in actual are criminal and the money is invested in a method that makes it look like clear cash and conceal the.

Source: researchgate.net

Source: researchgate.net

The use of real estate is an established method of money laundering internationally 1. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. CBA was fully publicly owned until April 1991 when it began going through the steps of privatization. The report cites the example of Yeo Jiawei who was convicted in Singapore of money laundering and obstructing justice as part of the 1MDB scandal using a Seychelles-based company for a series of property purchases in Australia worth at least 6 million. The information contained in the report was provided by 19 countries.

Source: pinterest.com

Source: pinterest.com

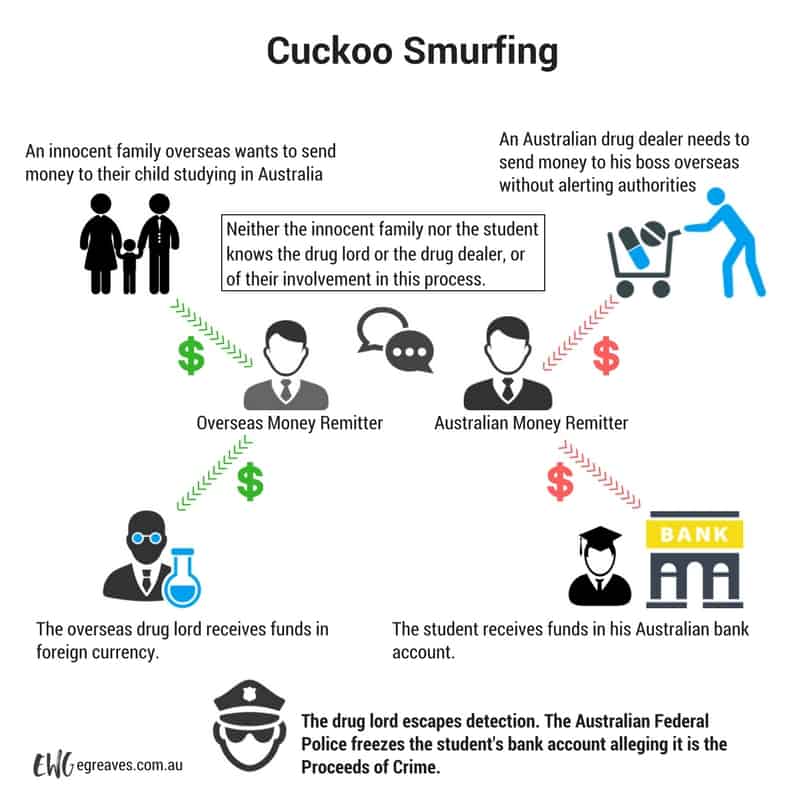

Sending smaller value wire transfers to overseas-based beneficiaries over a short period of time. How are virtual currencies used for money laundering. For example a foreign person may commit a money laundering offence under the Criminal Code if the predicate offence is a foreign crime but the dealing with the proceeds of the foreign crime occurs in Australia. Examples Of Money Laundering In Casinos The idea of money laundering is essential to be understood for these working in the monetary sector. Another form of laundering is through real estate.

Source: pinterest.com

Source: pinterest.com

AUSTRAC has identified high-value goods including real estate to be a significant money laundering channel in Australia 2. How are virtual currencies used for money laundering. AUSTRAC has identified high-value goods including real estate to be a significant money laundering channel in Australia 2. Sending smaller value wire transfers to overseas-based beneficiaries over a short period of time. Criminals buy high-value goods such as real estate as a way of laundering or concealing illicit funds.

Source: caanhousinginequalitywithaussieslockedout.com

Source: caanhousinginequalitywithaussieslockedout.com

By 2005 Nauru had passed anti-money laundering AML and tax haven laws with help from the Financial Action Task Force FATF. The Commonwealth Bank of Australia CBA or CommBank was established in 1911 through the Commonwealth Bank Act and soon after began operations in 1912 1. Examples Of Money Laundering In Casinos The idea of money laundering is essential to be understood for these working in the monetary sector. AUSTRAC has identified high-value goods including real estate to be a significant money laundering channel in Australia 2. The maximum penalties here depend on the amount of money involved ranging from at least 1m 100000 50000 10000 1000 or of any other value.

Source: sciencedirect.com

Source: sciencedirect.com

Any profits made would be associated with the sale and are completely legal. What kinds of money laundering are being detected by AUSTRAC in Australia. Theoretically someone could purchase a piece of real estate property with cash and quickly sell it. AUSTRAC has identified high-value goods including real estate to be a significant money laundering channel in Australia 2. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders.

Source: sciencedirect.com

Source: sciencedirect.com

Money laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate. This report was prepared by the Tax Crimes and Money Laundering Sub-Group of Working Party No. A 2005 mutual evaluation of Australias anti-money launderingcounter-terrorism financing regime by FATF cautioned against the potential inefficiency of the current regulatory system and the lack of additional measures Australia had introduced to further safeguard the non-profit sector from misuse. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. The maximum penalties here depend on the amount of money involved ranging from at least 1m 100000 50000 10000 1000 or of any other value.

Source: pinterest.com

Source: pinterest.com

It is a process by which dirty cash is transformed into clear money. Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a lot of cash transactions. It is a process by which dirty cash is transformed into clear money. What kinds of money laundering are being detected by AUSTRAC in Australia. Money laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate.

Source: pinterest.com

Source: pinterest.com

The examples below highlight the complexity of money laundering cases where new cyber technologies such as digital currencies are being used to facilitate money laundering as well as professional facilitators. Using people who are usually paid a commission to carry out small transactions or smuggle cash into or out of the country. Money laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate. The report cites the example of Yeo Jiawei who was convicted in Singapore of money laundering and obstructing justice as part of the 1MDB scandal using a Seychelles-based company for a series of property purchases in Australia worth at least 6 million. CBA was fully publicly owned until April 1991 when it began going through the steps of privatization.

Source: sciencedirect.com

Source: sciencedirect.com

By 2005 Nauru had passed anti-money laundering AML and tax haven laws with help from the Financial Action Task Force FATF. Created out of real world examples and case studies of money laundering and terrorist financing MLTF typologies are a useful way for an AMLCTF compliance professional to build a set of indicators or red flags to look out for when performing their compliance obligations. Investigations by the ACC-led Task Force Gordian which was established in March 2005 to combat money laundering and tax fraud revealed that the pilot had engaged in numerous money laundering activities between July 2005 and June 2006 where a total of 65 million was smuggled from Australia. For example a foreign person may commit a money laundering offence under the Criminal Code if the predicate offence is a foreign crime but the dealing with the proceeds of the foreign crime occurs in Australia. Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a lot of cash transactions.

Source: egreaves.com.au

Source: egreaves.com.au

This report was prepared by the Tax Crimes and Money Laundering Sub-Group of Working Party No. Using people who are usually paid a commission to carry out small transactions or smuggle cash into or out of the country. The sources of the money in actual are criminal and the money is invested in a method that makes it look like clear cash and conceal the. Money laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate. This post contains many of the money laundering typologies from.

Source: acfcs.org

Source: acfcs.org

In a number of legal and regulatory systems however the term money laundering has been extended to other forms of financial and business crimes and is sometimes used more generally to include the misuse of the financial system involving things such as securities digital currencies credit cards and traditional currency including terrorism financing and evasion of international sanctions. Using people who are usually paid a commission to carry out small transactions or smuggle cash into or out of the country. By July 1996 CBA was completely privatized 2. Any profits made would be associated with the sale and are completely legal. This report was prepared by the Tax Crimes and Money Laundering Sub-Group of Working Party No.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title examples of money laundering in australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information