15++ Fca aml supervision information

Home » money laundering Info » 15++ Fca aml supervision informationYour Fca aml supervision images are available. Fca aml supervision are a topic that is being searched for and liked by netizens today. You can Get the Fca aml supervision files here. Find and Download all royalty-free vectors.

If you’re searching for fca aml supervision pictures information related to the fca aml supervision keyword, you have visit the right site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Fca Aml Supervision. The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs. OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. This page highlights some specific new areas that firms need to comply with.

Uzivatel Financial Conduct Authority Na Twitteru Consultation Paper Recovering The Costs Of The Office For Professional Body Anti Money Laundering Supervision Opbas Further Consultation On Fees Structure Respond By 26 April Https T Co From twitter.com

Uzivatel Financial Conduct Authority Na Twitteru Consultation Paper Recovering The Costs Of The Office For Professional Body Anti Money Laundering Supervision Opbas Further Consultation On Fees Structure Respond By 26 April Https T Co From twitter.com

See IFA AML supervision for further information. Others have been less proactive in their approach. Faces effective and risk-based supervision by the FCA is critical to the overall effectiveness of the UKs AMLCTF regime. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. The role of supervision in the AMLCFT framework is to supervise and monitor financial institutions to ensure their effective management of MLTF risk and compliance assessment and with AMLCFT preventive measures. Ensuring a robust and consistently high standard of supervision by the professional body AML supervisors PBSs overseeing the legal.

Since 2015 the FCA has prioritised tackling financial crime and is committed to improving intelligence sharing with the government and relevant agencies and to use intelligence data and technology to.

Ensuring a robust and consistently high standard of supervision by the professional body AML supervisors PBSs overseeing the legal. A Director of Enforcement at the Financial Conduct Authority FCA has set out some of the key challenges the regulator expects in its new role as AMLCTF anti-money launderingcounter terrorist financing supervisor for some types of crypto businesses. OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. 12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK. The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs.

Source: fintech-alliance.com

Source: fintech-alliance.com

We have delivered tough messages and used our regulatory powers where necessary. Any UK business conducting specific cryptoasset activities falls within scope of the regulations and will need to comply with their requirements. The SAMLP has been running since early 2012 and currently covers 14 major. This page highlights some specific new areas that firms need to comply with. As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP.

Source: sygna.io

Source: sygna.io

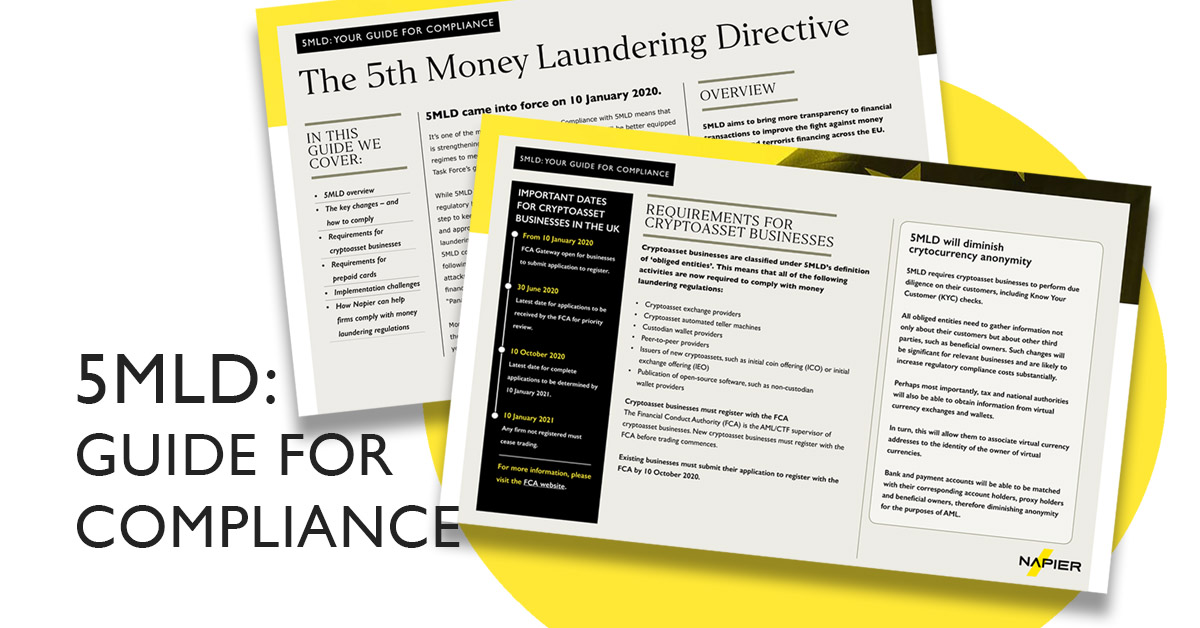

On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. Some have responded positively and implemented changes quickly. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. It also ensures better collaboration through information and intelligence sharing between professional body supervisors statutory AML supervisors HM Revenue and Customs the Gambling Commission and. See IFA AML supervision for further information.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. This page highlights some specific new areas that firms need to comply with. A Director of Enforcement at the Financial Conduct Authority FCA has set out some of the key challenges the regulator expects in its new role as AMLCTF anti-money launderingcounter terrorist financing supervisor for some types of crypto businesses. Regulated by the FCA for another purpose. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society.

Source:

Some have responded positively and implemented changes quickly. The SAMLP has been running since early 2012 and currently covers 14 major. Ensuring a robust and consistently high standard of supervision by the professional body AML supervisors PBSs overseeing the legal. The FCAs approach to AML supervision is a risk-based approach utilising information from the National risk assessment of money laundering and terrorist financing and the financial crime data return. Some have responded positively and implemented changes quickly.

Source: fcpablog.com

Source: fcpablog.com

It also ensures better collaboration through information and intelligence sharing between professional body supervisors statutory AML supervisors HM Revenue and Customs the Gambling Commission and. OPBAS supervises the 25 professional body supervisors in the legal and accountancy sectors. The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision. 12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK. Faces effective and risk-based supervision by the FCA is critical to the overall effectiveness of the UKs AMLCTF regime.

Source: twitter.com

Source: twitter.com

See IFA AML supervision for further information. The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs. Anti-Money Laundering Supervision by the Legal and Accountancy Professional Body Supervisors 17 PBSs have responded differently to the challenges they face. The SAMLP has been running since early 2012 and currently covers 14 major. Any UK business conducting specific cryptoasset activities falls within scope of the.

Source: tookitaki.ai

Source: tookitaki.ai

The Financial Conduct Authority FCA has become the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities. OPBAS housed within the FCA ensures a robust and consistently high standard of AML supervision across the legal and accountancy sectors. From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. The FCAs approach to AML supervision is a risk-based approach utilising information from the National risk assessment of money laundering and terrorist financing and the financial crime data return.

Source:

A Director of Enforcement at the Financial Conduct Authority FCA has set out some of the key challenges the regulator expects in its new role as AMLCTF anti-money launderingcounter terrorist financing supervisor for some types of crypto businesses. See IFA AML supervision for further information. FCA sets out approach to AML crypto supervision. On 15 October 2019 the FCA published Consultation Paper CP1929 on its fee proposals for the recovery of costs of supervising cryptoasset businesses when it becomes the Anti-Money Laundering AMLCounter Terrorist Financing CTF supervisor for such businesses from 10 January 2020. HMRC delivers its supervisory responsibility through its Anti-Money Laundering Supervisory AMLS teams.

Source: napier.ai

Source: napier.ai

Any UK business conducting specific cryptoasset activities falls within scope of the regulations and will need to comply with their requirements. FCA sets out approach to AML crypto supervision. Any UK business conducting specific cryptoasset activities falls within scope of the. OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society.

Source: avyse.co.uk

Source: avyse.co.uk

OPBAS is housed within the FCA and its key objectives are to reduce the harm of money laundering and terrorist financing by. Since 2015 the FCA has prioritised tackling financial crime and is committed to improving intelligence sharing with the government and relevant agencies and to use intelligence data and technology to. HMRC delivers its supervisory responsibility through its Anti-Money Laundering Supervisory AMLS teams. The FCAs approach to AML supervision is a risk-based approach utilising information from the National risk assessment of money laundering and terrorist financing and the financial crime data return. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

Source: biia.com

Source: biia.com

As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision. On 15 October 2019 the FCA published Consultation Paper CP1929 on its fee proposals for the recovery of costs of supervising cryptoasset businesses when it becomes the Anti-Money Laundering AMLCounter Terrorist Financing CTF supervisor for such businesses from 10 January 2020. Ensuring a robust and consistently high standard of supervision by the professional body AML supervisors PBSs overseeing the legal. Regulated by the FCA for another purpose.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. Others have been less proactive in their approach. 12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. The FCAs approach to AML supervision is a risk-based approach utilising information from the National risk assessment of money laundering and terrorist financing and the financial crime data return.

Source: sumsub.com

As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. HMRC delivers its supervisory responsibility through its Anti-Money Laundering Supervisory AMLS teams. Any UK business conducting specific cryptoasset activities falls within scope of the. 12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca aml supervision by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas