10+ High risk of money laundering countries ideas in 2021

Home » money laundering Info » 10+ High risk of money laundering countries ideas in 2021Your High risk of money laundering countries images are ready. High risk of money laundering countries are a topic that is being searched for and liked by netizens now. You can Get the High risk of money laundering countries files here. Find and Download all free vectors.

If you’re looking for high risk of money laundering countries images information connected with to the high risk of money laundering countries topic, you have visit the right site. Our site frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

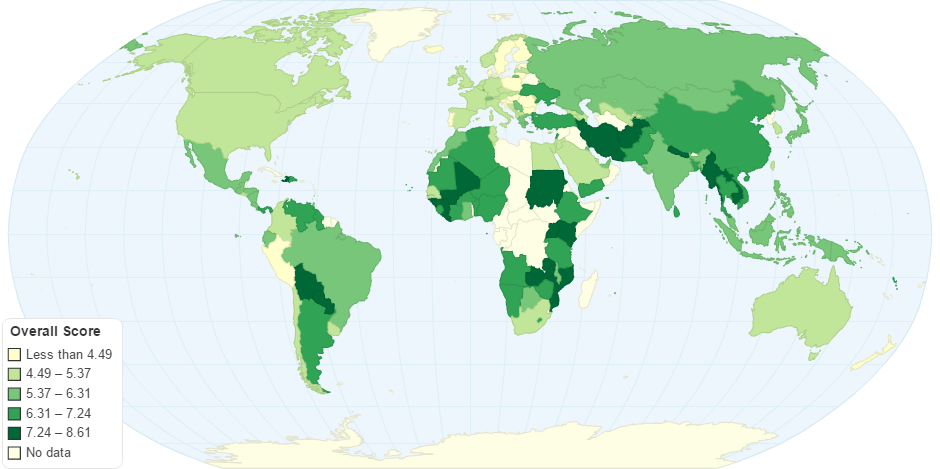

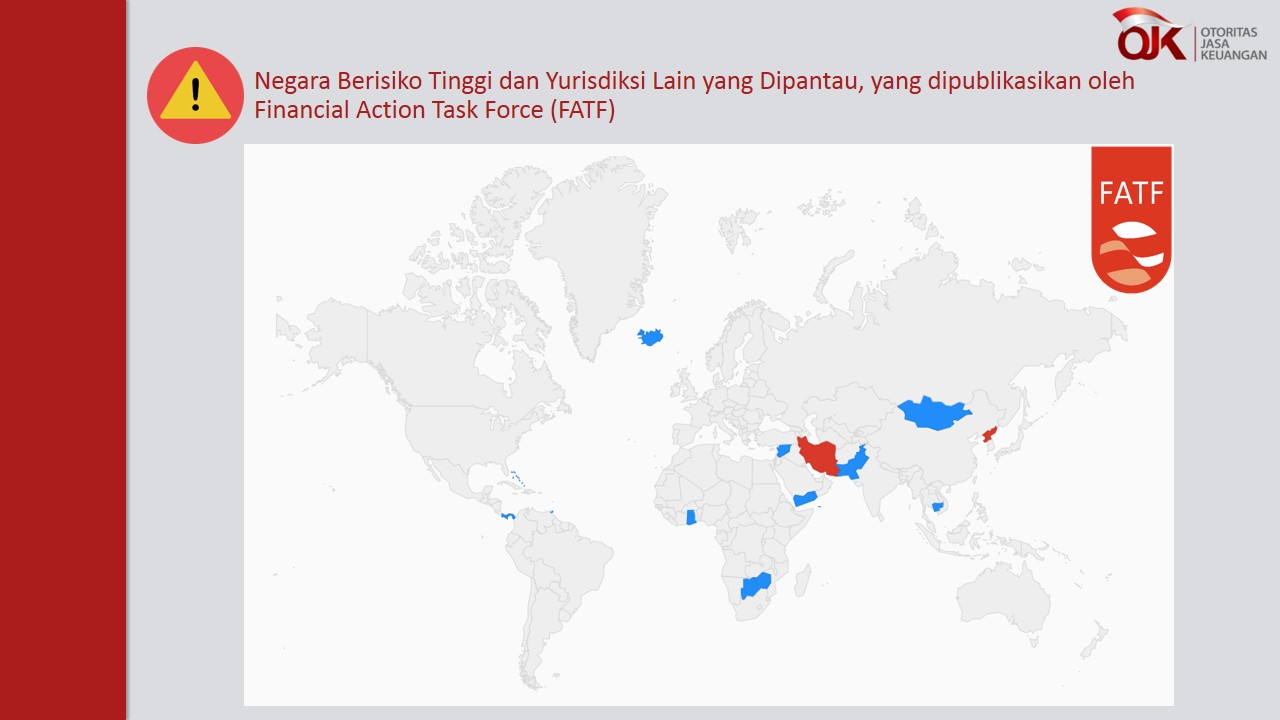

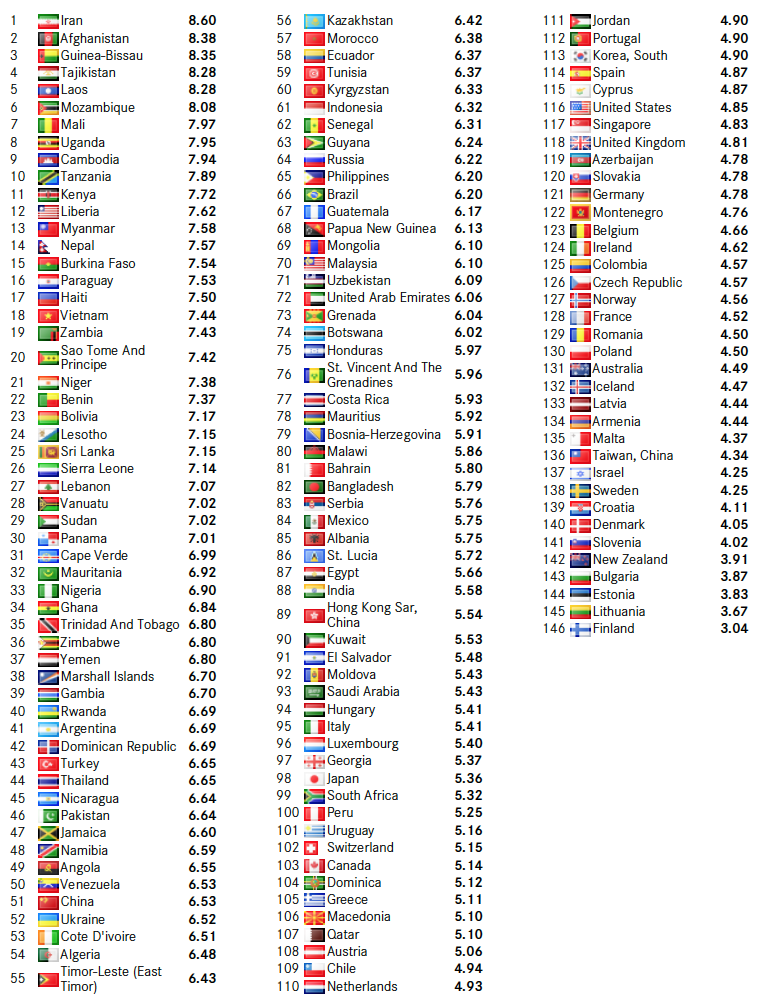

High Risk Of Money Laundering Countries. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333aAny references to high-risk third countries. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing MLTFPF risks emanating from the country. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

The 24 high-risk third countries are. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333aAny references to high-risk third countries.

On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries.

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The high risk countries are. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included.

The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. Money laundering high risk countries list.

Source: ojk.go.id

Source: ojk.go.id

The high risk countries are. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. The 24 high-risk third countries are.

Source: ec.europa.eu

Source: ec.europa.eu

Money laundering high risk countries list. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD.

Source: pinterest.com

Source: pinterest.com

Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The 24 high-risk third countries are. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering.

Source: ctmfile.com

Source: ctmfile.com

The high risk countries are. The high risk countries are. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333aAny references to high-risk third countries. A new UK list of high risk third countries for the purposes of enhanced customer due diligence requirements has been published. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. New delegated act on high-risk third countries. As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie.

Source: bi.go.id

Source: bi.go.id

This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. As of October 2018 the FATF has reviewed over 80 countries and. European Unions High Risk Third Country List found here amended in March 2017 and October 2017 HM Treasurys National Risk Assessment 2017 found here Products or services The following products or services may be at high risk of being used for money laundering or. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering.

Source: bi.go.id

Source: bi.go.id

Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: lki.lk

Source: lki.lk

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. High-Risk Countries for Money Laundering. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Money laundering high risk countries list. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018.

Source: in.pinterest.com

Source: in.pinterest.com

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. New delegated act on high-risk third countries. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. A new UK list of high risk third countries for the purposes of enhanced customer due diligence requirements has been published.

Source: ft.lk

Source: ft.lk

For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing MLTFPF risks emanating from the country. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included.

Source: ec.europa.eu

Source: ec.europa.eu

Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk. New delegated act on high-risk third countries.

Source: bi.go.id

Source: bi.go.id

The 24 high-risk third countries are. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. The high risk countries are.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high risk of money laundering countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas