15+ Fca aml enforcement cases ideas in 2021

Home » money laundering Info » 15+ Fca aml enforcement cases ideas in 2021Your Fca aml enforcement cases images are available. Fca aml enforcement cases are a topic that is being searched for and liked by netizens today. You can Get the Fca aml enforcement cases files here. Download all free photos.

If you’re searching for fca aml enforcement cases pictures information related to the fca aml enforcement cases interest, you have pay a visit to the right blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Fca Aml Enforcement Cases. Criminal proceedings for AML systems and controls failings. As with other recent investigations FCA officials concluded that the firms senior management was either invisible or lacked the power to sufficiently escalate compliance problems so that they could be resolved internally. According to the report in 201819 the FCA conducted 47 desk-based reviews of different firms AML systems and controls and conducted 64 on-site visits. Unauthorised business 142 cases retail conduct 134 cases insider dealing 88 cases financial crime 71 cases and pensions advice 61 cases.

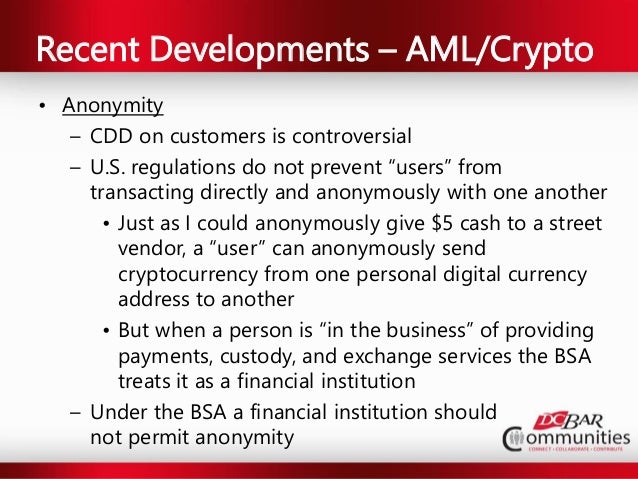

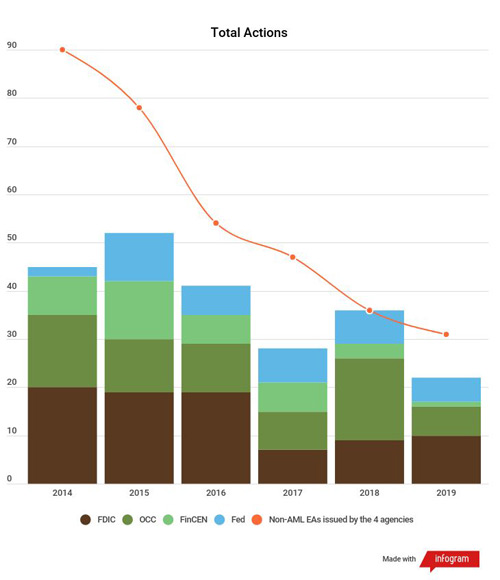

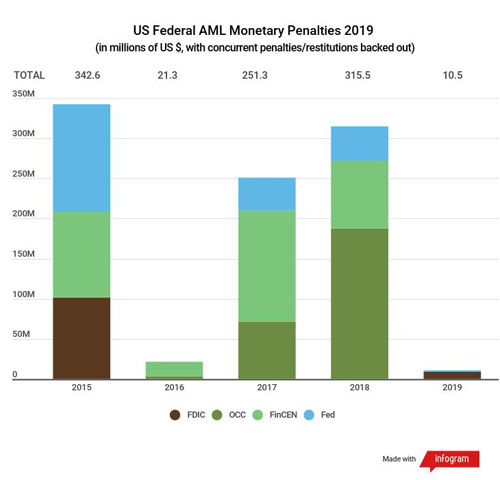

Financial Crimes Compliance And Enforcement Trends 2019 From slideshare.net

Financial Crimes Compliance And Enforcement Trends 2019 From slideshare.net

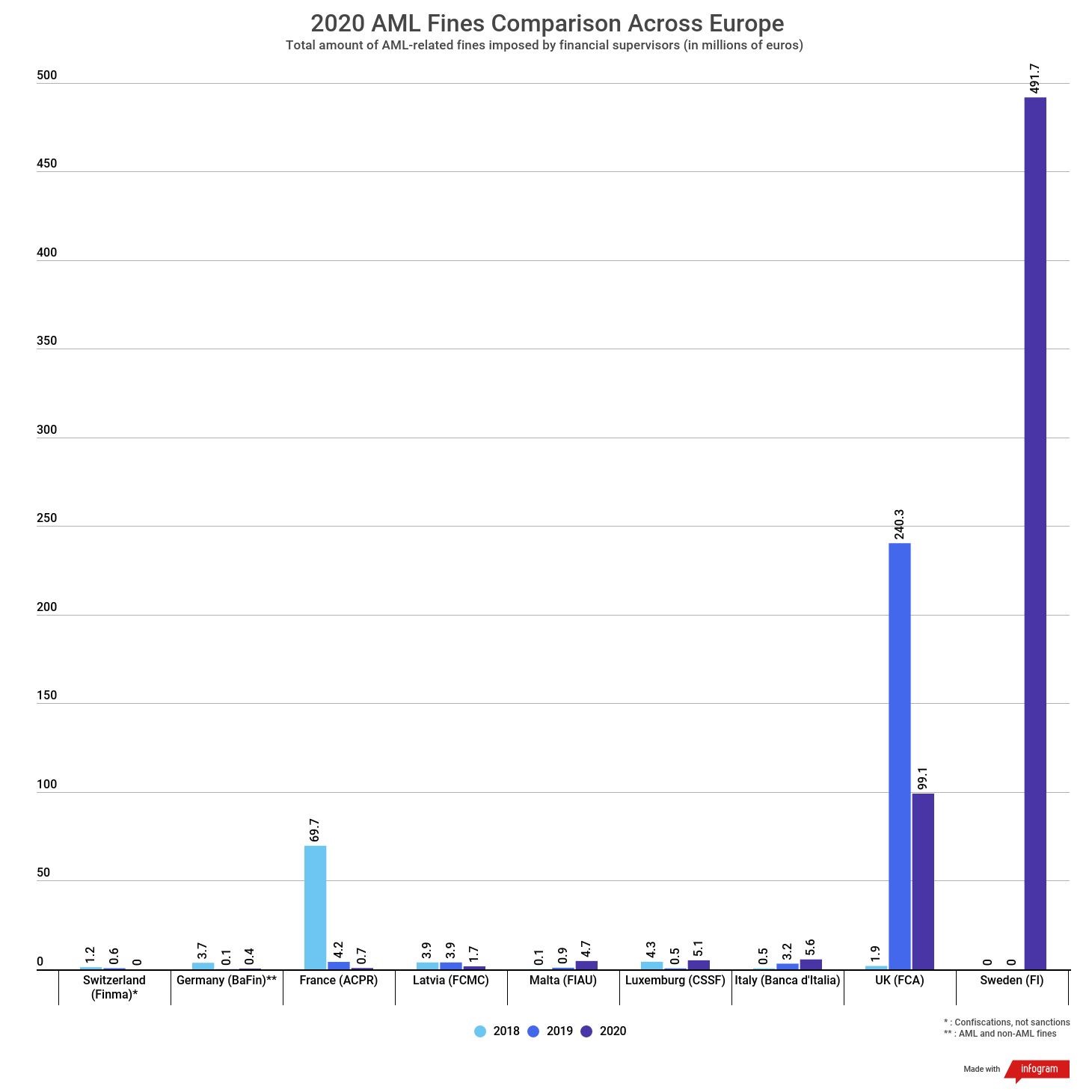

However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. This enforcement activity has given rise to a succession of public actions against firms for regulatory breaches of the Principles or the Money Laundering Regulations 10 or both. Unauthorised business 142 cases retail conduct 134 cases insider dealing 88 cases financial crime 71 cases and pensions advice 61 cases. Cases involve regulated firms that fail to meet the FCAs minimum standards ie Threshold Conditions. In 2020 the total value of fines issued by the FCA was 1925 million less than half the value of fines issued in 2019 3923 million. Six of these cases including this one concerning Mr Smith have been concluded since 2015.

FCA is one of the three UK statutory anti-money laundering supervisors in the UK under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs and regulates 19620 firms subject to the regulations.

