17+ Fourth money laundering directive eu information

Home » money laundering idea » 17+ Fourth money laundering directive eu informationYour Fourth money laundering directive eu images are ready in this website. Fourth money laundering directive eu are a topic that is being searched for and liked by netizens now. You can Get the Fourth money laundering directive eu files here. Find and Download all royalty-free images.

If you’re looking for fourth money laundering directive eu images information linked to the fourth money laundering directive eu topic, you have visit the ideal site. Our site frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

Fourth Money Laundering Directive Eu. The Member States had to transpose this Directive by 10 January 2020. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC.

4th Eu Money Laundering Directive A Practical Guide From Actico From actico.com

4th Eu Money Laundering Directive A Practical Guide From Actico From actico.com

The Member States had to transpose this Directive by 10 January 2020. The challenge for this framework is to keep pace with technological innovation in financial services. The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. It will replace the Third Money Laundering Directive. 05 October 2020 last update on. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector.

Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector.

05 October 2020 last update on. What is the Fourth Anti-Money Laundering Directive 4AMLD. The European Union Fourth Money Laundering Directive 4AMLD was ratified by the European Parliament in 2015 and was implemented in all EU states on the 26th June 2017. 05 October 2020 last update on. Financial Stability Financial Services and Capital Markets Union. The 4th EU Money Laundering Directive Key Requirements Money laundering is an issue that allows corrupt individuals to legitimise their illegal activities.

Source: bankinghub.eu

Source: bankinghub.eu

On 26 June 2015 the 4th Anti-Money Laundering Directive EU No. The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and. What is 4th AML Directive and how it affect my company organization. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing.

Source: coe.int

Source: coe.int

The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p. The Fourth AML Directive is a legislation passed by the European Union and ratified by the European Parliament in 2015.

Source: actico.com

Source: actico.com

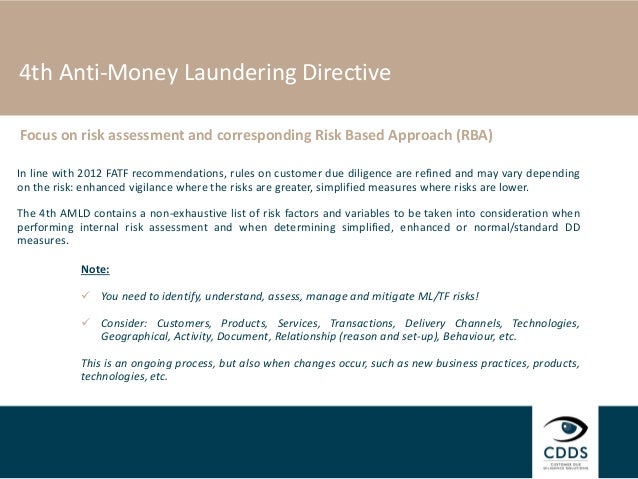

It will replace the Third Money Laundering Directive. The Fourth Anti Money Laundering Directive 4AMLD implemented the new recommendation by Financial Action Task Force 2012 FATF and revised the terms of the treaty once more to remove any ambiguities and improve consistency of AML and CTF. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. The challenge for this framework is to keep pace with technological innovation in financial services.

Source: bankinghub.eu

Source: bankinghub.eu

Banking and financial services. Financial crime is composed of Directive EU 2015849 the Fourth Anti-Money-Laundering Directive and Regulation EU 2015847 on information accompanying transfers of funds. The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and.

Source: actico.com

Source: actico.com

The European Union Fourth Money Laundering Directive 4AMLD was ratified by the European Parliament in 2015 and was implemented in all EU states on the 26th June 2017. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. This issue occurs consistently in the worlds most prestigious institutions perpetrated by the worlds most prestigious individuals. Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and.

Source:

Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. 05 October 2020 last update on. The purpose of the directive is to remove any ambiguities in the previous legislation and improve consistency of anti-money laundering AML and counter terrorist financing CTF rules across all EU. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. 5 May 2021 Author.

Source: slideshare.net

Source: slideshare.net

The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector. EU Member States have to implement the 4th AMLD by 26 June 2017 into national law. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. What is the Fourth Anti-Money Laundering Directive 4AMLD.

Source: ec.europa.eu

Source: ec.europa.eu

The 4th EU Money Laundering Directive Key Requirements Money laundering is an issue that allows corrupt individuals to legitimise their illegal activities. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. 5 May 2021 Author. Hopes lie in the implementation of the Fourth Money Laundering Directive MLD4 in 2017. This Directive is the fourth directive to address the threat of money laundering.

Source: slideshare.net

Source: slideshare.net

On June 26th the MLD4 came into force. 3 This Directive is the four th directive to address the threat of money launder ing. On 26 June 2015 the 4th Anti-Money Laundering Directive EU No. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU Text with EEA relevance PE722017REV1. In the wake of financial crises scandals and massive tax evasion the EU took its fight against Money Laundering to the next level.

Source: camsafroza.com

Source: camsafroza.com

The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. This Directive is the fourth directive to address the threat of money laundering. Financial crime is composed of Directive EU 2015849 the Fourth Anti-Money-Laundering Directive and Regulation EU 2015847 on information accompanying transfers of funds. This issue occurs consistently in the worlds most prestigious institutions perpetrated by the worlds most prestigious individuals. Financial Stability Financial Services and Capital Markets Union.

Source: shuftipro.com

Source: shuftipro.com

Banking and financial services. 5 May 2021 Author. Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. The European Union Fourth Money Laundering Directive 4AMLD was ratified by the European Parliament in 2015 and was implemented in all EU states on the 26th June 2017.

Source: bankinghub.eu

Source: bankinghub.eu

It carried out a number of modifications to the Third EU AML Directive. This issue occurs consistently in the worlds most prestigious institutions perpetrated by the worlds most prestigious individuals. 2015849 4th AMLD entered into force. Financial Stability Financial Services and Capital Markets Union. What is 4th AML Directive and how it affect my company organization.

Source: coe.int

Source: coe.int

It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. It was transposed into UK law on the same date via the The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. It carried out a number of modifications to the Third EU AML Directive. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. Hopes lie in the implementation of the Fourth Money Laundering Directive MLD4 in 2017.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fourth money laundering directive eu by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information