16++ Fca anti money laundering policy information

Home » money laundering idea » 16++ Fca anti money laundering policy informationYour Fca anti money laundering policy images are available in this site. Fca anti money laundering policy are a topic that is being searched for and liked by netizens now. You can Download the Fca anti money laundering policy files here. Find and Download all free photos.

If you’re searching for fca anti money laundering policy pictures information linked to the fca anti money laundering policy keyword, you have pay a visit to the right site. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Fca Anti Money Laundering Policy. FCG 318 13122018. The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. Money laundering terrorist financing fraud and the abuse of financial markets collectively provide the FCAs definition of financial crime.

Uk S Fca Issues Warning Letter To Banks Over Anti Money Laundering Failings Biia Com Business Information Industry Association From biia.com

Uk S Fca Issues Warning Letter To Banks Over Anti Money Laundering Failings Biia Com Business Information Industry Association From biia.com

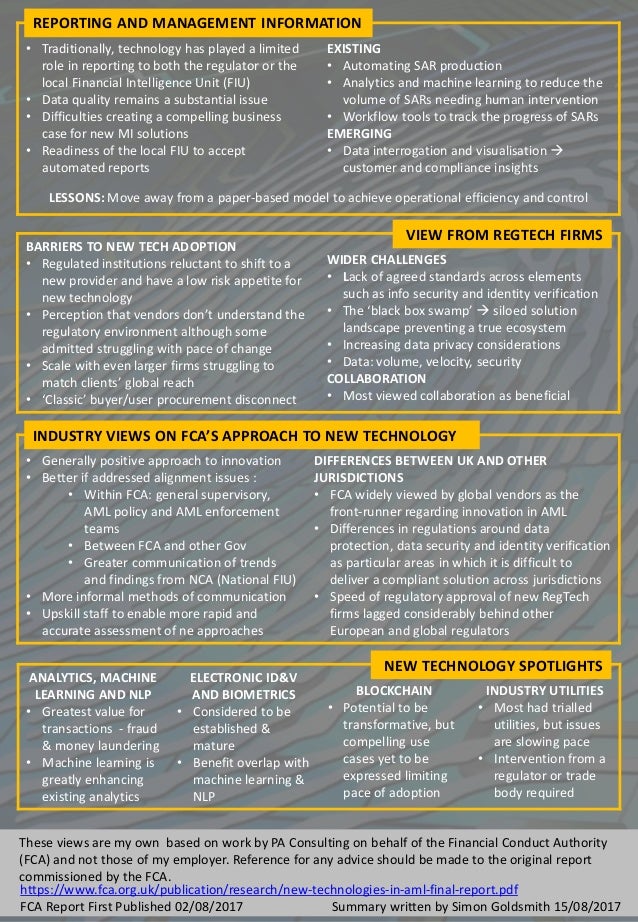

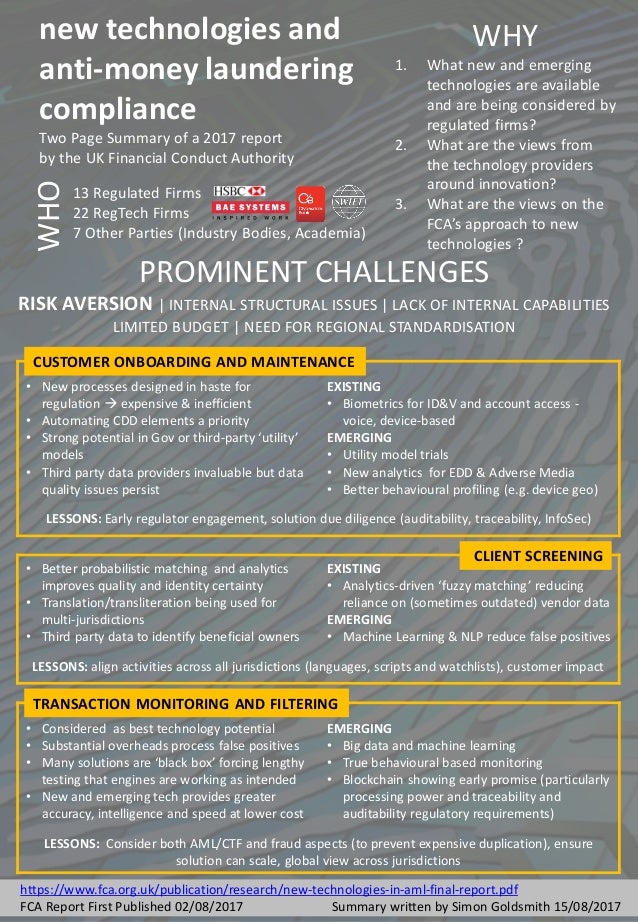

Last year the Government announced its decision to create an Office for Professional Body Anti-Money Laundering Supervision OPBAS to oversee professional body supervisors PBSs for AML. It also covers many of the supervisory authority requirements for the FCA and HMRC. We believe the report will be of interest to financial firms who are considering the use of new technologies in relation to their anti-money laundering compliance efforts. Disregarding money laundering risk when transactions present little or no credit risk. Money laundering terrorist financing fraud and the abuse of financial markets collectively provide the FCAs definition of financial crime. The Joint Money Laundering Steering Groups JMLSG guidance for the UK financial sector on the prevention of money laundering and combating terrorist financing isrelevant guidanceand is approved by HM Treasury under theMoney Laundering Regulations.

In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes.

The document provides a framework. The Firms has a zero tolerance for money laundering and is committed to mitigating the risks of money. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. The Firm is authorised by the Financial Conduct Authority FCA and as such will act in accordance with the anti-money laundering rules as defined in the FCA Handbook which will take precedence over the requirements of this policy.

Source: slideshare.net

Source: slideshare.net

It also covers many of the supervisory authority requirements for the FCA and HMRC. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The document provides a framework. Disregarding money laundering risk when transactions present little or no credit risk. Those responsible for reviewing escalated transactions have an extensive knowledge of trade-based money laundering.

Source:

Arrears Default Policy Template. The Firms has a zero tolerance for money laundering and is committed to mitigating the risks of money. Disregarding money laundering risk when transactions present little or no credit risk. Arrears Default Policy Template. Our Anti Money Laundering Policy Template provides 36 pages of content to help firms comply with the Money Laundering Regulations MLR.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

When considering a firms systems and controls against money laundering and terrorist financing we will consider whether the firm has followed relevant provisions of the JMLSGs guidance guidance issued by the FCA or taken account of the ESA guidelines. Our Anti Money Laundering Policy Template provides 36 pages of content to help firms comply with the Money Laundering Regulations MLR. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Arrears Default Policy Template. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering.

Source: slideshare.net

Source: slideshare.net

SYSC 636 G 01042009 RP. SYSC 636 G 01042009 RP. The Firms has a zero tolerance for money laundering and is committed to mitigating the risks of money. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. The Firm is authorised by the Financial Conduct Authority FCA and as such will act in accordance with the anti-money laundering rules as defined in the FCA Handbook which will take precedence over the requirements of this policy.

Source: biia.com

Source: biia.com

The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Our Anti Money Laundering Policy Template provides 36 pages of content to help firms comply with the Money Laundering Regulations MLR. Processing teams are encouraged to escalate suspicions for investigation as soon as possible. In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes. The guidance notes that accompany an FCA application provide a wealth of informaiton on what policies and documents firms need to have in place to comply with the rules.

Source: slideserve.com

Source: slideserve.com

The guidance notes that accompany an FCA application provide a wealth of informaiton on what policies and documents firms need to have in place to comply with the rules. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. The Firm is authorised by the Financial Conduct Authority FCA and as such will act in accordance with the anti-money laundering rules as defined in the FCA Handbook which will take precedence over the requirements of this policy. We believe the report will be of interest to financial firms who are considering the use of new technologies in relation to their anti-money laundering compliance efforts. Processing teams are encouraged to escalate suspicions for investigation as soon as possible.

Source: slideshare.net

Source: slideshare.net

Recently we commenced our first criminal proceeding against a bank under the Money Laundering Regulations 2007. What steps could the FCA take to encourage more innovation in anti-money laundering compliance. As confirmed in DEPP 623G. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed.

Source: ph.news.yahoo.com

The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors. Recently we commenced our first criminal proceeding against a bank under the Money Laundering Regulations 2007. The Firm is authorised by the Financial Conduct Authority FCA and as such will act in accordance with the an-money laundering rules as defined in the FCA Handbook which will take precedence over the requirements of this policy. As confirmed in DEPP 623G. Disregarding money laundering risk when transactions present little or no credit risk.

Source: finextra.com

Source: finextra.com

In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes. What steps could the FCA take to encourage more innovation in anti-money laundering compliance. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Due Diligence Policy Templates.

Affordability. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. The guidance notes that accompany an FCA application provide a wealth of informaiton on what policies and documents firms need to have in place to comply with the rules. SYSC 636 G 01042009 RP.

Source: sumsub.com

It also covers many of the supervisory authority requirements for the FCA and HMRC. The guidance notes that accompany an FCA application provide a wealth of informaiton on what policies and documents firms need to have in place to comply with the rules. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Due Diligence Policy Templates. It also covers many of the supervisory authority requirements for the FCA and HMRC.

Source: asiatokenfund.com

Source: asiatokenfund.com

The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors. The Financial Action Task Forces FATF is a financial watchdog that operates on a global level implementing an international anti-money laundering policy and ensuring that banks and financial institutions are complying with regulations to combat terrorist financing money laundering and. The Firms has a zero tolerance for money laundering and is committed to mitigating the risks of money. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. Detection investigation and prosecution where necessary either civilly or criminally of breaches of the Money Laundering Regulations SYSC 63 andor the Principles for Business are key priorities for the FCA.

Source: tookitaki.ai

Source: tookitaki.ai

What steps could the FCA take to encourage more innovation in anti-money laundering compliance. Due Diligence Policy Templates. Those responsible for reviewing escalated transactions have an extensive knowledge of trade-based money laundering. We cover many of the FCA Handbook areas and offer FCA policy templates such as. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca anti money laundering policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information