16+ Fca aml risk assessment information

Home » money laundering Info » 16+ Fca aml risk assessment informationYour Fca aml risk assessment images are available in this site. Fca aml risk assessment are a topic that is being searched for and liked by netizens today. You can Download the Fca aml risk assessment files here. Download all royalty-free photos.

If you’re searching for fca aml risk assessment pictures information related to the fca aml risk assessment topic, you have visit the right blog. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Fca Aml Risk Assessment. Text in brackets expands on this TheFCAmay followsimilar lines of inquirywhen discussing financial crime issues with firms. The implications of this are that first line employees often do not own or fully understand the financial crime risk faced by the firm impacting their ability to identify and tackle potentially suspicious activity. There are also issues with how the risk rating rationales are being. The FCA makes it clear in the reports introduction that.

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

This is scored from 0 5. Overcoming Common Challenges When Updating a Risk Assessment. The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. Review existing AML risk assessments to ensure capital market-specific red flags and scenarios from. Risk assessment is a continuous process based on the best information available from internal and external sources. The implications of this are that first line employees often do not own or fully understand the financial crime risk faced by the firm impacting their ability to identify and tackle potentially suspicious activity.

Moreover the FFIEC requires all FIs to maintain an EWRA.

2 unlikely may occur at some point. The implications of this are that first line employees often do not own or fully understand the financial crime risk faced by the firm impacting their ability to identify and tackle potentially suspicious activity. Not only does it demonstrate that you have been through the required. The key risks and the methodology in place to assess the aggregate inherent risk profile of individual customers. The UKs National Risk Assessment NRA of Money Laundering and Terrorist Financing was published in 2020. Risk assessment is a one-off exercise.

Source: pinterest.com

Source: pinterest.com

3 possible likely that the event will occur at some point. Customer risk assessments. As the risks change over time your risk assessment will need to be kept up-to-date. They note CRAs being too generic failing to recognise differences between AML and terrorist financing risks or between correspondent banking and trade finance products. Risk assessment is a one-off exercise.

Source: biia.com

Source: biia.com

These questions will help you to consider whether your firms approach isappropriate. Moreover the FFIEC requires all FIs to maintain an EWRA. The firms risk assessment is comprehensive. The FCA HMRC to conduct their own risk assessments. The implications of this are that first line employees often do not own or fully understand the financial crime risk faced by the firm impacting their ability to identify and tackle potentially suspicious activity.

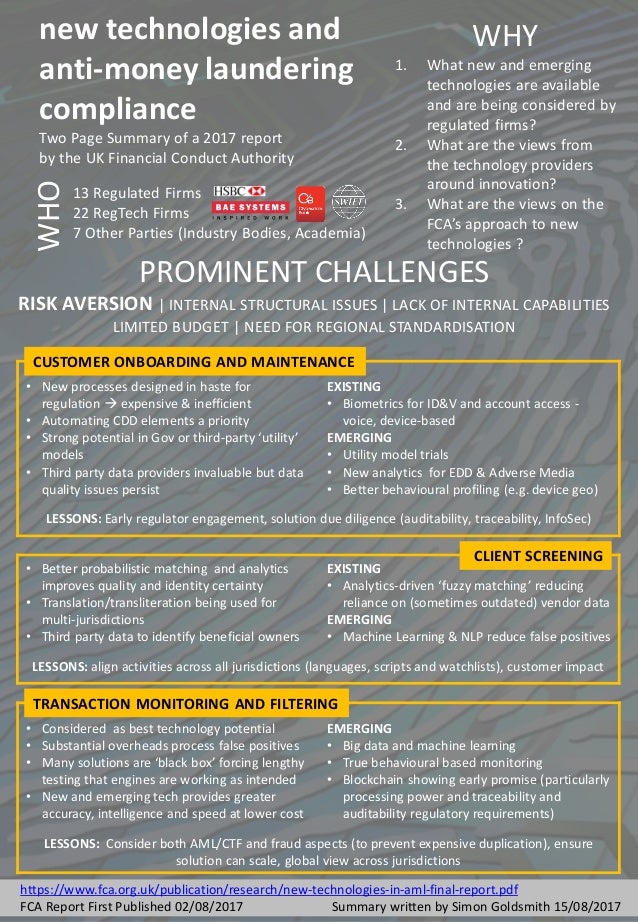

Source: slideshare.net

Source: slideshare.net

The UKs National Risk Assessment NRA of Money Laundering and Terrorist Financing was published in 2020. Anti-Money Laundering and Anti-Bribery and Corruption Systems controls. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. There are also issues with how the risk rating rationales are being. The firms risk assessment is comprehensive.

Source: br.pinterest.com

Source: br.pinterest.com

The FCA has identified circumstances where compliance departments undertake first line activities for example completing all due diligence checks or all aspects of customer risk assessment. 3 possible likely that the event will occur at some point. The questions draw attention to some of the key points firms. Risk assessment is a continuous process based on the best information available from internal and external sources. These questions will help you to consider whether your firms approach isappropriate.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The UKs National Risk Assessment NRA of Money Laundering and Terrorist Financing was published in 2020. Risk assessments should be carried out regularly in order to identify assess and manage AML and ABC risks. For lower risk factors the FCA expects first line of defence staff to document their assessment for accepting this risk at on-boarding and periodic review. Anti-Money Laundering and Anti-Bribery and Corruption Systems controls. Not only does it demonstrate that you have been through the required.

Source: amlrightsource.com

Source: amlrightsource.com

0 - no likelihood of the risk factor impacting the business. The firms risk assessment is comprehensive. 3 possible likely that the event will occur at some point. The key risks and the methodology in place to assess the aggregate inherent risk profile of individual customers. 4 probable the event is likely to occur in most cases.

Source: ar.pinterest.com

Source: ar.pinterest.com

As the risks change over time your risk assessment will need to be kept up-to-date. The assessments highlight key risk areas how well those risks are managed and support a risk-based allocation of resource to the highest risk areas as well as the establishment of strategic more long term and tactical immediate workaround action plans for managing the identified risks. Risk assessment process has been highlighted by a number of recent enforcement actions. Not only does it demonstrate that you have been through the required. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering.

Source: asiatokenfund.com

Source: asiatokenfund.com

1 rare may occur at some time but this would be by exception. It is also mandatory for regulated firms and supervisory authorities ie. Risk assessments are incomplete. Overcoming Common Challenges When Updating a Risk Assessment. The FCA HMRC to conduct their own risk assessments.

Source: psplab.com

Source: psplab.com

The FCA has identified circumstances where compliance departments undertake first line activities for example completing all due diligence checks or all aspects of customer risk assessment. In 2018 FATF published guidance on money laundering risks in the securities sectors that included examples of such red flags. The FCA HMRC to conduct their own risk assessments. 1 rare may occur at some time but this would be by exception. As with the business risk assessment the FCA comments are broad and scathing.

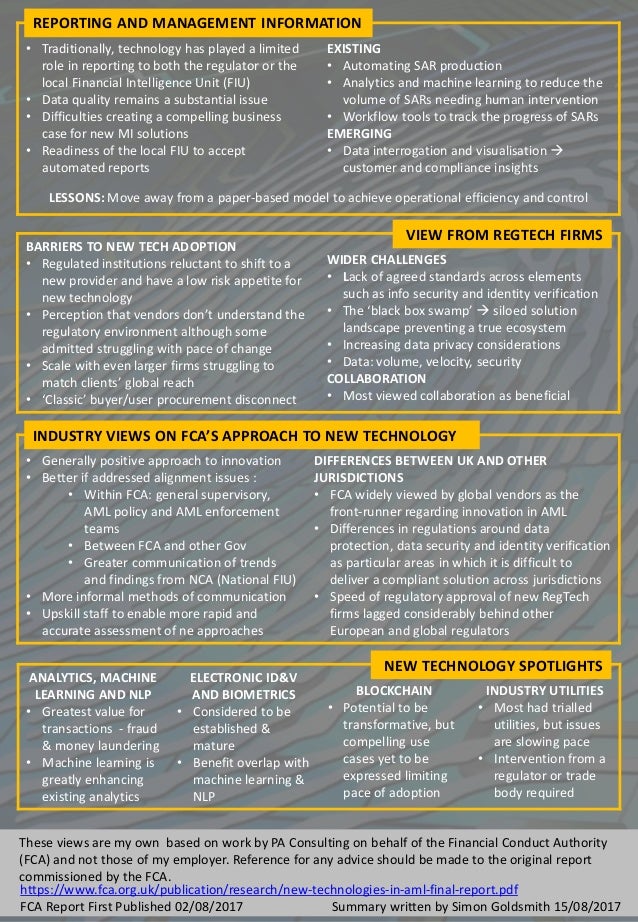

Source: slideshare.net

Source: slideshare.net

The implications of this are that first line employees often do not own or fully understand the financial crime risk faced by the firm impacting their ability to identify and tackle potentially suspicious activity. For lower risk factors the FCA expects first line of defence staff to document their assessment for accepting this risk at on-boarding and periodic review. The FCA has identified circumstances where compliance departments undertake first line activities for example completing all due diligence checks or all aspects of customer risk assessment. They should seek to take into account the latest NRA findings and guidance when completing internal assessments. Finally while firms tend to focus on the AML and sanctions risks posed by their customers the assessment of other risks for example tax evasion or bribery and corruption is often overlooked.

Source: tookitaki.ai

Source: tookitaki.ai

Risk assessment is a one-off exercise. The questions draw attention to some of the key points firms. Risk assessment is a continuous process based on the best information available from internal and external sources. Overcoming Common Challenges When Updating a Risk Assessment. 3 possible likely that the event will occur at some point.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

For lower risk factors the FCA expects first line of defence staff to document their assessment for accepting this risk at on-boarding and periodic review. Text in brackets expands on this TheFCAmay followsimilar lines of inquirywhen discussing financial crime issues with firms. The FCA makes it clear in the reports introduction that. There are also issues with how the risk rating rationales are being. The assessments highlight key risk areas how well those risks are managed and support a risk-based allocation of resource to the highest risk areas as well as the establishment of strategic more long term and tactical immediate workaround action plans for managing the identified risks.

Source: sumsub.com

What you should do. Moreover the FFIEC requires all FIs to maintain an EWRA. 3 possible likely that the event will occur at some point. They note CRAs being too generic failing to recognise differences between AML and terrorist financing risks or between correspondent banking and trade finance products. 0 - no likelihood of the risk factor impacting the business.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas