12++ Hmrc money laundering cases ideas in 2021

Home » money laundering idea » 12++ Hmrc money laundering cases ideas in 2021Your Hmrc money laundering cases images are ready. Hmrc money laundering cases are a topic that is being searched for and liked by netizens now. You can Find and Download the Hmrc money laundering cases files here. Get all royalty-free vectors.

If you’re looking for hmrc money laundering cases images information linked to the hmrc money laundering cases topic, you have visit the right site. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

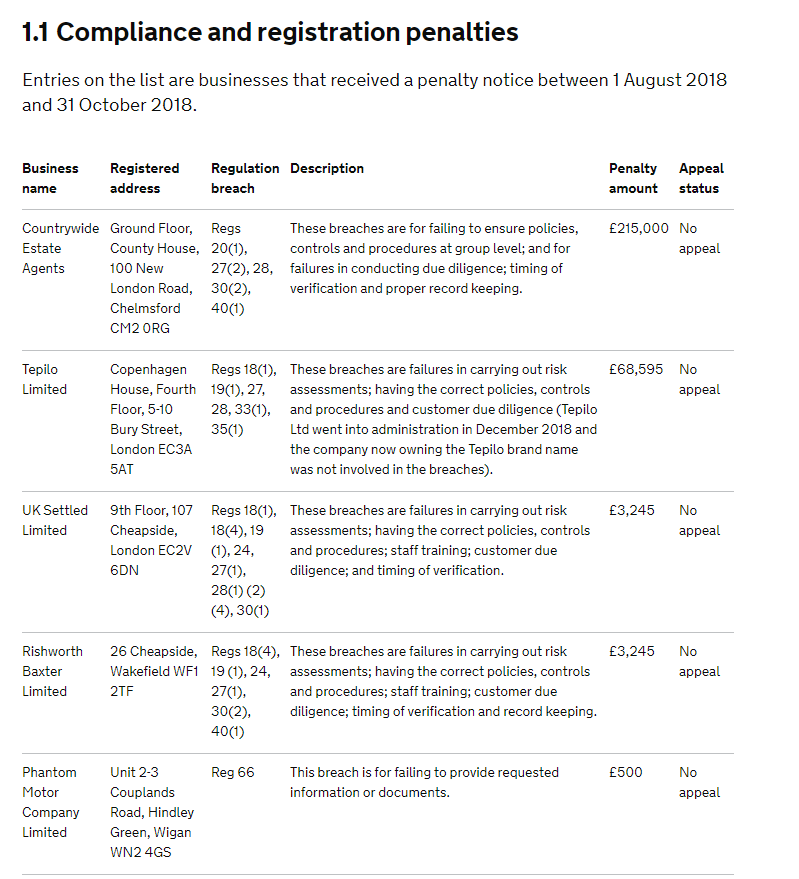

Hmrc Money Laundering Cases. He contacted an insurance broker and delivered a total amount of USD 250000 in three cash. The case dates back to 2014 when an HMRC anti-money laundering supervision team member told Martin that he must tighten up his due diligence on some clients. HMRC Criminal Investigations Case Studies. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments.

Aml Hmrc Flexes Enforcement Muscle To The Tune Of 7 8 Million Criminal Law Blog Kingsley Napley From kingsleynapley.co.uk

Aml Hmrc Flexes Enforcement Muscle To The Tune Of 7 8 Million Criminal Law Blog Kingsley Napley From kingsleynapley.co.uk

Intermediaries case study 19. The company was fined for failing to ensure that its money-laundering. Our work with Interpol to take apart a pan-European crime gang involved in cigarette trafficking drug smuggling and money laundering As well as successful prosecutions HMRC issued a. The amount of fines varies depending on the cause of non-compliance the seriousness of the crime the businesss size and the amount subject to money laundering. In the same period the average size of individual fines increased from 1310 to 3450. According to further research from regulatory consultancy fscom HMRC money-laundering fines in 2018 totalled 23m.

Tax evasion is an offence under the money laundering rules so it is no surprise that HMRC pays close attention to these reports.

He contacted an insurance broker and delivered a total amount of USD 250000 in three cash. You need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC but is not Published 23 October 2014. According to further research from regulatory consultancy fscom HMRC money-laundering fines in 2018 totalled 23m. Acting for lead suspects in Operation Shootout a multi-national alleged VAT fraud with UK tax losses of 500 million. HMRC inspects more than 30000 businesses from 9 different sectors within the scope of its regulations. Money laundering means exchanging money or assets that were obtained criminally for money or other assets that are clean.

Source: brightlinelaw.co.uk

Source: brightlinelaw.co.uk

You need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC but is not Published 23 October 2014. Jonathan Fisher a tax barrister says it has been estimated that. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. HMRC Criminal Investigations Case Studies. MONEY LAUNDERING CASE STUDIES Case study 19 to 24.

Source:

Money laundering supports organised crime and is harmful to businesses the public and society as a whole. However Martin protested against HMRCs enhanced due diligence hand-slap and failed to pay the annual MLR fee. The HM Revenue and Customs HMRC has issued an official demand using its anti-tax avoidance powers in one case and in another a tribunal is. Acting for a major overseas political party in allegations of money laundering. Estate agent group Countrywide has been hit with a 215000 fine by HMRC for money-laundering failures.

Source: calyx-solutions.com

Source: calyx-solutions.com

However Martin protested against HMRCs enhanced due diligence hand-slap and failed to pay the annual MLR fee. Acting for a major overseas political party in allegations of money laundering. As of 25 July 2018 HM Revenue Customs have introduced a penalty administration fee for all anti-money laundering control penalties. According to further research from regulatory consultancy fscom HMRC money-laundering fines in 2018 totalled 23m. Money laundering supports organised crime and is harmful to businesses the public and society as a whole.

Source: napier.ai

Source: napier.ai

The sensational Carroll Foundation Trust and parallel Gerald 6th Duke of Sutherland Trust multi-billion dollar corporate identity theft liquidation bank fraud bribery case has revealed that the HM Government Insolvency Service senior civil servant David Chapman the former Insolvency Service Chief Executive Sarah Albon and the Insolvency Service Birmingham case officer Graham Rogers are. MONEY LAUNDERING CASE STUDIES Case study 19 to 24. HMRC fulfills its supervision responsibility through Anti-Money Laundering Inspection AMLS teams. The sensational Carroll Foundation Trust and parallel Gerald 6th Duke of Sutherland Trust multi-billion dollar corporate identity theft liquidation bank fraud bribery case has revealed that the HM Government Insolvency Service senior civil servant David Chapman the former Insolvency Service Chief Executive Sarah Albon and the Insolvency Service Birmingham case officer Graham Rogers are. Tackling this crime is a priority for HMRC and we will not hesitate to investigate.

Source: northwest-6.co.uk

Source: northwest-6.co.uk

In the same period the average size of individual fines increased from 1310 to 3450. As of 25 July 2018 HM Revenue Customs have introduced a penalty administration fee for all anti-money laundering control penalties. A person later arrested for drug trafficking made a financial investment life insurance of USD 250000 by means of an insurance broker. A rise of 91 on the previous years 12m. You need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC but is not Published 23 October 2014.

Source: nationalcrimeagency.gov.uk

Source: nationalcrimeagency.gov.uk

A person later arrested for drug trafficking made a financial investment life insurance of USD 250000 by means of an insurance broker. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. As of 25 July 2018 HM Revenue Customs have introduced a penalty administration fee for all anti-money laundering control penalties. Fscoms figures show that HMRC made 1340 AML interventions over the past. Jonathan Fisher a tax barrister says it has been estimated that.

Source: researchgate.net

Source: researchgate.net

The smashing of international criminal gangs large money laundering seizures and fake investment schemes all feature in HM Revenue and Customs top criminal cases of 2019. Fscoms figures show that HMRC made 1340 AML interventions over the past. In the same period the average size of individual fines increased from 1310 to 3450. As of 25 July 2018 HM Revenue Customs have introduced a penalty administration fee for all anti-money laundering control penalties. Money laundering supports organised crime and is harmful to businesses the public and society as a whole.

Source: socexconference.co.uk

Source: socexconference.co.uk

The company was fined for failing to ensure that its money-laundering. Businesses will be required to pay a 1500 penalty handling fee for violations if they fail to carry out. In the same period the average size of individual fines increased from 1310 to 3450. Money laundering means exchanging money or assets that were obtained criminally for money or other assets that are clean. The clean money or.

Source: kingsleynapley.co.uk

Source: kingsleynapley.co.uk

The smashing of international criminal gangs large money laundering seizures and fake investment schemes all feature in HM Revenue and Customs top criminal cases of 2019. Intermediaries case study 19. The HM Revenue and Customs HMRC has issued an official demand using its anti-tax avoidance powers in one case and in another a tribunal is. The clean money or. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments.

Source: kingsleynapley.co.uk

Source: kingsleynapley.co.uk

A pair of money launderers that helped clean up millions of pounds of dirty cash have been jailed for a total of 12 years after an HM Revenue and Customs HMRC investigation. Tackling this crime is a priority for HMRC and we will not hesitate to investigate. The smashing of international criminal gangs large money laundering seizures and fake investment schemes all feature in HM Revenue and Customs top criminal cases of 2019. HMRC inspects more than 30000 businesses from 9 different sectors within the scope of its regulations. HMRC Criminal Investigations Case Studies.

Source: cityam.com

Source: cityam.com

HM Revenue and Customs HMRC is one of the 25 Anti-Money Laundering AML supervisors in the UK. Money laundering supports organised crime and is harmful to businesses the public and society as a whole. As of 25 July 2018 HM Revenue Customs have introduced a penalty administration fee for all anti-money laundering control penalties. The HM Revenue and Customs HMRC has issued an official demand using its anti-tax avoidance powers in one case and in another a tribunal is. The amount of fines varies depending on the cause of non-compliance the seriousness of the crime the businesss size and the amount subject to money laundering.

Source: vinciworks.com

Source: vinciworks.com

Intermediaries case study 19. Intermediaries case study 19. The amount of fines varies depending on the cause of non-compliance the seriousness of the crime the businesss size and the amount subject to money laundering. Acting for lead suspects in Operation Shootout a multi-national alleged VAT fraud with UK tax losses of 500 million. In the same period the average size of individual fines increased from 1310 to 3450.

Source: nfda-uk.co.uk

Source: nfda-uk.co.uk

The amount of fines varies depending on the cause of non-compliance the seriousness of the crime the businesss size and the amount subject to money laundering. Businesses will be required to pay a 1500 penalty handling fee for violations if they fail to carry out. According to further research from regulatory consultancy fscom HMRC money-laundering fines in 2018 totalled 23m. These nine sectors are as follows. MONEY LAUNDERING CASE STUDIES Case study 19 to 24.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc money laundering cases by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information