11+ Fca anti money laundering guidance info

Home » money laundering Info » 11+ Fca anti money laundering guidance infoYour Fca anti money laundering guidance images are available. Fca anti money laundering guidance are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca anti money laundering guidance files here. Get all free photos and vectors.

If you’re looking for fca anti money laundering guidance images information linked to the fca anti money laundering guidance interest, you have visit the ideal site. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

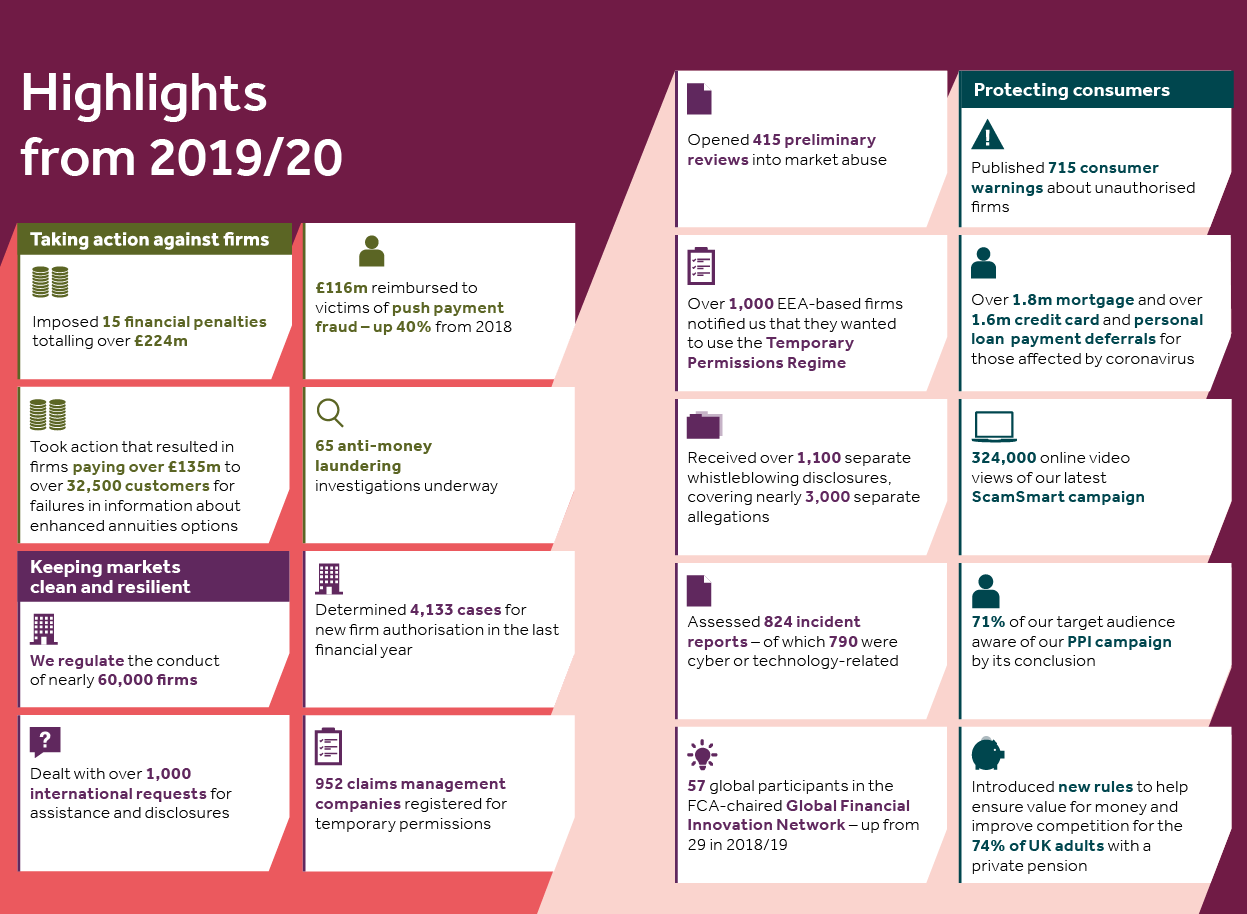

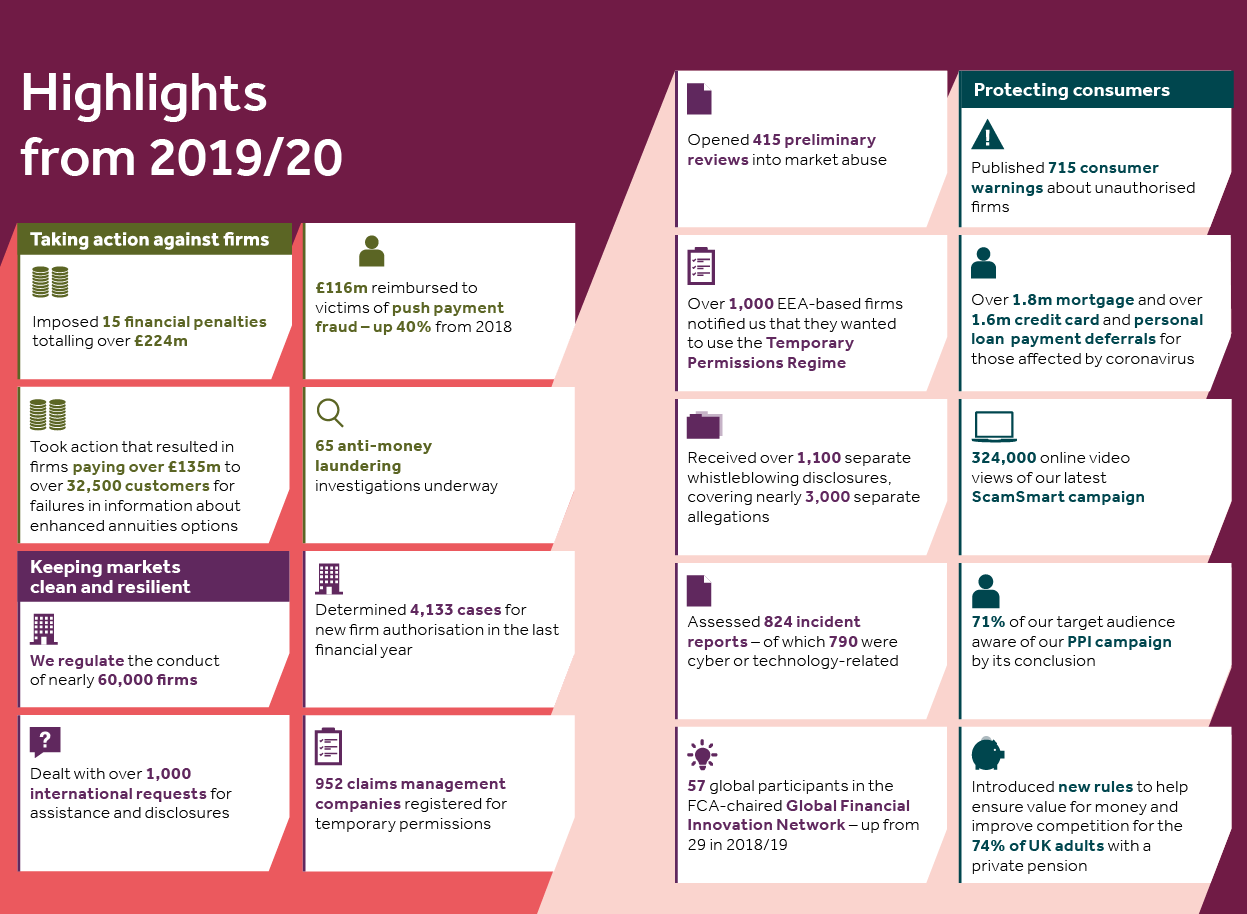

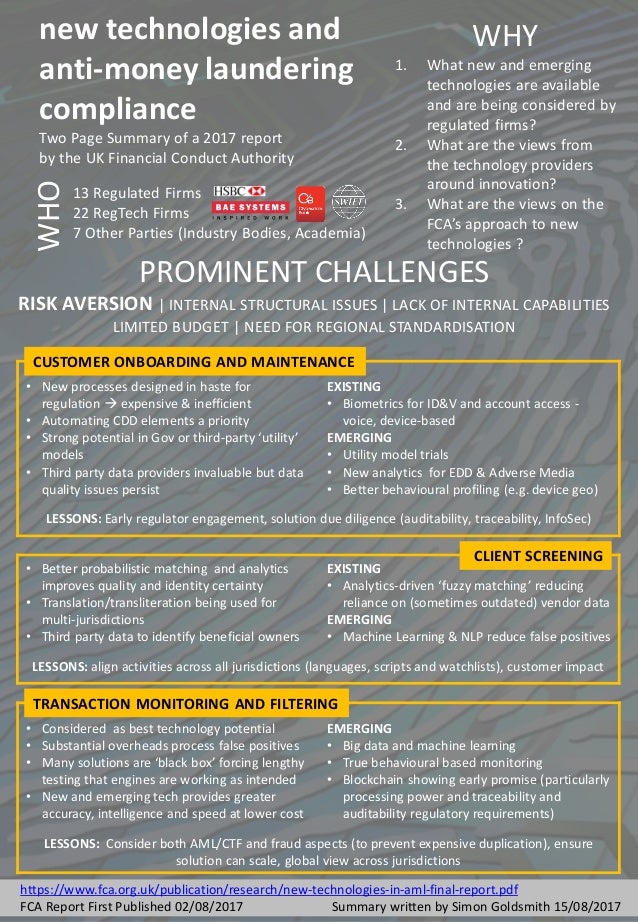

Fca Anti Money Laundering Guidance. In March 2017 we consulted on guidance GC172 in. FCA Anti-Money Laundering Guidance The team at Ecompli are well-versed in providing FCA Anti-Money Laundering guidance to businesses throughout the UK. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering source book and replacing it with the principle based rules found in the Senior Management Arrangements Systems.

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Dealing with the appropriate treatment of Politically Exposed Persons PEPs for anti-money laundering. Effective systems and controls can help firms to detect prevent and deter financial crime. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering. The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors and issuing guidance. FCG provides guidance on financial crime systems and controls both generally and in relation to specific risks such as money laundering bribery and corruption and.

1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime.

In March 2017 we consulted on guidance GC172 in. The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering source book and replacing it with the principle based rules found in the Senior Management Arrangements Systems. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. Those responsible for reviewing escalated transactions have an extensive knowledge of trade-based money laundering. Processing teams are encouraged to escalate suspicions for investigation as soon as possible. Anti-money laundering guidance for the legal sector.

Source: asiatokenfund.com

Source: asiatokenfund.com

Body Anti-Money Laundering Supervision OPBAS to oversee professional body supervisors PBSs for AML. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. Body Anti-Money Laundering Supervision OPBAS to oversee professional body supervisors PBSs for AML.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

FCA Anti-Money Laundering Guidance The team at Ecompli are well-versed in providing FCA Anti-Money Laundering guidance to businesses throughout the UK. And to meet the. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

Source: biia.com

Source: biia.com

23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. FCG provides guidance on financial crime systems and controls both generally and in relation to specific risks such as money laundering bribery and corruption and. The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering source book and replacing it with the principle based rules found in the Senior Management Arrangements Systems. Effective systems and controls can help firms to detect prevent and deter financial crime. Based approach guidance agreed by Anti-Money Laundering Supervisors Forum members in 20088.

Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. The FCA is empowered to impose fines and at least in theory bring criminal prosecutions for breaches of The Money Laundering Terrorist Financing and. 23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. It applies only to business relationships undertaken in the course of business in the UK. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

In March 2017 we consulted on guidance GC172 in. FCG 318 13122018. Effective systems and controls can help firms to detect prevent and deter financial crime. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction.

Source: ibsintelligence.com

Source: ibsintelligence.com

23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. FCG 318 13122018. And to meet the. It applies only to business relationships undertaken in the course of business in the UK. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime.

While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. When considering a firms systems and controls against money laundering and terrorist financing we will consider whether the firm has followed relevant provisions of the JMLSGs guidance guidance issued by the FCA or taken account of the ESA guidelines. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Dealing with the appropriate treatment of Politically Exposed Persons PEPs for anti-money laundering.

They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Body Anti-Money Laundering Supervision OPBAS to oversee professional body supervisors PBSs for AML. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. Processing teams are encouraged to escalate suspicions for investigation as soon as possible.

Source: slideshare.net

Source: slideshare.net

Dealing with the appropriate treatment of Politically Exposed Persons PEPs for anti-money laundering. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. Anti-money laundering guidance for the legal sector. Effective systems and controls can help firms to detect prevent and deter financial crime. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules.

Source: slideplayer.com

Source: slideplayer.com

Fca anti money laundering guidance. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. 23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. Body Anti-Money Laundering Supervision OPBAS to oversee professional body supervisors PBSs for AML. Effective systems and controls can help firms to detect prevent and deter financial crime.

Source: shuftipro.com

Source: shuftipro.com

FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. Fca anti money laundering guidance. 23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury.

Source: finextra.com

Source: finextra.com

Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. FCG 318 13122018. FCA Anti-Money Laundering Guidance The team at Ecompli are well-versed in providing FCA Anti-Money Laundering guidance to businesses throughout the UK. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules.

Source: slideshare.net

Source: slideshare.net

FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. Dealing with the appropriate treatment of Politically Exposed Persons PEPs for anti-money laundering. Those responsible for reviewing escalated transactions have an extensive knowledge of trade-based money laundering. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca anti money laundering guidance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas