11++ Fca money laundering reporting officer ideas in 2021

Home » money laundering idea » 11++ Fca money laundering reporting officer ideas in 2021Your Fca money laundering reporting officer images are ready in this website. Fca money laundering reporting officer are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca money laundering reporting officer files here. Get all royalty-free vectors.

If you’re looking for fca money laundering reporting officer images information connected with to the fca money laundering reporting officer interest, you have visit the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Fca Money Laundering Reporting Officer. Under the regulation all financial sector businesses are required to implement the MLRO position in accordance with rules set out in the Financial Conduct Authority FCA. A firm should ensure that the systems and controls include. The Money Laundering Reporting Officer has a pivotal role to play in ensuring that a firm is compliance with anti-money laundering regulations. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager.

S7c Money Laundering Reporting Officer Mlro Certification Trainin From slideshare.net

S7c Money Laundering Reporting Officer Mlro Certification Trainin From slideshare.net

Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. The Financial Conduct Authority FCA have specific regulatory rules and requirements set out in the Senior Management Arrangements Systems and Controls SYSC section of their handbook which relate to financial crime and specifically anti-money laundering officer controls measures and audits. In addition to ensuring their firms compliance with anti-money laundering controls MLROs have a duty to deal with any information knowledge or suspicion of money laundering and properly disclose such matters to law enforcement in this case the National Crime Agency NCA. Money laundering reporting officer the individual appointed by a firm 33 in accordance with SYSC 326I R 33 or SYSC 639 R. The Financial Conduct Authority FCA has fined Sonali Bank UK Limited SBUK 3250600 and has imposed a restriction. Additionally theyre responsible for ensuring that when appropriate knowledge or suspicion of money laundering.

Handling issues connected with a companys senior management eg.

2 appropriate provision of information to its governing body and senior management including a report at least annually by that firms money laundering reporting officer on the operation and effectiveness of those systems and controls. Ensuring the firms AML compliance. Composing a consistent AML policy the company will pursue. Press Releases First published. 2 appropriate provision of information to its governing body and senior management including a report at least annually by that firms money laundering reporting officer on the operation and effectiveness of those systems and controls. Some refer to the MLRO as the nominated officer.

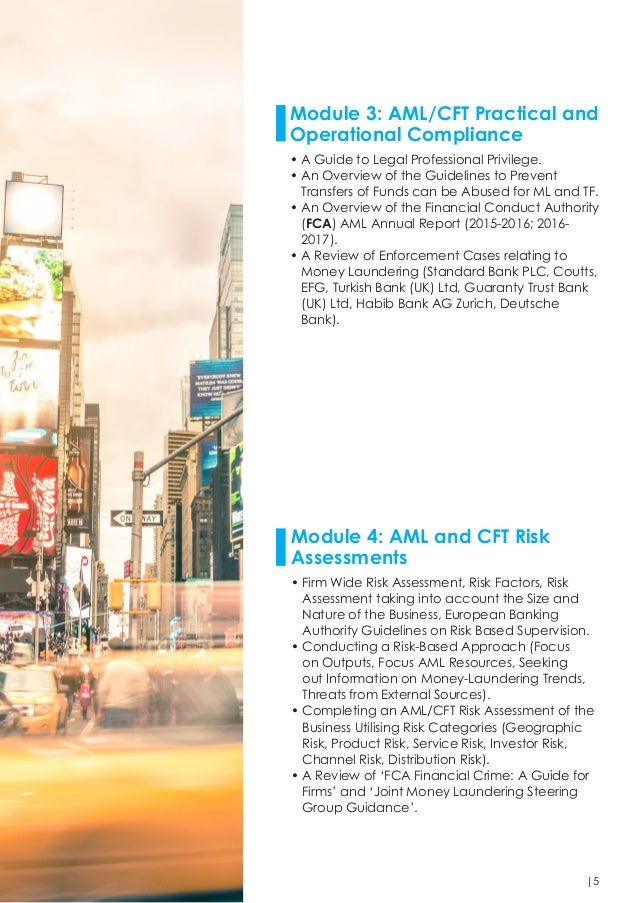

Source: slideshare.net

Source: slideshare.net

Disclosure of money laundering affairs. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. In this decision report we review the FCAs action against Sonali Bank UK Ltd Sonali Bank and its money laundering reporting officer MLRO Steven Smith in connection with failings identified in relation to Sonali Banks anti-money laundering AML controls.

Source: pt.slideshare.net

Source: pt.slideshare.net

A Money Laundering Reporting Officer MLRO is tasked with overseeing a firms compliance with the Financial Conduct Authoritys FCA rules on money laundering. 2 appropriate provision of information to its governing body and senior management including a report at least annually by that firms money laundering reporting officer on the operation and effectiveness of those systems and controls. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. Money laundering reporting officer the individual appointed by a firm 33 in accordance with SYSC 326I R 33 or SYSC 639 R. The role of Money Laundering Reporting Officer is defined by the Financial Conduct Authority and is outlined in the FCA handbook.

Source: sumsub.com

Reporting suspicious activity to the law enforcement. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. And 2 ensure that its MLRO has a level of authority and independence within the firm and access to resources and information sufficient to enable him to carry out that responsibility. The Money Laundering Reporting Officer role was introduced in the UK under section 59 of the Money Laundering Regulations 2007. The Money Laundering Reporting Officer has a pivotal role to play in ensuring that a firm is compliance with anti-money laundering regulations.

Source: biia.com

Source: biia.com

They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. Ensuring the firms AML compliance. Disclosure of money laundering affairs. Composing a consistent AML policy the company will pursue. The Financial Conduct Authority FCA have specific regulatory rules and requirements set out in the Senior Management Arrangements Systems and Controls SYSC section of their handbook which relate to financial crime and specifically anti-money laundering officer controls measures and audits.

Source: member.fintech.global

Source: member.fintech.global

59 Is there anything wrong with this page. A Money Laundering Reporting Officer MLRO is tasked with overseeing a firms compliance with the Financial Conduct Authoritys FCA rules on money laundering. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. The Money Laundering Reporting Officer role was introduced in the UK under section 59 of the Money Laundering Regulations 2007. 1 FCG 322G The Money Laundering Reporting Officer MLRO applies only to firms who are subject to the money laundering provisions in SYSC 326A J or SYSC 63 except it does not apply to sole traders who have no employees.

Source: cclcompliance.co.uk

Source: cclcompliance.co.uk

Under the regulation all financial sector businesses are required to implement the MLRO position in accordance with rules set out in the Financial Conduct Authority FCA. The Money Laundering Reporting Officer role was introduced in the UK under section 59 of the Money Laundering Regulations 2007. The role of Money Laundering Reporting Officer is defined by the Financial Conduct Authority and is outlined in the FCA handbook. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. Handling issues connected with a companys senior management eg.

Source: docplayer.net

Source: docplayer.net

2 appropriate provision of information to its governing body and senior management including a report at least annually by that firms money laundering reporting officer on the operation and effectiveness of those systems and controls. 2 appropriate provision of information to its governing body and senior management including a report at least annually by that firms money laundering reporting officer on the operation and effectiveness of those systems and controls. 59 Is there anything wrong with this page. Your nominated officers role is to be aware of any suspicious activity in the business that might be linked to money laundering or terrorist financing and if necessary to report it. Disclosure of money laundering affairs.

Source: professional.dowjones.com

Source: professional.dowjones.com

59 Is there anything wrong with this page. Additionally theyre responsible for ensuring that when appropriate knowledge or suspicion of money laundering. And 2 ensure that its MLRO has a level of authority and independence within the firm and access to resources and information sufficient to enable him to carry out that responsibility. Composing a consistent AML policy the company will pursue. Handling issues connected with a companys senior management eg.

Source: tookitaki.ai

Source: tookitaki.ai

In addition to ensuring their firms compliance with anti-money laundering controls MLROs have a duty to deal with any information knowledge or suspicion of money laundering and properly disclose such matters to law enforcement in this case the National Crime Agency NCA. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. Disclosure of money laundering affairs. The nominated officer liabilities are. Handling issues connected with a companys senior management eg.

Source: slideshare.net

Source: slideshare.net

They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. 1 1 appropriate training for its employees in relation to money laundering. 1 FCG 322G The Money Laundering Reporting Officer MLRO applies only to firms who are subject to the money laundering provisions in SYSC 326A J or SYSC 63 except it does not apply to sole traders who have no employees. The Financial Conduct Authority FCA has fined Sonali Bank UK Limited SBUK 3250600 and has imposed a restriction. Appoint an individual as MLRO with responsibility for oversight of its compliance with the FCAs rules on systems and controls against money laundering.

A Money Laundering Reporting Officer MLRO is tasked with overseeing a firms compliance with the Financial Conduct Authoritys FCA rules on money laundering. Disclosure of money laundering affairs. The Financial Conduct Authority FCA have specific regulatory rules and requirements set out in the Senior Management Arrangements Systems and Controls SYSC section of their handbook which relate to financial crime and specifically anti-money laundering officer controls measures and audits. Reporting suspicious activity to the law enforcement. Press Releases First published.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

Reporting suspicious activity to the law enforcement. Under the regulation all financial sector businesses are required to implement the MLRO position in accordance with rules set out in the Financial Conduct Authority FCA. Ensuring the firms AML compliance. Money laundering reporting officer the individual appointed by a firm 33 in accordance with SYSC 326I R 33 or SYSC 639 R. He needs to be senior to be free to act on his own authority and to be informed of any relevant knowledge or suspicion in the relevant firm.

Source: skillcast.com

Source: skillcast.com

The job of the MLRO is to act as the focal point within the relevant firm for the oversight of all activity relating to anti-money laundering. A Money Laundering Reporting Officer MLRO is tasked with overseeing a firms compliance with the Financial Conduct Authoritys FCA rules on money laundering. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Ensuring the firms AML compliance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca money laundering reporting officer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information