13+ Fincen travel rule requirements info

Home » money laundering idea » 13+ Fincen travel rule requirements infoYour Fincen travel rule requirements images are ready. Fincen travel rule requirements are a topic that is being searched for and liked by netizens now. You can Get the Fincen travel rule requirements files here. Find and Download all royalty-free photos and vectors.

If you’re looking for fincen travel rule requirements pictures information connected with to the fincen travel rule requirements interest, you have visit the right blog. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Fincen Travel Rule Requirements. However the provisions of 31 CFR. What are the Travel rules requirements. The account number of the transmittor if used. For a discussion of the concept of business model as used within this guidance.

What Is The Fincen Travel Rule Compliance Best Practices From tier1fin.com

What Is The Fincen Travel Rule Compliance Best Practices From tier1fin.com

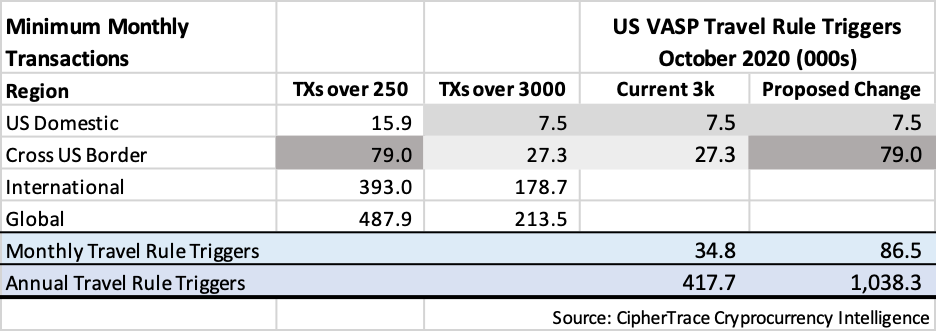

The address of the transmittor. It requires covered financial institutions to establish and maintain written policies and procedures that are reasonably designed to. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international transfers of 250 or more. The name of the transmittor. The FATF Travel Rule Recommendation 16 obligates member countries virtual asset service providers VASPs financial institutions and obliged entities to share beneficiary and originator information with counterparties during transmittals above 1000. In October 2020 FinCEN released a proposed rule change lowering the threshold for travel rule information sharing and retention from 3000 to 250 for all cross-border payments involving US financial institutions.

Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution.

Identify and verify the identity of the beneficial owners of companies opening accounts. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. The amount of the transmittal order. In October 2020 FinCEN released a proposed rule change lowering the threshold for travel rule information sharing and retention from 3000 to 250 for all cross-border payments involving US financial institutions. Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter. This rule became effective May 28 1996 and was issued by the Treasury Departments Financial Crimes Enforcement Network FinCEN.

Source: nafcu.org

The Travel Rule was promoted by FinCEN in keeping with their mandate to enforce the Bank Secrecy Act. Identify and verify the identity of the beneficial owners of companies opening accounts. A Bank Secrecy Act BSA rule 31 CFR 10333goften called theTravel rulerequires all financial institutions to pass on certain informationto the next financial institution in certain funds transmittals involving morethan one financial institution. Travel Rule Requirements Global anti-money laundering watchdog the Financial Action Task Force FATF has modified their Travel Rule guidance R. The Travel Rule was promoted by FinCEN in keeping with their mandate to enforce the Bank Secrecy Act.

Source: sygna.io

From the basics of what types of transactions fall under the Rule to mandatory versus optional data requirements to all the various exceptions plus the many nuances addressed by subsequent guidance not contained in the Rule. All transmittors financial institutions must include and send the following in the transmittal order. The Travel Rule requires that when transmitting funds worth 3000 or more FinCEN-regulated businesses must provide the recipient institution with information about the identities of those sending and receiving the funds. The Travel Rule was promoted by FinCEN in keeping with their mandate to enforce the Bank Secrecy Act. Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter.

