15+ Fca aml good practice ideas

Home » money laundering Info » 15+ Fca aml good practice ideasYour Fca aml good practice images are available in this site. Fca aml good practice are a topic that is being searched for and liked by netizens now. You can Download the Fca aml good practice files here. Get all free photos and vectors.

If you’re searching for fca aml good practice images information related to the fca aml good practice keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

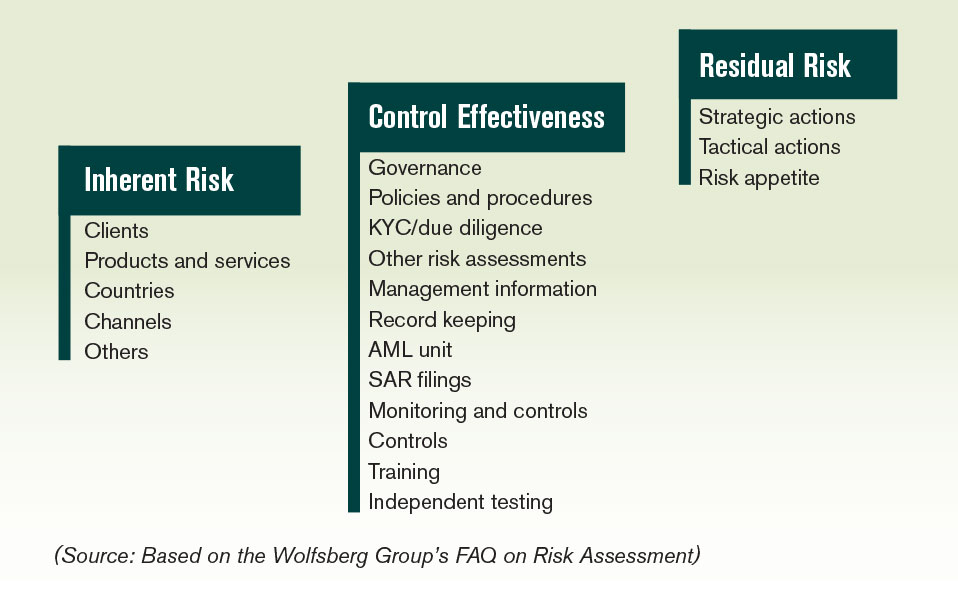

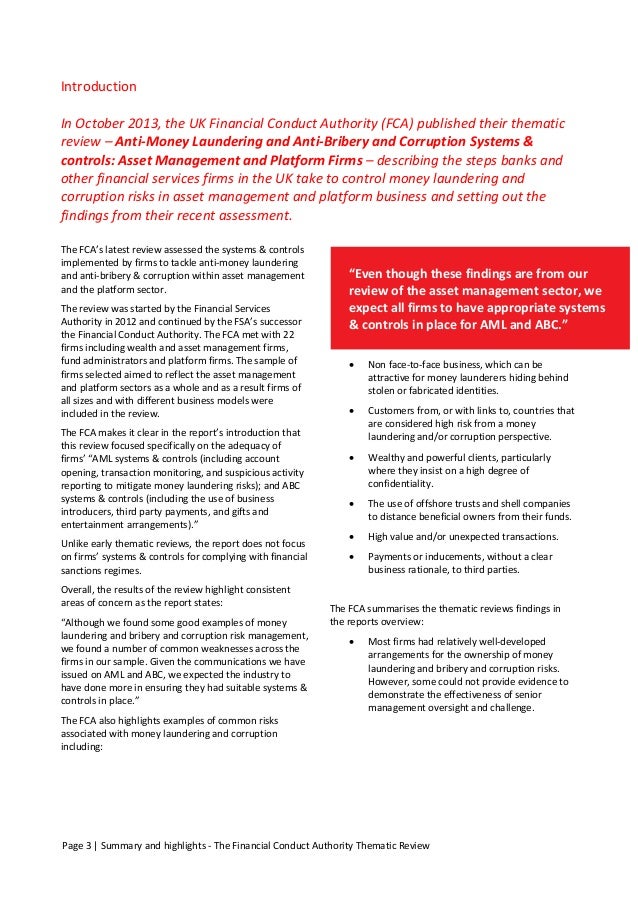

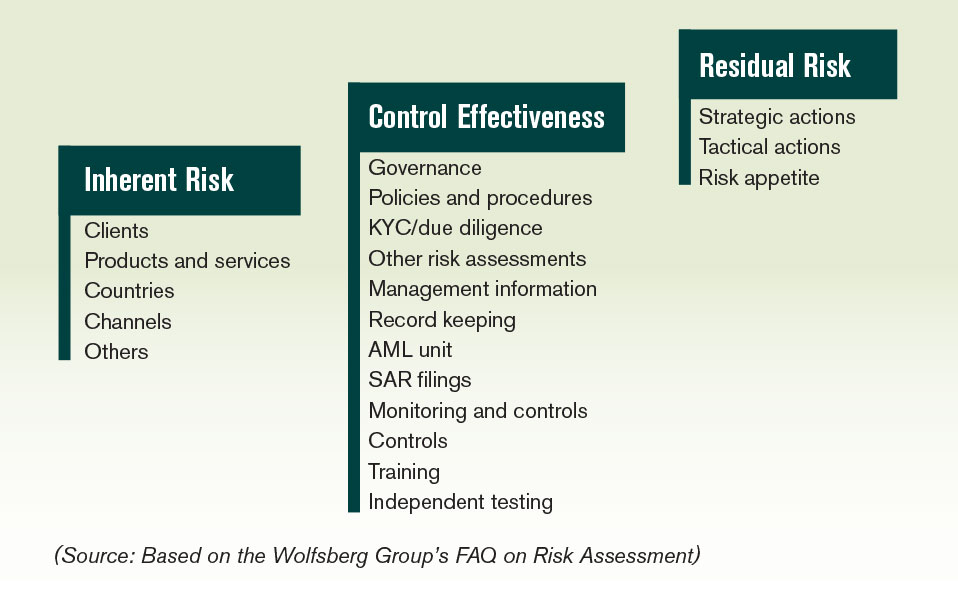

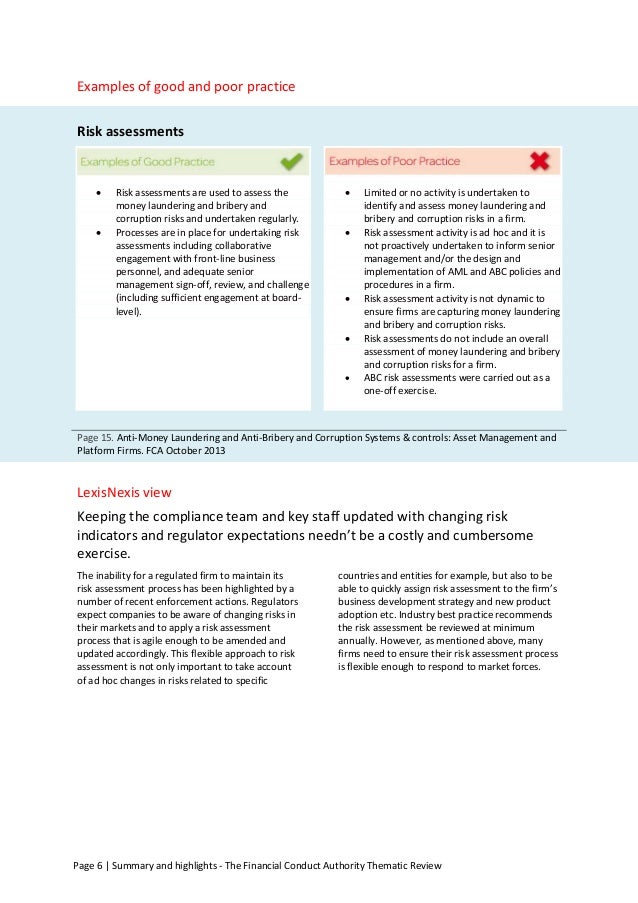

Fca Aml Good Practice. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. Examples of good practice. The FCA makes it clear in the reports introduction that this review focused specifically on the adequacy of firms AML systems. A lack of commitment to AML risk management among senior management and key AML staff.

Financial Crime Risk Assessment Acams Today From acamstoday.org

Financial Crime Risk Assessment Acams Today From acamstoday.org

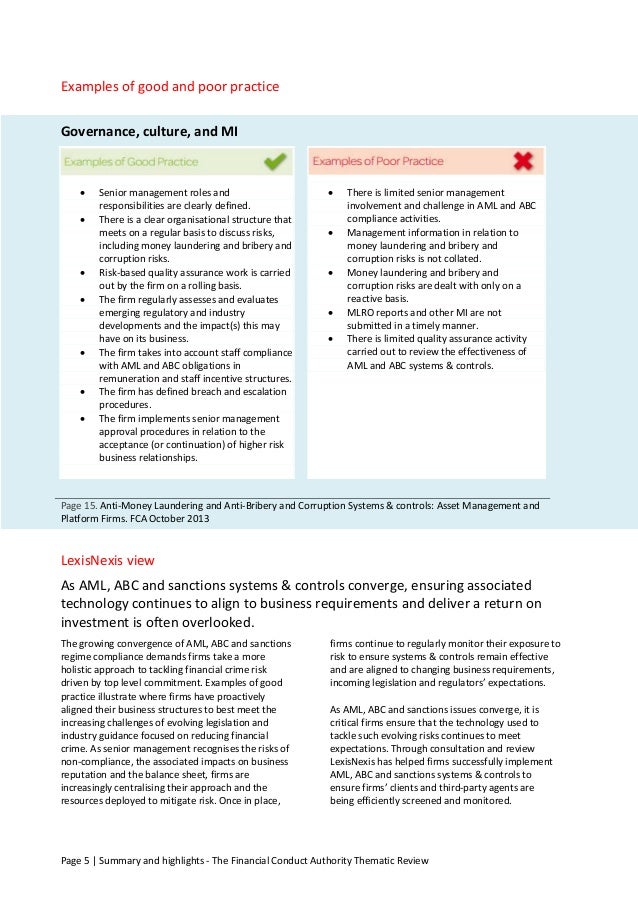

Overall the FCA encountered very few instances of poor practice and many instances of full compliance with the relevant obligations. Or where approval of senior management is mandated good practice involves firms having a governance committee responsible for key decision making on matters such as material financial crime related escalations and customer sign-off at onboarding and at periodic review. Were better engaged in AML and CTF issues. This report represents the culmination of three months of research and over 40 interviews with regulated firms technology providers and other bodies. Instead it describes the state of compliance and gives examples of good and poor practice. As in any other area of their business firms should adopt an appropriate risk-based approach to anti-money laundering taking into account relevant factors.

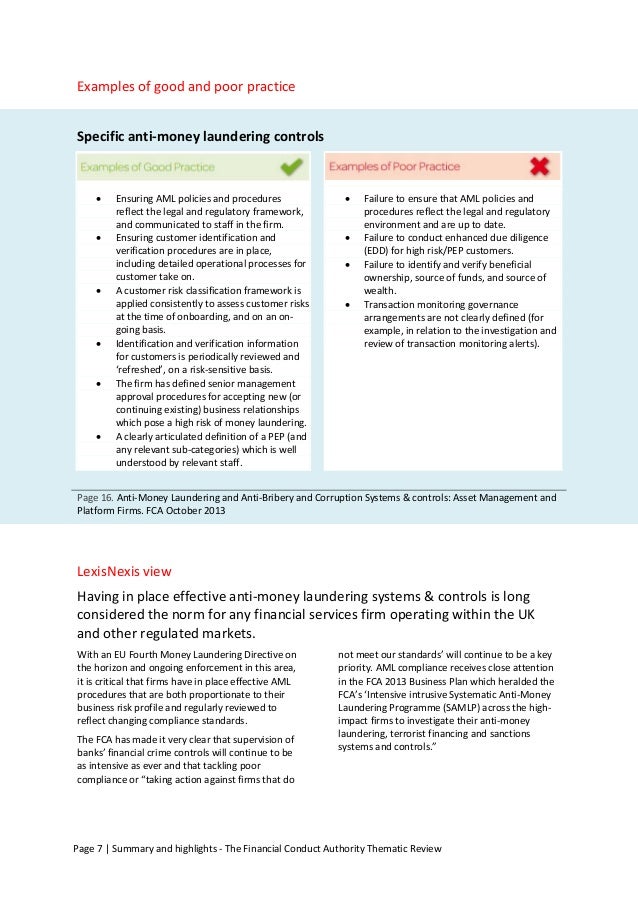

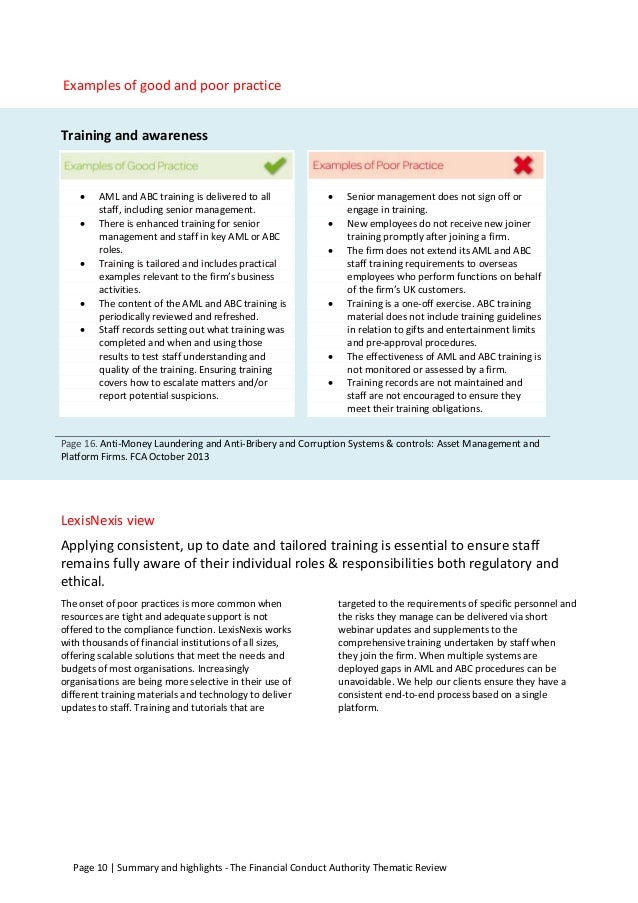

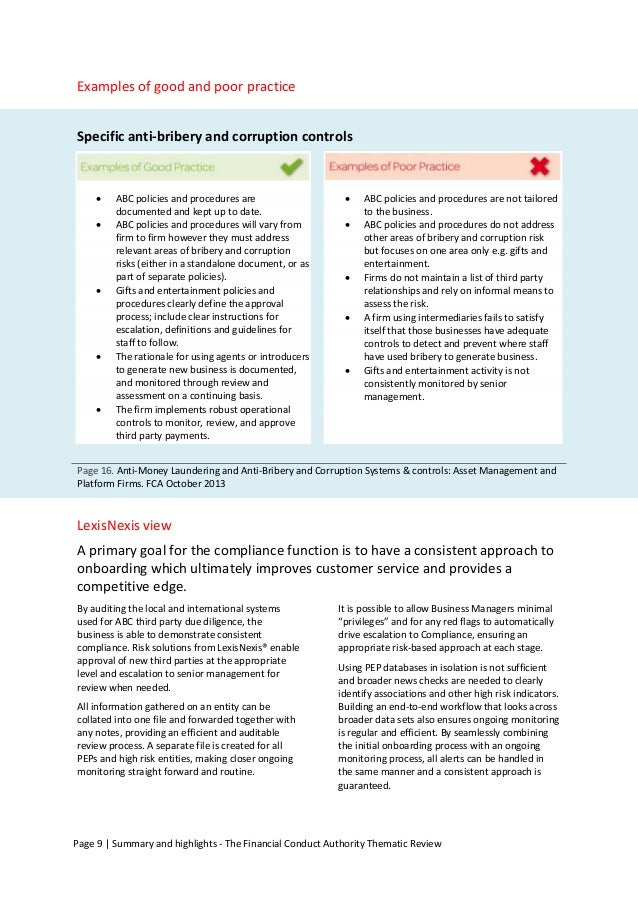

17 The examples of good and poor practice we are consulting on are reprinted below for your convenience.

And ABC systems controls including the use of business introducers third party payments and gifts and entertainment arrangements. Good practice Ensuring that key decisions on financial crime issues and follow-up actions are documented including deadlines and the individuals responsible for delivery. Under Regulation 217d of MLRs EMIs. Technologies in Anti-Money Laundering AML compliance by PA Consulting Group PA on behalf of the considered by regulated Financial Conduct Authority in the UK FCA. The FCA makes it clear in the reports introduction that this review focused specifically on the adequacy of firms AML systems. Examples of poor practice Senior management take money laundering risk seriously and understand what the Money Laundering Regulations 2007 are trying to achieve.

Source: slideshare.net

Source: slideshare.net

This chapter is relevant and its statements of good and poor practice apply to all firms for whom we are the supervisory authority under the Money Laundering Regulations. In 201011 the Financial Services Authority FSA reviewed 27 banks to assess their anti-money laundering AML systems and controls in high-risk situations the 2011 AML review. As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. Consolidated examples of good and poor practice. Instead it describes the state of compliance and gives examples of good and poor practice.

Source: bovill.com

Source: bovill.com

Overall the FCA encountered very few instances of poor practice and many instances of full compliance with the relevant obligations. A national retail bank is likely to have a greater exposure to fraud and therefore to have more information to contribute to such efforts than a small local building society and we would expect this to be reflected in their levels of engagement. Decisions on allocation of compliance and audit resource are risk-based. As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. Examples of poor practice A GI Intermediary used an on-line training website costing around 100 per employee per year.

Source: slideshare.net

Source: slideshare.net

As in any other area of their business firms should adopt an appropriate risk-based approach to anti-money laundering taking into account relevant factors. As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. Examples of poor practice Internal audit and compliance routinely test the firms defences against financial crime including specific financial crime threats. As in any other area of their business firms should adopt an appropriate risk-based approach to anti-money laundering taking into account relevant factors. 18 You can send your response by email to.

Source: slideshare.net

Source: slideshare.net

Ad AML coverage from every angle. Ad AML coverage from every angle. Decisions on allocation of compliance and audit resource are risk-based. Alternatively responses can be sent by post to. It is good practice for firms to engage with relevant cross-industry efforts to combat fraud.

Source: slideshare.net

Source: slideshare.net

Latest news reports from the medical literature videos from the experts and more. Consolidated examples of good and poor practice. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. 18 You can send your response by email to. Overall the FCA encountered very few instances of poor practice and many instances of full compliance with the relevant obligations.

Source: acamstoday.org

Source: acamstoday.org

In our view this would support a finding of low risk although this conclusion is not explicitly drawn by FCA. And ABC systems controls including the use of business introducers third party payments and gifts and entertainment arrangements. It is good practice for firms to engage with relevant cross-industry efforts to combat fraud. 17 The examples of good and poor practice we are consulting on are reprinted below for your convenience. The FCA makes it clear in the reports introduction that this review focused specifically on the adequacy of firms AML systems.

Technologies in Anti-Money Laundering AML compliance by PA Consulting Group PA on behalf of the considered by regulated Financial Conduct Authority in the UK FCA. FCTR 412 G 13122018 1 The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. Ad AML coverage from every angle. It is good practice for firms to engage with relevant cross-industry efforts to combat fraud. In our view this would support a finding of low risk although this conclusion is not explicitly drawn by FCA.

Source: slideshare.net

Source: slideshare.net

We welcome any comments you may have. The depth of the review is determined by the risk ranking assigned to the client. Examples of good practice. FCTR 412 G 13122018 1 The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. Instead it describes the state of compliance and gives examples of good and poor practice.

Source: avyse.co.uk

Source: avyse.co.uk

Examples of good practice. 17 The examples of good and poor practice we are consulting on are reprinted below for your convenience. Under Regulation 217d of MLRs EMIs. Compliance unit and audit teams lack experience in financial crime matters. There were many examples of good practice particularly in the way the larger firms had fully embraced the risk- based approach to AML and senior managements accountability for effective AML.

Source: slideshare.net

Source: slideshare.net

Examples of good practice. Compliance unit and audit teams lack experience in financial crime matters. Examples of poor practice Senior management take money laundering risk seriously and understand what the Money Laundering Regulations 2007 are trying to achieve. Examples of poor practice Internal audit and compliance routinely test the firms defences against financial crime including specific financial crime threats. Examples of good practice.

Source: slideshare.net

Source: slideshare.net

A national retail bank is likely to have a greater exposure to fraud and therefore to have more information to contribute to such efforts than a small local building society and we would expect this to be reflected in their levels of engagement. This chapter is relevant and its statements of good and poor practice apply to all firms for whom we are the supervisory authority under the Money Laundering Regulations. FCTR 412 G 13122018 1 The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. Alternatively responses can be sent by post to. As in any other area of their business firms should adopt an appropriate risk-based approach to anti-money laundering taking into account relevant factors.

Source: planetcompliance.com

Source: planetcompliance.com

Examples of poor practice A GI Intermediary used an on-line training website costing around 100 per employee per year. Examples of poor practice A GI Intermediary used an on-line training website costing around 100 per employee per year. As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. Latest news reports from the medical literature videos from the experts and more. 18 You can send your response by email to.

Source: shuftipro.com

Source: shuftipro.com

Compliance unit and audit teams lack experience in financial crime matters. Proposed good and poor practice guidance in this report please respond to the consultation on the guide. As in any other area of their business firms should adopt an appropriate risk-based approach to anti-money laundering taking into account relevant factors. Staff were also required to complete refresher training. FCTR 412 G 13122018 1 The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml good practice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas