10++ Examples of suspicious activity money laundering uk information

Home » money laundering Info » 10++ Examples of suspicious activity money laundering uk informationYour Examples of suspicious activity money laundering uk images are available in this site. Examples of suspicious activity money laundering uk are a topic that is being searched for and liked by netizens now. You can Find and Download the Examples of suspicious activity money laundering uk files here. Find and Download all free photos.

If you’re looking for examples of suspicious activity money laundering uk images information connected with to the examples of suspicious activity money laundering uk keyword, you have pay a visit to the right blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

Examples Of Suspicious Activity Money Laundering Uk. The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. The case was resolved after four days. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. Examples of suspicious transactions are listed below.

Money Laundering Wikiwand From wikiwand.com

Money Laundering Wikiwand From wikiwand.com

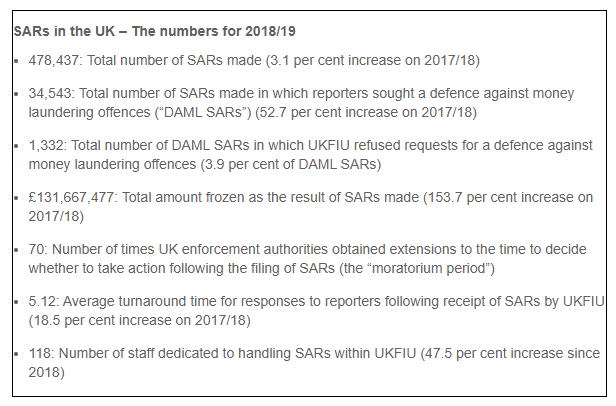

Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. Reports alert law enforcement to potential instances of money laundering or terrorist financing. IAIS Examples of money laundering and suspicious transactions involving insurance October 2004 Page 3 of 9 the applicant for insurance business purchases policies in amounts considered beyond the customers apparent means the applicant for insurance business establishes a. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information.

Transactions not in keeping with the investors normal activity the financial markets in which the investor is active and the business which the investor operates.

MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No. Below are extracts taken from the SAR annual report 2018 produced by the NCA which give examples of suspicious activities and the use of SARs. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. A large number of security transactions across a number of jurisdictions. Money laundering underpins and enables most forms of organised crime enabling organised crime groups to further their operations and conceal their assets. Examples of unusual dealing patterns and abnormal transactions may be as follows.

IAIS Examples of money laundering and suspicious transactions involving insurance October 2004 Page 3 of 9 the applicant for insurance business purchases policies in amounts considered beyond the customers apparent means the applicant for insurance business establishes a. The accountant however was unavailable when the officer called several times. For example if youre acting for a client in a property transaction and you suspect the purchase funds are criminal property youd need a DAML before you could exchange contracts. Transactions not in keeping with the investors normal activity the financial markets in which the investor is active and the business which the investor operates. The term DAML refers to appropriate consent given by the NCA to a firm to carry out an activity that is otherwise prohibited by the principal money laundering offences under POCA.

Source: academia.edu

Source: academia.edu

Examples of unusual dealing patterns and abnormal transactions may be as follows. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation. High-end money laundering is a national security threat with the potential to undermine the integrity of the UK. IAIS Examples of money laundering and suspicious transactions involving insurance October 2004 Page 3 of 9 the applicant for insurance business purchases policies in amounts considered beyond the customers apparent means the applicant for insurance business establishes a.

Source: researchgate.net

Source: researchgate.net

The accountant however was unavailable when the officer called several times. Transactions not in keeping with the investors normal activity the financial markets in which the investor is active and the business which the investor operates. What is a suspicious activity report. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing.

Source: wikiwand.com

Source: wikiwand.com

A SAR reported that a limited company was deliberately understating its business income on its VAT returns. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. A large number of security transactions across a number of jurisdictions.

Source: efinancemanagement.com

Source: efinancemanagement.com

Money laundering underpins and enables most forms of organised crime enabling organised crime groups to further their operations and conceal their assets. A SAR reported that a limited company was deliberately understating its business income on its VAT returns. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. Money laundering underpins and enables most forms of organised crime enabling organised crime groups to further their operations and conceal their assets.

Source: pinterest.com

Source: pinterest.com

The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. SARs are made by financial institutions and other professionals such as solicitors accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity. The accountant however was unavailable when the officer called several times. Examples of suspicious transactions are listed below.

Source: pideeco.be

Source: pideeco.be

The case was resolved after four days. Often its just because its something unusual for your business for example. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. The accountant however was unavailable when the officer called several times.

Source: fsblockchain.medium.com

Source: fsblockchain.medium.com

A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. What is a suspicious activity report. Money laundering underpins and enables most forms of organised crime enabling organised crime groups to further their operations and conceal their assets. Often its just because its something unusual for your business for example. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information.

Source: researchgate.net

Source: researchgate.net

The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. Night deposits ATM deposits exchanging money for cashiers checks or larger bills and smuggling cash out of the country are all examples of placement. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation. What is a suspicious activity report.

Source: wikiwand.com

Source: wikiwand.com

Below are extracts taken from the SAR annual report 2018 produced by the NCA which give examples of suspicious activities and the use of SARs. When it became clear that the reporter was not seeking a defence to money laundering the case was closed. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No.

Source: researchgate.net

Source: researchgate.net

For example if youre acting for a client in a property transaction and you suspect the purchase funds are criminal property youd need a DAML before you could exchange contracts. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. When it became clear that the reporter was not seeking a defence to money laundering the case was closed. Examples of suspicious transactions are listed below. The case was resolved after four days.

Source: pinterest.com

Source: pinterest.com

Placement is vital for money launderers as it helps to mask dirty funds with clean money and provide legitimacy to the funds. Night deposits ATM deposits exchanging money for cashiers checks or larger bills and smuggling cash out of the country are all examples of placement. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. Title Forenames Address Surname Date and place of birth if known Source of client Professional privilege apply. The accountant however was unavailable when the officer called several times.

Source: tookitaki.ai

Source: tookitaki.ai

MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No. The case was resolved after four days. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. Transactions not in keeping with the investors normal activity the financial markets in which the investor is active and the business which the investor operates. Placement is vital for money launderers as it helps to mask dirty funds with clean money and provide legitimacy to the funds.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title examples of suspicious activity money laundering uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas