15++ Fca anti money laundering regulations 2017 ideas in 2021

Home » money laundering Info » 15++ Fca anti money laundering regulations 2017 ideas in 2021Your Fca anti money laundering regulations 2017 images are available in this site. Fca anti money laundering regulations 2017 are a topic that is being searched for and liked by netizens now. You can Get the Fca anti money laundering regulations 2017 files here. Get all royalty-free vectors.

If you’re looking for fca anti money laundering regulations 2017 pictures information connected with to the fca anti money laundering regulations 2017 topic, you have visit the right site. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

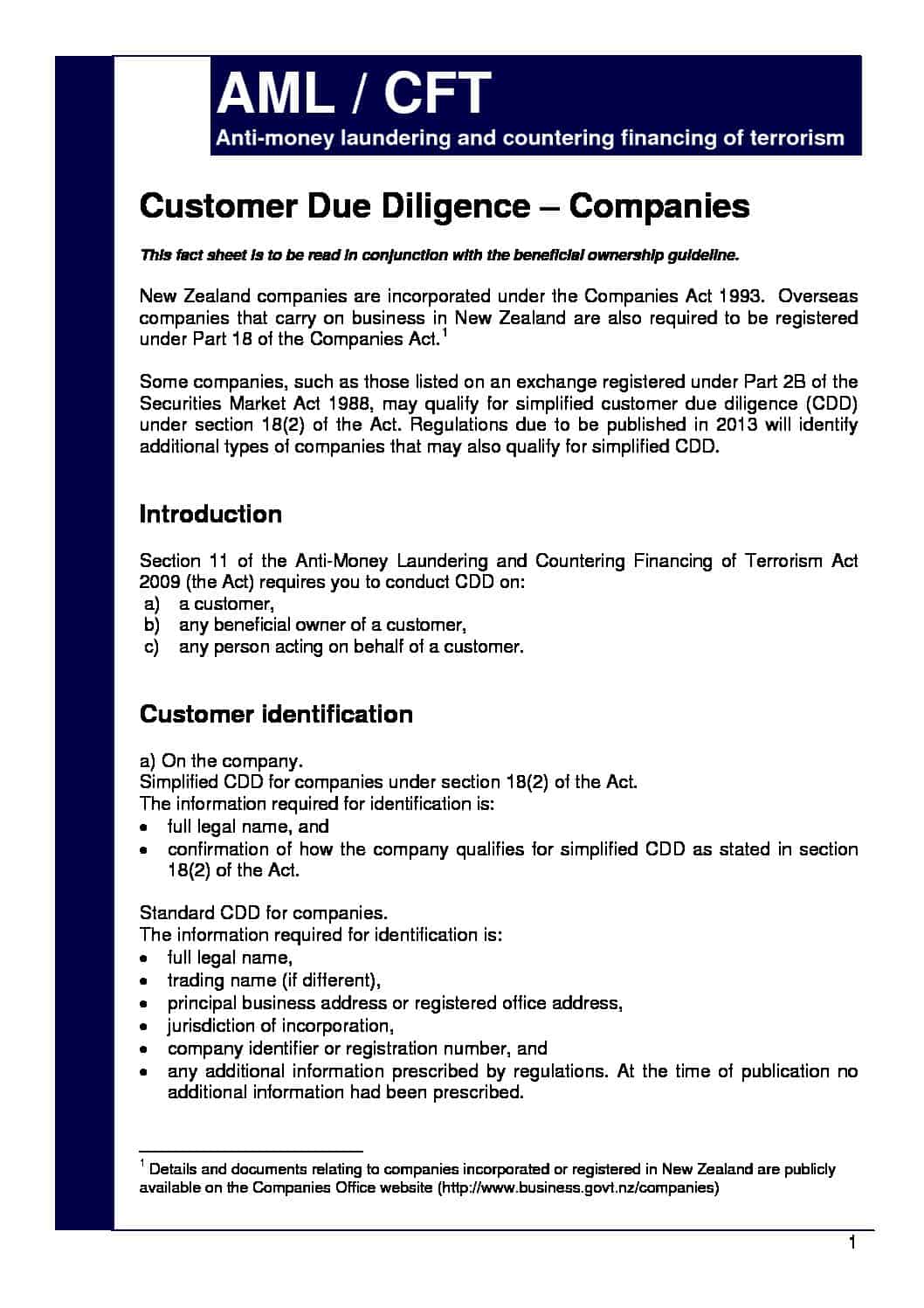

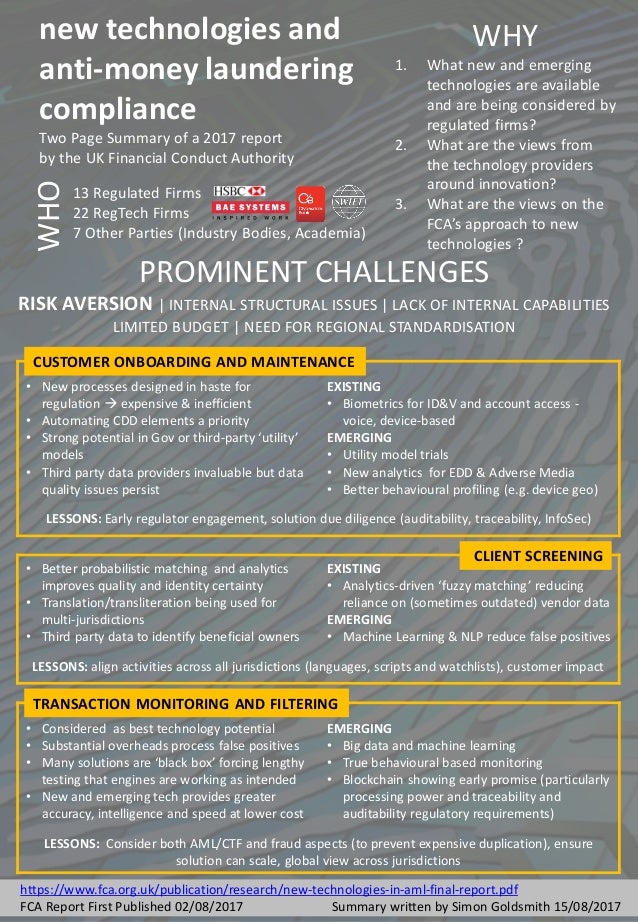

Fca Anti Money Laundering Regulations 2017. The regulations require firms subject to anti-money laundering obligations to ensure that they create. The 2017 MLRs have been informed by the responses submitted and. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Uk S Fca Issues Warning Letter To Banks Over Anti Money Laundering Failings Biia Com Business Information Industry Association From biia.com

Uk S Fca Issues Warning Letter To Banks Over Anti Money Laundering Failings Biia Com Business Information Industry Association From biia.com

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. 2 These Regulations come into force on 26th June 2017. FCA supervision and enforcement. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs 2017 came into effect on 26 June 2017. In March 2017 we consulted on guidance GC172 in connection with politically exposed persons PEPs. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account.

Ahead of that we consulted on proposals to ensure that our policies and procedures. FCA supervision and enforcement. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. In this years AML report the FCA notes that the size and global nature of the UK financial industry is at significant risk of money laundering. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs 2017 came into effect on 26 June 2017. Show CP1713 PDF The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 will replace the Money Laundering Regulations 2007 and the Transfer of Funds Information on the Payer Regulations 2007.

Source: slideplayer.com

Source: slideplayer.com

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. This page highlights some specific new areas that firms need to comply with. FCA supervision and enforcement. Since 10 January 2020 existing businesses operating immediately before 10 January 2020 carrying on cryptoasset activity in the UK have needed to be compliant with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended MLRs including the requirement to be registered with the FCA by 9 January 2021 in order to.

Source: shuftipro.com

Source: shuftipro.com

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. EG 19141 01032016 RP. The regulations require firms subject to anti-money laundering obligations to ensure that they create. The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718.

Source: brill.com

Source: brill.com

We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. 20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the. Under regulation 78 of the Money Laundering Regulations. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

Source: pdfprof.com

Source: pdfprof.com

