11++ Fca anti money laundering report ideas

Home » money laundering Info » 11++ Fca anti money laundering report ideasYour Fca anti money laundering report images are ready in this website. Fca anti money laundering report are a topic that is being searched for and liked by netizens now. You can Get the Fca anti money laundering report files here. Download all royalty-free photos and vectors.

If you’re looking for fca anti money laundering report images information related to the fca anti money laundering report topic, you have come to the ideal blog. Our website frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Fca Anti Money Laundering Report. We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. It enables criminal activity and undermines the reputation of the UK financial services sector. The newly published Report states that some of the FCAs current AML investigations are now dual track ie. The Financial Conduct Authoritys FCA Anti-Money Laundering AML Annual Report 201819 underlines that firms still have some way to go in their efforts to stamp out the problem.

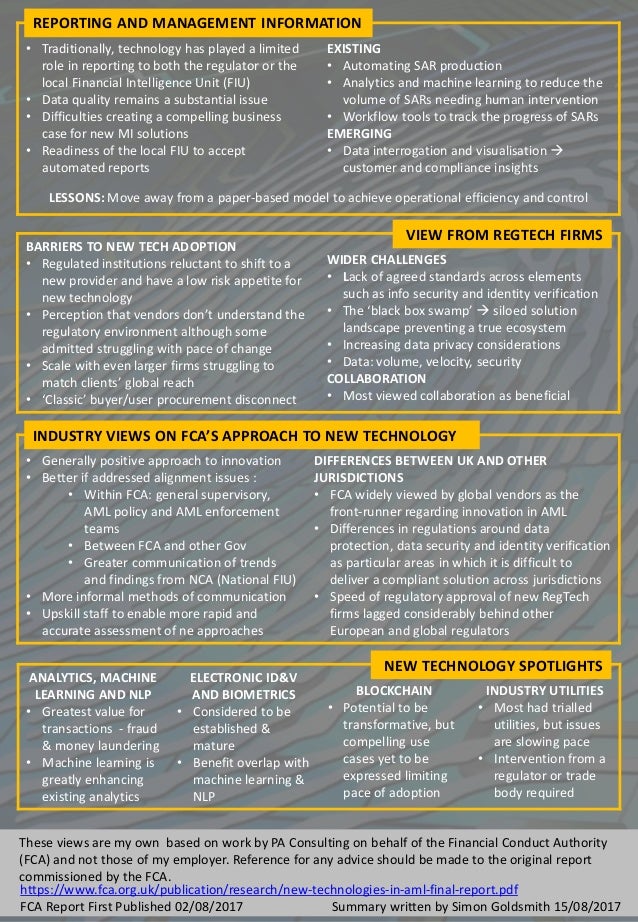

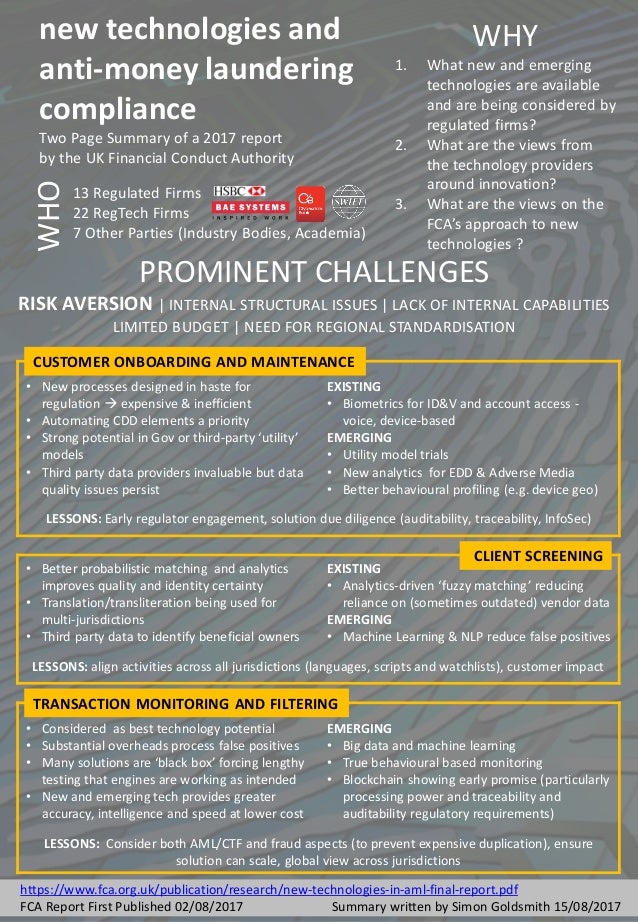

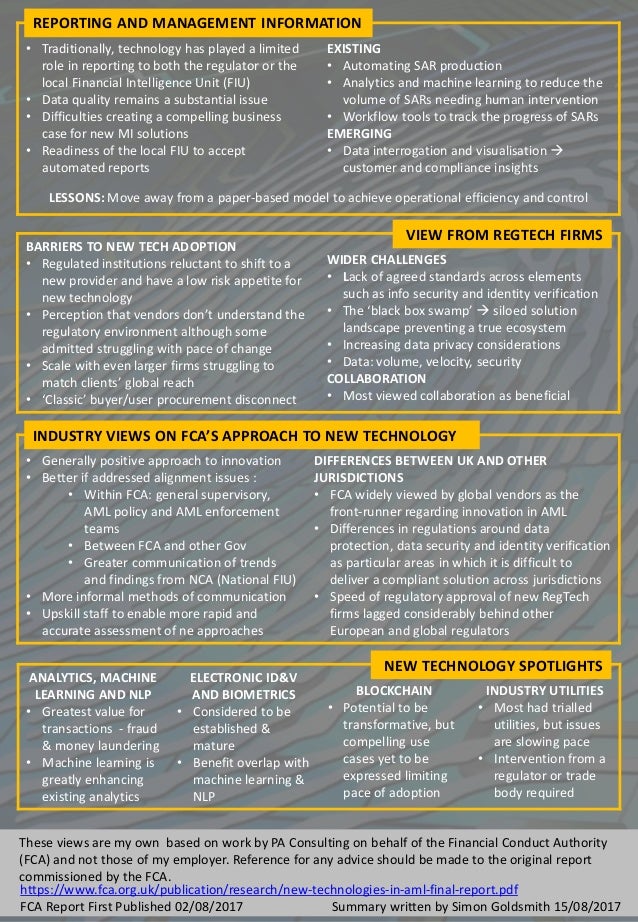

New Technologies And Anti Money Laundering Compliance Personal Summa From slideshare.net

New Technologies And Anti Money Laundering Compliance Personal Summa From slideshare.net

This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. The FATFs final report is likely to be published towards the end of 2018. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals.

The newly published Report states that some of the FCAs current AML investigations are now dual track ie.

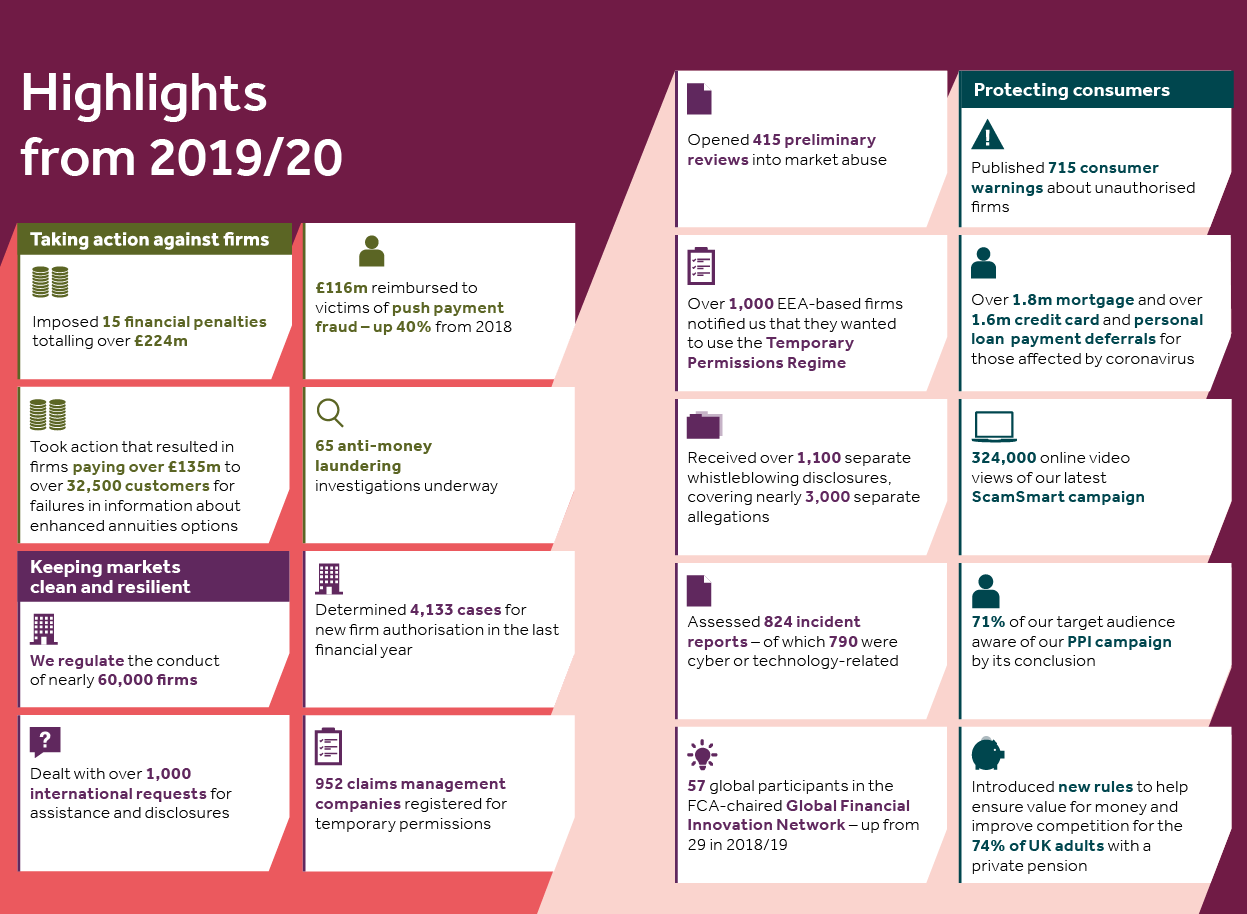

The FCA investigation was disclosed in Monzos annual report which showed the banks pre-tax losses widened 12 in the year to February to 130m due. As the biggest AML supervisor in the UK we played a major part in this Mutual Evaluation working closely with the Treasury and other partners. On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. Including the FCAs work. The Financial Conduct Authoritys FCA Anti-Money Laundering AML Annual Report 201819 underlines that firms still have some way to go in their efforts to stamp out the problem.

Source: finextra.com

Source: finextra.com

AML compliance is required from all FCA registered firms. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. What steps could the FCA take to encourage more innovation in anti-money laundering compliance. The Financial Conduct Authoritys FCA Anti-Money Laundering AML Annual Report 201819 underlines that firms still have some way to go in their efforts to stamp out the problem. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: leaprate.com

Source: leaprate.com

6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments. Including the FCAs work. The responsibilities to be discharged by the MLRO are set out in ML 7111 R. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: coinfomania.com

Source: coinfomania.com

The firm has identified good sources of information on money laundering risks such as National Risk Assessments ESA Guidelines FATF mutual evaluations and typology reports NCA alerts press reports court judgements reports by non-governmental organisations and commercial due diligence providers. Duty to respond to requests for information about accounts and safe-deposit boxes. Including the FCAs work. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals.

Source: slideshare.net

Source: slideshare.net

The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718. The newly published Report states that some of the FCAs current AML investigations are now dual track ie. It enables criminal activity and undermines the reputation of the UK financial services sector. The FATFs final report is likely to be published towards the end of 2018. Including the FCAs work.

Source: slideshare.net

Source: slideshare.net

Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. The firm has identified good sources of information on money laundering risks such as National Risk Assessments ESA Guidelines FATF mutual evaluations and typology reports NCA alerts press reports court judgements reports by non-governmental organisations and commercial due diligence providers. The newly published Report states that some of the FCAs current AML investigations are now dual track ie. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account.

Source: slideplayer.com

Source: slideplayer.com

Anti-money Laundering Compliance FCA. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. Introduction Money laundering harms society. In this the FCAs fourth Anti-money laundering Report we explain how we have sought to achieve our AML objectives in the last year. Regulation 30A is a new requirement for firms to report to Companies House discrepancies between the information the firm holds on their customers compared with the information held in the Companies House Register.

Source: biia.com

Source: biia.com

The newly published Report states that some of the FCAs current AML investigations are now dual track ie. Regulation 30A is a new requirement for firms to report to Companies House discrepancies between the information the firm holds on their customers compared with the information held in the Companies House Register. The purpose of the FCR is to increase the FCAs understanding of a variety of issues on a firm by firm basis such as the total number of clients the number of high risk clients the number of internal suspicious reports and external suspicious activity reports SARS submitted as well as the most common types of fraud. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718.

Source: ibsintelligence.com

Source: ibsintelligence.com

This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. In this the FCAs fourth Anti-money laundering Report we explain how we have sought to achieve our AML objectives in the last year. On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account.

Source:

The FCA has released its third annual anti-money laundering AML report 2015-2016 emphasizing financial crime as one of the regulators top seven priorities for 20162017. As the biggest AML supervisor in the UK we played a major part in this Mutual Evaluation working closely with the Treasury and other partners. The responsibilities to be discharged by the MLRO are set out in ML 7111 R. Our risk-based approach to AML supervision developments in our AML supervision strategy findings and outcomes from our recent specialist supervision work. AML compliance is required from all FCA registered firms.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

What steps could the FCA take to encourage more innovation in anti-money laundering compliance. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. What steps could the FCA take to encourage more innovation in anti-money laundering compliance. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. We believe the report will be of interest to financial firms who are considering the use of new technologies in relation to their anti-money laundering compliance efforts.

Source: sumsub.com

On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. The purpose of the FCR is to increase the FCAs understanding of a variety of issues on a firm by firm basis such as the total number of clients the number of high risk clients the number of internal suspicious reports and external suspicious activity reports SARS submitted as well as the most common types of fraud. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: slideplayer.com

Source: slideplayer.com

This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. The FCA has released its third annual anti-money laundering AML report 2015-2016 emphasizing financial crime as one of the regulators top seven priorities for 20162017. We believe the report will be of interest to financial firms who are considering the use of new technologies in relation to their anti-money laundering compliance efforts. It enables criminal activity and undermines the reputation of the UK financial services sector. AML supervision strategy The quality of firms AML systems and controls remains high on the FCAs agenda as is the implementation of its AML supervision strategy.

Source: slideserve.com

Source: slideserve.com

AML supervision strategy The quality of firms AML systems and controls remains high on the FCAs agenda as is the implementation of its AML supervision strategy. It enables criminal activity and undermines the reputation of the UK financial services sector. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. 6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca anti money laundering report by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas