11++ Features of prevention of money laundering act info

Home » money laundering idea » 11++ Features of prevention of money laundering act infoYour Features of prevention of money laundering act images are ready in this website. Features of prevention of money laundering act are a topic that is being searched for and liked by netizens today. You can Find and Download the Features of prevention of money laundering act files here. Get all free photos.

If you’re looking for features of prevention of money laundering act images information linked to the features of prevention of money laundering act interest, you have pay a visit to the ideal site. Our site always gives you hints for seeking the highest quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

Features Of Prevention Of Money Laundering Act. Combating the channelising of money into illegal activities and economic crimes. Providing for the confiscation of property derived from or involved in money laundering. PMLA defines money laundering offense and provides for the freezing seizure and confiscation of the proceeds of crime. What are the Offenses under PLMA.

Everything You Need To Know About The Prevention Of Money Laundering Act Indianmoney From indianmoney.com

Everything You Need To Know About The Prevention Of Money Laundering Act Indianmoney From indianmoney.com

The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. Salient Features of this act are as follows. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment. As stated in the Preamble to the Act it is an Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and to punish those who commit the offence of money laundering. It is responsible for enforcement of the Foreign Exchange Management Act 1999 FEMA and certain provisions under the Prevention of Money Laundering Act. Prevention of Money Laundering Act 2002 was enacted to fight against the criminal offence of legalizing the incomeprofits from an illegal source.

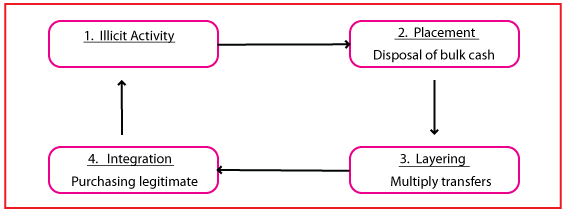

Money laundering is the process where proceeds of a crime or unlawful activity are filtered in such a way that the source of their origin is disguised.

It came into force in 2005. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. WHEREAS the Political Declaration and Global Programme of Action. To provide for confiscation and seizure of property obtained from laundered money. Section 3 of Prevention of Money Laundering Act 2002 hereinafter referred to as PMLA defines money laundering as Whosoever attempts to indulge in any process or activity connected proceeds of. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment.

Source: jagranjosh.com

Source: jagranjosh.com

Prevention of Money Laundering Act 2002 is one of the legislation whose provisions have been frequently challenged to be arbitrary and violative of Fundamental Rights of the citizens. Combating the channelising of money into illegal activities and economic crimes. As stated in the Preamble to the Act it is an Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and to punish those who commit the offence of money laundering. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the NDA government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. Offence of money laundering has been defined in the section 3 of the Prevention Of Money laundering Act.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment. The Act and Rules notified there under impose obligation on banking companies financial institutions. What are the Offenses under PLMA. Providing for the confiscation of property derived from or involved in money laundering. PREVENTION OF MONEY LAUNDERING ACT 2002 2.

Source: wikiwand.com

Source: wikiwand.com

Salient features Provision of Punishment for money-laundering. The law was enacted to combat money laundering in India and has three main objectives. PMLA and the Rules notified there under came into force with effect from July 1 2005. To provide for confiscation and seizure of property obtained from laundered money. WHEREAS the Political Declaration and Global Programme of Action.

Source: livelaw.in

Source: livelaw.in

The specific legislation dealing with money laundering is the Prevention of Money-Laundering Act 2002 for short PMLA. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment. The Prevention of Money Laundering Act 2002 enables the Government or the public authority to confiscate the property earned from the illegally gained proceeds. Features of Money Laundering. Prevention of Money laundering Act 2002 was a major step taken by Indian Government for tracing and stopping fraudulent monetary activities but despite of this step a lot of scams happened in Country which proved this act to be a failure.

Source: ratojob.com

Source: ratojob.com

This Act was enacted to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering. PMLA defines money laundering offence and provides for the freezing seizure and confiscation of the proceeds of crime. PREVENTION OF MONEY LAUNDERING ACT 2002 2. The Act and Rules notified there under impose obligation on banking companies financial institutions. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment.

Source: youtube.com

Source: youtube.com

The Prevention of Money Laundering Act 2002 enables the Government or the public authority to confiscate the property earned from the illegally gained proceeds. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The methods used to launder money are similar whether its for white-collar crimes such as tax evasion peopledrug trafficking or proceeds from fraud and internet scams. THE PREVENTION OF MONEY-LAUNDERING ACT 2002 15 of 2003 17th January 2003 An Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and for matters connected therewith or incidental thereto. Actions taken against persons involved in Money Laundering.

Source: livelaw.in

Source: livelaw.in

Offence of money laundering has been defined in the section 3 of the Prevention Of Money laundering Act. Money laundering is the process where proceeds of a crime or unlawful activity are filtered in such a way that the source of their origin is disguised. Section 3 of Prevention of Money Laundering Act 2002 hereinafter referred to as PMLA defines money laundering as Whosoever attempts to indulge in any process or activity connected proceeds of. Features of Money Laundering. The Anti-Money Laundering Act Criminalizes money laundering.

Source: taxguru.in

Source: taxguru.in

PMLA and the Rules notified there under came into force with effect from July 1 2005. Functions- To collect develop and disseminate intelligence relating to violations of FEMA 1999 the intelligence inputs are received from various sources such as Central and State Intelligence agencies complaints etc. Prevention of Money Laundering Act 2002 is an Act of the Parliament of India enacted by the NDA government to prevent money-laundering and to provide for confiscation of property derived from money-laundering. Prevention of Money laundering Act 2002 was a major step taken by Indian Government for tracing and stopping fraudulent monetary activities but despite of this step a lot of scams happened in Country which proved this act to be a failure. Section 3 of Prevention of Money Laundering Act 2002 hereinafter referred to as PMLA defines money laundering as Whosoever attempts to indulge in any process or activity connected proceeds of.

Source: researchgate.net

Source: researchgate.net

As stated in the Preamble to the Act it is an Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and to punish those who commit the offence of money laundering. Providing for any other matters connected with or incidental to the act of money laundering. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment. The Prevention of Money Laundering Act 2002 enables the Government or the public authority to confiscate the property earned from the illegally gained proceeds. As stated in the Preamble to the Act it is an Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and to punish those who commit the offence of money laundering.

Source: civilserviceindia.com

Source: civilserviceindia.com

Combating the channelising of money into illegal activities and economic crimes. Prevention of Money Laundering Act 2002 was enacted to fight against the criminal offence of legalizing the incomeprofits from an illegal source. To prevent and control money laundering. Any person who is directly or indirectly attempts to become the part of the such illigal activity shall be guilty according to the offence of money laundering. The methods used to launder money are similar whether its for white-collar crimes such as tax evasion peopledrug trafficking or proceeds from fraud and internet scams.

Source: indianmoney.com

Source: indianmoney.com

PREVENTION OF MONEY LAUNDERING ACT 2002 2. Section 3 of Prevention of Money Laundering Act 2002 hereinafter referred to as PMLA defines money laundering as Whosoever attempts to indulge in any process or activity connected proceeds of. Actions taken against persons involved in Money Laundering. Features of Money Laundering Money laundering means billions of pounds and dollars a year are laundered through our financial systems. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic Substance Act 1985 then the punishment.

Source: researchgate.net

Source: researchgate.net

Combating the channelising of money into illegal activities and economic crimes. Offence of money laundering has been defined in the section 3 of the Prevention Of Money laundering Act. Salient Features of this act are as follows. To prevent and control money laundering. Prevention of Money Laundering Act 2002 was enacted to fight against the criminal offence of legalizing the incomeprofits from an illegal source.

Source: slideshare.net

Source: slideshare.net

The Prevention of Money Laundering Act 2002 enables the Government or the public authority to confiscate the property earned from the illegally gained proceeds. Salient features Provision of Punishment for money-laundering. Providing for any other matters connected with or incidental to the act of money laundering. To prevent and control money laundering. What is the object of Prevention of Money Laundering Act 2002.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title features of prevention of money laundering act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information