15++ Fca aml enforcement cases 2020 ideas

Home » money laundering idea » 15++ Fca aml enforcement cases 2020 ideasYour Fca aml enforcement cases 2020 images are ready in this website. Fca aml enforcement cases 2020 are a topic that is being searched for and liked by netizens today. You can Download the Fca aml enforcement cases 2020 files here. Download all royalty-free images.

If you’re searching for fca aml enforcement cases 2020 pictures information connected with to the fca aml enforcement cases 2020 interest, you have come to the ideal blog. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Fca Aml Enforcement Cases 2020. However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. For the FCA how a firm handles non-financial misconduct NFM is indicative of its wider culture. Prior to June 2020 the United States total share in AML. All relate to areas which have been a focus for the FCA for some time.

European Uk Aml Enforcement Remained Strong In 2020 Lexology From lexology.com

European Uk Aml Enforcement Remained Strong In 2020 Lexology From lexology.com

Will continue to use our range of powers to monitor make enquiries investigate and if necessary take enforcement action to protect the integrity and orderly. It contains some interesting statistics which emphasise that when the FCA looks to conduct a supervisory review of a firms AML controls the stakes are extremely high. This enforcement data shows the enforcement action we took in 202021 and it forms part of our Annual Report. All relate to areas which have been a focus for the FCA for some time. In the year to 31 March 2020 the FCA closed 185 cases down 2 per cent from the previous year. Following consultation changes to the Financial Crime Guide which reflect amendments to the MLRs are now in effect from 1 October 2020.

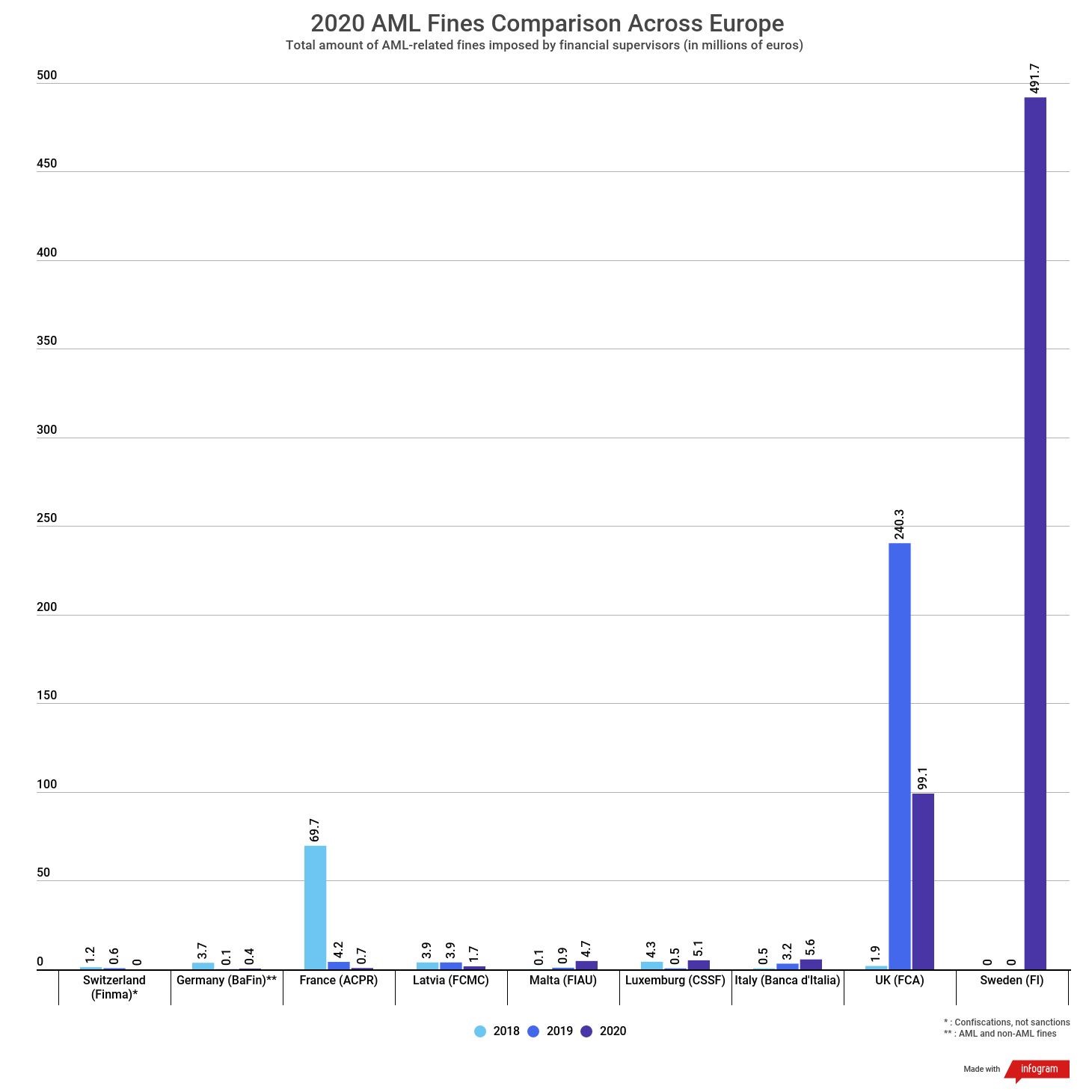

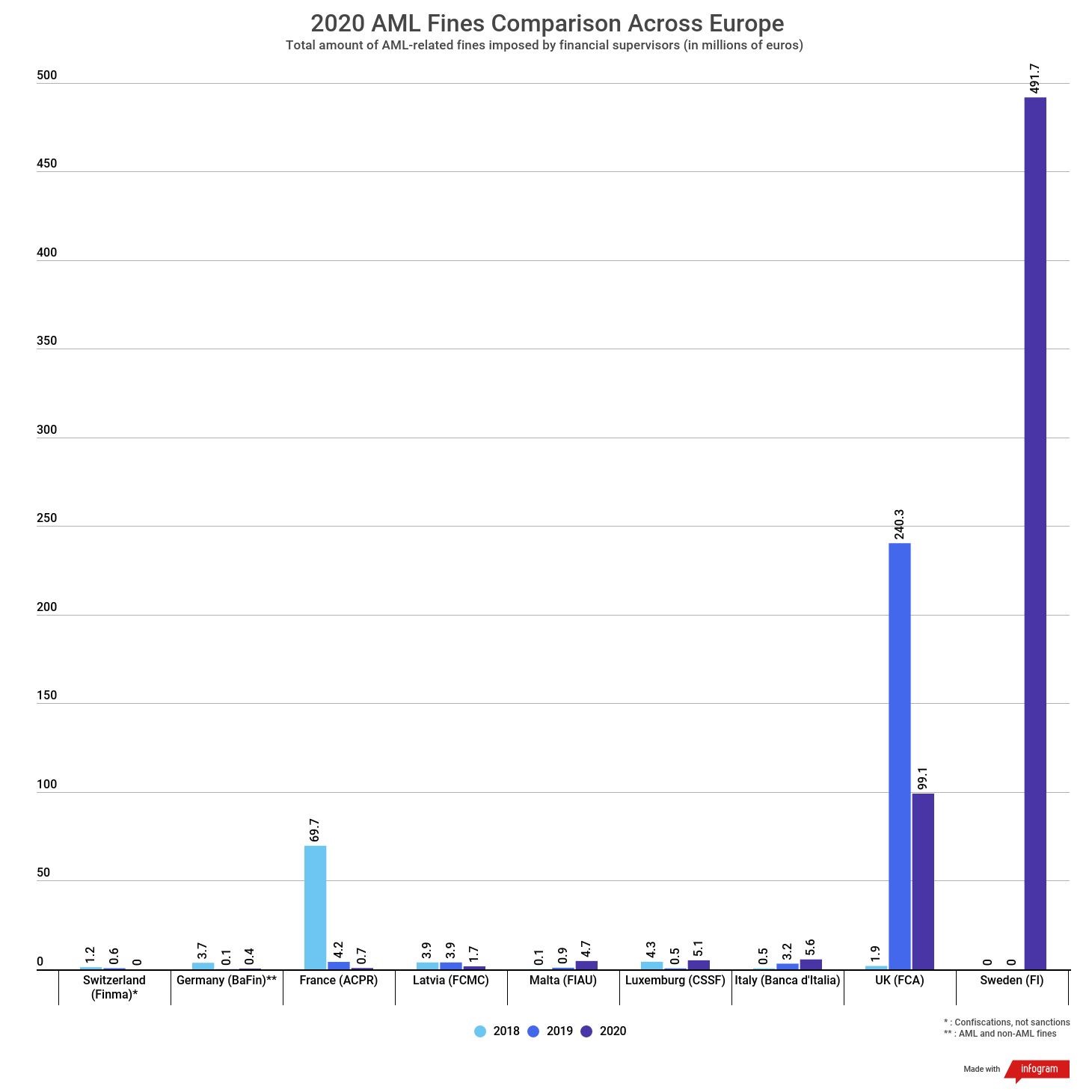

The investigation led by the Swedish regulator.

The report highlights the enforcement risk associated with supervisory visits. The Claimants issued a judicial review to challenge a decision by the FCAs Regulatory Decisions Committee not to stay the regulatory proceedings against the first Claimant. The MLRs as amended apply to banks building societies and credit unions. Prior to June 2020 the United States total share in AML. The investigation led by the Swedish regulator. While COVID-19 may have impacted the FCAs enforcement capacity we anticipate a continued emphasis on both of these areas with firms needing to adapt to the evolving risks presented by new working.

Source: skillcast.com

Source: skillcast.com

In 2020 Swedish Financial Supervisory Authority FSA fined the second largest Swedish bank Skandinaviska Enskilda Banken SEB 1073 million 1 billion Swedish crowns following a review of the banks efforts to comply with AML policiesThe regulator was investigating SEBs AML governance and controls in Latvia Lithuania and Estonia. The FCAs open cases as at 31 March 2020 highlight the emphasis placed by the FCA on financial crime 71 open cases and insider dealing and market manipulation 117 open cases. FCA responds to High Court decision to stay proceedings in enforcement case. For the FCA how a firm handles non-financial misconduct NFM is indicative of its wider culture. Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling.

Source: lexology.com

Source: lexology.com

Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling. It is interesting then to look at the types of cases the FCA has opened in 2020 as an indication of the areas in which misconduct arose. Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling. A seemingly innocuous decrease. And ensuring timely and accurate market disclosures.

Source: biia.com

Source: biia.com

All relate to areas which have been a focus for the FCA for some time. On June 17 2020 the Financial Conduct Authority FCA the non-governmental financial regulator in the United Kingdom issued a Final Notice to Commerzbank London the Bank a branch of the large German business bank assessing it 378 million for systemic failures to establish and effectively maintain an anti-money laundering AML program. Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling. Overview of enforcement action In 202021 we issued 134 Final Notices 119 against firms and individuals trading as firms and 15 against individuals secured 147 outcomes using our enforcement powers 144 regulatorycivil and 3 criminal and imposed 10 financial penalties totalling. This enforcement data shows the enforcement action we took in 201920 and it forms part of our Annual Report.

Source: skillcast.com

Source: skillcast.com

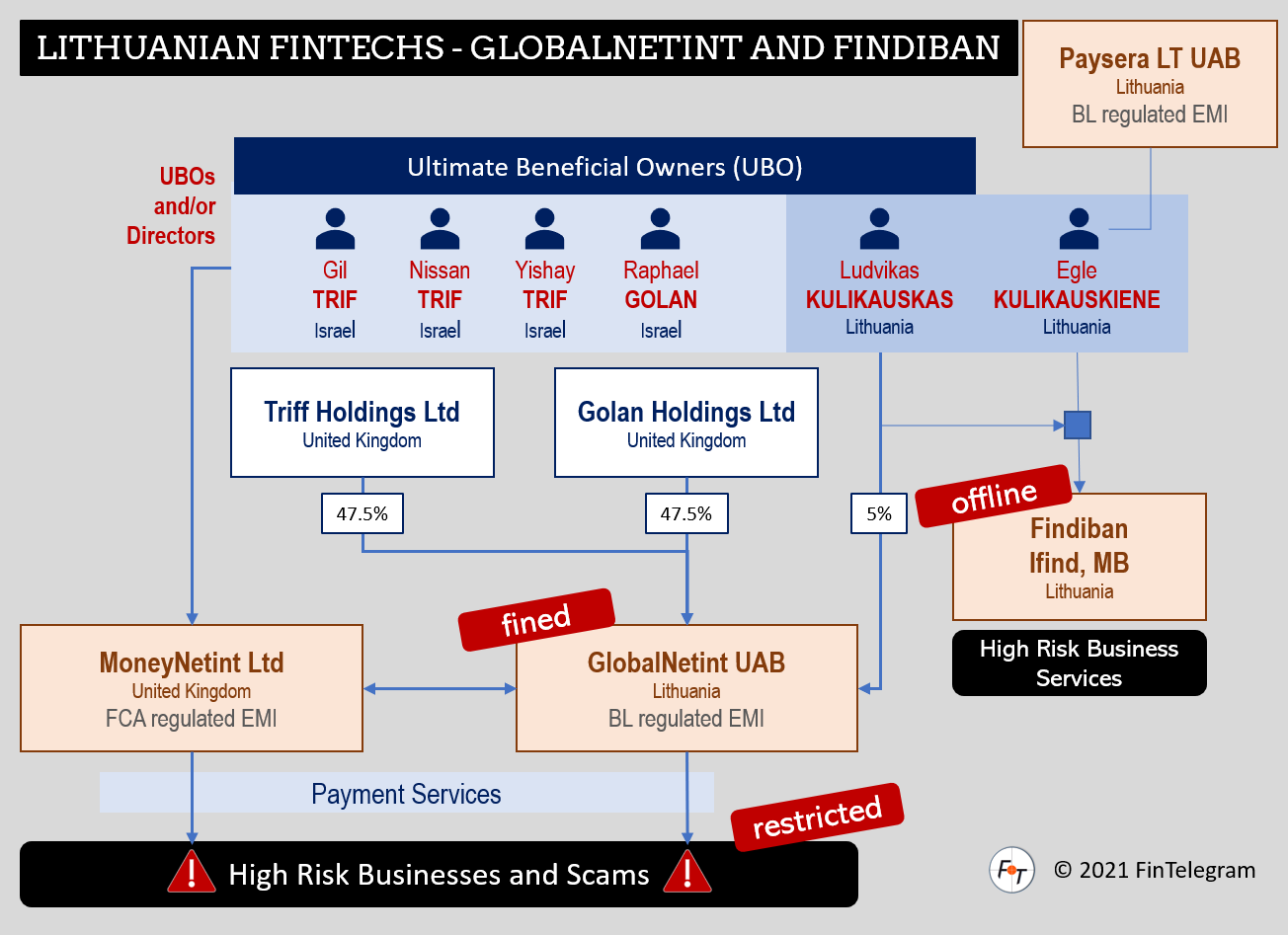

All relate to areas which have been a focus for the FCA for some time. HM Treasurys report was published on 6. The FCA now routinely conducts some AML investigations on both a criminal and regulatory or dual track basis. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance failures. This enforcement data shows the enforcement action we took in 202021 and it forms part of our Annual Report.

Source: fintelegram.com

Source: fintelegram.com

Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling. Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling. However the impact of this conduct on compliance with the Conduct Rules remains opaque with the FCAs trio of NFM actions in 2020 giving no clarity on workplace NFM and the High Court in Beckwith in the legal services context but with potential read-across preferring a case-by-case approach. It contains some interesting statistics which emphasise that when the FCA looks to conduct a supervisory review of a firms AML controls the stakes are extremely high. They also apply to other firms undertaking certain financial activities see Schedule 2 of the regulations.

Source: complyadvantage.com

Source: complyadvantage.com

Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance failures. This enforcement data shows the enforcement action we took in 202021 and it forms part of our Annual Report. Fca aml enforcement cases. It contains some interesting statistics which emphasise that when the FCA looks to conduct a supervisory review of a firms AML controls the stakes are extremely high. All relate to areas which have been a focus for the FCA for some time.

Source: lexology.com

Source: lexology.com

This enforcement data shows the enforcement action we took in 201920 and it forms part of our Annual Report. Citing data obtained via a freedom of information FOI request the newspaper found that since January the FCA has suspended seven of its 14 criminal investigations into suspected breaches of money laundering regulations including two dual-track cases that could have resulted in either criminal or civil proceedings and five single-track probes that focused solely on criminality. Overview of enforcement action In 201920 we issued 203 Final Notices 187 against firms and individuals trading as firms and 16 against individuals secured 217 outcomes using our enforcement powers 208 regulatorycivil and 9 criminal and imposed 15 financial penalties totalling. The FCA now routinely conducts some AML investigations on both a criminal and regulatory or dual track basis. In a speech in April 2019 the FCAs Director of Enforcement and Market Oversight Mark Steward signalled that the FCA was giving greater consideration to pursuing criminal prosecutions for AML offences in appropriate cases even though he thought that such.

Source: moneylaundering.com

Source: moneylaundering.com

After a relatively quiet start to the year on the enforcement front the FCA published three notable Final Notices in June 2020. Following consultation changes to the Financial Crime Guide which reflect amendments to the MLRs are now in effect from 1 October 2020. HM Treasurys report was published on 6 August 2020 and covers the year 2018-2019. The investigation led by the Swedish regulator. Citing data obtained via a freedom of information FOI request the newspaper found that since January the FCA has suspended seven of its 14 criminal investigations into suspected breaches of money laundering regulations including two dual-track cases that could have resulted in either criminal or civil proceedings and five single-track probes that focused solely on criminality.

Source:

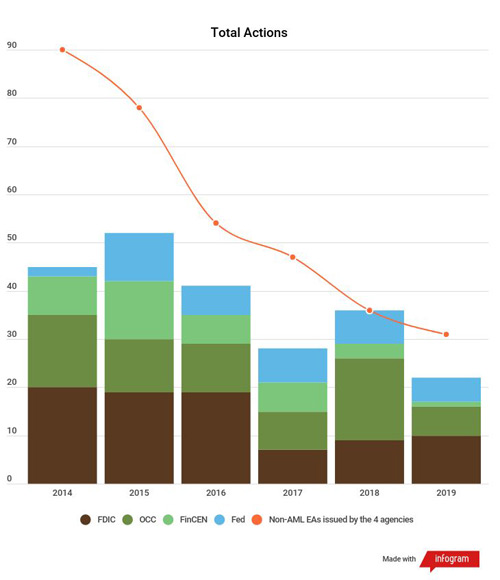

A seemingly innocuous decrease. 12 rows 14102020. The FCA now routinely conducts some AML investigations on both a criminal and regulatory or dual track basis. The report highlights the enforcement risk associated with supervisory visits. Prior to June 2020 the United States total share in AML.

Source: sumsub.com

In 201920 the FCA opened just 184 cases compared to 343 during 201819 and 302 during 201718. New Technologies And Anti Money Laundering Compliance Personal Summa. For the FCA how a firm handles non-financial misconduct NFM is indicative of its wider culture. Will continue to use our range of powers to monitor make enquiries investigate and if necessary take enforcement action to protect the integrity and orderly. All relate to areas which have been a focus for the FCA for some time.

Source: ibsintelligence.com

Source: ibsintelligence.com

The FCA now routinely conducts some AML investigations on both a criminal and regulatory or dual track basis. They also apply to other firms undertaking certain financial activities see Schedule 2 of the regulations. It is interesting then to look at the types of cases the FCA has opened in 2020 as an indication of the areas in which misconduct arose. And ensuring timely and accurate market disclosures. In 201920 the FCA opened just 184 cases compared to 343 during 201819 and 302 during 201718.

Source: shuftipro.com

Source: shuftipro.com

It contains some interesting statistics which emphasise that when the FCA looks to conduct a supervisory review of a firms AML controls the stakes are extremely high. However when compared with case opening figures for the previous two years it demonstrates a marked drop. This enforcement data shows the enforcement action we took in 202021 and it forms part of our Annual Report. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance failures. The Claimants issued a judicial review to challenge a decision by the FCAs Regulatory Decisions Committee not to stay the regulatory proceedings against the first Claimant.

HM Treasurys report was published on 6. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance failures. However when compared with case opening figures for the previous two years it demonstrates a marked drop. HM Treasurys report was published on 6 August 2020 and covers the year 2018-2019. It contains some interesting statistics which emphasise that when the FCA looks to conduct a supervisory review of a firms AML controls the stakes are extremely high.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca aml enforcement cases 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information