13++ Greatest risk of money laundering ideas

Home » money laundering Info » 13++ Greatest risk of money laundering ideasYour Greatest risk of money laundering images are available. Greatest risk of money laundering are a topic that is being searched for and liked by netizens today. You can Download the Greatest risk of money laundering files here. Get all royalty-free photos and vectors.

If you’re looking for greatest risk of money laundering images information linked to the greatest risk of money laundering topic, you have visit the right blog. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

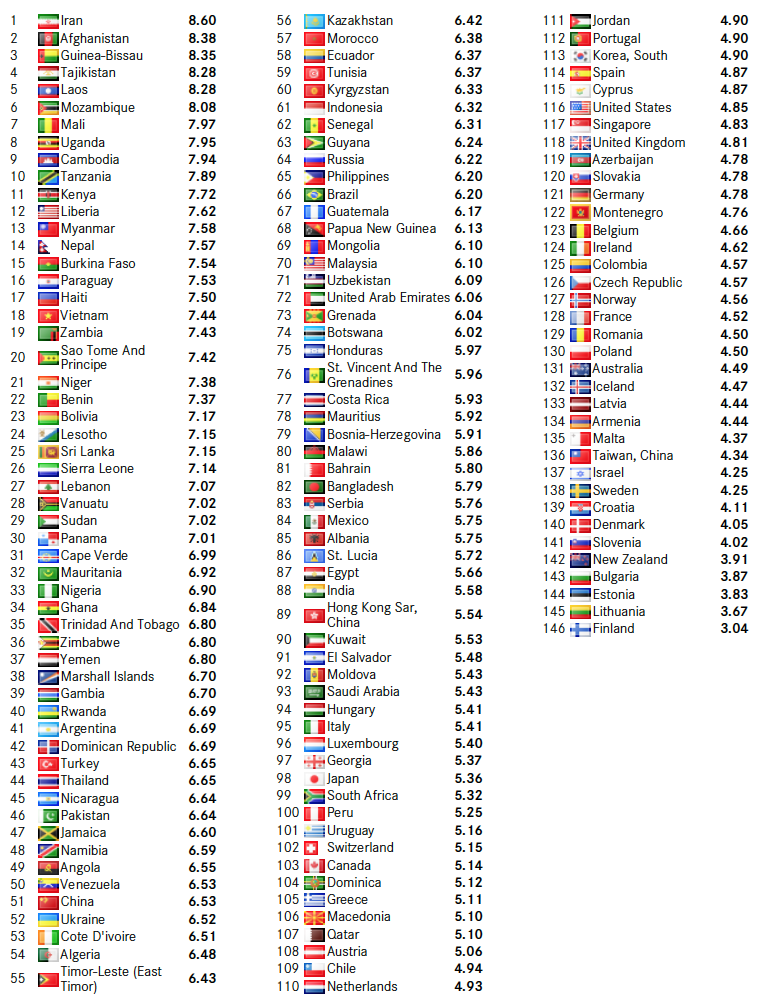

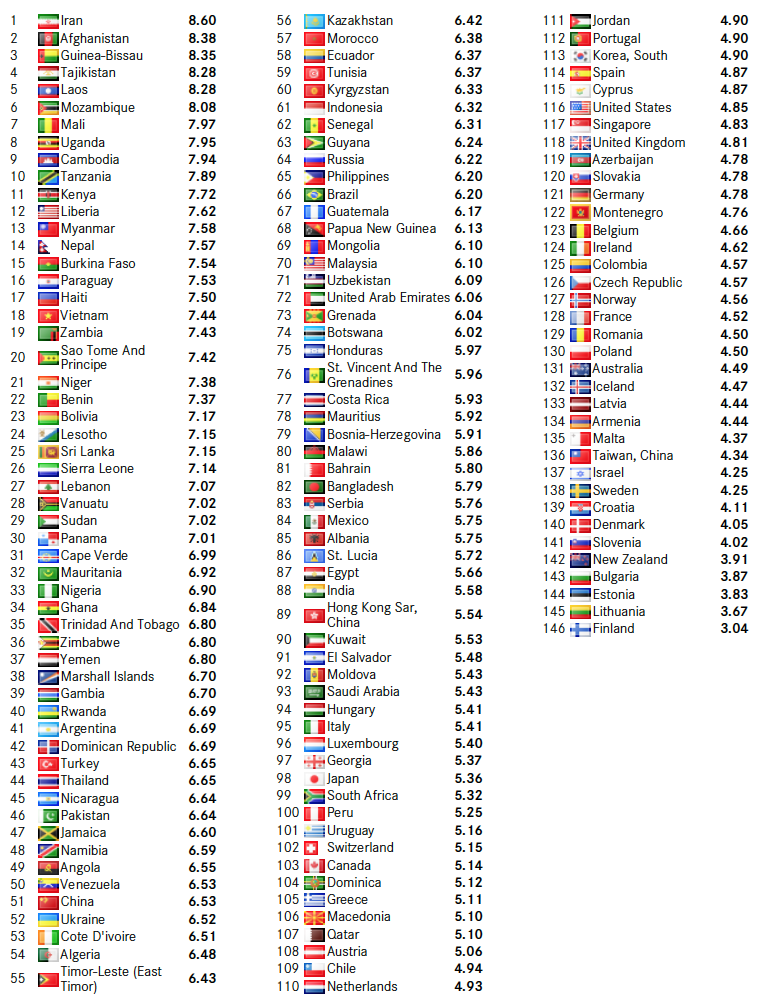

Greatest Risk Of Money Laundering. To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. Understanding risk within the Recommendation 12 context is important for two reasons. From its findings researchers stated that the impact of money laundering is more pronounced where a powerful CEO is present and is only partly reduced by the presence of a large independent executive board. These products allow individuals to deposit large amounts of money into the financial system available for.

Global Money Laundering Risk Index Rises With Iran Rated Worst And Finland Least Risky Ctmfile From ctmfile.com

Global Money Laundering Risk Index Rises With Iran Rated Worst And Finland Least Risky Ctmfile From ctmfile.com

Understanding risk within the Recommendation 12 context is important for two reasons. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. The United Kingdoms banking and professional services are still the greatest sectors of money laundering risk in the country two years after a government study highlighted their key role in facilitating financial crime. Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. 1 products and services 2 customers and entities and 3 geographic location.

What is money laundering risk assessment.

Understanding risk within the Recommendation 12 context is important for two reasons. As a result of global anti-money laundering and counter-terrorism financing measures within the banking finance and real estate sectors money laundering has. Placement in which the money is. A risk-based approach to anti-money laundering facilitates a proactive approach designed to identify and assess relevant risks and justify the investment and deployment of the appropriate countermeasuresThe concept first appeared in the Financial Services Authority. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. Financial institutions face the challenge of addressing the threat of money laundering on multiple fronts.

Source: financierworldwide.com

Source: financierworldwide.com

HM Treasury maintains lists of financial sanctions imposed in the UK by country administration or terrorist group. These products allow individuals to deposit large amounts of money into the financial system available for. That may include freezing an account a review of the customers identity and overall activity profile and. Financial institutions face the challenge of addressing the threat of money laundering on multiple fronts. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Source: ctmfile.com

Source: ctmfile.com

The studys results showed that money laundering enforcement was associated with an increase in bank risk. HM Treasury maintains lists of financial sanctions imposed in the UK by country administration or terrorist group. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. 1 products and services 2 customers and entities and 3 geographic location. Inherent BSAAML risk falls into three main categories.

Source: financierworldwide.com

Source: financierworldwide.com

As a result of global anti-money laundering and counter-terrorism financing measures within the banking finance and real estate sectors money laundering has. To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. These products allow individuals to deposit large amounts of money into the financial system available for. Understanding risk within the Recommendation 12 context is important for two reasons. The United Kingdoms banking and professional services are still the greatest sectors of money laundering risk in the country two years after a government study highlighted their key role in facilitating financial crime.

As a result of global anti-money laundering and counter-terrorism financing measures within the banking finance and real estate sectors money laundering has. The challenge is even greater for complex institutions that operate across several lines of business IT systems and business cultures. On Thursday the UK published a new national risk assessment NRA on money laundering and terrorism financing which outlined progress made on recommendations in. The most significant money laundering and terrorist financing risks in the insurance industry are found in life insurance and annuity products. The studys results showed that money laundering enforcement was associated with an increase in bank risk.

Source: piranirisk.com

Source: piranirisk.com

Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. The United Kingdoms banking and professional services are still the greatest sectors of money laundering risk in the country two years after a government study highlighted their key role in facilitating financial crime. Understanding risk within the Recommendation 12 context is important for two reasons. With regulators adopting stricter norms on financial transactions and increasing their enforcement efforts institutions are facing increased complexity on customer. What are the 3 main factors to consider in determining AML risk.

Source: actec.org

Source: actec.org

The United Kingdoms banking and professional services are still the greatest sectors of money laundering risk in the country two years after a government study highlighted their key role in facilitating financial crime. 1 products and services 2 customers and entities and 3 geographic location. On Thursday the UK published a new national risk assessment NRA on money laundering and terrorism financing which outlined progress made on recommendations in. With regulators adopting stricter norms on financial transactions and increasing their enforcement efforts institutions are facing increased complexity on customer. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Source: slideplayer.com

Source: slideplayer.com

First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Once a customer or suspicious activity has been flagged the bank should take additional steps to mitigate the risk of the bank being used for criminal activity. 1 products and services 2 customers and entities and 3 geographic location. As a result of global anti-money laundering and counter-terrorism financing measures within the banking finance and real estate sectors money laundering has. The most significant money laundering and terrorist financing risks in the insurance industry are found in life insurance and annuity products.

Source: researchgate.net

Source: researchgate.net

As a result of global anti-money laundering and counter-terrorism financing measures within the banking finance and real estate sectors money laundering has. That may include freezing an account a review of the customers identity and overall activity profile and. These products allow individuals to deposit large amounts of money into the financial system available for. The most significant money laundering and terrorist financing risks in the insurance industry are found in life insurance and annuity products. What are the 3 main factors to consider in determining AML risk.

Source: semanticscholar.org

Source: semanticscholar.org

A risk-based approach to anti-money laundering facilitates a proactive approach designed to identify and assess relevant risks and justify the investment and deployment of the appropriate countermeasuresThe concept first appeared in the Financial Services Authority. With regulators adopting stricter norms on financial transactions and increasing their enforcement efforts institutions are facing increased complexity on customer. The most significant money laundering and terrorist financing risks in the insurance industry are found in life insurance and annuity products. HM Treasury maintains lists of financial sanctions imposed in the UK by country administration or terrorist group. The United Kingdoms banking and professional services are still the greatest sectors of money laundering risk in the country two years after a government study highlighted their key role in facilitating financial crime.

Source: intosaijournal.org

Source: intosaijournal.org

That may include freezing an account a review of the customers identity and overall activity profile and. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. What are the 3 main factors to consider in determining AML risk. Inherently high risk for money laundering. Financial institutions face the challenge of addressing the threat of money laundering on multiple fronts.

Source: adgm.com

Source: adgm.com

Once a customer or suspicious activity has been flagged the bank should take additional steps to mitigate the risk of the bank being used for criminal activity. HM Treasury maintains lists of financial sanctions imposed in the UK by country administration or terrorist group. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to. The nature of cash-intensive businesses and the difficulty in identifying unusual activity may cause these businesses to be considered higher risk.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

The United Kingdoms banking and professional services are still the greatest sectors of money laundering risk in the country two years after a government study highlighted their key role in facilitating financial crime. Placement in which the money is. To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products. HM Treasury maintains lists of financial sanctions imposed in the UK by country administration or terrorist group.

Source: elibrary.imf.org

Source: elibrary.imf.org

To combat money laundering or terrorist financing organizations must understand the breadth and depth of the threats they face. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products. What are the 3 main factors to consider in determining AML risk. With regulators adopting stricter norms on financial transactions and increasing their enforcement efforts institutions are facing increased complexity on customer. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title greatest risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas