16+ Fca money laundering red flags information

Home » money laundering idea » 16+ Fca money laundering red flags informationYour Fca money laundering red flags images are available. Fca money laundering red flags are a topic that is being searched for and liked by netizens now. You can Get the Fca money laundering red flags files here. Find and Download all free vectors.

If you’re looking for fca money laundering red flags pictures information connected with to the fca money laundering red flags topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

Fca Money Laundering Red Flags. The FCAs report sets out seven examples of typologies of money laundering in capital markets and identifies some of the key risk areas and red flags. Cash and some electronic currencies can enable anonymity. FCA Dear CEO Letter. Money laundering is damaging in many ways.

Fca Compliance In An Era Of Unprecedented Government Stimulus Corporate Compliance Insights From corporatecomplianceinsights.com

Fca Compliance In An Era Of Unprecedented Government Stimulus Corporate Compliance Insights From corporatecomplianceinsights.com

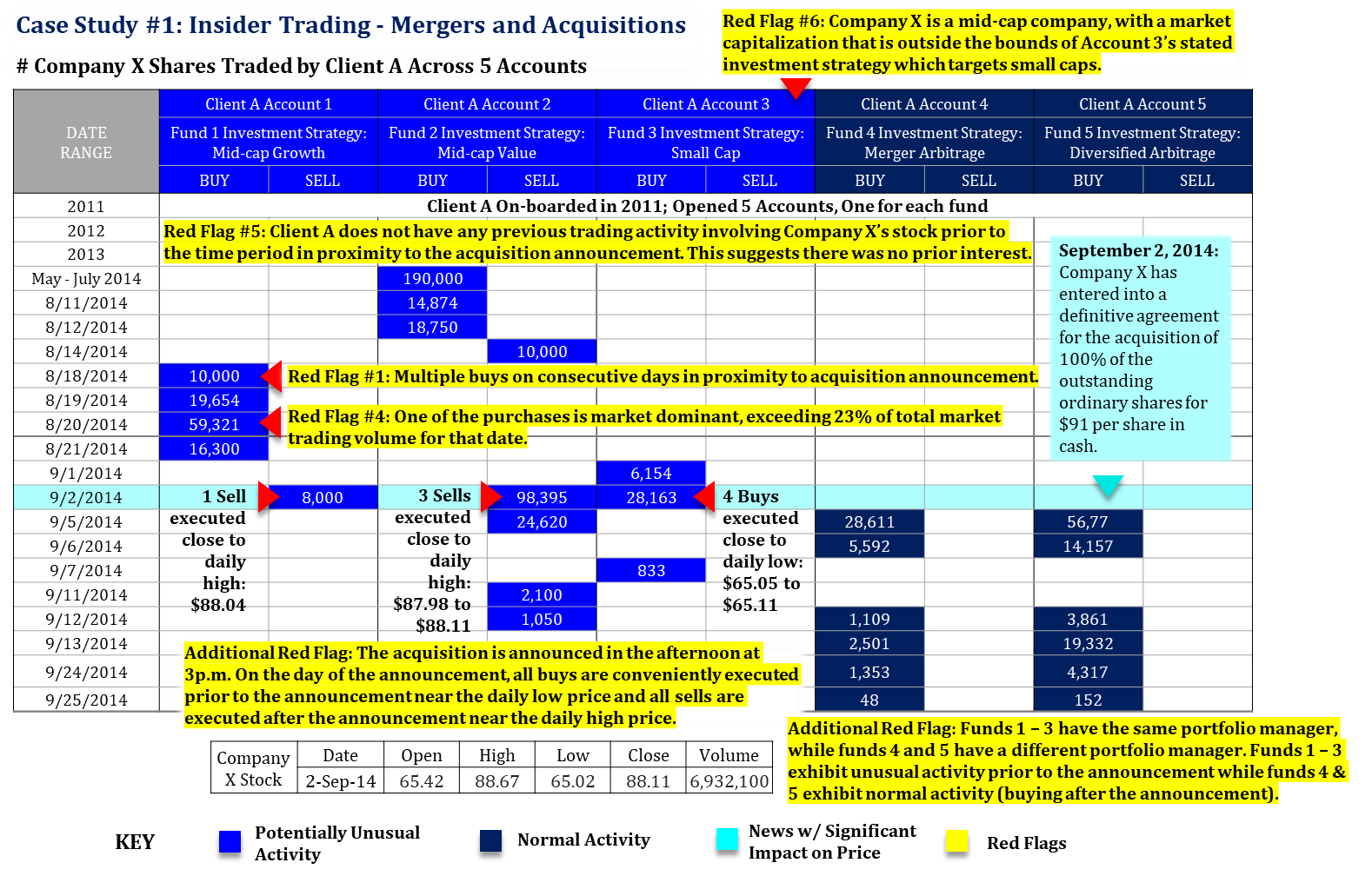

Cash and some electronic currencies can enable anonymity. Staff identify key parties to a transaction and screen them against sanctions lists. Key parties include the instructing party but may include other parties on a risk-sensitive basis. One of the themes of the FCA thematic report is the similarity of several market abuse and money laundering Red Flags. In 2018 FATF published guidance on money laundering risks in the securities sectors that included examples of such red flags. July 24 2019 webmaster Money Laundring UK Anti Money Laundering UK US.

FCA Dear CEO Letter.

The FCA launched their finalised guidance on the treatment of Politically Exposed Persons PEP for anti-money laundering purposes in July 2017. You can read it in full here this article has consolidated the key points. The use of cash in a transaction can suggest a higher. Certain license requirements for fiduciaries administering family offices abolished. And money laundering may take place. Staff are not required to consider trade specific money laundering risks eg FATFWolfsberg red flags.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

Money laundering is damaging in many ways. Key parties include the instructing party but may include other parties on a risk-sensitive basis. In 2018 FATF published guidance on money laundering risks in the securities sectors that included examples of such red flags. The lesson here should be clear if red flags are raised or serious issues brought to your attention by your staff or in particular by the FCA then it is important to respond appropriately. Money laundering is damaging in many ways.

Source: bovill.com

Source: bovill.com

The FCA launched their finalised guidance on the treatment of Politically Exposed Persons PEP for anti-money laundering purposes in July 2017. Money Laundering Red Flags. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business. So what are these indicators. The Monetary Authority of Singapore MAS the Hong Kong Monetary Authority HKMA and the Financial Conduct Authority FCA in the UK are some of the global regulators that have issued guidelines and red flag checks around trade finance echoing those issued by the International Chamber of Commerce ICC Bankers Association for Finance and Trade BAFT and the Wolfsberg Group.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

FCA Financial Conduct Authority. In light of the FCAs recent turn towards a greater use of its criminal prosecution powers in relation to money laundering offences. One of the themes of the FCA thematic report is the similarity of several market abuse and money laundering Red Flags. Key parties include the instructing party but may include other parties on a risk-sensitive basis. Money laundering is damaging in many ways.

Source: businessinsider.com

Staff identify key parties to a transaction and screen them against sanctions lists. In 2018 FATF published guidance on money laundering risks in the securities sectors that included examples of such red flags. Compliance failures also increase banks exposure to failure to prevent. The use of cash in a transaction can suggest a higher. Key parties include the instructing party but may include other parties on a risk-sensitive basis.

Source: trulioo.com

Source: trulioo.com

Government agencies and international organizations. The Financial Action Task Force FATF an independent inter-governmental body issued a report in 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing. It can also be used in a money laundering context to layer criminal funds. Money Laundering Red Flags. Review existing AML risk assessments to ensure capital market-specific red flags and scenarios from the.

Source: corporatecomplianceinsights.com

Source: corporatecomplianceinsights.com

Financial crime and customer redress. The report identifies 42 Red Flag Indicators or warning signs of money laundering and terrorist financing. It can also be used in a money laundering context to layer criminal funds. The Financial Action Task Force FATF an independent inter-governmental body issued a report in 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing. The lesson here should be clear if red flags are raised or serious issues brought to your attention by your staff or in particular by the FCA then it is important to respond appropriately.

Source: slideshare.net

Source: slideshare.net

Red flags There are a range of indicators which help those at the front line identify potential money laundering in their sectors. The use of cash in a transaction can suggest a higher. Expertise in trade-based money laundering is also held in a department outside of the trade finance business eg Compliance so that. One red flag alone may not be an issue but if you begin to see more then you need to think again. It can also be used in a money laundering context to layer criminal funds.

Source: blog.macfarlanes.com

Source: blog.macfarlanes.com

Where red flags are used by banks as part of operational procedures they are regularly updated and easily accessible to staff. And money laundering may take place. The Financial Action Task Force FATF an independent inter-governmental body issued a report in 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing. PEP Politically Exposed Persons. You can read it in full here this article has consolidated the key points.

Source: kyc360.riskscreen.com

Source: kyc360.riskscreen.com

Money Laundering Red Flags. The Financial Action Task Force FATF the Wolfsberg Group and the Joint Money Laundering Steering Group JMLSG have all drawn attention to the misuse of international trade finance as one of the ways criminal organisations and terrorist financiers move money to disguise its origins and integrate it into the legitimate economy. If the legal -. FCA Financial Conduct Authority. The report identifies 42 Red Flag Indicators or warning signs of money laundering and terrorist financing.

Source: cointribune.com

Source: cointribune.com

MLR Money Laundering Regulations. Certain license requirements for fiduciaries administering family offices abolished. The Notice provided that these red flags were in addition to the money laundering red flags that appeared in Notice to Members 02-21 NTM 02-21 published in April 2002. Wash Trading for example can be used in the cause of market abuse to tick prices up or down and to give an illusory view of market volume and open interest. The FCA launched their finalised guidance on the treatment of Politically Exposed Persons PEP for anti-money laundering purposes in July 2017.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

And money laundering may take place. One red flag alone may not be an issue but if you begin to see more then you need to think again. The Financial Action Task Force FATF an independent inter-governmental body issued a report in 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing. July 24 2019 webmaster Money Laundring UK Anti Money Laundering UK US. Key parties include the instructing party but may include other parties on a risk-sensitive basis.

Source: acamstoday.org

Source: acamstoday.org

The Monetary Authority of Singapore MAS the Hong Kong Monetary Authority HKMA and the Financial Conduct Authority FCA in the UK are some of the global regulators that have issued guidelines and red flag checks around trade finance echoing those issued by the International Chamber of Commerce ICC Bankers Association for Finance and Trade BAFT and the Wolfsberg Group. Red flags There are a range of indicators which help those at the front line identify potential money laundering in their sectors. Key parties include the instructing party but may include other parties on a risk-sensitive basis. The report identifies 42 Red Flag Indicators or warning signs of money laundering and terrorist financing. The Notice provided that these red flags were in addition to the money laundering red flags that appeared in Notice to Members 02-21 NTM 02-21 published in April 2002.

Source: sumsub.com

Expertise in trade-based money laundering is also held in a department outside of the trade finance business eg Compliance so that. The lesson here should be clear if red flags are raised or serious issues brought to your attention by your staff or in particular by the FCA then it is important to respond appropriately. Key parties include the instructing party but may include other parties on a risk-sensitive basis. Cash and some electronic currencies can enable anonymity. Staff identify key parties to a transaction and screen them against sanctions lists.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca money laundering red flags by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information