18+ Fca aml transaction monitoring ideas

Home » money laundering idea » 18+ Fca aml transaction monitoring ideasYour Fca aml transaction monitoring images are available. Fca aml transaction monitoring are a topic that is being searched for and liked by netizens today. You can Download the Fca aml transaction monitoring files here. Get all royalty-free photos and vectors.

If you’re looking for fca aml transaction monitoring pictures information linked to the fca aml transaction monitoring topic, you have visit the right blog. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Fca Aml Transaction Monitoring. THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a. The draft Money Laundering Regulations implementing the 3rd Money Laundering Directive will be laid before Parliament in the coming weeks. The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. Where a firm uses automated transaction monitoring systems it understands their capabilities and limitations.

Pin On Blockchain Criptomonedas From pinterest.com

Pin On Blockchain Criptomonedas From pinterest.com

Trade surveillance systems for AML and for market abuse monitoring should be sufficiently calibrated to allow firms to recognise the correlation between ML and market abuse risks. Transaction monitoring of correspondent relationships is a challenge for banks due to often erratic yet legitimate flows of funds. Your transaction monitoring program must be based on your risk assessment of your business or organisation and define the processes you follow to identify suspicious customer transactions including. There may be firms particularly smaller firms that monitor credibly and effectively using manual procedures. More specifically firms will have to. THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a.

This report represents the culmination of three months of research and over 40 interviews with regulated firms technology providers and other bodies.

1The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a. 1The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. The customer making frequent transactions just below transaction monitoring alert thresholds debits to and credits from third parties where there is no obvious explanation for the transaction and the customer providing insufficient or misleading information when asked about a transaction or being otherwise evasive. AML Transaction Monitoring Sytems Page 1 Introduction 1. Small firms are able to apply credible manual procedures to scrutinise customers behaviour.

Source: biia.com

Source: biia.com

There may be firms particularlysmaller firms that monitor credibly and. Transaction reporting failures highlight the need for accurate transaction reporting by firms. The customer making frequent transactions just below transaction monitoring alert thresholds debits to and credits from third parties where there is no obvious explanation for the transaction and the customer providing insufficient or misleading information when asked about a transaction or being otherwise evasive. Where a firm uses automated transaction monitoring systems it understands their capabilities and limitations. 1The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities.

Source: sumsub.com

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Trade surveillance systems for AML and for market abuse monitoring should be sufficiently calibrated to allow firms to recognise the correlation between ML and market abuse risks. The customer making frequent transactions just below transaction monitoring alert thresholds debits to and credits from third parties where there is no obvious explanation for the transaction and the customer providing insufficient or misleading information when asked about a transaction or being otherwise evasive. The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a.

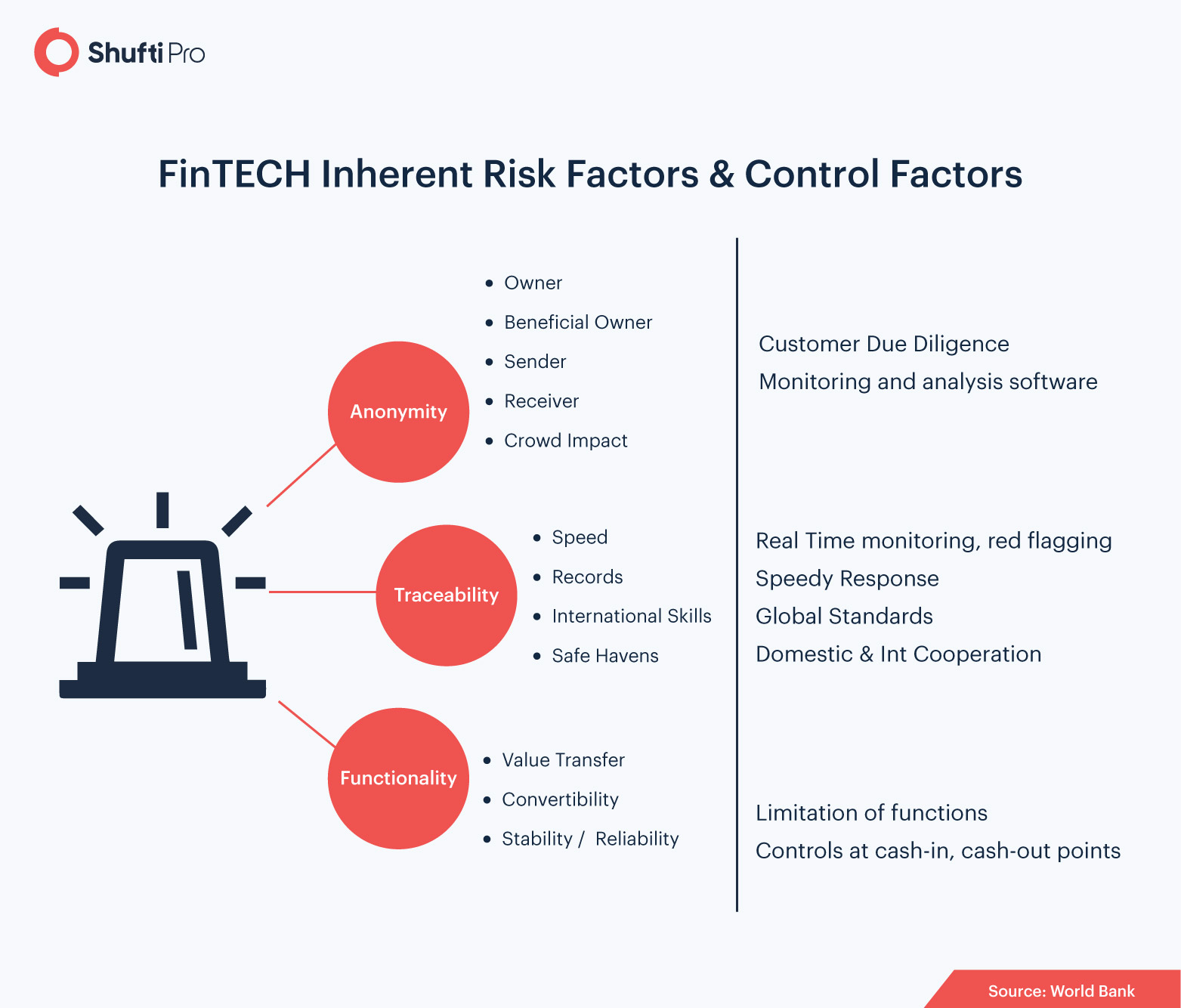

Source: shuftipro.com

Source: shuftipro.com

THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Trade surveillance systems for AML and for market abuse monitoring should be sufficiently calibrated to allow firms to recognise the correlation between ML and market abuse risks. The MLRO can provide little evidence that unusual transactions are brought to their attention. AML Transaction Monitoring Sytems Page 1 Introduction 1.

Source: finextra.com

Source: finextra.com

As a result of these omissions Deutsche Bank was unable to obtain sufficient information about its customers to provide a basis for transaction monitoring and advance the risk assessment process. Transaction reporting failures highlight the need for accurate transaction reporting by firms. THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a. Technologies in Anti-Money Laundering AML compliance by PA Consulting Group PA on behalf of the considered by regulated Financial Conduct Authority in the UK FCA. Transaction monitoring of correspondent relationships is a challenge for banks due to often erratic yet legitimate flows of funds.

Source: pinterest.com

Source: pinterest.com

The customer making frequent transactions just below transaction monitoring alert thresholds debits to and credits from third parties where there is no obvious explanation for the transaction and the customer providing insufficient or misleading information when asked about a transaction or being otherwise evasive. Trade surveillance systems for AML and for market abuse monitoring should be sufficiently calibrated to allow firms to recognise the correlation between ML and market abuse risks. The regulations will make transaction monitoring TM compulsory. There may be firms particularly smaller firms that monitor credibly and effectively using manual procedures. Automatically boost transaction rates without increasing chargebacks or friendly fraud.

Source: qa.nonprod.trulioo.com

Source: qa.nonprod.trulioo.com

The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Ineffective transaction monitoring there should be a combination of automated and manual monitoring. In addition to these penalties FCA Sapien Capital Limited was fined 178000 in 2021 for citing PRIN 2 and PRIN 3 violations related to financial crime risk in the business firms sector.

Source: trulioo.com

Source: trulioo.com

Mark Steward Director of Enforcement and Market Oversight said in his speech Partly contested cases the pipeline and AML. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The customer making frequent transactions just below transaction monitoring alert thresholds debits to and credits from third parties where there is no obvious explanation for the transaction and the customer providing insufficient or misleading information when asked about a transaction or being otherwise evasive. There may be firms particularly smaller firms that monitor credibly and effectively using manual procedures. Technologies in Anti-Money Laundering AML compliance by PA Consulting Group PA on behalf of the considered by regulated Financial Conduct Authority in the UK FCA.

Source: fineksus.com

Source: fineksus.com

Mark Steward Director of Enforcement and Market Oversight said in his speech Partly contested cases the pipeline and AML. THURSDAY JULY 15TH 2021 The UK Financial Conduct Authority has asked retail banks to correct deficiencies that it has spotted in their transaction monitoring systems in a. Transaction monitoring of correspondent relationships is a challenge for banks due to often erratic yet legitimate flows of funds. There may be firms particularlysmaller firms that monitor credibly and. You must document how you monitor customer transactions in Part A of your AMLCTF program.

Source:

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. FCA Spots Key AML Failures In Retail Banks Transaction Monitoring DATE PUBLISHED. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Transaction monitoring of correspondent relationships is a challenge for banks due to often erratic yet legitimate flows of funds. The draft Money Laundering Regulations implementing the 3rd Money Laundering Directive will be laid before Parliament in the coming weeks.

Source: comply-radar.com

Source: comply-radar.com

The MLRO can provide little evidence that unusual transactions are brought to their attention. As a result of these omissions Deutsche Bank was unable to obtain sufficient information about its customers to provide a basis for transaction monitoring and advance the risk assessment process. The MLRO can provide little evidence that unusual transactions are brought to their attention. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Statement of good practice Depending on the nature and scale of a firms business activities.

Source: comply-radar.com

Source: comply-radar.com

Without accurate reports the FCAs ability to undertake effective surveillance and monitoring is undermined. Automatically boost transaction rates without increasing chargebacks or friendly fraud. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. In addition to these penalties FCA Sapien Capital Limited was fined 178000 in 2021 for citing PRIN 2 and PRIN 3 violations related to financial crime risk in the business firms sector. There may be firms particularlysmaller firms that monitor credibly and.

Source: contineofrs.com

Small firms are able to apply credible manual procedures to scrutinise customers behaviour. You must document how you monitor customer transactions in Part A of your AMLCTF program. FCA Spots Key AML Failures In Retail Banks Transaction Monitoring DATE PUBLISHED. AML Transaction Monitoring Sytems Page 1 Introduction 1. 1The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities.

Ineffective transaction monitoring there should be a combination of automated and manual monitoring. The customer making frequent transactions just below transaction monitoring alert thresholds debits to and credits from third parties where there is no obvious explanation for the transaction and the customer providing insufficient or misleading information when asked about a transaction or being otherwise evasive. Transaction reporting failures highlight the need for accurate transaction reporting by firms. Banks ultimately need to rely on the explanations of unusual transactions given by respondents and this can be difficult to corroborate. Ineffective transaction monitoring there should be a combination of automated and manual monitoring.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml transaction monitoring by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information