11++ Fca aml record keeping info

Home » money laundering Info » 11++ Fca aml record keeping infoYour Fca aml record keeping images are ready. Fca aml record keeping are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca aml record keeping files here. Get all free photos.

If you’re looking for fca aml record keeping pictures information linked to the fca aml record keeping topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Fca Aml Record Keeping. Some banks conducted good quality AML due diligence and monitoring of relationships while others particularly some smaller banks conducted little and in some cases none. The MLRs will generally only apply if you are entering into regulated credit agreements as a lender. These are some of the tasks you are obliged to perform so your business is in line with AML requirements. These areas include but are not limited to.

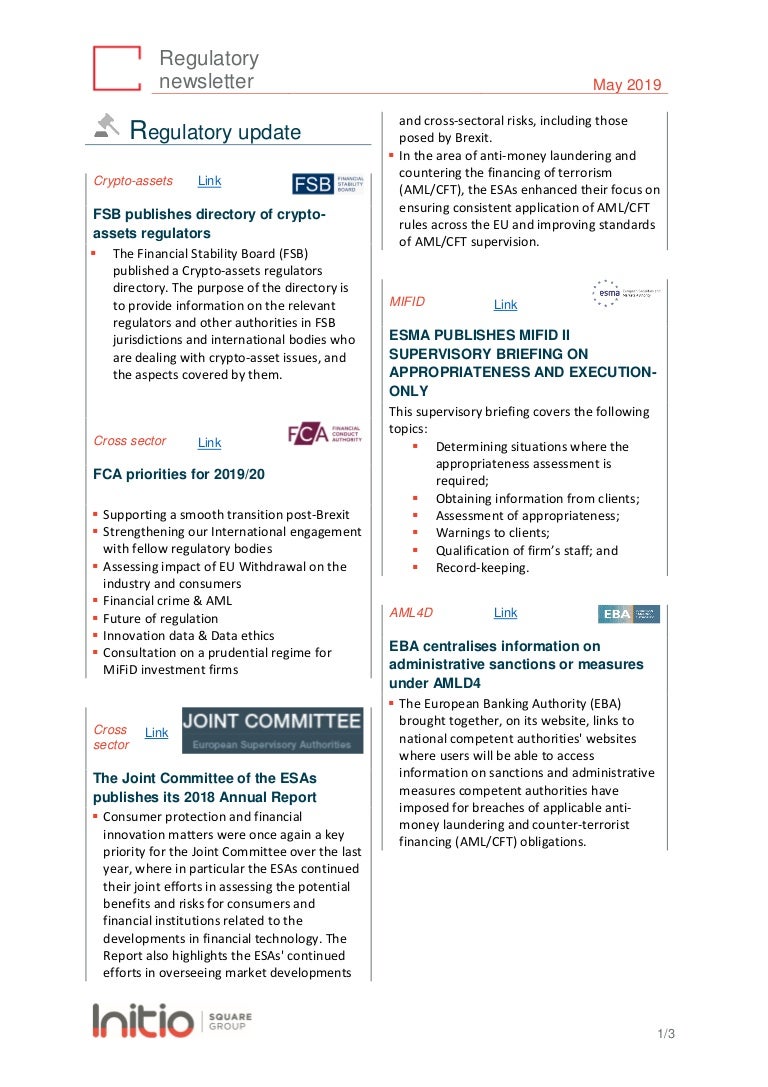

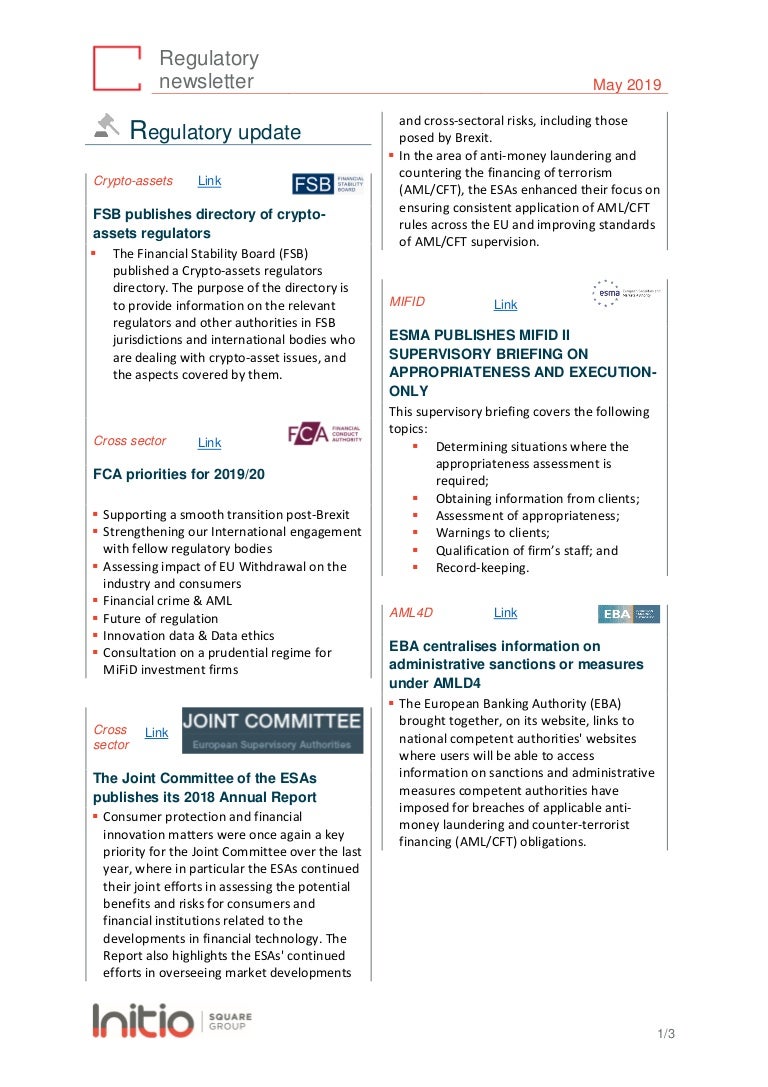

Initio Regulatory Watch May 2019 From slideshare.net

Initio Regulatory Watch May 2019 From slideshare.net

In several smaller banks a tick-box approach to AML due diligence was noted. 7 March 2018 Mike Kennedy. Skills knowledge and expertise assessments. The Fourth Money Laundering Directive came into effect on 26 June 2017 introducing a number of enhancements to previous requirements related to combatting money laundering and terrorist financing. CMCOB 241 G 01042019. All reporting entities must keep records to comply with their AMLCTF obligations.

Pension opt-out or FSAVC indefinitely.

The records should be kept up to date as stated in the rule. Finance HR Key Retention Exception Drivers s Exceptions Exceptions rs s Exceptions Exceptions Exceptions rs rs. Information required to evidence how the FCA operates on a day to day basis this will include processes procedures and evidence of operational decisions taken. Motor vehicle dealers who are insurers or who act as insurance intermediaries and solicitors also have record-keeping obligations to comply with the Financial Transactions Reports Act 1988. Scope of responsibilities for certain approved persons of small non-directive insurers. 10 years from the date superseded or 6 years for large non-directive insurers 4.

Source: shuftipro.com

Source: shuftipro.com

1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. In this video we cover AMLCFT record keeping. The FCAs financial crime rules are set out in SYSC 63. 1 if relating to a pension transfer pension conversion 4. These areas include but are not limited to.

Source: slideshare.net

Source: slideshare.net

Retention requirements are driven by multiple pieces of legislation. 1 if relating to a pension transfer pension conversion 4. Failure to digest the number and detailed nature of such publications was specifically cited by the FCA in its recent assessment of Barclays oversights in managing risks posed by some of its high-risk customers. Firms are reminded that SYSC 911R requires a firm to arrange for orderly records to be kept of its business and internal organisation including all services and transactions undertaken by it which must be sufficient to enable the FCA to monitor the firms compliance with the requirements under. The minimum compliance arrangements noted by the FCA include.

Source: sumsub.com

AML Financial crime. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. These are some of the tasks you are obliged to perform so your business is in line with AML requirements. Along with customer due diligence and suspicious transaction and activity reporting record keeping is corners. And to meet the.

Source: protiviti.com

Source: protiviti.com

Retention requirements are driven by multiple pieces of legislation. And to meet the. Retention requirements are driven by multiple pieces of legislation. The FCAs financial crime rules are set out in SYSC 63. All reporting entities must keep records to comply with their AMLCTF obligations.

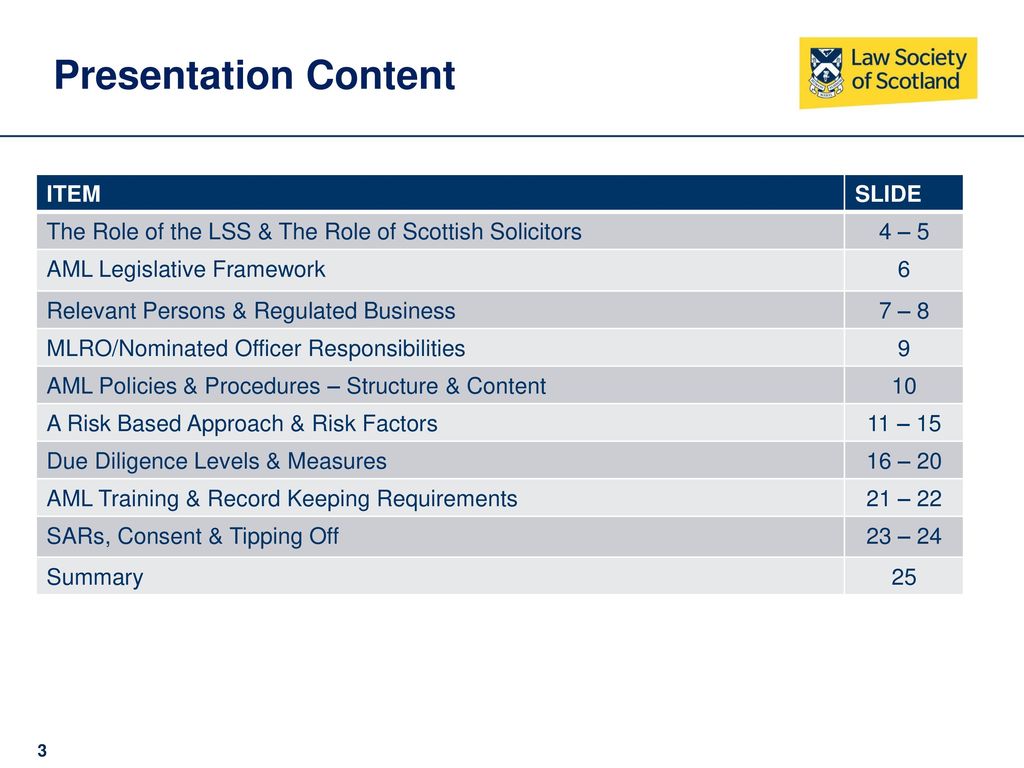

Source: slideserve.com

Source: slideserve.com

Record-keeping involves creating full and accurate records and storing and managing them. In this video we cover AMLCFT record keeping. The records should be kept up to date as stated in the rule. To meet the criteria of record keeping it is recommended you consider the following Should a meeting between staff be held where AML CFT compliance is discussed ensure there is some type of written record of these discussions. Firms are reminded that SYSC 911R requires a firm to arrange for orderly records to be kept of its business and internal organisation including all services and transactions undertaken by it which must be sufficient to enable the FCA to monitor the firms compliance with the requirements under.

Source: slideplayer.com

Source: slideplayer.com

10 years from the date superseded or 6 years for large non-directive insurers 4. The Fourth Money Laundering Directive came into effect on 26 June 2017 introducing a number of enhancements to previous requirements related to combatting money laundering and terrorist financing. The FCAs financial crime rules are set out in SYSC 63. As stated in rule. The MLRs will generally only apply if you are entering into regulated credit agreements as a lender.

Source: tookitaki.ai

Source: tookitaki.ai

Scope of the Applicants business. Information required to evidence how the FCA operates on a day to day basis this will include processes procedures and evidence of operational decisions taken. And to meet the. Firm must retain its records relating to suitability for a minimum of the following periods. Financial crime and AML procedures.

Source:

6 years from the date superseded. 1 if relating to a pension transfer pension conversion 4. 10 years from the date superseded or 6 years for large non-directive insurers 4. Record keeping Keeping records of all customer identification documents and transactions to more easily investigate possible ML threats. These areas include but are not limited to.

Source: hirett.co.uk

Source: hirett.co.uk

Financial crime and AML procedures. Information security and Business continuity. Firm must retain its records relating to suitability for a minimum of the following periods. The records in 1 must be sufficient to enable the FCA to fulfil its supervisory tasks and to perform the enforcement actions under the regulatory system including MiFID MiFIR and the Market Abuse Regulation and in particular to ascertain that the common platform firm has complied with all obligations including those with respect to clients or potential clients and to the integrity of the market. Some banks conducted good quality AML due diligence and monitoring of relationships while others particularly some smaller banks conducted little and in some cases none.

Source: acamstoday.org

Source: acamstoday.org

Scope of the Applicants business. The Fourth Money Laundering Directive came into effect on 26 June 2017 introducing a number of enhancements to previous requirements related to combatting money laundering and terrorist financing. Motor vehicle dealers who are insurers or who act as insurance intermediaries and solicitors also have record-keeping obligations to comply with the Financial Transactions Reports Act 1988. Firms are reminded that SYSC 911R requires a firm to arrange for orderly records to be kept of its business and internal organisation including all services and transactions undertaken by it which must be sufficient to enable the FCA to monitor the firms compliance with the requirements under. Some banks conducted good quality AML due diligence and monitoring of relationships while others particularly some smaller banks conducted little and in some cases none.

Source: neopay.co.uk

Source: neopay.co.uk

Skills knowledge and expertise assessments. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. These areas include but are not limited to. Scope of responsibilities for certain approved persons of small non-directive insurers. But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime.

Source: slideplayer.com

Source: slideplayer.com

Financial institutions are additionally expected to integrate the FCAs reviews policy statements and anti-money laundering AML annual reports into their policies and procedures. Anti-money laundering record keeping. Retention requirements are driven by multiple pieces of legislation. In this video we cover AMLCFT record keeping. Information required to evidence how the FCA operates on a day to day basis this will include processes procedures and evidence of operational decisions taken.

Source:

The records in 1 must be sufficient to enable the FCA to fulfil its supervisory tasks and to perform the enforcement actions under the regulatory system including MiFID MiFIR and the Market Abuse Regulation and in particular to ascertain that the common platform firm has complied with all obligations including those with respect to clients or potential clients and to the integrity of the market. CMCOB 241 G 01042019. As a minimum the FCA authorisation application process expects firms to have a compliance program or FCA Compliance Manual that covers all the areas noted in the full and limited permissions guidance notes. Firm must retain its records relating to suitability for a minimum of the following periods. Skills knowledge and expertise assessments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml record keeping by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas