15++ Funds transfer recordkeeping and travel rule ideas in 2021

Home » money laundering idea » 15++ Funds transfer recordkeeping and travel rule ideas in 2021Your Funds transfer recordkeeping and travel rule images are available in this site. Funds transfer recordkeeping and travel rule are a topic that is being searched for and liked by netizens now. You can Download the Funds transfer recordkeeping and travel rule files here. Find and Download all royalty-free photos.

If you’re searching for funds transfer recordkeeping and travel rule pictures information related to the funds transfer recordkeeping and travel rule topic, you have visit the ideal blog. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

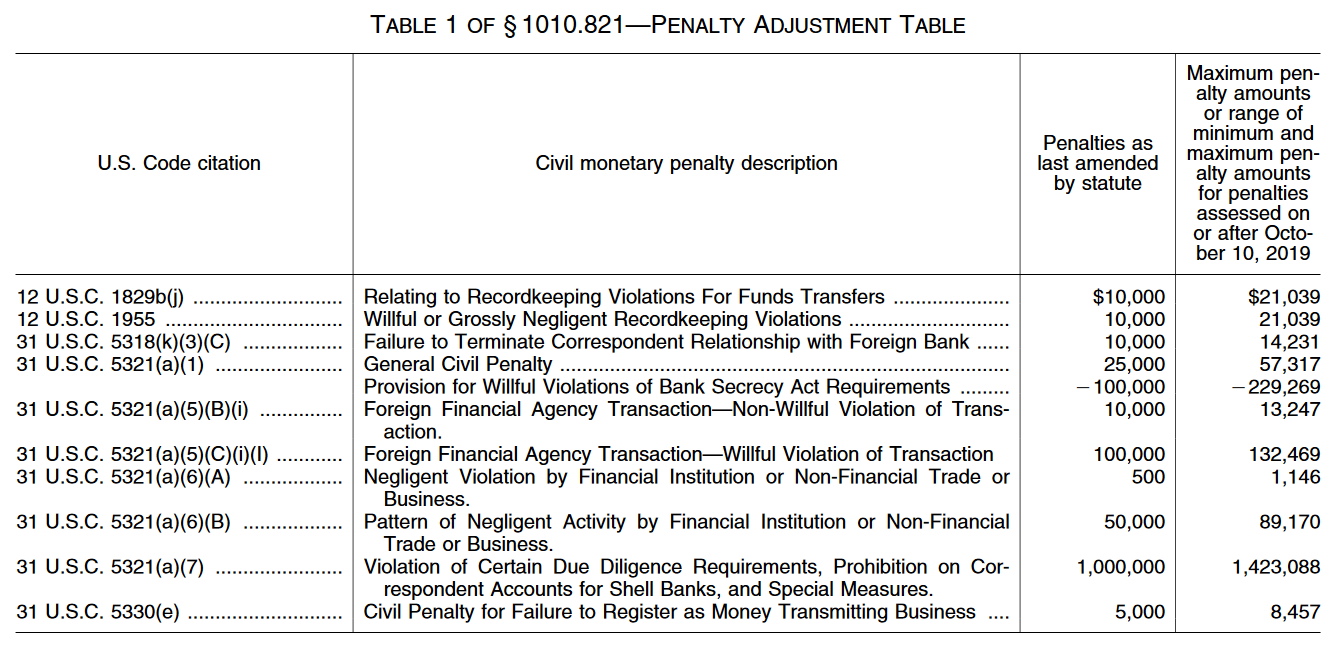

Funds Transfer Recordkeeping And Travel Rule. The recordkeeping rule and the travel rule apply to transmittals of funds and funds transfers. The Treasury and not the Board is authorized to issue regulations requiring. I For each payment order that it accepts as an originators. Financial institutions are also required to verify the identity of the person making or receiving a funds.

Https Www Un Org Ipsas Corporate 20guidance Corporate Guidance Funding Arrangements Pdf From

The Travel rule should be examined in concert with the TreasuryÕs related recordkeeping rule concerning the transmittal of funds. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000. Are all transmittals of funds subject to this rule.

Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000.

Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over. The Treasury and not the Board is authorized to issue regulations requiring.

Source: pikpng.com

Source: pikpng.com

I For each payment order that it accepts as an originators. 1 The travel rule codified at 31 CFR 1010410f requires financial institutions conducting funds transferstransmittals to include certain information on the originator and recipient. Financial institutions are also required to verify the identity of the person making or receiving a funds. A Each agent agency branch or office located within the United States of a bank is subject to the requirements of this paragraph a with respect to a funds transfer in the amount of 3000 or more and is required to retain either the original or a copy or reproduction of each of the following. A transmittal of funds is defined as a series of transactions beginning with the transmittors transmittal order made for the purpose of making payment to the recipient of the order 31 CFR 1010100ddd.

Source: elibrary.imf.org

Source: elibrary.imf.org

The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank.

Source: nafcu.org

Source: nafcu.org

At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. The Joint Rule requires additional record keeping related to certain funds transmittals and transfers by brokerdealers and other financial institutions. 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. This requirement is commonly referred to as the Travel Rule 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers.

Source:

The Joint Rule requires additional record keeping related to certain funds transmittals and transfers by brokerdealers and other financial institutions. I For each payment order that it accepts as an originators. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. This requirement is commonly referred to as the Travel Rule 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. Financial institutions are also required to verify the identity of the person making or receiving a funds.

Source: elibrary.imf.org

Source: elibrary.imf.org

Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over. At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. Iv Generally speaking these rules apply when two money service businesses MSBs or other financial institutions covered by the rules transfer 3000 or more in funds including virtual currencies on behalf of a client. Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000.

Source: elibrary.imf.org

Source: elibrary.imf.org

The threshold for domestic transactions remains unchanged at 3000. 1 The travel rule codified at 31 CFR 1010410f requires financial institutions conducting funds transferstransmittals to include certain information on the originator and recipient. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000. The Treasury and not the Board is authorized to issue regulations requiring.

Source: elibrary.imf.org

Source: elibrary.imf.org

Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. The Travel rule should be examined in concert with the TreasuryÕs related recordkeeping rule concerning the transmittal of funds. Travel Rule Complete Beneficiaries Addresses. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000.

Source: id.pinterest.com

Source: id.pinterest.com

Is there a change as of May 31 2003 that I missed. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. The term includes any transmittal order. The Joint Rule requires additional record keeping related to certain funds transmittals and transfers by brokerdealers and other financial institutions. 1 The travel rule codified at 31 CFR 1010410f requires financial institutions conducting funds transferstransmittals to include certain information on the originator and recipient.

Source: pinterest.com

Source: pinterest.com

Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. The recordkeeping rule and the travel rule apply to transmittals of funds and funds transfers. 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. We have received a letter from the Home Loan Bankwhich states in order to comply with Travel Rule as of May 312003 the required information regarding beneficiaries of funds transfers needs to include complete addresses. Are all transmittals of funds subject to this rule.

Source: elibrary.imf.org

Source: elibrary.imf.org

1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. Financial institutions are also required to verify the identity of the person making or receiving a funds. The Joint Rule requires additional record keeping related to certain funds transmittals and transfers by brokerdealers and other financial institutions. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. A Each agent agency branch or office located within the United States of a bank is subject to the requirements of this paragraph a with respect to a funds transfer in the amount of 3000 or more and is required to retain either the original or a copy or reproduction of each of the following.

Source: elibrary.imf.org

Source: elibrary.imf.org

Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. The Travel rule should be examined in concert with the TreasuryÕs related recordkeeping rule concerning the transmittal of funds. Is there a change as of May 31 2003 that I missed. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank.

Source: elibrary.imf.org

Source: elibrary.imf.org

The Treasury and not the Board is authorized to issue regulations requiring. Financial institutions are also required to verify the identity of the person making or receiving a funds. I For each payment order that it accepts as an originators. The Treasury and not the Board is authorized to issue regulations requiring. The threshold for domestic transactions remains unchanged at 3000.

Source: elibrary.imf.org

Source: elibrary.imf.org

The Treasury and not the Board is authorized to issue regulations requiring. The term includes any transmittal order. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. Travel Rule Complete Beneficiaries Addresses.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title funds transfer recordkeeping and travel rule by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information