13+ High risk money laundering jurisdictions ideas

Home » money laundering Info » 13+ High risk money laundering jurisdictions ideasYour High risk money laundering jurisdictions images are ready. High risk money laundering jurisdictions are a topic that is being searched for and liked by netizens today. You can Download the High risk money laundering jurisdictions files here. Find and Download all royalty-free photos.

If you’re looking for high risk money laundering jurisdictions pictures information connected with to the high risk money laundering jurisdictions interest, you have come to the ideal site. Our site always gives you hints for refferencing the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

High Risk Money Laundering Jurisdictions. Iran As communicated in the statement on high-risk jurisdictions subject to a call for action dated 21 February 2020 the FATF welcomed Irans. High-risk and other monitored jurisdictions. Therefore please refer to the statement on these jurisdictions adopted in February 2020. The Financial Action Task Force FATF also known as the Global Anti-Money Laundering watchdog updates its list of high-risk and other monitored jurisdictions which are considered to have weak AML-CFT regimes.

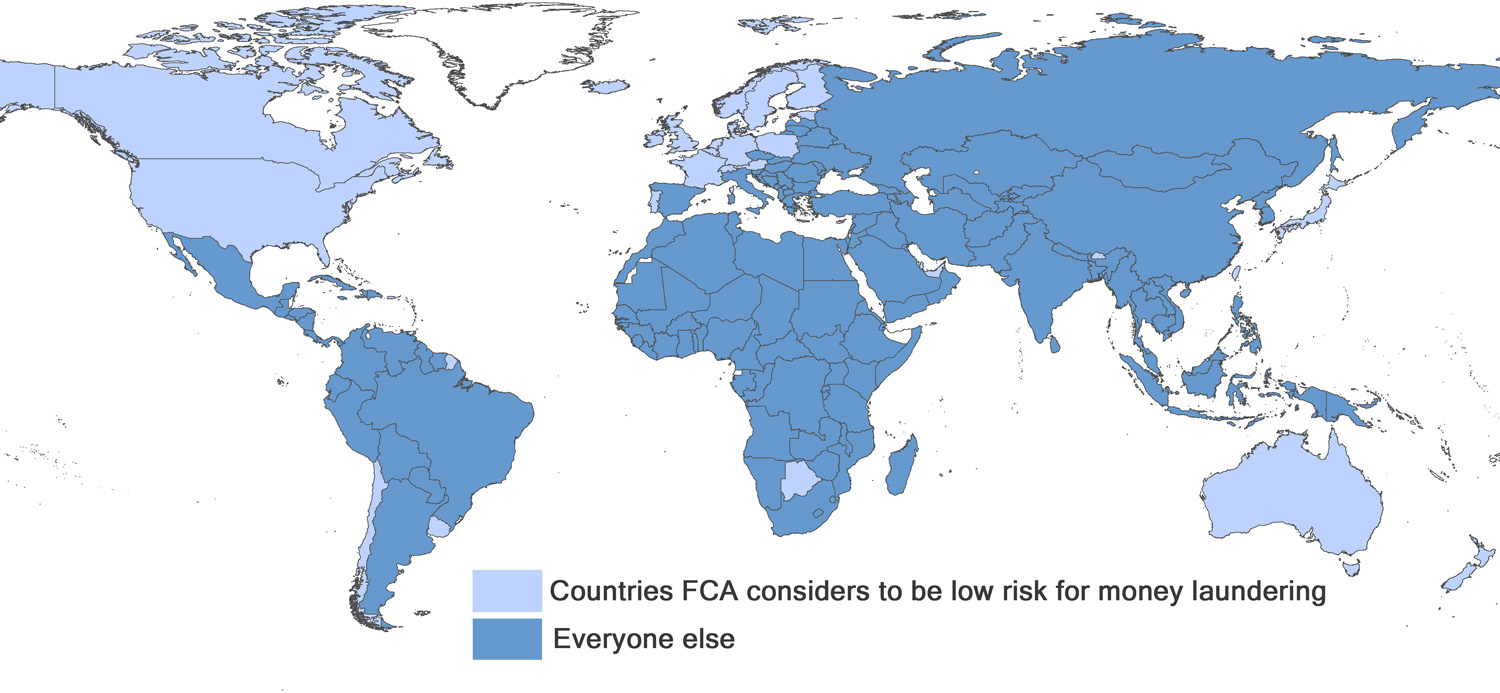

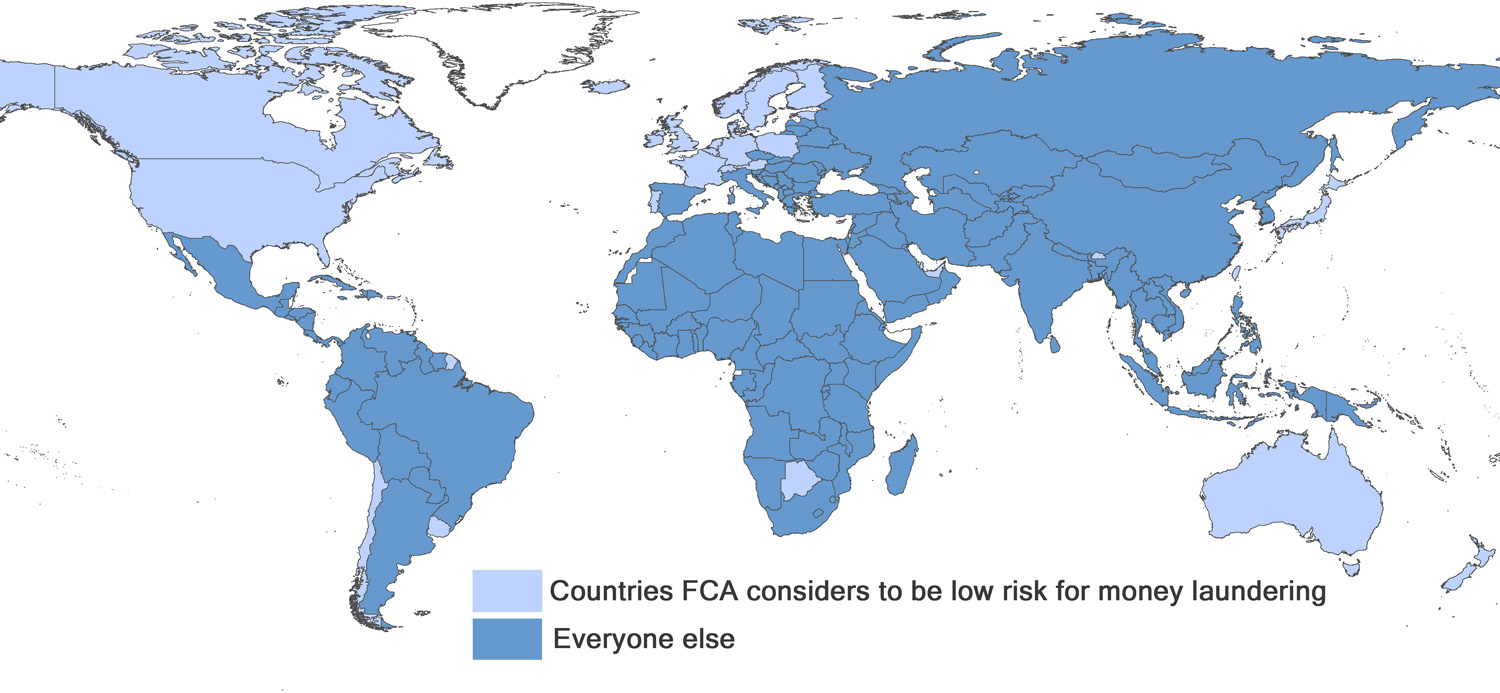

Why Arbitrary Measures Of Money Laundering Risk Are Nonsensical And Unfair Center For Global Development From cgdev.org

Why Arbitrary Measures Of Money Laundering Risk Are Nonsensical And Unfair Center For Global Development From cgdev.org

Kathy Lynn Simmons JP today issued AML-ATF Advisory 22018 about the risks in a number of jurisdictions arising from inadequate systems and controls to combat money laundering. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie. And 2 Jurisdictions with strategic AMLCFT insufficiencies that have not yet made the adequate. The Financial Action Task Force FATF vide public High-Risk document Jurisdictions subject to a Call for Action dated 25 2021 has called on its June members and other jurisdictions to refer to the statement on these jurisdictions adopted in February 2020.

Therefore please refer to the statement on these jurisdictions adopted in February 2020.

What is a High-Risk Jurisdiction. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The sources of the cash in precise are prison and the cash is invested in a way that makes it appear to be clean cash and conceal the identification of the felony part of the money earned. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies. Which jurisdictions does the FATF regard as high risk for money laundering. The Financial Action Task Force FATF is an inter-governmental body established to promote effective anti-money laundering and counter-terrorism financing AMLCFT systems worldwide.

Source: shyamsewag.com

Source: shyamsewag.com

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk. High-risk and other monitored jurisdictions. Iran As communicated in the statement on high-risk jurisdictions subject to a call for action dated 21 February 2020 the FATF welcomed Irans. FATF hadearlier identified the following jurisdictions as having strategic. HM Treasury Advisory Notice.

Source: redalyc.org

Source: redalyc.org

Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies. Therefore please refer to the statement on these jurisdictions adopted in February 2020. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. High-Risk Jurisdictions subject to a Call for Action previously called Public Statement High-risk jurisdictions have significant strategic deficiencies in their regimes to counter money laundering terrorist financing and financing of proliferation.

Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. High-Risk Jurisdictions subject to a Call for Action previously called Public Statement High-risk jurisdictions have significant strategic deficiencies in their regimes to counter money laundering terrorist financing and financing of proliferation. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies.

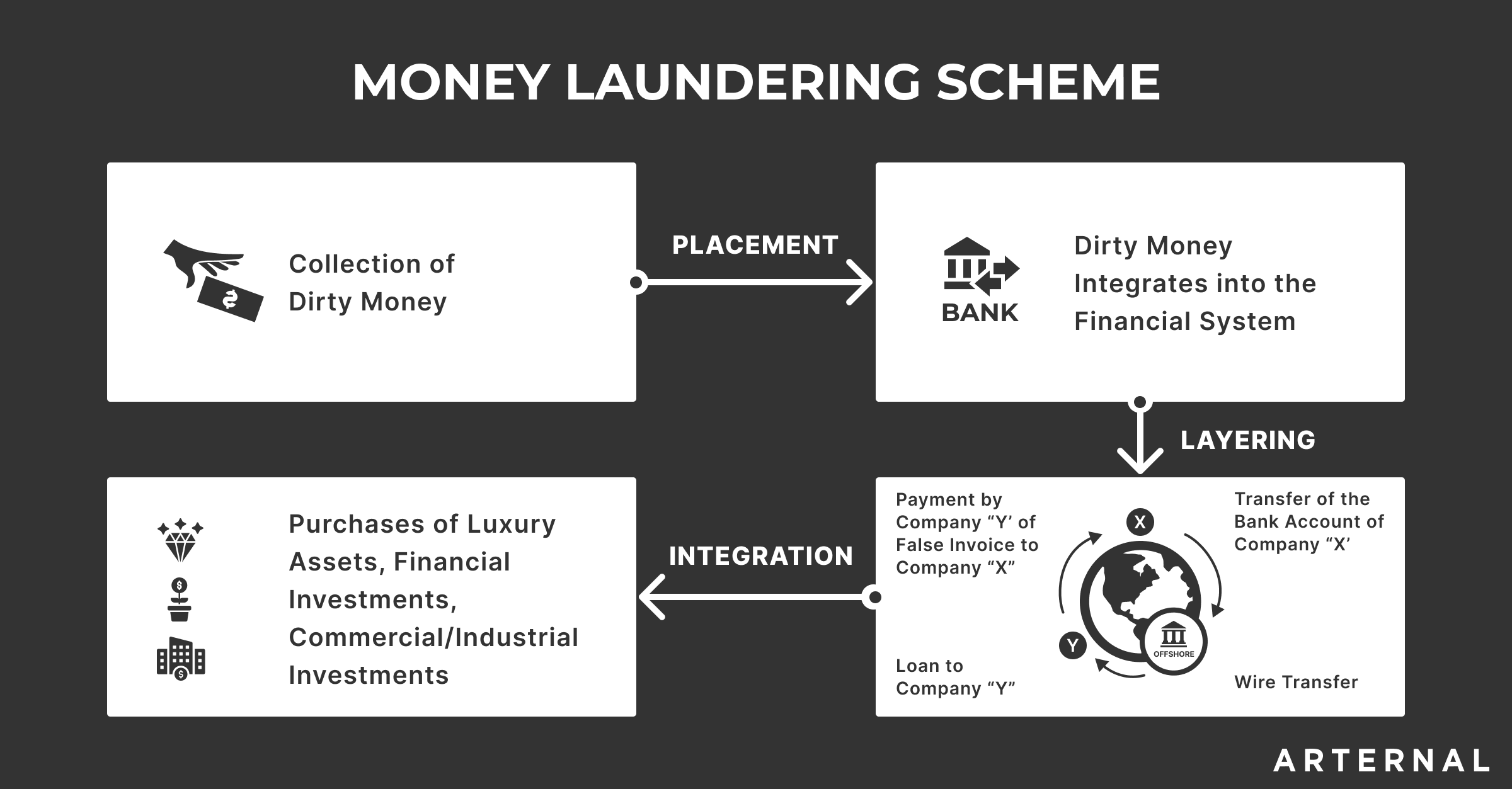

Its a process by which soiled money is converted into clear cash. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs. High-risk and non-cooperative jurisdictions according to FATF Australia is a member of the Financial Action Task Force FATF an inter-governmental body that sets AMLCTF standards monitors the progress of members and identifies vulnerabilities. The sources of the cash in precise are prison and the cash is invested in a way that makes it appear to be clean cash and conceal the identification of the felony part of the money earned.

Source: bi.go.id

Source: bi.go.id

The first public document the statement High-Risk Jurisdictions subject to a Call for Action previously called Public Statement identifies countries or jurisdictions with serious strategic deficiencies to counter money laundering terrorist financing and financing of proliferation. The idea of cash laundering is very important to be understood for these working within the financial sector. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies. Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. High-risk and non-cooperative jurisdictions according to FATF Australia is a member of the Financial Action Task Force FATF an inter-governmental body that sets AMLCTF standards monitors the progress of members and identifies vulnerabilities.

Source: bi.go.id

Source: bi.go.id

The 24 high-risk third countries are. Requirement to apply Enhanced Due Diligence for higher risk jurisdictions. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The FATF has developed a series of Recommendations that are recognised as the. Therefore please refer to the statement on these jurisdictions adopted in February 2020.

This is done three times a year. Background and current high risk countries. The first public document the statement High-Risk Jurisdictions subject to a Call for Action previously called Public Statement identifies countries or jurisdictions with serious strategic deficiencies to counter money laundering terrorist financing and financing of proliferation. The Financial Action Task Force or FATF is a global organization that develops policies and regulations to combat money laundering. High-risk and non-cooperative jurisdictions according to FATF Australia is a member of the Financial Action Task Force FATF an inter-governmental body that sets AMLCTF standards monitors the progress of members and identifies vulnerabilities.

Source: bi.go.id

Source: bi.go.id

The 24 high-risk third countries are. High-risk and other monitored jurisdictions. The FATF has developed a series of Recommendations that are recognised as the. What is a High-Risk Jurisdiction. Before we review the list of jurisdictions that the FATF has labeled as high-risk lets first define what it means to be a high-risk jurisdiction.

Source: baselgovernance.org

Source: baselgovernance.org

HM Treasury Advisory Notice. High-Risk Jurisdictions Subject to a Call for Action 21 February 2021 High-risk jurisdictions have significant strategic deficiencies in their regimes to counter money laundering terrorist. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. HM Treasury Advisory Notice.

Source: arternal.com

Source: arternal.com

The Financial Action Task Force FATF is an inter-governmental body established to promote effective anti-money laundering and counter-terrorism financing AMLCFT systems worldwide. Before we review the list of jurisdictions that the FATF has labeled as high-risk lets first define what it means to be a high-risk jurisdiction. HM Treasury Advisory Notice. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk. And 2 Jurisdictions with strategic AMLCFT insufficiencies that have not yet made the adequate.

Source: cgdev.org

Source: cgdev.org

The Financial Action Task Force FATF is an inter-governmental body established to promote effective anti-money laundering and counter-terrorism financing AMLCFT systems worldwide. Kathy Lynn Simmons JP today issued AML-ATF Advisory 22018 about the risks in a number of jurisdictions arising from inadequate systems and controls to combat money laundering. High-risk and non-cooperative jurisdictions according to FATF Australia is a member of the Financial Action Task Force FATF an inter-governmental body that sets AMLCTF standards monitors the progress of members and identifies vulnerabilities. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies.

Source: ec.europa.eu

Source: ec.europa.eu

Requirement to apply Enhanced Due Diligence for higher risk jurisdictions Minister of Legal Affairs Hon. Money Laundering and Terrorist Financing controls in higher risk jurisdictions. And 2 Jurisdictions with strategic AMLCFT insufficiencies that have not yet made the adequate. High-risk and other monitored jurisdictions. One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849.

Source: idmerit.com

Source: idmerit.com

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. High-Risk Jurisdictions Subject to a Call for Action 21 February 2021 High-risk jurisdictions have significant strategic deficiencies in their regimes to counter money laundering terrorist. Which jurisdictions does the FATF regard as high risk for money laundering. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk. High-risk and non-cooperative jurisdictions according to FATF Australia is a member of the Financial Action Task Force FATF an inter-governmental body that sets AMLCTF standards monitors the progress of members and identifies vulnerabilities.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high risk money laundering jurisdictions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas