10++ High risk indicators of money laundering info

Home » money laundering Info » 10++ High risk indicators of money laundering infoYour High risk indicators of money laundering images are available in this site. High risk indicators of money laundering are a topic that is being searched for and liked by netizens today. You can Download the High risk indicators of money laundering files here. Get all free photos.

If you’re looking for high risk indicators of money laundering pictures information related to the high risk indicators of money laundering topic, you have visit the right blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

High Risk Indicators Of Money Laundering. 14 It is worth noting that the following list is not comprehensive and that the indicators may be applicable to other types of exploitation as well eg. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new. According to the NRA money laundering investigations often see the use of trusts and companies as vehicles to hide beneficial ownership. Volume of revenue trade or business premises size knowledge of declaration of systematic losses or gains or with regard to.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering. The size nature and complexity of a business. These indicators should assist our supervisees consideration of Anti-Money Laundering AML risks for your own business and which feed into your firms AML risk assessment. Trade document and commodity risk indicators Risk indicators relating to trade documents and commodities include. Labour exploitation predominantly occurs in nine high-risk business types although these vary considerably by geography and types of exploitation. According to the NRA money laundering investigations often see the use of trusts and companies as vehicles to hide beneficial ownership.

Volume of revenue trade or business premises size knowledge of declaration of systematic losses or gains or with regard to.

The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Volume of revenue trade or business premises size knowledge of declaration of systematic losses or gains or with regard to. International authorities generally apply five primary categories of risk indicator that businesses should assess. The AASG risk outlook provides further guidance and red flag indicators on each of these risk areas. Contracts invoices or other trade documents have inconsistencies do not make commercial sense or have vague descriptions of the traded commodities.

Source: taxguru.in

Source: taxguru.in

Anti-Money Laundering high-risk indicators We have compiled details of areas that may indicate a higher risk of money laundering in insolvency work. According to the NRA money laundering investigations often see the use of trusts and companies as vehicles to hide beneficial ownership. The size nature and complexity of a business. Red flag indicators should always be considered in context. The indicators are derived from a sampling of the data received by the FATF and the Egmont Group of FIUs in the course of the Trade-Based Money Laundering project.

Source: pinterest.com

Source: pinterest.com

High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. Contracts invoices or other trade documents have inconsistencies do not make commercial sense or have vague descriptions of the traded commodities. 14 It is worth noting that the following list is not comprehensive and that the indicators may be applicable to other types of exploitation as well eg. Labour exploitation predominantly occurs in nine high-risk business types although these vary considerably by geography and types of exploitation. It says those service providers who offer for example the replacement of nominee directors or registered offices are most at risk.

Source: ctmfile.com

Source: ctmfile.com

The size nature and complexity of a business. 14 It is worth noting that the following list is not comprehensive and that the indicators may be applicable to other types of exploitation as well eg. According to the NRA money laundering investigations often see the use of trusts and companies as vehicles to hide beneficial ownership. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. The size nature and complexity of a business.

Source: ec.europa.eu

Source: ec.europa.eu

POSSIBLE INDICATORS Transfers of funds between business accounts and personal accounts that are not business related Suspicious withdrawals and deposits of large sums of money into accounts Attorneys trust accounts that receives funds from clients and purchasing high value assets for clients. These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering. There is an excessively high or low price attached to the securities transferred with regard to any circumstance indicating such an excess eg. Anti-Money Laundering high-risk indicators We have compiled details of areas that may indicate a higher risk of money laundering in insolvency work. It says those service providers who offer for example the replacement of nominee directors or registered offices are most at risk.

Source: bi.go.id

Source: bi.go.id

There is an excessively high or low price attached to the securities transferred with regard to any circumstance indicating such an excess eg. The size nature and complexity of a business. Anti-Money Laundering high-risk indicators We have compiled details of areas that may indicate a higher risk of money laundering in insolvency work. It says those service providers who offer for example the replacement of nominee directors or registered offices are most at risk. These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering.

Source: bi.go.id

Source: bi.go.id

High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. There is an excessively high or low price attached to the securities transferred with regard to any circumstance indicating such an excess eg. Contracts invoices or other trade documents have inconsistencies do not make commercial sense or have vague descriptions of the traded commodities. From this regulators can develop a risk-based approach. Which of these businesses are the highest risk for money laundering.

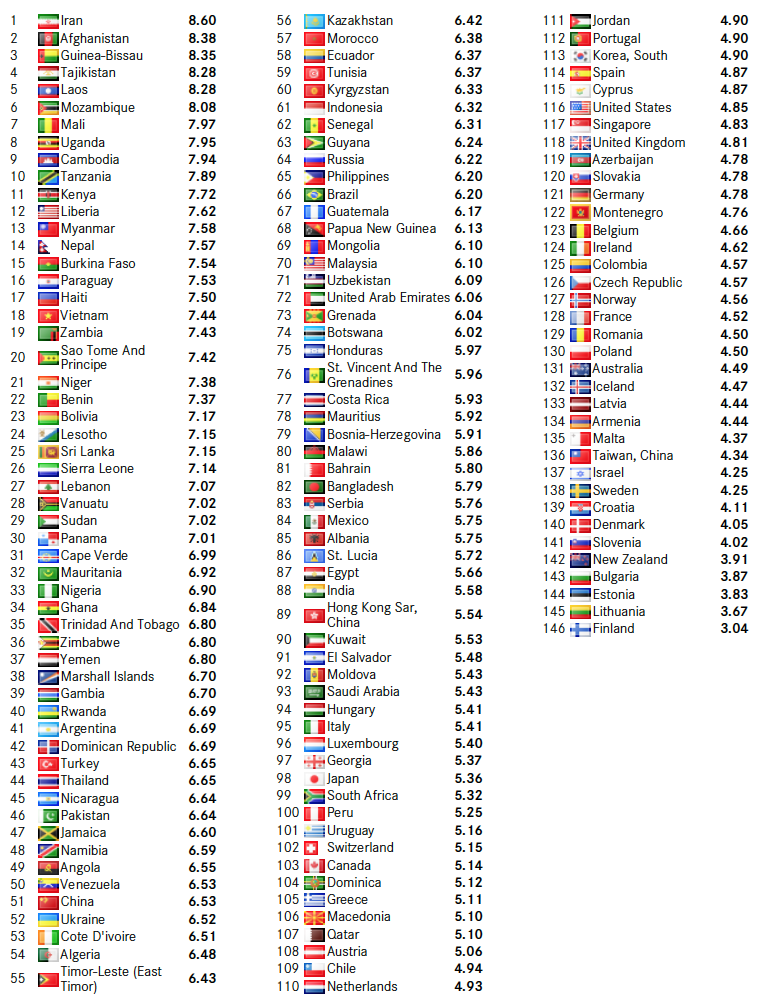

Source: baselgovernance.org

Source: baselgovernance.org

Which of these businesses are the highest risk for money laundering. Sources of wealth and legal entity type to identify suspicious or illegal activity. Which of these businesses are the highest risk for money laundering. The size nature and complexity of a business. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs.

Source: acamstoday.org

Source: acamstoday.org

Money Laundering Risk Indicators. Money Laundering Risk Indicators. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. In addition the NRA states that the risk is highest when accountants do not fully understand the money laundering risks and do not implement appropriate risk-based controls particularly where accountants fail to register with a supervisor.

Source: bi.go.id

Source: bi.go.id

From this regulators can develop a risk-based approach. Volume of revenue trade or business premises size knowledge of declaration of systematic losses or gains or with regard to. From this regulators can develop a risk-based approach. In addition the NRA states that the risk is highest when accountants do not fully understand the money laundering risks and do not implement appropriate risk-based controls particularly where accountants fail to register with a supervisor. These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering.

Source: bi.go.id

Freestanding red flags such as those listed below can be developed or combined with information from operational agencies which can in turn be further. Trade document and commodity risk indicators Risk indicators relating to trade documents and commodities include. According to the NRA money laundering investigations often see the use of trusts and companies as vehicles to hide beneficial ownership. These indicators should assist our supervisees consideration of Anti-Money Laundering AML risks for your own business and which feed into your firms AML risk assessment. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs.

Source: redalyc.org

Source: redalyc.org

Anti-Money Laundering high-risk indicators We have compiled details of areas that may indicate a higher risk of money laundering in insolvency work. Insufficient trade or customs documents supporting transactions. Sources of wealth and legal entity type to identify suspicious or illegal activity. Risks posed by their customers products and operations as well as the presence of conventional risk indicators. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks.

Source: acamstoday.org

Source: acamstoday.org

The type of customer involved eg. International authorities generally apply five primary categories of risk indicator that businesses should assess. The indicators are derived from a sampling of the data received by the FATF and the Egmont Group of FIUs in the course of the Trade-Based Money Laundering project. Anti-Money Laundering high-risk indicators We have compiled details of areas that may indicate a higher risk of money laundering in insolvency work. Contracts invoices or other trade documents have inconsistencies do not make commercial sense or have vague descriptions of the traded commodities.

Source: tbsnews.net

Source: tbsnews.net

These risk indicators are designed to help public and private entities identify suspicious activity associated with trade based money laundering. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Money Laundering Risk Indicators. POSSIBLE INDICATORS Transfers of funds between business accounts and personal accounts that are not business related Suspicious withdrawals and deposits of large sums of money into accounts Attorneys trust accounts that receives funds from clients and purchasing high value assets for clients. The indicators are derived from a sampling of the data received by the FATF and the Egmont Group of FIUs in the course of the Trade-Based Money Laundering project.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high risk indicators of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas