16+ Examples of tipping off money laundering ideas

Home » money laundering idea » 16+ Examples of tipping off money laundering ideasYour Examples of tipping off money laundering images are ready in this website. Examples of tipping off money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Examples of tipping off money laundering files here. Find and Download all free photos and vectors.

If you’re looking for examples of tipping off money laundering images information related to the examples of tipping off money laundering keyword, you have visit the right blog. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

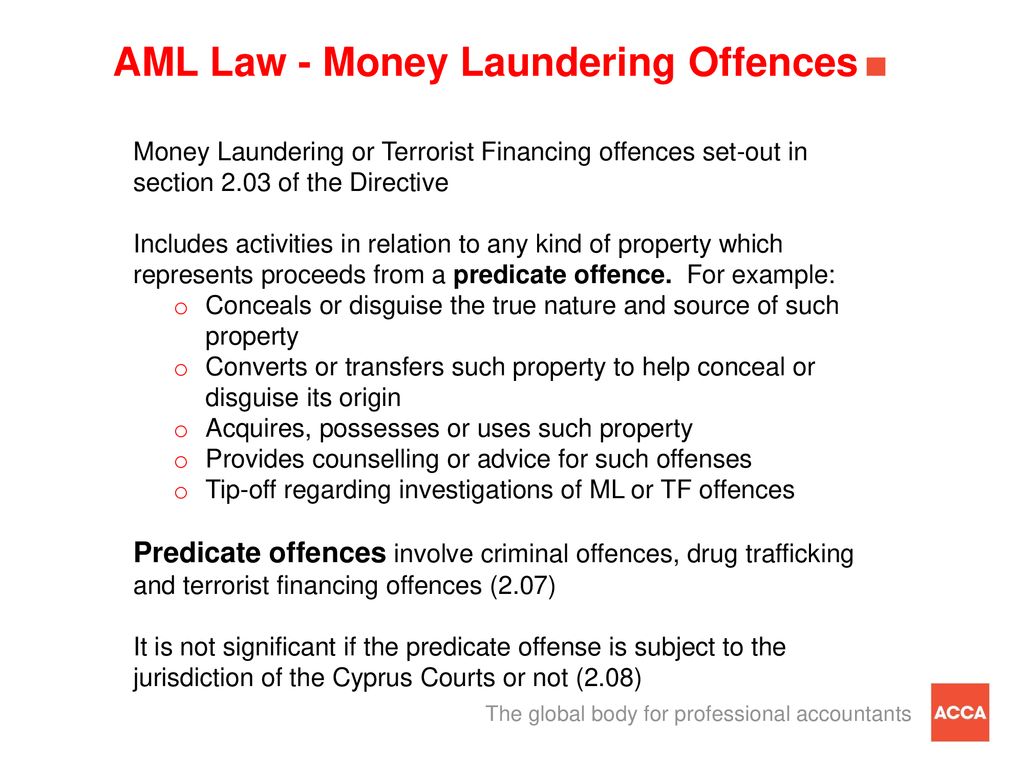

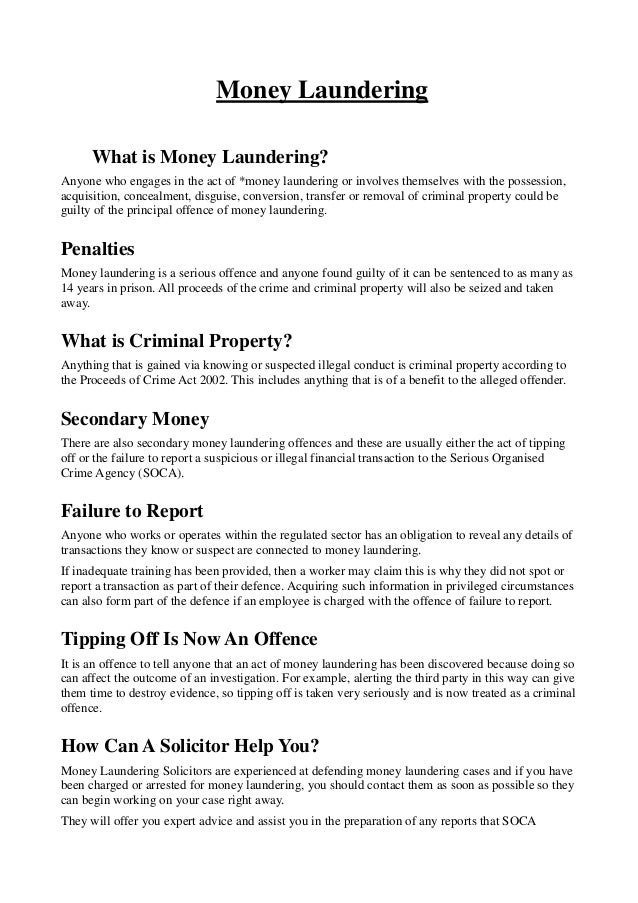

Examples Of Tipping Off Money Laundering. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. A client know that their suspicious activity has been reported to an MLRO or to NCA. What is tipping off money laundering. The offence is committed when a person knows or suspects subjectively that a protected or authorised disclosure has been made and makes a disclosure to a third part client which is likely to prejudice any investigation which either is or might be conducted.

Warning somebody that they are part of a money laundering investigation for instance this could be warning somebody that they could be involved in a money laundering investigation. Tipping off means whether deliberately or inadvertently letting a person eg. It is also an offence for a person in the regulated sector to tip off ie. A client know that their suspicious activity has been reported to an MLRO or to NCA. Any instance where an individual within the Group including its Associates discloses information to someone outside of the approved reporting chain and in so doing the information could potentially prejudice an investigation into money-laundering. What is tipping off money laundering.

Prevention of Crime Act No 24 of 1999 which stipulates criminal and civil offences tipping-off and penalties.

Bankers and other professionals may also be liable for money laundering under the offence of tipping off. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. What type of actions are considered Tipping Off. Failure to make an appropriate disclosure and tipping off the. Prevention of Crime Act No 24 of 1999 which stipulates criminal and civil offences tipping-off and penalties. It is also an offence for a person in the regulated sector to tip off ie.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

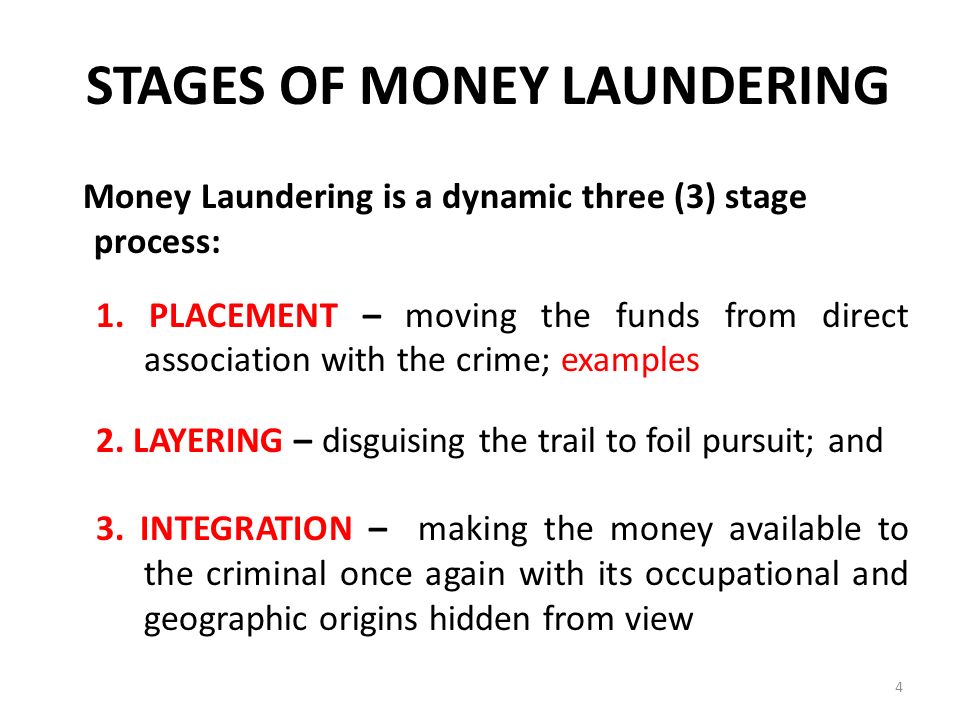

REPORTING CONCERNS The regulated sector is required to disclose suspicions of money laundering and to avoid tipping off the suspect. By moving money from one location casino to another restaurant the trail of the money becomes muddied and eventually unfollowable. Tipping off means whether deliberately or inadvertently letting a person eg. Meaning of tipping off in money laundering. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field.

Source: slideplayer.com

Source: slideplayer.com

Tipping off could occur at the stage of initial contact with the customer during the processing of transactions or obtaining information when investigations are being conducted on a suspicion or even after reporting to an appropriate agency. The offence is committed when a person knows or suspects subjectively that a protected or authorised disclosure has been made and makes a disclosure to a third part client which is likely to prejudice any investigation which either is or might be conducted. For example a person might be considered to have reasonable grounds for knowledge of money laundering if he had actual knowledge of or possessed information which would indicate to a reasonable person that another person was committing or had committed a money laundering offence. Meaning of tipping off in money laundering. This could result in them changing their behaviour to avoid being caught in the act of.

Source: pinterest.com

Source: pinterest.com

A client know that their suspicious activity has been reported to an MLRO or to NCA. 333A Proceeds of Crime Act 2002. CASES OF TIPPING OFFWithin the ICAEW Disciplinary section was news that an accountant was reprimanded relating to non compliance with the Money Laundering RegulationsThe charge was that the member failed to comply with statement 1304 of the Members Handbook in that he failed to make a suspicious activity report on a timely basis to the. The offence is committed when a person knows or suspects subjectively that a protected or authorised disclosure has been made and makes a disclosure to a third part client which is likely to prejudice any investigation which either is or might be conducted. Prohibited by law from disclosing tipping-off the fact that a suspicious transaction report or related information is being filed with the FIU.

Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Meaning of tipping off in money laundering. A client know that their suspicious activity has been reported to an MLRO or to NCA. Tipping off could occur at the stage of initial contact with the customer during the processing of transactions or obtaining information when investigations are being conducted on a suspicion or even after reporting to an appropriate agency. A SAR or b there is a money laundering investigation taking place where the tipping off is likely either to prejudice any investigation arising from the disclosure or to prejudice the investigation disclosed to the person.

Source: slideplayer.com

Source: slideplayer.com

For example if youre working on a conveyancing transaction you can make enquiries and carry out searches but youd commit a money laundering offence if you exchanged. Failure to make an appropriate disclosure and tipping off the. The following questions and answers are designed to help with some of the more common questions relating to tipping off. A client know that their suspicious activity has been reported to an MLRO or to NCA. However if you do not have a defence against money laundering DAML from the National Crime Agency NCA youre prohibited from carrying out any act that would amount to a principal money laundering offence.

Source: researchgate.net

Source: researchgate.net

This chapter focuses on the process of tipping off which is the process of letting the customer know that he is or might be the subject of a suspicion. A SAR or b there is a money laundering investigation taking place where the tipping off is likely either to prejudice any investigation arising from the disclosure or to prejudice the investigation disclosed to the person. CASES OF TIPPING OFFWithin the ICAEW Disciplinary section was news that an accountant was reprimanded relating to non compliance with the Money Laundering RegulationsThe charge was that the member failed to comply with statement 1304 of the Members Handbook in that he failed to make a suspicious activity report on a timely basis to the. Tipping off Applies to bankers and other professionals Bankers and other professionals may also be liable for money laundering under the offence of tipping off. It is also an offence for a person in the regulated sector to tip off ie.

Source: researchgate.net

Source: researchgate.net

However if you do not have a defence against money laundering DAML from the National Crime Agency NCA youre prohibited from carrying out any act that would amount to a principal money laundering offence. This only applies where the information is received during the course of business in the regulated sector. CASES OF TIPPING OFFWithin the ICAEW Disciplinary section was news that an accountant was reprimanded relating to non compliance with the Money Laundering RegulationsThe charge was that the member failed to comply with statement 1304 of the Members Handbook in that he failed to make a suspicious activity report on a timely basis to the. A SAR or b there is a money laundering investigation taking place where the tipping off is likely either to prejudice any investigation arising from the disclosure or to prejudice the investigation disclosed to the person. Warning somebody that they are part of a money laundering investigation for instance this could be warning somebody that they could be involved in a money laundering investigation.

The offence is committed when a person knows or suspects subjectively that a protected or authorised disclosure has been made and makes a disclosure to a third part client which is likely to prejudice any investigation which either is or might be conducted. Inform a person suspected of money laundering that a he or someone else has made a lawful disclosure ie. A client know that their suspicious activity has been reported to an MLRO or to NCA. Layering is the stage that makes tracing of dirty money more difficult. Authorised disclosures called a suspicious activity report or SAR are made to the National Crime Agency NCA.

Source: researchgate.net

Source: researchgate.net

This could result in them changing their behaviour to avoid being caught in the act of. However if you do not have a defence against money laundering DAML from the National Crime Agency NCA youre prohibited from carrying out any act that would amount to a principal money laundering offence. A client know that their suspicious activity has been reported to an MLRO or to NCA. 333A Proceeds of Crime Act 2002. Tipping off is where someone informs a person or people who are or who are suspected of being involved on money laundering in such a way as to reduce the likelihood of their being investigated or prejudicing and investigation.

Source: businessforensics.nl

Source: businessforensics.nl

Tipping off means whether deliberately or inadvertently letting a person eg. For example a person might be considered to have reasonable grounds for knowledge of money laundering if he had actual knowledge of or possessed information which would indicate to a reasonable person that another person was committing or had committed a money laundering offence. What is tipping off money laundering. The first is tipping off which is contained in s. Inform a person suspected of money laundering that a he or someone else has made a lawful disclosure ie.

Source: slideplayer.com

Source: slideplayer.com

Inform a person suspected of money laundering that a he or someone else has made a lawful disclosure ie. Inform a person suspected of money laundering that a he or someone else has made a lawful disclosure ie. How do I approach this without tipping off. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. For example a person might be considered to have reasonable grounds for knowledge of money laundering if he had actual knowledge of or possessed information which would indicate to a reasonable person that another person was committing or had committed a money laundering offence.

Source: slideshare.net

Source: slideshare.net

The offence is committed when a person knows or suspects subjectively that a protected or authorised disclosure has been made and makes a disclosure to a third part client which is likely to prejudice any investigation which either is or might be conducted. Failure to make an appropriate disclosure and tipping off the. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Meaning of tipping off in money laundering. Any instance where an individual within the Group including its Associates discloses information to someone outside of the approved reporting chain and in so doing the information could potentially prejudice an investigation into money-laundering.

Inform a person suspected of money laundering that a he or someone else has made a lawful disclosure ie. I have found some invoices that my client has not included in the information for their tax return. However if you do not have a defence against money laundering DAML from the National Crime Agency NCA youre prohibited from carrying out any act that would amount to a principal money laundering offence. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. Tipping off Applies to bankers and other professionals Bankers and other professionals may also be liable for money laundering under the offence of tipping off.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title examples of tipping off money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information