14+ Fiamla regulations 2018 information

Home » money laundering Info » 14+ Fiamla regulations 2018 informationYour Fiamla regulations 2018 images are available. Fiamla regulations 2018 are a topic that is being searched for and liked by netizens now. You can Find and Download the Fiamla regulations 2018 files here. Download all royalty-free photos and vectors.

If you’re searching for fiamla regulations 2018 pictures information connected with to the fiamla regulations 2018 topic, you have come to the ideal site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

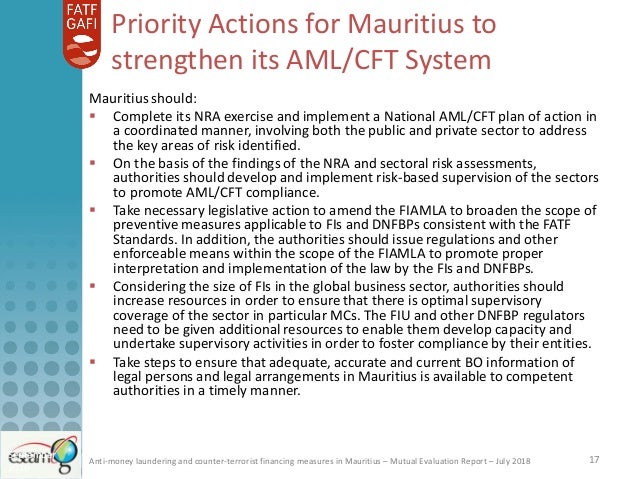

Fiamla Regulations 2018. Financial Intelligence and Anti-Money Laundering Regulations 2018 The Captive Insurance Amendment of Schedule Regulations 2021 The FSC is the integrated regulator in Mauritius for the financial services sector other than banking and global business. Commencement First Schedule Second Schedule Third Schedule An Act To provide for the establishment and management of a Financial Intelligence Unit and a Review Committee to supervise its activities. Also the FIAMLA Regulations 2003 have been replaced with the Financial Intelligence and Anti-Money Laundering Regulations 2018 the Regulations which came into force on 1 October 2018. Amongst others the FIAMLA makes provision for an independent FIU the obligation of filing suspicious transaction reports CDD obligations as well as a framework for the AMLCFT supervision of Designated Non-Financial Businesses and Professions DNFBPs.

Mauritius Mutual Evaluation Ratings 2018 From slideshare.net

Mauritius Mutual Evaluation Ratings 2018 From slideshare.net

These regulations may be cited as the Financial Intelligence and Anti-Money Laundering Regulations 2018. First toassist the financial institutions under the purview of the FSC in complying with the requirements of the FIAMLA and the FIAML Regulations 2018. These have been identified by the FIAMLA as an institution or a person licensed or registered or required to be licensed or registered under the following pieces of legislation. To download a copy of the Actplease click Here. Amongst others the FIAMLA makes provision for an independent FIU the obligation of filing suspicious transaction reports CDD obligations as well as a framework for the AMLCFT supervision of Designated Non-Financial Businesses and Professions DNFBPs. Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of their clients.

To download a copy of the Act - Updated please Click here.

Money Laundering 1 Any personpartwho - a engages in a transaction that involves property which is or in whole or in. 11 of 2018 PART II - MONEY LAUNDERING OFFENCES 3. Commencement First Schedule Second Schedule Third Schedule An Act To provide for the establishment and management of a Financial Intelligence Unit and a Review Committee to supervise its activities. To provide for the reporting of. 6 August 2021. Key Repo Rate.

Source: slideshare.net

Source: slideshare.net

These have been identified by the FIAMLA as an institution or a person licensed or registered or required to be licensed or registered under the following pieces of legislation. This article discusses the enhanced measures implemented to strengthen the anti-money laundering legislative framework through the Financial Intelligence and Anti-Money Laundering Act FIAMLA. In addition a new set of regulations namely the FIAML Regulations 2018 were promulgated on 28 September 2018 and became effective on 01 October 2018. In 2018 the FIAML Regulations 2018 were made and revoked the 2003 FIAML Regulations. It consolidates the Commissions guidance on anti-money laundering financing of terrorism and financing of proliferation of weapons of mass destruction.

Source: amarbheenick.blogspot.com

Source: amarbheenick.blogspot.com

To download a copy of the Regulations please Click here. In 2018 the FIAML Regulations 2018 were made and revoked the 2003 FIAML Regulations. Key Repo Rate. Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of their clients. Amongst others the FIAMLA makes provision for an independent FIU the obligation of filing suspicious transaction reports CDD obligations as well as a framework for the AMLCFT supervision of Designated Non-Financial Businesses and Professions DNFBPs.

Source: iflr1000.com

Source: iflr1000.com

To download a copy of the Regulations please Click here. Yield on 91-Day BOMGMTB. In addition a new set of regulations namely the FIAML Regulations 2018 were promulgated on 28 September 2018 and became effective on 01 October 2018. To download a copy of the Regulations please Click here. In 2018 the FIAML Regulations 2018 were made and revoked the 2003 FIAML Regulations.

The most noteworthy change is the replacement of the FIAMLA Regulations 2003 with a new version Regulations 2018 which came into force on 1 October 2018. To download a copy of the Actplease click Here. The aim of the Handbook is to assist the financial institutions under the purview of the Commission in complying with the requirements of the FIAMLA and the FIAML Regulations 2018. To download a copy of the Regulations please Click here. The most noteworthy change is the replacement of the FIAMLA Regulations 2003 with a new version Regulations 2018 which came into force on 1 October 2018.

108 of 2018 THE FINANCIAL INTELLIGENCE AND ANTI-MONEY LAUNDERING ACT Regulations made by the Minister under sections 17C 17D 17E and 35 of the Financial Intelligence and Anti-Money Laundering Act 1. The most noteworthy change is the replacement of the FIAMLA Regulations 2003 with a new version Regulations 2018 which came into force on 1 October 2018. The amendments are focused to address the shortcomings identified in the Report and this article is an attempt to elucidate on the key amendments and provide a brief outline of the same. Also the FIAMLA Regulations 2003 have been replaced with the Financial Intelligence and Anti-Money Laundering Regulations 2018 the Regulations which came into force on 1 October 2018. To download a copy of the Act - Updated please Click here.

To download a copy of the Act please click here. To download a copy of the Act please click here. Money Laundering 1 Any personpartwho - a engages in a transaction that involves property which is or in whole or in. To download a copy Click here. To provide for the reporting of.

Source: ablerconsulting.com

Source: ablerconsulting.com

In addition a new set of regulations namely the FIAML Regulations 2018 were promulgated on 28 September 2018 and became effective on 01 October 2018. 11 of 2018 PART II - MONEY LAUNDERING OFFENCES 3. Yield on 91-Day BOMGMTB. First toassist the financial institutions under the purview of the FSC in complying with the requirements of the FIAMLA and the FIAML Regulations 2018. Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of their clients.

These regulations may be cited as the Financial Intelligence and Anti-Money Laundering Regulations 2018. 6 August 2021. Financial Intelligence and Anti-Money Laundering Regulations 2018 The Captive Insurance Amendment of Schedule Regulations 2021 The FSC is the integrated regulator in Mauritius for the financial services sector other than banking and global business. To provide for the offences of money laundering. To provide for the reporting of.

Source: amarbheenick.blogspot.com

Source: amarbheenick.blogspot.com

FIAMLA Financial Intelligence and Anti-Money Laundering Act 2002 FIAML Regulations Financial Intelligence and Anti-Money Laundering Regulations 2018 FIU Financial Intelligence Unit LPP Legal Professional Privilege MER Mutual Evaluation Report ML Money Laundering MLRO Money Laundering Reporting Officer NRA National Risk Assessment. As it currently stands all statutes pertaining to AMLCFT apply to all Financial Institutions FIs and the Designated Non-Financial Businesses and Professions DNFBPs4. Money Laundering 1 Any personpartwho - a engages in a transaction that involves property which is or in whole or in. To download a copy Click here. To download a copy of the Act please click here.

To download a copy of the Actplease click Here. In 2018 the FIAML Regulations 2018 were made and revoked the 2003 FIAML Regulations. These have been identified by the FIAMLA as an institution or a person licensed or registered or required to be licensed or registered under the following pieces of legislation. Financial Intelligence and Anti-Money Laundering Regulations 2018 The Captive Insurance Amendment of Schedule Regulations 2021 The FSC is the integrated regulator in Mauritius for the financial services sector other than banking and global business. To download a copy of the Act - Updated please Click here.

Source: slideshare.net

Source: slideshare.net

In addition a new set of regulations namely the FIAML Regulations 2018 were promulgated on 28 September 2018 and became effective on 01 October 2018. Money Laundering 1 Any personpartwho - a engages in a transaction that involves property which is or in whole or in. This article discusses the enhanced measures implemented to strengthen the anti-money laundering legislative framework through the Financial Intelligence and Anti-Money Laundering Act FIAMLA. Also the FIAMLA Regulations 2003 have been replaced with the Financial Intelligence and Anti-Money Laundering Regulations 2018 the Regulations which came into force on 1 October 2018. First toassist the financial institutions under the purview of the FSC in complying with the requirements of the FIAMLA and the FIAML Regulations 2018.

Source: blc.mu

Source: blc.mu

The Regulations 2018 revoked the Financial Intelligence and Anti-Money Laundering Regulations 2003 and. 108 of 2018 THE FINANCIAL INTELLIGENCE AND ANTI-MONEY LAUNDERING ACT Regulations made by the Minister under sections 17C 17D 17E and 35 of the Financial Intelligence and Anti-Money Laundering Act 1. The amendments are focused to address the shortcomings identified in the Report and this article is an attempt to elucidate on the key amendments and. First toassist the financial institutions under the purview of the FSC in complying with the requirements of the FIAMLA and the FIAML Regulations 2018. This article discusses the enhanced measures implemented to strengthen the anti-money laundering legislative framework through the Financial Intelligence and Anti-Money Laundering Act FIAMLA.

11 of 2018 PART II - MONEY LAUNDERING OFFENCES 3. FIAMLA Financial Intelligence and Anti-Money Laundering Act 2002 FIAML Regulations Financial Intelligence and Anti-Money Laundering Regulations 2018 FIU Financial Intelligence Unit LPP Legal Professional Privilege MER Mutual Evaluation Report ML Money Laundering MLRO Money Laundering Reporting Officer NRA National Risk Assessment. To download a copy of the Act please click here. First toassist the financial institutions under the purview of the FSC in complying with the requirements of the FIAMLA and the FIAML Regulations 2018. To download a copy of the Regulations please Click here.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fiamla regulations 2018 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas