20++ Highest risk of money laundering country 2020 information

Home » money laundering idea » 20++ Highest risk of money laundering country 2020 informationYour Highest risk of money laundering country 2020 images are ready in this website. Highest risk of money laundering country 2020 are a topic that is being searched for and liked by netizens today. You can Find and Download the Highest risk of money laundering country 2020 files here. Get all royalty-free images.

If you’re searching for highest risk of money laundering country 2020 images information related to the highest risk of money laundering country 2020 interest, you have visit the ideal blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Highest Risk Of Money Laundering Country 2020. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. On 7 May the European Commission announced that Mauritius would be added to its revised list of high-risk third countries having strategic deficiencies in their regime regarding anti-money laundering and countering terrorist financing as of 1 October.

Art Market In The Frame Of Money Laundering From shuftipro.com

Art Market In The Frame Of Money Laundering From shuftipro.com

The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. Money Laundering and Financial Crimes As submitted to Congress hide. New delegated act on high-risk third countries. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD.

You should have risk-based systems and controls in place for.

Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Money Laundering and Financial Crimes As submitted to Congress - United States Department of State. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which. Countries are scored on a scale from 0 to 100 with 0 standing for highly corrupt and 100 for very clean. New-Zealand and Denmark top the list with a score of 87100 while Somalia is at the bottom with 9100.

Source: ec.europa.eu

Source: ec.europa.eu

Released today the 9th Basel AML Index will disappoint anyone wishing for tangible progress in combating money laundering and terrorist financing MLTF around the world. The new third countries listed by the EU have been identified as having strategic deficiencies in their AMLCFT. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process.

Source: bi.go.id

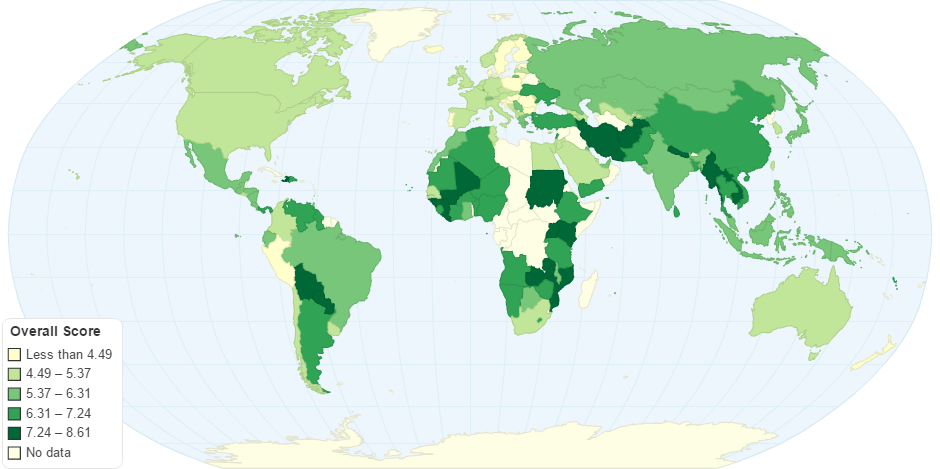

The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. The Netherlands is number eight on the list with a score of 82100. The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. The average MLTF risk score across all 141 countries in the 2020 Public Edition of the Basel AML Index remains unacceptably high at 522 out of 10 where 10 equals maximum risk. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries.

Source: idmerit.com

Source: idmerit.com

2020 INCSR-Volume II. The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk third country. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries.

Source: legaljobs.io

Source: legaljobs.io

On 7 May the European Commission announced that Mauritius would be added to its revised list of high-risk third countries having strategic deficiencies in their regime regarding anti-money laundering and countering terrorist financing as of 1 October. 2 identifying and freezing terrorist assets in line with the relevant United Nations Security Council resolutions. Home Bureau of International Narcotics and Law Enforcement Affairs Remarks Releases. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum.

2 identifying and freezing terrorist assets in line with the relevant United Nations Security Council resolutions. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. Home Bureau of International Narcotics and Law Enforcement Affairs Remarks Releases. In February 2020 the FATF noted that there are still items not completed and Iran should fully address. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring.

Source: bi.go.id

Source: bi.go.id

The announcement was made at a press. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. 2020 INCSR-Volume II. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which.

Source: shuftipro.com

Source: shuftipro.com

Money Laundering and Financial Crimes As submitted to Congress - United States Department of State. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. Money Laundering and Financial Crimes As submitted to Congress hide. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world.

Source: bi.go.id

Source: bi.go.id

Money laundering high risk countries list. The EUs revised list of high-risk third countries takes effect on 1 October 2020. Released today the 9th Basel AML Index will disappoint anyone wishing for tangible progress in combating money laundering and terrorist financing MLTF around the world. Money laundering high risk countries list. The new third countries listed by the EU have been identified as having strategic deficiencies in their AMLCFT.

Source: complyadvantage.com

Source: complyadvantage.com

The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk third country. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The 24 high-risk third countries are. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: bi.go.id

Source: bi.go.id

The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. 2 identifying and freezing terrorist assets in line with the relevant United Nations Security Council resolutions. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK. The EUs revised list of high-risk third countries takes effect on 1 October 2020. The new third countries listed by the EU have been identified as having strategic deficiencies in their AMLCFT.

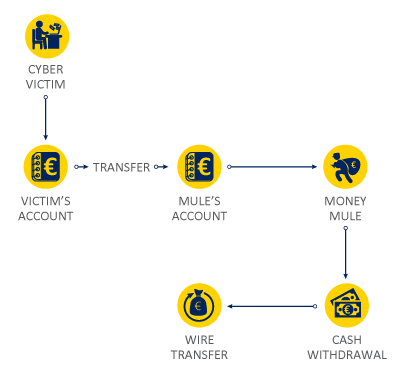

Source: europol.europa.eu

Source: europol.europa.eu

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. Countries are scored on a scale from 0 to 100 with 0 standing for highly corrupt and 100 for very clean. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries.

Source: shuftipro.com

Source: shuftipro.com

The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. Through an amendment of the Delegated Regulation EU 20161675 the Regulation supplementing Directive EU 2015849 of the European Parliament and the European Council the European Commission the EC has on 7 May 2020 identified inter alia Mauritius as a high-risk third country with strategic deficiencies in its Anti Money-Laundering and Counter Financing Terrorism.

Source: mdpi.com

Source: mdpi.com

In February 2020 the FATF noted that there are still items not completed and Iran should fully address. You should have risk-based systems and controls in place for. The 24 high-risk third countries are. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing risk in the UK. Home Bureau of International Narcotics and Law Enforcement Affairs Remarks Releases.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title highest risk of money laundering country 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information