12++ Features of anti money laundering act ideas

Home » money laundering Info » 12++ Features of anti money laundering act ideasYour Features of anti money laundering act images are available. Features of anti money laundering act are a topic that is being searched for and liked by netizens today. You can Download the Features of anti money laundering act files here. Download all free photos.

If you’re looking for features of anti money laundering act pictures information connected with to the features of anti money laundering act topic, you have pay a visit to the right blog. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

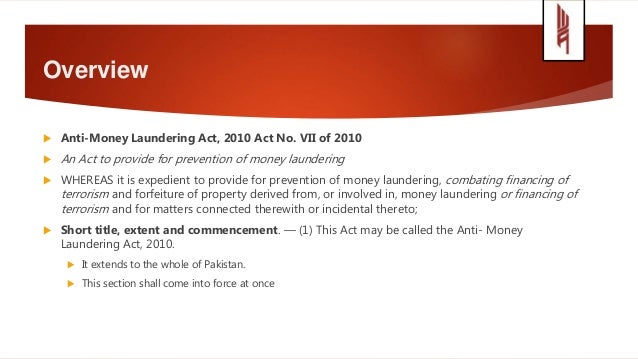

Features Of Anti Money Laundering Act. The AMLO was reframed via the Anti-Money Laundering Act 2010 AMLA and various changes were incorporated in it including a well-built preamble and a thorough definition of money laundering21 The feature of combating terrorist financing is also included in the preamble. The most important features of these recommendations are generally as follows. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules. Creates a Financial Intelligence Unit FIU.

Pdf International Anti Money Laundering Programs From researchgate.net

Pdf International Anti Money Laundering Programs From researchgate.net

To ensure compliance with its law the Act imposes stringent sanctions for various money laundering infractions in the form of fines and imprisonment. State of mind of a person includes. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules. Currently the provision of pure advisory services is not subject to the Anti-Money Laundering Act. 01062009 by enactment of Prevention of Money Laundering Amendment Act 2009. The AMLO was reframed via the Anti-Money Laundering Act 2010 AMLA and various changes were incorporated in it including a well-built preamble and a thorough definition of money laundering21 The feature of combating terrorist financing is also included in the preamble.

Relaxes strict bank deposit secrecy laws.

Creates a Financial Intelligence Unit FIU. The following is a summary of the most significant changes to the AML legal landscape including. Salient features Provision of Punishment for money-laundering. The AMLA builds on and updates the Bank Secrecy Act of 1970 BSA and the USA PATRIOT Act of 2001 to modernize anti-money laundering and. Creates a Financial Intelligence Unit FIU. Standard antimoney laundering and counterterrorism financing program has the meaning given by subsection 84 1.

Source: researchgate.net

Source: researchgate.net

For example an individual who commits money laundering is now liable on summary conviction to a fine not less than 100 and not more than 500 of the proceeds of the crime and in the case of a corporate entity a fine of not less than 300. 01062009 by enactment of Prevention of Money Laundering Amendment Act 2009. Relaxes strict bank deposit secrecy laws. Forty Recommendations for Anti-Money Laundering. Currently the provision of pure advisory services is not subject to the Anti-Money Laundering Act.

Source: pdfprof.com

Source: pdfprof.com

The most important features of these recommendations are generally as follows. Criminalization of offence s of money laundering and the financing of terrorism. A the knowledge intention opinion suspicion belief or purpose of the person. The AMLA builds on and updates the Bank Secrecy Act of 1970 BSA and the USA PATRIOT Act of 2001 to modernize anti-money laundering and. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules.

Source: pdfprof.com

Source: pdfprof.com

In the following the main features of the draft law will be summarized and explained. Provides for freezingseizureforfeiture recovery of dirty moneyproperty. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the NDA government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. This Act has been substantially amended by way of enlarging its scope in 2009 wef. Creates a Financial Intelligence Unit FIU.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others. Standard antimoney laundering and counterterrorism financing program has the meaning given by subsection 84 1. The most important features of these recommendations are generally as follows. Provides for freezingseizureforfeiture recovery of dirty moneyproperty. 9160 The Anti-Money Laundering Act AMLA of 2001 a.

Source: tookitaki.ai

Source: tookitaki.ai

The following is a summary of the most significant changes to the AML legal landscape including. These recommendations were issued in 1990 and have been amended several times. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules. 01062009 by enactment of Prevention of Money Laundering Amendment Act 2009. For example an individual who commits money laundering is now liable on summary conviction to a fine not less than 100 and not more than 500 of the proceeds of the crime and in the case of a corporate entity a fine of not less than 300.

Source:

For example an individual who commits money laundering is now liable on summary conviction to a fine not less than 100 and not more than 500 of the proceeds of the crime and in the case of a corporate entity a fine of not less than 300. The following is a summary of the most significant changes to the AML legal landscape including. 1 In this Act a designation power in relation to regulations under section 1 means a power contained in the regulations by virtue of section 9 2 a for an appropriate Minister to designate persons for the purposes of the regulations or of any provisions of the regulations. The AMLA builds on and updates the Bank Secrecy Act of 1970 BSA and the USA PATRIOT Act of 2001 to modernize anti-money laundering and. The Money Laundering Control Act Of 1986 The Money Laundering Control Act of 1986 was written to make money laundering a federal crime.

Source: shuftipro.com

Source: shuftipro.com

Furthermore the Anti-Money Laundering Council AMLC now has an added function to require the Land Registration Authority LRA and all its Registries of Deeds to submit to the AMLC reports on all real estate transactions involving an amount in excess of Five hundred thousand pesos P50000000 within fifteen 15 days from the date of registration of the transaction in a form to be. A the knowledge intention opinion suspicion belief or purpose of the person. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic. Salient features Provision of Punishment for money-laundering. The Money Laundering Control Act Of 1986 The Money Laundering Control Act of 1986 was written to make money laundering a federal crime.

Source: ratojob.com

Source: ratojob.com

Salient Features of RA. Imposes requirements on customer identification record-keeping and reporting of covered and suspicious transactions. Relaxes strict bank deposit secrecy laws. Introduction of Advisors as a new category of persons subject to AMLA. Salient Features of RA.

Source: slideshare.net

Source: slideshare.net

01062009 by enactment of Prevention of Money Laundering Amendment Act 2009. Currently the provision of pure advisory services is not subject to the Anti-Money Laundering Act. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the NDA government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The Money Laundering Control Act Of 1986 The Money Laundering Control Act of 1986 was written to make money laundering a federal crime.

Source: brill.com

Source: brill.com

For example an individual who commits money laundering is now liable on summary conviction to a fine not less than 100 and not more than 500 of the proceeds of the crime and in the case of a corporate entity a fine of not less than 300. Forty Recommendations for Anti-Money Laundering. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the NDA government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The Money Laundering Control Act Of 1986 The Money Laundering Control Act of 1986 was written to make money laundering a federal crime. 01062009 by enactment of Prevention of Money Laundering Amendment Act 2009.

Source: researchgate.net

Source: researchgate.net

For example an individual who commits money laundering is now liable on summary conviction to a fine not less than 100 and not more than 500 of the proceeds of the crime and in the case of a corporate entity a fine of not less than 300. The following is a summary of the most significant changes to the AML legal landscape including. 01062009 by enactment of Prevention of Money Laundering Amendment Act 2009. AMLA applies if a person or entity is entitled to dispose of funds or other assets and thus acts as a so-called financial intermediary. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others.

Source: branddocs.com

Source: branddocs.com

Salient Features of RA. Relaxes strict bank deposit secrecy laws. The Money Laundering Control Act Of 1986 The Money Laundering Control Act of 1986 was written to make money laundering a federal crime. The AMLA builds on and updates the Bank Secrecy Act of 1970 BSA and the USA PATRIOT Act of 2001 to modernize anti-money laundering and. Standard antimoney laundering and counterterrorism financing program has the meaning given by subsection 84 1.

Source: ec.europa.eu

Source: ec.europa.eu

Currently the provision of pure advisory services is not subject to the Anti-Money Laundering Act. Relaxes strict bank deposit secrecy laws. Salient features Provision of Punishment for money-laundering. AMLA applies if a person or entity is entitled to dispose of funds or other assets and thus acts as a so-called financial intermediary. Salient Features of RA.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title features of anti money laundering act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas