20++ Fca approach to risk of money laundering ideas in 2021

Home » money laundering idea » 20++ Fca approach to risk of money laundering ideas in 2021Your Fca approach to risk of money laundering images are ready in this website. Fca approach to risk of money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Fca approach to risk of money laundering files here. Find and Download all free photos and vectors.

If you’re looking for fca approach to risk of money laundering pictures information linked to the fca approach to risk of money laundering keyword, you have visit the right site. Our site always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

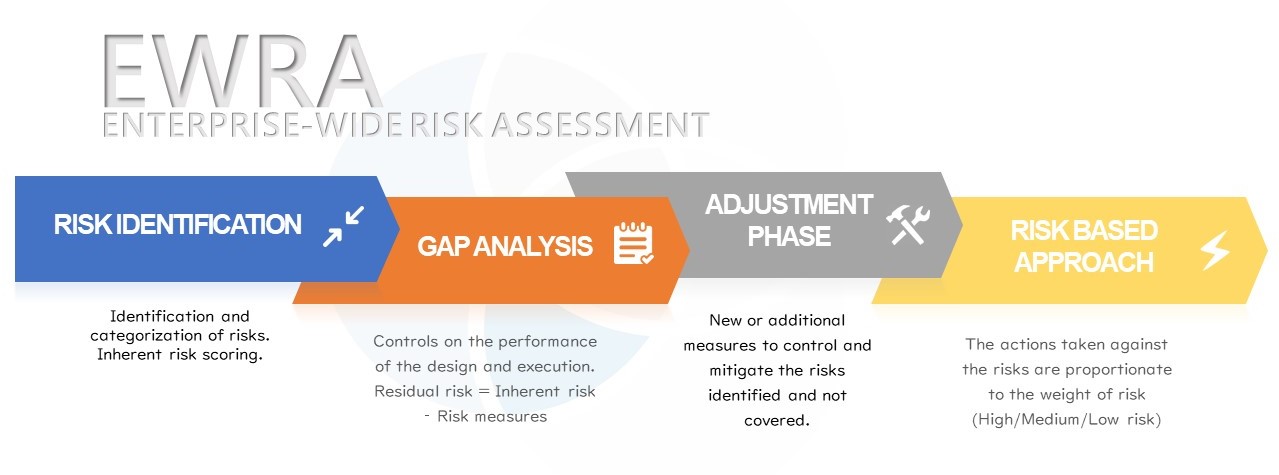

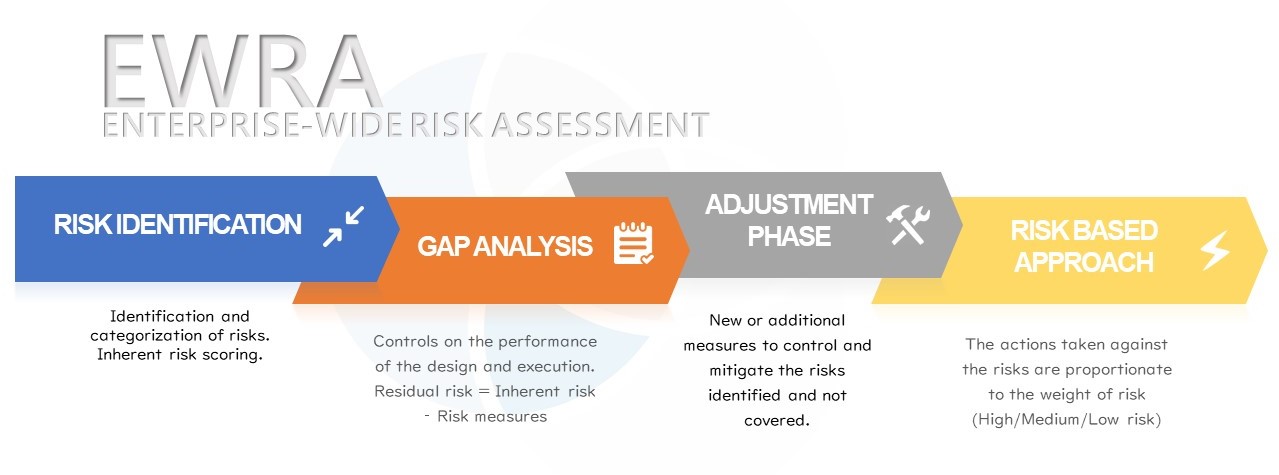

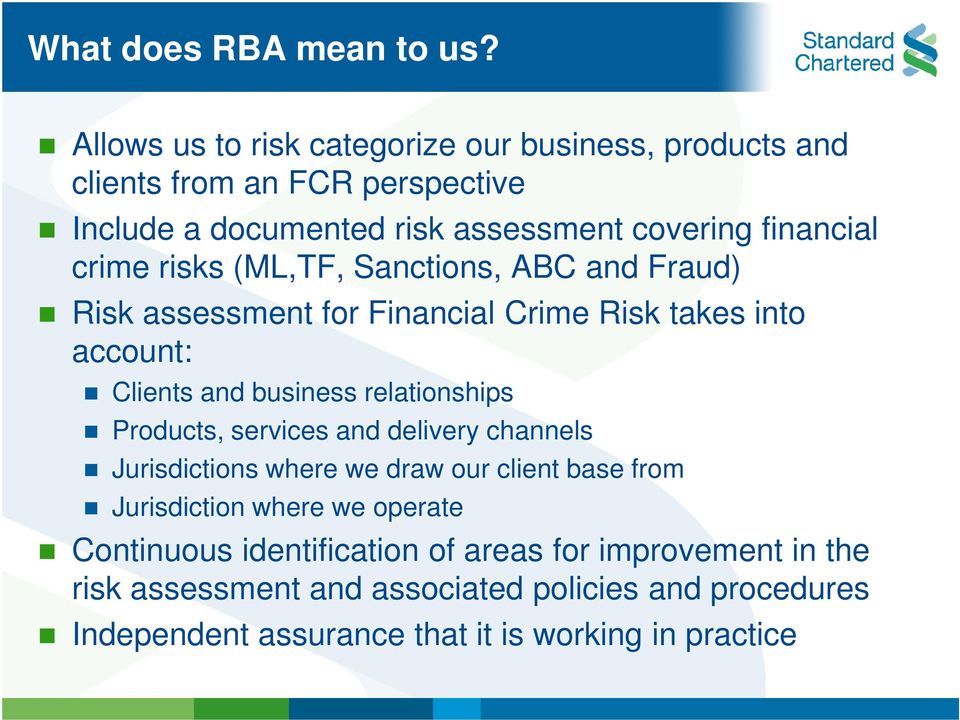

Fca Approach To Risk Of Money Laundering. Additionally those EU firms with subsidiaries or branches in such high risk countries are also required to take additional specified. Money laundering risk assessment. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. In our thematic review of capital markets the money laundering risks that we identified.

Aml Ewra How To Conduct Anti Money Laundering Overall Risk Assessment From pideeco.be

Aml Ewra How To Conduct Anti Money Laundering Overall Risk Assessment From pideeco.be

The FCA will adopt the approach outlined in EG 12 when prosecuting Money Laundering Regulations offences. It may also be of interest to other firms we supervise under the Money Laundering Regulations. What is a risk-based approach. A Risk-Based Approach for Anti-Money Laundering FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering. The FCA has three proactive programmes for AML supervision. Further information on managing money-laundering risk.

Firms must have effective ways of managing their money laundering risks and meeting their obligations.

We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls. We found there was a risk that some banks respondents could be influenced by allegedly corrupt PEPs increasing the risk of these banks being used as vehicles for corruption andor money laundering. Firms must have effective ways of managing their money laundering risks and meeting their obligations. The FCAs approach to enforcement of breaches of AML obligations is set out in our Enforcement guide. Authority under theMoney Laundering Regulations. A Risk-Based Approach for Anti-Money Laundering FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering.

Source: in.pinterest.com

Source: in.pinterest.com

Further information on managing money-laundering risk. It may also be of interest to other firms we supervise under the Money Laundering Regulations. Firms must have effective ways of managing their money laundering risks and meeting their obligations. The FCA has three proactive programmes for AML supervision. With customers such as PEPs who might pose a higher risk of money laundering.

Source: docplayer.net

Source: docplayer.net

A more risk-based approach is required where PEPs own direct or control respondent banks. A more risk-based approach is required where PEPs own direct or control respondent banks. What is a risk-based approach. Additionally those EU firms with subsidiaries or branches in such high risk countries are also required to take additional specified. If they do not align their AML processes with those recommended by the JMLSG they will need to demonstrate that their alternative approach is as effective in achieving those outcomes.

Source: avyse.co.uk

Source: avyse.co.uk

Potentially exposed to a high money laundering risk. Understanding your relationship with them. In 2012 FATF published a series of recommendations for nations to take against money laundering within their borders. We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. The FCAs approach to enforcement of breaches of AML obligations is set out in our Enforcement guide.

Source: docplayer.net

Source: docplayer.net

1The FCA will adopt a risk-based approach to its enforcement under2 the Money Laundering. If they do not align their AML processes with those recommended by the JMLSG they will need to demonstrate that their alternative approach is as effective in achieving those outcomes. Authority under theMoney Laundering Regulations. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. 1The FCA will adopt a risk-based approach to its enforcement under2 the Money Laundering.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

A more risk-based approach is required where PEPs own direct or control respondent banks. What is a risk-based approach. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. In 2012 FATF published a series of recommendations for nations to take against money laundering within their borders.

Source: pideeco.be

Source: pideeco.be

Understanding your relationship with them. The FCA has three proactive programmes for AML supervision. In our thematic review of capital markets the money laundering risks that we identified. It may also be of interest to other firms we supervise under the Money Laundering Regulations. An individual assessment of risk associated with a business relationship or occasional transaction can inform but is no substitute for a business-wide risk.

Source: docplayer.net

Source: docplayer.net

What is a risk-based approach. In March 2008 theFSAconducted a review of firmsimplementation of a risk-based approach to anti-money laundering. The importance of this EU list for firms is highlighted by Article 1 11 of the Fifth Money Laundering Directive 5AMLD which requires firms to adopt specified enhanced customer diligence measures for transactions involving high risk third countries. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls. In our thematic review of capital markets the money laundering risks that we identified.

Source: amlsuptech.co.uk

Source: amlsuptech.co.uk

We found there was a risk that some banks respondents could be influenced by allegedly corrupt PEPs increasing the risk of these banks being used as vehicles for corruption andor money laundering. Some firms will also be required to comply with the Money Laundering Regulations. FATF based these recommendations on the idea of risk-based approaches to anti-money laundering. The importance of this EU list for firms is highlighted by Article 1 11 of the Fifth Money Laundering Directive 5AMLD which requires firms to adopt specified enhanced customer diligence measures for transactions involving high risk third countries. The FCAs approach to enforcement of breaches of AML obligations is set out in our Enforcement guide.

Source: docplayer.net

Source: docplayer.net

Potentially exposed to a high money laundering risk. In 2012 FATF published a series of recommendations for nations to take against money laundering within their borders. The Financial Action Task Force is an intergovernmental organization founded by the G7 nations to combat money laundering around the world. Some firms will also be required to comply with the Money Laundering Regulations. In the majority of cases where both the Regulations and the FCA rules apply and regulatory action.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

An individual assessment of risk associated with a business relationship or occasional transaction can inform but is no substitute for a business-wide risk. Further information on managing money-laundering risk. Understanding the money laundering risks in the capital markets. In the majority of cases where both the Regulations and the FCA rules apply and regulatory action. In March 2008 theFSAconducted a review of firmsimplementation of a risk-based approach to anti-money laundering.

Source: cgdev.org

Source: cgdev.org

The Financial Action Task Force is an intergovernmental organization founded by the G7 nations to combat money laundering around the world. The nature of transactions in this sector means that effective customer risk assessment and customer due diligence CDD are key to reducing the opportunities for money laundering the FCA said in the review which also outlined how criminals might exploit free of payment bond transfers mirror trading debt issuance equity placement and over-collateralized account funding among other activity. A Risk-Based Approach for Anti-Money Laundering FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. In 2012 FATF published a series of recommendations for nations to take against money laundering within their borders.

Source: pinterest.com

Source: pinterest.com

Understanding the money laundering risks in the capital markets. In 2012 FATF published a series of recommendations for nations to take against money laundering within their borders. Understanding the money laundering risks in the capital markets. In July 2007 theFSAundertook a review of the anti-money laundering AML systems and controls at severalFSA-regulated private banks. What is a risk-based approach.

Source: docplayer.net

Source: docplayer.net

Since then a FCA thematic review to further understand the emerging risks cited in the NRA was undertaken and published in June 2019. Further information on managing money-laundering risk. The Financial Action Task Force is an intergovernmental organization founded by the G7 nations to combat money laundering around the world. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. The importance of this EU list for firms is highlighted by Article 1 11 of the Fifth Money Laundering Directive 5AMLD which requires firms to adopt specified enhanced customer diligence measures for transactions involving high risk third countries.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca approach to risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information