Source: tier1fin.com

Source: tier1fin.com

From the basics of what types of transactions fall under the Rule to mandatory versus optional data requirements to all the various exceptions plus the many nuances addressed by subsequent guidance not contained in the Rule. The proposed rule lowers the applicable threshold from 3000 to. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. The account number of the transmittor if used. The Travel Rule requires that when transmitting funds worth 3000 or more FinCEN-regulated businesses must provide the recipient institution with information about the identities of those sending and receiving the funds.

Source: pinterest.com

Source: pinterest.com

Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. In October 2020 FinCEN released a proposed rule change lowering the threshold for travel rule information sharing and retention from 3000 to 250 for all cross-border payments involving US financial institutions. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more. The address of the transmittor. A Bank Secrecy Act BSA rule 31 CFR 10333goften called theTravel rulerequires all financial institutions to pass on certain informationto the next financial institution in certain funds transmittals involving morethan one financial institution.

Source: tier1fin.com

Source: tier1fin.com

FINCEN GUIDANCE 1 The Financial Crimes Enforcement Network FinCEN is issuing this interpretive guidance to remind persons subject to the Bank Secrecy Act BSA how FinCEN regulations relating to money services businesses MSBs apply to certain business models. What are the Travel rules requirements. All transmittors financial institutions must include and send the following in the transmittal order. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more. The identity of the transmittors financial institution.

Source: pinterest.com

Source: pinterest.com

All transmittors financial institutions must include and send the following in the transmittal order. Identify and verify the identity of the beneficial owners of companies opening accounts. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. The name of the transmittor. The FATF Travel Rule Recommendation 16 obligates member countries virtual asset service providers VASPs financial institutions and obliged entities to share beneficiary and originator information with counterparties during transmittals above 1000.

Source: kyc-chain.com

Source: kyc-chain.com

Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international transfers of 250 or more. However the provisions of 31 CFR. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. In October 2020 FinCEN released a proposed rule change lowering the threshold for travel rule information sharing and retention from 3000 to 250 for all cross-border payments involving US financial institutions. Identify and verify the identity of the beneficial owners of companies opening accounts.

Source: tier1fin.com

Source: tier1fin.com

This rule became effective May 28 1996 and was issued by the Treasury Departments Financial Crimes Enforcement Network FinCEN. The name of the transmittor. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international. The address of the transmittor. However the provisions of 31 CFR.

Source: ciphertrace.com

Source: ciphertrace.com

16 to help mitigate money laundering and terrorist financing risks associated with virtual asset activities. The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. Travel Rule Requirements Global anti-money laundering watchdog the Financial Action Task Force FATF has modified their Travel Rule guidance R. The CDD Rule has four core requirements. Identify and verify the identity of the beneficial owners of companies opening accounts.

Source: ciphertrace.com

Source: ciphertrace.com

Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter. The CDD Rule has four core requirements. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more. The amount of the transmittal order. What are the Travel rules requirements.

Source: ciphertrace.com

Source: ciphertrace.com

The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. The amount of the transmittal order. The FATF Travel Rule Recommendation 16 obligates member countries virtual asset service providers VASPs financial institutions and obliged entities to share beneficiary and originator information with counterparties during transmittals above 1000. The Travel Rule was promoted by FinCEN in keeping with their mandate to enforce the Bank Secrecy Act. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000.

Source: slideshare.net

Source: slideshare.net

What are the Travel rules requirements. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. What are the Travel rules requirements.

Source: tier1fin.com

Source: tier1fin.com

The FATF Travel Rule Recommendation 16 obligates member countries virtual asset service providers VASPs financial institutions and obliged entities to share beneficiary and originator information with counterparties during transmittals above 1000. 16 to help mitigate money laundering and terrorist financing risks associated with virtual asset activities. For a discussion of the concept of business model as used within this guidance. The name of the transmittor. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fincen travel rule requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information