10++ Fifth money laundering directive trusts ideas in 2021

Home » money laundering idea » 10++ Fifth money laundering directive trusts ideas in 2021Your Fifth money laundering directive trusts images are ready. Fifth money laundering directive trusts are a topic that is being searched for and liked by netizens now. You can Download the Fifth money laundering directive trusts files here. Download all royalty-free photos and vectors.

If you’re looking for fifth money laundering directive trusts images information linked to the fifth money laundering directive trusts keyword, you have visit the ideal site. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

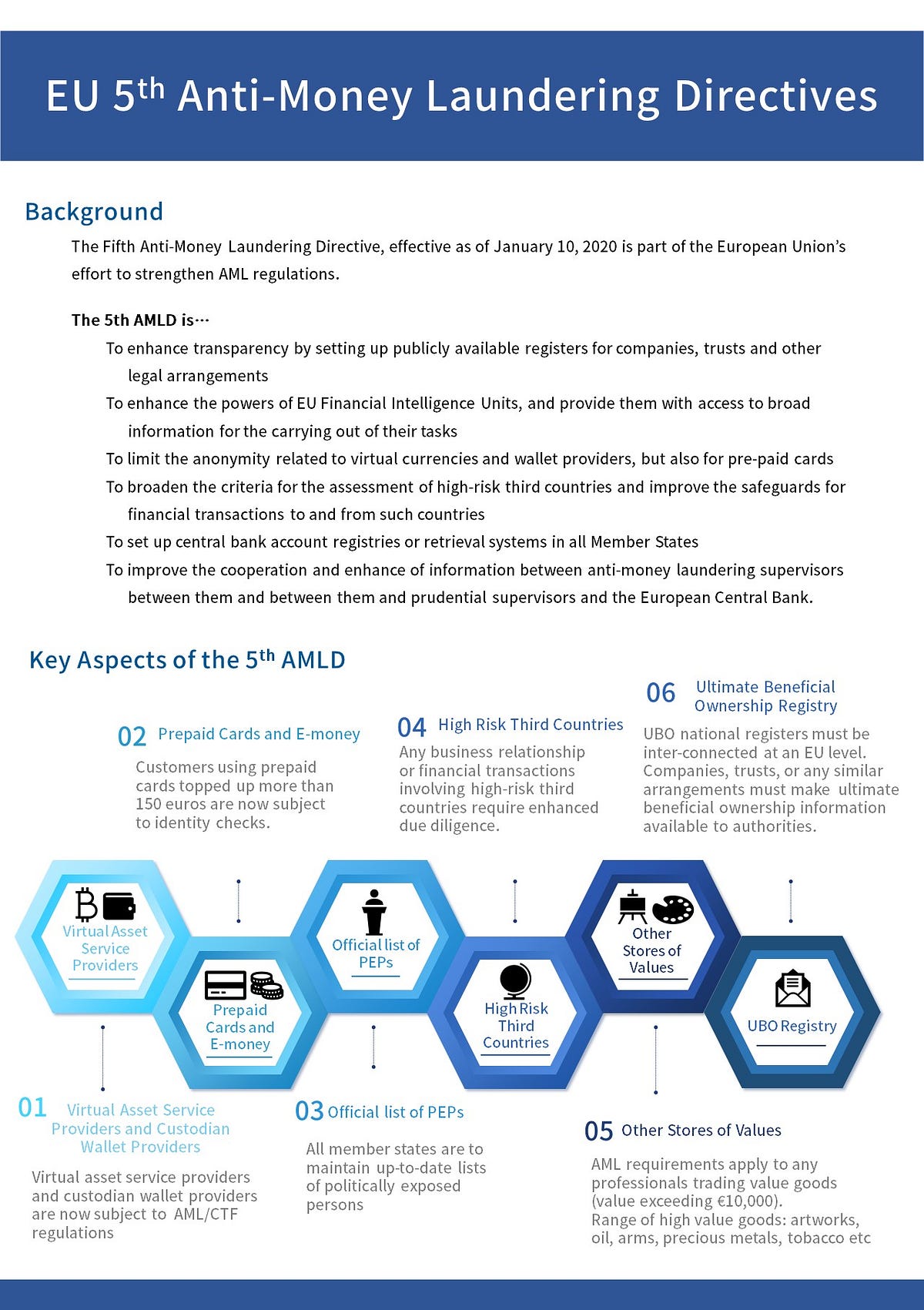

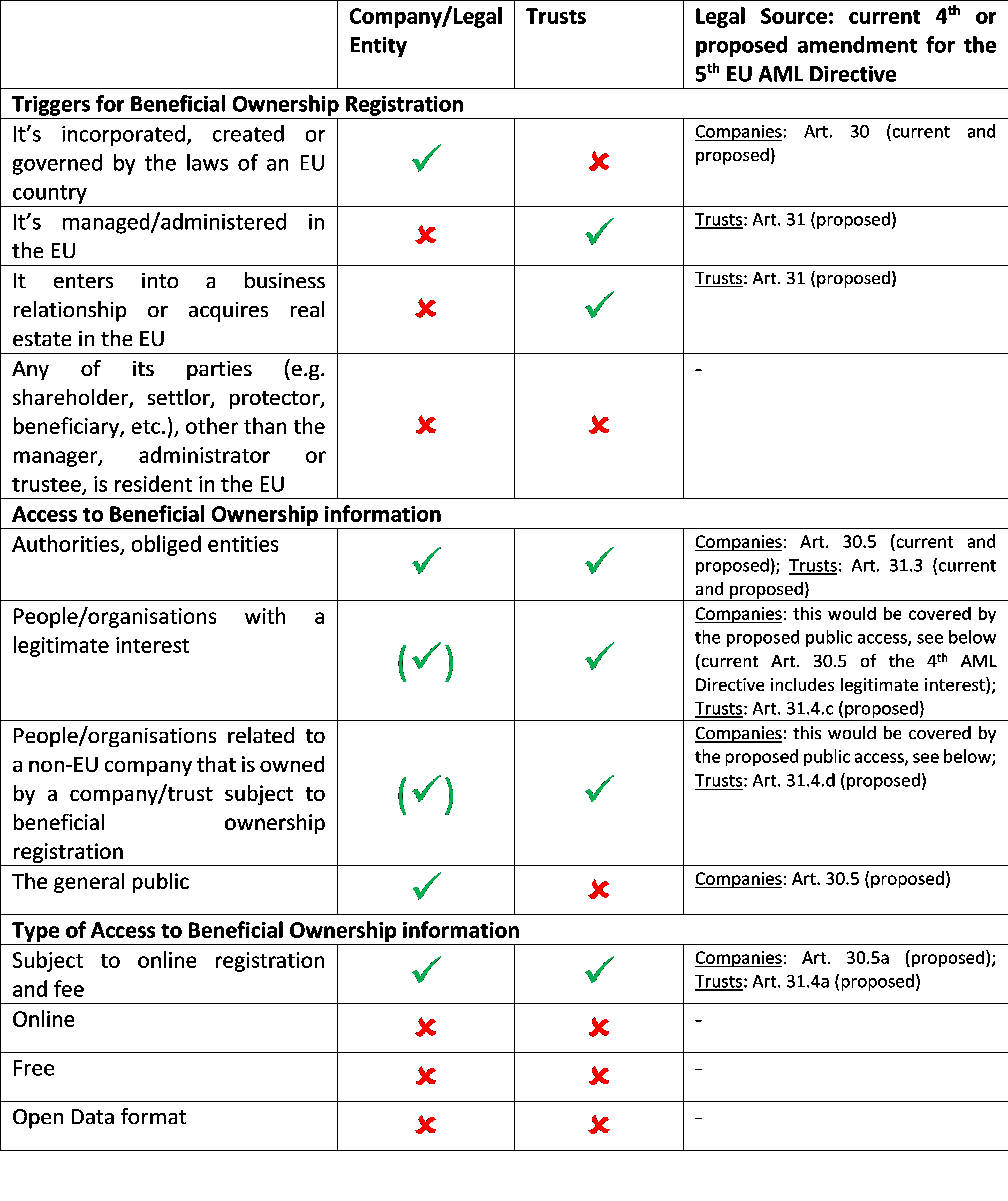

Fifth Money Laundering Directive Trusts. Fifth Money Laundering Directive and Trusts - Royal London for advisers Fifth Money Laundering Directive and Trusts Ian Smart 27 February 2020 On 24 January HMRC and HM Treasury published a technical consultation on the Fifth Money Laundering Directive. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law. 5th Money Laundering Directive and Trust Registration Service Ian Smart 11 August 2020 On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. It is important to note that trusts required to.

European Union Money Laundering Directives Overview Cams Afroza From camsafroza.com

European Union Money Laundering Directives Overview Cams Afroza From camsafroza.com

The fourth EU Money Laundering Directive required all UK express trusts in existence on 6 April 2016 with a UK tax consequence to register with HMRC by 31 January 2018. The regulations did not cover trust registration. It will also apply to non-EU resident trusts which own UK land or property or which have. Following the implementation of the Fourth Money Laundering Directive 4MLD TRS was created and is used to register taxpaying trusts and estates. Its a course of by which dirty money is transformed into clear cash. The 4 th Anti-Money Laundering Directive 4 th AMLD imposed a number of obligations on trustees including the necessity to keep records on beneficial ownership and to register with the Trust Registration Service TRS if the trust had a tax consequence.

The regulations did not cover trust registration.

The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. Fifth Anti Money Laundering Directive Trusts August 08 2021 The concept of money laundering is essential to be understood for those working in the monetary sector. The 4 th Anti-Money Laundering Directive 4 th AMLD imposed a number of obligations on trustees including the necessity to keep records on beneficial ownership and to register with the Trust Registration Service TRS if the trust had a tax consequence. 5MLD removes this link with taxation widening the definition of those trusts required to register and changing the registration deadline requirements. This captured all UK trusts that are not considered dormant as well as non-UK trusts with a UK tax liability. The Directive affects all UK express trusts and many non-UK express trusts and extends the reach of the 4th Money Laundering Directive 4MLD which.

Source: researchgate.net

Source: researchgate.net

In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law. The EUs 5th Money Laundering Directive 5MLD was transposed into UK law on 10 January 2020. The 4 th Anti-Money Laundering Directive 4 th AMLD imposed a number of obligations on trustees including the necessity to keep records on beneficial ownership and to register with the Trust Registration Service TRS if the trust had a tax consequence. THE FIFTH EU ANTI-MONEY LAUNDERING DIRECTIVE THE NEW TRUST REGISTRATION REQUIREMENT AND WHAT IT MEANS FOR BUSINESS The new EU Anti-Money Laundering Directive AMLD51 will require trustees of express trusts to register information on the beneficial ownership of the trust in a central national register. The consultation outlined how the government intended to implement changes to the Trust Registration.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

Fifth Anti Money Laundering Directive Trusts August 08 2021 The concept of money laundering is essential to be understood for those working in the monetary sector. The new Directive will bring into its scope all UK express trusts not just those with UK tax implications. 5th Money Laundering Directive and Trust Registration Service Ian Smart 11 August 2020 On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. The Directive affects all UK express trusts and many non-UK express trusts and extends the reach of the 4th Money Laundering Directive 4MLD which. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law.

Source: complyadvantage.com

Source: complyadvantage.com

In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law. The fourth EU Money Laundering Directive required all UK express trusts in existence on 6 April 2016 with a UK tax consequence to register with HMRC by 31 January 2018. 5MLD removes this link with taxation widening the definition of those trusts required to register and changing the registration deadline requirements. It is important to note that trusts required to. The regulations did not cover trust registration.

Source: integress.co.uk

Source: integress.co.uk

It is important to note that trusts required to. Following the implementation of the Fourth Money Laundering Directive 4MLD TRS was created and is used to register taxpaying trusts and estates. Its a course of by which dirty money is transformed into clear cash. THE FIFTH EU ANTI-MONEY LAUNDERING DIRECTIVE THE NEW TRUST REGISTRATION REQUIREMENT AND WHAT IT MEANS FOR BUSINESS The new EU Anti-Money Laundering Directive AMLD51 will require trustees of express trusts to register information on the beneficial ownership of the trust in a central national register. It will also apply to non-EU resident trusts which own UK land or property or which have.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

Fifth Anti Money Laundering Directive Trusts August 08 2021 The concept of money laundering is essential to be understood for those working in the monetary sector. Its a course of by which dirty money is transformed into clear cash. Following the implementation of the Fourth Money Laundering Directive 4MLD TRS was created and is used to register taxpaying trusts and estates. The 4 th Anti-Money Laundering Directive 4 th AMLD imposed a number of obligations on trustees including the necessity to keep records on beneficial ownership and to register with the Trust Registration Service TRS if the trust had a tax consequence. This captured all UK trusts that are not considered dormant as well as non-UK trusts with a UK tax liability.

Source: vinciworks.com

Source: vinciworks.com

5MLD removes this link with taxation widening the definition of those trusts required to register and changing the registration deadline requirements. The fourth EU Money Laundering Directive required all UK express trusts in existence on 6 April 2016 with a UK tax consequence to register with HMRC by 31 January 2018. The 4 th Anti-Money Laundering Directive 4 th AMLD imposed a number of obligations on trustees including the necessity to keep records on beneficial ownership and to register with the Trust Registration Service TRS if the trust had a tax consequence. This captured all UK trusts that are not considered dormant as well as non-UK trusts with a UK tax liability. The EUs 5th Money Laundering Directive 5MLD was transposed into UK law on 10 January 2020.

Source: camsafroza.com

Source: camsafroza.com

5th Money Laundering Directive and Trust Registration Service Ian Smart 11 August 2020 On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. The sources of the cash in actual are legal and the money is invested in a approach that makes it appear to be. A technical consultation Fifth Money Laundering Directive and Trust Registration Service. Fifth Anti Money Laundering Directive Trusts August 08 2021 The concept of money laundering is essential to be understood for those working in the monetary sector. The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition.

The 4 th Anti-Money Laundering Directive 4 th AMLD imposed a number of obligations on trustees including the necessity to keep records on beneficial ownership and to register with the Trust Registration Service TRS if the trust had a tax consequence. Following the implementation of the Fourth Money Laundering Directive 4MLD TRS was created and is used to register taxpaying trusts and estates. This captured all UK trusts that are not considered dormant as well as non-UK trusts with a UK tax liability. The consultation outlined how the government intended to implement changes to the Trust Registration. The Fourth EU Money Laundering Directive 4MLD was the reason that HMRC introduced the Trust Registration Service which broadly requires all trusts with tax liabilities to register with HMRC.

Source: willwriters.com

Source: willwriters.com

It will also apply to non-EU resident trusts which own UK land or property or which have. 5MLD removes this link with taxation widening the definition of those trusts required to register and changing the registration deadline requirements. THE FIFTH EU ANTI-MONEY LAUNDERING DIRECTIVE THE NEW TRUST REGISTRATION REQUIREMENT AND WHAT IT MEANS FOR BUSINESS The new EU Anti-Money Laundering Directive AMLD51 will require trustees of express trusts to register information on the beneficial ownership of the trust in a central national register. Fifth Anti Money Laundering Directive Trusts August 08 2021 The concept of money laundering is essential to be understood for those working in the monetary sector. This document summarises the responses received to the consultation seeking views on the expansion of the Trust Registration Service as required to transpose the Fifth Money Laundering.

Source: fineksus.com

Source: fineksus.com

The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. 5MLD removes this link with taxation widening the definition of those trusts required to register and changing the registration deadline requirements. This captured all UK trusts that are not considered dormant as well as non-UK trusts with a UK tax liability. The sources of the cash in actual are legal and the money is invested in a approach that makes it appear to be. The regulations did not cover trust registration.

Source: wilberforce.co.uk

Source: wilberforce.co.uk

The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. The sources of the cash in actual are legal and the money is invested in a approach that makes it appear to be. Fifth Anti Money Laundering Directive Trusts August 08 2021 The concept of money laundering is essential to be understood for those working in the monetary sector. The Directive affects all UK express trusts and many non-UK express trusts and extends the reach of the 4th Money Laundering Directive 4MLD which. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law.

Source: pearse-trust.ie

Source: pearse-trust.ie

The consultation outlined how the government intended to implement changes to the Trust Registration. The new Directive will bring into its scope all UK express trusts not just those with UK tax implications. The consultation outlined how the government intended to implement changes to the Trust Registration. It will also apply to non-EU resident trusts which own UK land or property or which have. Read our response to the original consultation.

Source: taxjustice.net

Source: taxjustice.net

The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. The new Directive will bring into its scope all UK express trusts not just those with UK tax implications. The Directive affects all UK express trusts and many non-UK express trusts and extends the reach of the 4th Money Laundering Directive 4MLD which. The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fifth money laundering directive trusts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information