11+ High risk money laundering activities info

Home » money laundering idea » 11+ High risk money laundering activities infoYour High risk money laundering activities images are available. High risk money laundering activities are a topic that is being searched for and liked by netizens now. You can Get the High risk money laundering activities files here. Find and Download all free images.

If you’re looking for high risk money laundering activities pictures information linked to the high risk money laundering activities topic, you have pay a visit to the right site. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

High Risk Money Laundering Activities. In any other situation where there is a higher risk of money laundering. What are considered higher risk customer types for money laundering. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. These requirements have been strengthened by the Fifth Anti-Money Laundering Directive.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

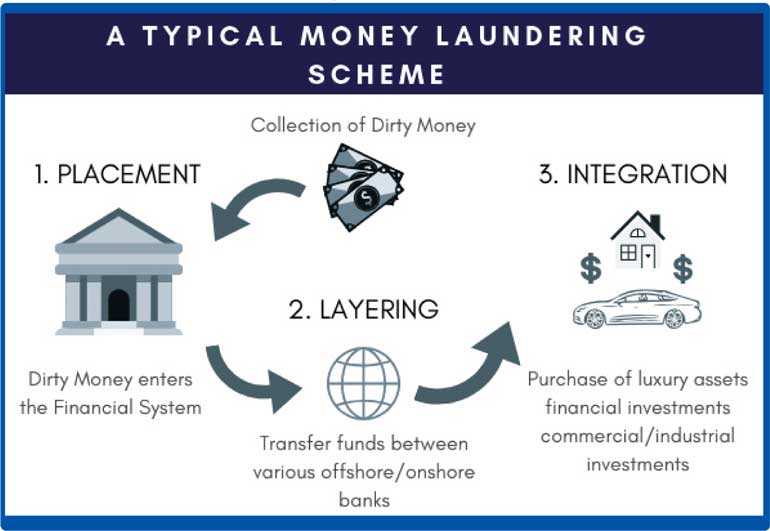

Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. TheFSAfocused in particular on correspondent bankingrelationships wire transfer payments and high-risk customers includingpolitically exposed persons PEPs. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons. In a globalized world with high capital mobility it is essential that together with properly financial and tax controls there are those that ensure the transparency of the origin of funds in order to avoid money laundering financing of terrorist activities proliferation of weapons of mass destruction and the financing of other illicit activities. Footnote 47 The United Nations defines money laundering as any act or attempted act to disguise the source of money or assets derived from criminal activity Essentially money laundering is the process whereby dirty moneyproduced through criminal activityis transformed into clean money the criminal origin of which is difficult to trace.

The involvement of third parties particularly where they are the payor or payee.

In a globalized world with high capital mobility it is essential that together with properly financial and tax controls there are those that ensure the transparency of the origin of funds in order to avoid money laundering financing of terrorist activities proliferation of weapons of mass destruction and the financing of other illicit activities. Home Money Laundering Terrorism Financing Malaysia AMLCFT Regime - International Standards - Regime in Malaysia - - Legal Regulatory Framework - - Preventive Measures - - Financial Law Enforcement - - Domestic International Cooperation National Risks Assessment Sanctions Dealings withHigh-Risk Countries - Terrorism Terrorism Financing. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC. 1212 In June 2011 theFSApublished the findings of its thematic review of howbanks operating in the UK were managing money-laundering risk in higher-risk situations. The movement of assets by a third party can contribute to money laundering so its important to identify the source of funds for each transaction. Understanding risk within the Recommendation 12 context is important for two reasons.

Source: ft.lk

Source: ft.lk

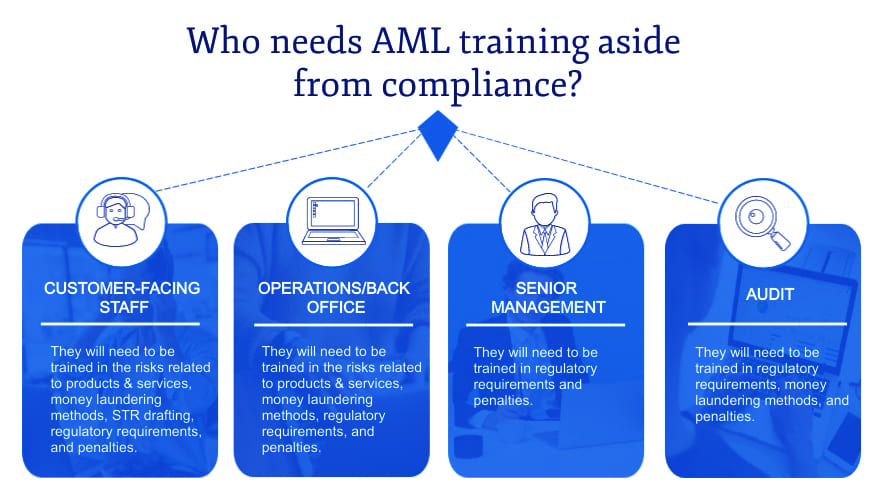

Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers. These requirements have been strengthened by the Fifth Anti-Money Laundering Directive. The criteria included the availability and access to beneficial ownership information existence of effective proportionate and dissuasive sanctions in case of breaches of anti-money laundering and counter terrorist financing obligations as well as third countries practice in cooperation and exchange of. Home Money Laundering Terrorism Financing Malaysia AMLCFT Regime - International Standards - Regime in Malaysia - - Legal Regulatory Framework - - Preventive Measures - - Financial Law Enforcement - - Domestic International Cooperation National Risks Assessment Sanctions Dealings withHigh-Risk Countries - Terrorism Terrorism Financing. TheFSAconducted 35 visits to 27 bankinggroups in the UK that had significant international activity.

Source: bi.go.id

Source: bi.go.id

This section also should include a brief summary of the scope of any offshore sector free trade zones the informal financial sector alternative remittance systems or other prevalent area of concern or. These requirements have been strengthened by the Fifth Anti-Money Laundering Directive. TheFSAconducted 35 visits to 27 bankinggroups in the UK that had significant international activity. The involvement of third parties particularly where they are the payor or payee. In any other situation where there is a higher risk of money laundering.

Source: bi.go.id

Understanding risk within the Recommendation 12 context is important for two reasons. The criteria included the availability and access to beneficial ownership information existence of effective proportionate and dissuasive sanctions in case of breaches of anti-money laundering and counter terrorist financing obligations as well as third countries practice in cooperation and exchange of. Customers involved in potentially higher-risk activities including activities that may be subject to exportimport restrictions eg equipment for military or police organizations of foreign governments weapons ammunition chemical mixtures classified defense articles sensitive technical data nuclear materials precious gems or certain natural resources such as metals ore and crude oil. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. TheFSAconducted 35 visits to 27 bankinggroups in the UK that had significant international activity.

Source: bi.go.id

Source: bi.go.id

1212 In June 2011 theFSApublished the findings of its thematic review of howbanks operating in the UK were managing money-laundering risk in higher-risk situations. These requirements have been strengthened by the Fifth Anti-Money Laundering Directive. Understanding risk within the Recommendation 12 context is important for two reasons. Footnote 47 The United Nations defines money laundering as any act or attempted act to disguise the source of money or assets derived from criminal activity Essentially money laundering is the process whereby dirty moneyproduced through criminal activityis transformed into clean money the criminal origin of which is difficult to trace. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons.

Source: pideeco.be

Source: pideeco.be

Home Money Laundering Terrorism Financing Malaysia AMLCFT Regime - International Standards - Regime in Malaysia - - Legal Regulatory Framework - - Preventive Measures - - Financial Law Enforcement - - Domestic International Cooperation National Risks Assessment Sanctions Dealings withHigh-Risk Countries - Terrorism Terrorism Financing. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. The criteria included the availability and access to beneficial ownership information existence of effective proportionate and dissuasive sanctions in case of breaches of anti-money laundering and counter terrorist financing obligations as well as third countries practice in cooperation and exchange of. Understanding risk within the Recommendation 12 context is important for two reasons. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares.

Source: pinterest.com

Source: pinterest.com

Customers involved in potentially higher-risk activities including activities that may be subject to exportimport restrictions eg equipment for military or police organizations of foreign governments weapons ammunition chemical mixtures classified defense articles sensitive technical data nuclear materials precious gems or certain natural resources such as metals ore and crude oil. In cases where the client has entered into transactions that are complex and unusually large. Understanding risk within the Recommendation 12 context is important for two reasons. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares.

Source: bi.go.id

Source: bi.go.id

The involvement of third parties particularly where they are the payor or payee. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons. Banks are among the largest institutions in the field of finance. Since banks worldwide mediate millions of transactions throughout the day these institutions are at a higher risk of financial crimes. The movement of assets by a third party can contribute to money laundering so its important to identify the source of funds for each transaction.

Source: bi.go.id

Source: bi.go.id

Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Home Money Laundering Terrorism Financing Malaysia AMLCFT Regime - International Standards - Regime in Malaysia - - Legal Regulatory Framework - - Preventive Measures - - Financial Law Enforcement - - Domestic International Cooperation National Risks Assessment Sanctions Dealings withHigh-Risk Countries - Terrorism Terrorism Financing. High-value transactions generally pose a greater risk of money laundering for instance. Inherently high risk for money laundering. And in fact criminal organizations often carry out their money laundering activities through banks and other financial institutions.

Source: ec.europa.eu

Source: ec.europa.eu

Customers The following may suggest a high risk of money laundering or terrorist financing. What are considered higher risk customer types for money laundering. Cash based businesses. TheFSAfocused in particular on correspondent bankingrelationships wire transfer payments and high-risk customers includingpolitically exposed persons PEPs. And in fact criminal organizations often carry out their money laundering activities through banks and other financial institutions.

Source: acamstoday.org

Source: acamstoday.org

Customers The following may suggest a high risk of money laundering or terrorist financing. In cases where the client has provided false or stolen identification documentation or information. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC. In any other situation where there is a higher risk of money laundering. The involvement of third parties particularly where they are the payor or payee.

Source: redalyc.org

Source: redalyc.org

TheFSAconducted 35 visits to 27 bankinggroups in the UK that had significant international activity. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. Customers involved in potentially higher-risk activities including activities that may be subject to exportimport restrictions eg equipment for military or police organizations of foreign governments weapons ammunition chemical mixtures classified defense articles sensitive technical data nuclear materials precious gems or certain natural resources such as metals ore and crude oil. In a globalized world with high capital mobility it is essential that together with properly financial and tax controls there are those that ensure the transparency of the origin of funds in order to avoid money laundering financing of terrorist activities proliferation of weapons of mass destruction and the financing of other illicit activities. Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers.

Source: pinterest.com

Source: pinterest.com

Customers involved in potentially higher-risk activities including activities that may be subject to exportimport restrictions eg equipment for military or police organizations of foreign governments weapons ammunition chemical mixtures classified defense articles sensitive technical data nuclear materials precious gems or certain natural resources such as metals ore and crude oil. In any other situation where there is a higher risk of money laundering. Customers The following may suggest a high risk of money laundering or terrorist financing. And in fact criminal organizations often carry out their money laundering activities through banks and other financial institutions. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC.

Source: pinterest.com

Source: pinterest.com

Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons. Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers. This section also should include a brief summary of the scope of any offshore sector free trade zones the informal financial sector alternative remittance systems or other prevalent area of concern or. TheFSAconducted 35 visits to 27 bankinggroups in the UK that had significant international activity. The criteria included the availability and access to beneficial ownership information existence of effective proportionate and dissuasive sanctions in case of breaches of anti-money laundering and counter terrorist financing obligations as well as third countries practice in cooperation and exchange of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title high risk money laundering activities by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information