In May 2021 the FCA notified us that it had started an investigation into our compliance with the Money Laundering Regulations 2017 potential breaches of some of the FCA Principles for. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. Show CP1713 PDF The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 will replace the Money Laundering Regulations 2007 and the Transfer of Funds Information on the Payer Regulations 2007. Previous FCA action has focussed on imposing fines for breaches and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime.

Source: researchgate.net

Source: researchgate.net

20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the. Under regulation 78 of the Money Laundering Regulations. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. Ahead of that we consulted on proposals to ensure that our policies and procedures.

Source: slideshare.net

Source: slideshare.net

Ahead of that we consulted on proposals to ensure that our policies and procedures. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. B regularly review and update the policies controls and procedures established under. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. FCA supervision and enforcement.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs 2017 came into effect on 26 June 2017. The 2017 MLRs have been informed by the responses submitted and.

Source: pdfprof.com

Source: pdfprof.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. In the summer of 2017 the UKs AML laws were overhauled to implement the EUs latest AML directive. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. Since 10 January 2020 existing businesses operating immediately before 10 January 2020 carrying on cryptoasset activity in the UK have needed to be compliant with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended MLRs including the requirement to be registered with the FCA by 9 January 2021 in order to. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations give the FCA responsibility for supervising the anti-money laundering controls of businesses that offer certain services.

Source: biia.com

Source: biia.com

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Money Laundering Regulations 2017. Money laundering registration. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Under regulation 78 of the Money Laundering Regulations.

Source: pdfprof.com

Source: pdfprof.com

Money laundering regulations 2017 fca. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. EG 19141 01032016 RP. The regulations require firms subject to anti-money laundering obligations to ensure that they create. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime.

Source: newsoncompliance.com

Source: newsoncompliance.com

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The 2017 MLRs have been informed by the responses submitted and. Ahead of that we consulted on proposals to ensure that our policies and procedures. B regularly review and update the policies controls and procedures established under. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI.

Source: pdfprof.com

Source: pdfprof.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. FCA supervision and enforcement. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime. B regularly review and update the policies controls and procedures established under. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI.

Source: pdfprof.com

Source: pdfprof.com

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs 2017 came into effect on 26 June 2017. Under regulation 78 of the Money Laundering Regulations. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca anti money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.