Many of those result from skilled persons reports commissioned by the FCA where the specialist supervisory teams own. According to the report in 201819 the FCA conducted 47 desk-based reviews of different firms AML systems and controls and conducted 64 on-site visits. However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. Many of those result from skilled persons reports commissioned by the FCA where the specialist supervisory teams own. It is independent of the FCA and will consider the case. 12 rows This Final Notice refers to Asia Research and Capital Managements failure to.

Source: complyadvantage.com

Source: complyadvantage.com

While COVID-19 may have impacted the FCAs enforcement capacity we anticipate a continued emphasis on both of these areas with firms needing to adapt to the evolving risks presented by new working. Key takeaways from recent FCA anti-money laundering outcomes. This enforcement data shows the enforcement action we took in 201920 and it forms part of our Annual Report. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. Six of these cases including this one concerning Mr Smith have been concluded since 2015.

Source: slideshare.net

Source: slideshare.net

However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. However the number of enforcement cases concluded against compliance professionals is on the rise. In 2020 the total value of fines issued by the FCA was 1925 million less than half the value of fines issued in 2019 3923 million. Many of those result from skilled persons reports commissioned by the FCA where the specialist supervisory teams own.

Source: lexology.com

Source: lexology.com

While COVID-19 may have impacted the FCAs enforcement capacity we anticipate a continued emphasis on both of these areas with firms needing to adapt to the evolving risks presented by new working. The Financial Conduct Authority FCA has been criticised for its lack of enforcement of anti-money laundering AML legislation so far in 2020. Cases involve regulated firms that fail to meet the FCAs minimum standards ie Threshold Conditions. The Principles relied on. FCA is one of the three UK statutory anti-money laundering supervisors in the UK under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs and regulates 19620 firms subject to the regulations.

Source: slideshare.net

Source: slideshare.net

Last month the FCA imposed a fine of nearly 35 million on Goldman Sachs for failing to properly report transactions over a 10-year period. It is independent of the FCA and will consider the case. Last month the FCA imposed a fine of nearly 35 million on Goldman Sachs for failing to properly report transactions over a 10-year period. A Freedom of Information request has revealed that no criminal prosecutions have been made under AML legislation this year. Financial crime and anti-money laundering AML Three recent examples of FCA enforcement action emphasise the importance of firms implementing proper systems and controls regarding AML and transaction reporting and we expect this to continue to be a focus area.

Source: qa.nonprod.trulioo.com

Source: qa.nonprod.trulioo.com

Of the firms reviewed none were found to be fully compliant with the regulations and the FCA took formal action on approximately 57 of the firms reviewed and approximately 52 of the firms visited. The FCAs focus in enforcement action was in the same five areas as the previous year. 12 rows This Final Notice refers to Asia Research and Capital Managements failure to. Of the firms reviewed none were found to be fully compliant with the regulations and the FCA took formal action on approximately 57 of the firms reviewed and approximately 52 of the firms visited. Six of these cases including this one concerning Mr Smith have been concluded since 2015.

Source: slideshare.net

Source: slideshare.net

FCA is one of the three UK statutory anti-money laundering supervisors in the UK under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs and regulates 19620 firms subject to the regulations. In 2020 the total value of fines issued by the FCA was 1925 million less than half the value of fines issued in 2019 3923 million. Criminal proceedings for AML systems and controls failings. Six of these cases including this one concerning Mr Smith have been concluded since 2015. Key takeaways from recent FCA anti-money laundering outcomes.

Source: shuftipro.com

Source: shuftipro.com

The Principles relied on. Since 2008 the FSA and FCA have concluded 14 enforcement cases against compliance officers four of whom were MLROs. Cases involve regulated firms that fail to meet the FCAs minimum standards ie Threshold Conditions. For the FCA how a firm handles non-financial misconduct NFM is indicative of its wider culture. 12 rows This Final Notice refers to Asia Research and Capital Managements failure to.

Source: pinterest.com

Source: pinterest.com

Cases involve regulated firms that fail to meet the FCAs minimum standards ie Threshold Conditions. Key takeaways from recent FCA anti-money laundering outcomes. According to the report in 201819 the FCA conducted 47 desk-based reviews of different firms AML systems and controls and conducted 64 on-site visits. Criminal proceedings for AML systems and controls failings. As with other recent investigations FCA officials concluded that the firms senior management was either invisible or lacked the power to sufficiently escalate compliance problems so that they could be resolved internally.

Source: moneylaundering.com

Source: moneylaundering.com

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. However the number of enforcement cases concluded against compliance professionals is on the rise. It is independent of the FCA and will consider the case. According to the report in 201819 the FCA conducted 47 desk-based reviews of different firms AML systems and controls and conducted 64 on-site visits. While COVID-19 may have impacted the FCAs enforcement capacity we anticipate a continued emphasis on both of these areas with firms needing to adapt to the evolving risks presented by new working.

Source: acfcs.org

Source: acfcs.org

The Financial Conduct Authority FCA has been criticised for its lack of enforcement of anti-money laundering AML legislation so far in 2020. HM Treasurys report was published on 6. However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. Of the firms reviewed none were found to be fully compliant with the regulations and the FCA took formal action on approximately 57 of the firms reviewed and approximately 52 of the firms visited.

Source: iclg.com

Source: iclg.com

Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. Six of these cases including this one concerning Mr Smith have been concluded since 2015. The FCAs focus in enforcement action was in the same five areas as the previous year. Since 2008 the FSA and FCA have concluded 14 enforcement cases against compliance officers four of whom were MLROs. The FCAs open cases as at 31 March 2020 highlight the emphasis placed by the FCA on financial crime 71 open cases and insider dealing and market manipulation 117 open cases.

Source: allenovery.com

Source: allenovery.com

According to the report in 201819 the FCA conducted 47 desk-based reviews of different firms AML systems and controls and conducted 64 on-site visits. However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. However the number of enforcement cases concluded against compliance professionals is on the rise. The Principles relied on. Many of those result from skilled persons reports commissioned by the FCA where the specialist supervisory teams own.

Source: moneylaundering.com

Source: moneylaundering.com

Unauthorised business 142 cases retail conduct 134 cases insider dealing 88 cases financial crime 71 cases and pensions advice 61 cases. Unauthorised business 142 cases retail conduct 134 cases insider dealing 88 cases financial crime 71 cases and pensions advice 61 cases. Cases involve regulated firms that fail to meet the FCAs minimum standards ie Threshold Conditions. Tribunal statistics In some instances a person who receives a statutory notice from us has the right to make a reference to the Tribunal. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml enforcement cases by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas