14++ Fca handbook aml training info

Home » money laundering Info » 14++ Fca handbook aml training infoYour Fca handbook aml training images are available in this site. Fca handbook aml training are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca handbook aml training files here. Get all royalty-free photos and vectors.

If you’re looking for fca handbook aml training images information related to the fca handbook aml training keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Fca Handbook Aml Training. 07012021 See all updates. HIRETT LTD has implemented a comprehensive Anti-Money Laundering and Financial Crime training program to ensure that all staff in particular individuals responsible for transaction processing andor initiating andor establishing business relationships undergo AML knowledge competency and awareness training. This page highlights some specific new areas that firms need to comply with. In June 2011 the FSA published the findings of its thematic review of how banks operating in the UK were managing money-laundering risk in higher-risk situations.

Anti Money Laundering Ppt Download From slideplayer.com

Anti Money Laundering Ppt Download From slideplayer.com

A thorough understanding of its financial crime risks is key if a firm is to apply proportionate and effective systems and controls. As a result of that review a number of improvements and recommendations have already been or are being implemented. FCTR 1212 G 13122018. Its AML systems and controls including engaging a third party consultant to review and overhaul its AML processes revise its training programme for private bankers and review its PEP and other high risk customer files. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. The FSA focused in particular on correspondent banking relationships wire transfer payments and high-risk customers including politically exposed persons.

But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk.

Reviewing AML policies and procedures as a one-off exercise. Information contained in the handbook should be adapted to. As a result of that review a number of improvements and recommendations have already been or are being implemented. HIRETT LTD has implemented a comprehensive Anti-Money Laundering and Financial Crime training program to ensure that all staff in particular individuals responsible for transaction processing andor initiating andor establishing business relationships undergo AML knowledge competency and awareness training. A high-level competence requirement the competent employees rule that. Examples of poor practice.

Source: hirett.co.uk

Source: hirett.co.uk

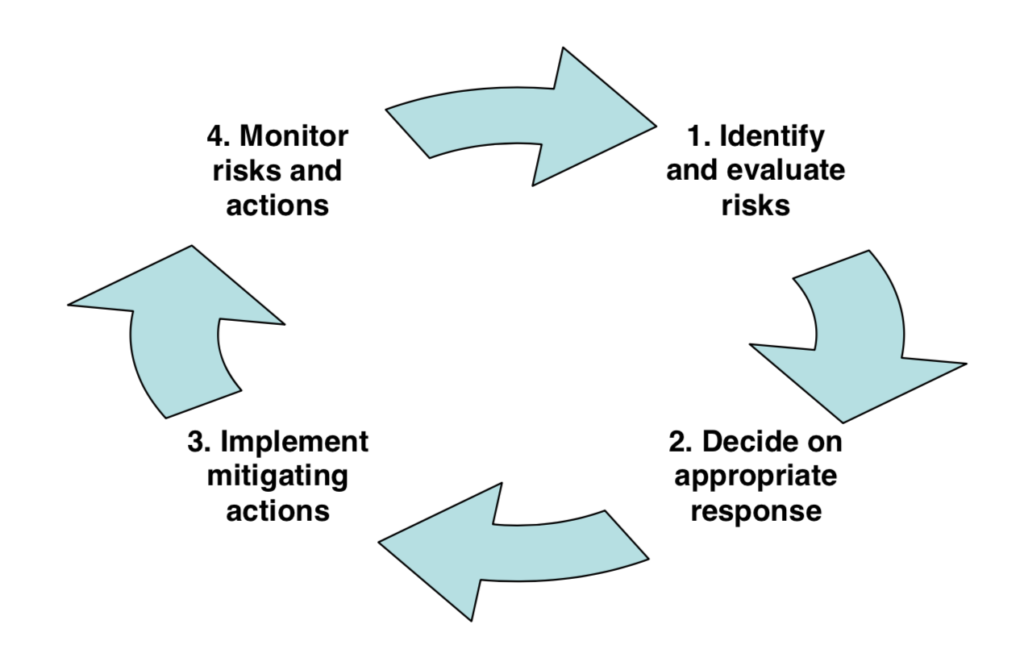

Firms implementation of a risk-based approach to AML. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among. As many of us in the industry are aware the Financial system is governed by various bodies and regulators. FCTR 531 G 13122018. The FSA focused in particular on correspondent banking relationships wire transfer payments and high-risk customers including politically exposed persons.

Source: handbook.fca.org.uk

Source: handbook.fca.org.uk

ANTI-MONEY LAUNDERING AND COUNTERING THE FINANCING OF TERRORISM HANDBOOK October November 2019 Whilst this publication has been prepared by the Financial Services Authority it is not a legal document and should not be relied upon in respect of points of law. Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. The risk-based approach means a focus on outputs. As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. We also provide policy templates and procedures for the UK GDPR AML.

Source:

A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. The report explored in depth a number of key areas that required improvement including a review of staff training and the need to ensure staff are aware that it is a constant requirement to ensure. The depth of the review is determined by the risk. Examples of poor practice. Examples of good practice.

Source:

FCTR 513 G 13122018. Reviewing AML policies and procedures as a one-off exercise. As a result of that review a number of improvements and recommendations have already been or are being implemented. FCG 313 13122018. 07012021 See all updates.

Source:

A thorough understanding of its financial crime risks is key if a firm is to apply proportionate and effective systems and controls. The report explored in depth a number of key areas that required improvement including a review of staff training and the need to ensure staff are aware that it is a constant requirement to ensure. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. The FSA focused in particular on correspondent banking relationships wire transfer payments and high-risk customers including politically exposed persons. FCG 313 13122018.

Source: slideplayer.com

Source: slideplayer.com

The FSA visited 43 firms in total and gathered additional information from approximately 90 small firms with a survey. But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk. A thorough understanding of its financial crime risks is key if a firm is to apply proportionate and effective systems and controls. The Joint Money Laundering Steering Group Guidance written by the industry and endorsed by the Treasury is readily available to provide firms with practical help in meeting their legal and regulatory obligations in the areas of both anti-money laundering and terrorist financing. The FSA focused in particular on correspondent banking relationships wire transfer payments and high-risk customers including politically exposed persons.

Source: yumpu.com

Source: yumpu.com

This page highlights some specific new areas that firms need to comply with. Money laundering risk is the risk that a firm may be used to further money laundering. ANTI-MONEY LAUNDERING AND COUNTERING THE FINANCING OF TERRORISM HANDBOOK October November 2019 Whilst this publication has been prepared by the Financial Services Authority it is not a legal document and should not be relied upon in respect of points of law. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

![]() Source: handbook.fca.org.uk

Source: handbook.fca.org.uk

Training and competence. Under the FIAMLA a financial institution is an institution or a person licensed or registered or required to be licensed or registered under. Firms implementation of a risk-based approach to AML. Reviewing AML policies and procedures as a one-off exercise. HIRETT LTD has implemented a comprehensive Anti-Money Laundering and Financial Crime training program to ensure that all staff in particular individuals responsible for transaction processing andor initiating andor establishing business relationships undergo AML knowledge competency and awareness training.

Source: hirett.co.uk

Source: hirett.co.uk

Reviewing AML policies and procedures as a one-off exercise. As many of us in the industry are aware the Financial system is governed by various bodies and regulators. Firms implementation of a risk-based approach to AML. As a result of that review a number of improvements and recommendations have already been or are being implemented. This page highlights some specific new areas that firms need to comply with.

Source: br.pinterest.com

Source: br.pinterest.com

The second area of risk relates to cryptocurrency firms. The handbook guides Firms across a range of topics from Financial Reporting Requirements2 to Market Abuse Regulation. 07012021 See all updates. In June 2011 the FSA published the findings of its thematic review of how banks operating in the UK were managing money-laundering risk in higher-risk situations. Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation.

Source: slideplayer.com

Source: slideplayer.com

The risk-based approach means a focus on outputs. As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. Reference for that purpose should be made to the appropriate statutory provisions. A thorough understanding of its financial crime risks is key if a firm is to apply proportionate and effective systems and controls. Examples of good practice.

Source: studylib.net

Source: studylib.net

A section 14 77 77A or 79A of the Financial Services Act. A thorough understanding of its financial crime risks is key if a firm is to apply proportionate and effective systems and controls. This AMLCFT Handbook is designed to provide guidance to all financial institutions. We also provide policy templates and procedures for the UK GDPR AML. The risk-based approach to anti-money laundering.

Source: sumsub.com

One large firms procedures required it to undertake periodic Know Your Customer KYCCustomer Due Diligence CDD reviews of existing clients. B the Insurance Act. This handbook is intended to assist NBFIs in developing and implementing policies and procedures to combat money laundering and the financing of terrorism. This AMLCFT Handbook is designed to provide guidance to all financial institutions. C the Securities Act.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca handbook aml training by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas