20+ Hmrc money laundering registration fee ideas in 2021

Home » money laundering Info » 20+ Hmrc money laundering registration fee ideas in 2021Your Hmrc money laundering registration fee images are available. Hmrc money laundering registration fee are a topic that is being searched for and liked by netizens today. You can Download the Hmrc money laundering registration fee files here. Find and Download all free images.

If you’re searching for hmrc money laundering registration fee images information connected with to the hmrc money laundering registration fee topic, you have visit the right blog. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

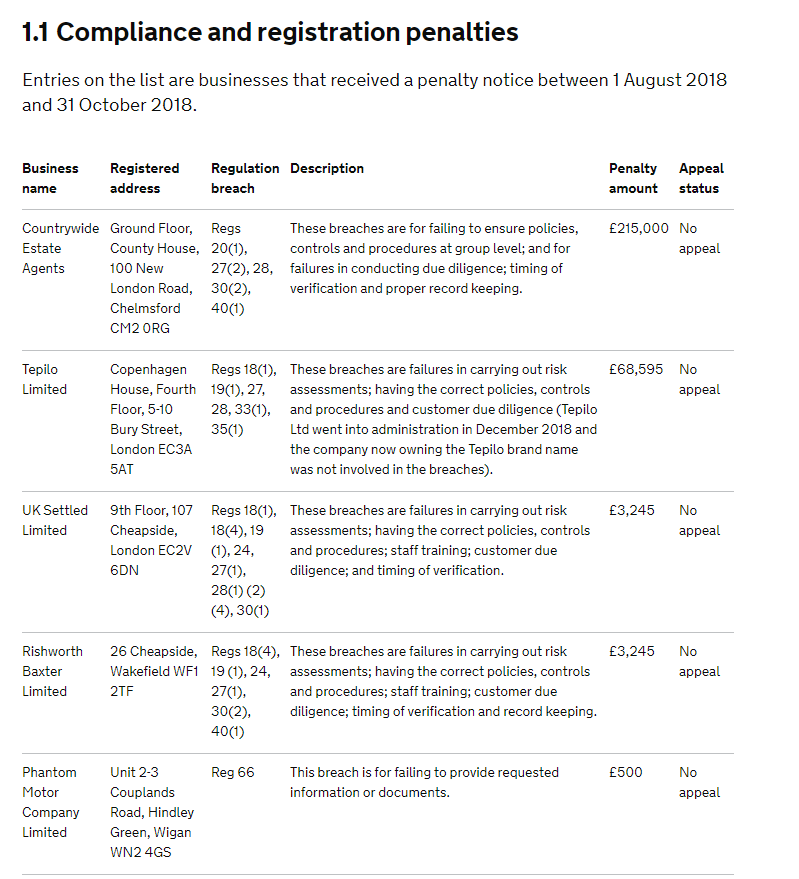

Hmrc Money Laundering Registration Fee. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017692 replaced the Money Laundering Regulations 2007. The annual registration fee increased to 300 per premises for businesses with a turnover of 5000 or above the annual registration fee increased to 180 for businesses with a turnover below 5000. The annual registration fee increased from 130 to 300 per premises for businesses with a turnover of 5000 or above. The HMRCs online register for letting agents to register their anti-money laundering activities has finally opened.

Should Virtual Assistants Register For Anti Money Laundering Supervision Money Laundering Virtual Assistant Online Share Trading From br.pinterest.com

Should Virtual Assistants Register For Anti Money Laundering Supervision Money Laundering Virtual Assistant Online Share Trading From br.pinterest.com

The howls of protest from the industry over the increased charges appear to have persuaded HMRC to. If you do not pay the correct renewal fee then HMRC may terminate your registration and remove your business from its anti-money laundering register. Anti Money Laundering Registration Hmrc on August 08 2021 Get link. There are also fees to pay for fit and proper tests if appropriate and for premises you register. Hmrc money laundering registration fee. Businesses can be subject to criminal penalties for trading without registering when they are required to register.

The annual registration fee is increasing to 300 per premises for businesses with turnover of 5000 or above the annual registration fee is increasing to 180 for businesses with a turnover below 5000.

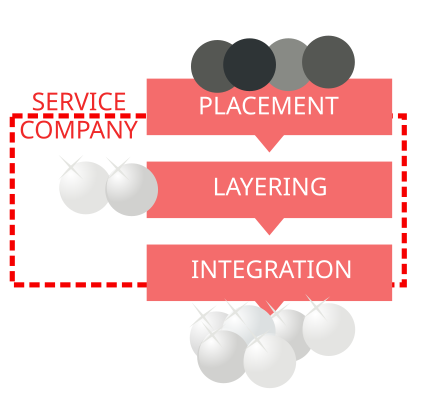

There are also fees to pay for fit and proper tests if appropriate and for premises you register. It is a process by which soiled money is transformed into clean cash. Hmrc Anti Money Laundering Registration Fee August 08 2021 The concept of money laundering is essential to be understood for these working within the financial sector. When you register or renew your registration with HMRC there are fees you need to pay. Following the consultation from May 2019 HMRC increased fees as follows. Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval Accountancy sector guidance for money laundering supervision.

Source: pinterest.com

Source: pinterest.com

The annual registration fee is increasing to 300 per premises for businesses with turnover of 5000 or above the annual registration fee is increasing to 180 for businesses with a turnover below 5000. The sources of the money in actual are criminal. Businesses can be subject to criminal penalties for trading without registering when they are required to register. Money laundering registration hmrc. The sources of the money in precise are prison and.

Source:

HMRCs anti money laundering supervision fees changed from 1 May 2019. Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval Accountancy sector guidance for money laundering supervision. The concept of cash laundering is very important to be understood for those working in the financial sector. There are also fees to pay for fit and proper tests if appropriate and for premises you register. This site details how to register and what actions you will be required to take under the money laundering regulations.

Source: pinterest.com

Source: pinterest.com

It is a process by which soiled money is transformed into clean cash. Its a process by which dirty money is converted into clear money. Its a criminal offence to trade as an estate agency or letting agency business without being registered or after your registration is cancelled with HMRC for money laundering supervision. Pin On Aml Cft Compliance In Guyana. The new fees for anti-money laundering supervision which came into effect on 1 st May 2019 has disgruntled many tax accounting businesses.

Source: vinciworks.com

Source: vinciworks.com

Pin On Aml Cft Compliance In Guyana. They dont supply a VAT invoice so it seems the 115 fee is not a taxable supply. Our anti-money laundering supervision fees are changing from May 1 2019. The HMRCs online register for letting agents to register their anti-money laundering activities has finally opened. The annual registration fee increased from 130 to 300 per premises for businesses with a turnover of 5000 or above.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval Accountancy sector guidance for money laundering supervision. Businesses can be subject to criminal penalties for trading without registering when they are required to register. Hmrc Money Laundering Registration Fee on August 05 2021 Get link. Our anti-money laundering supervision fees are changing from May 1 2019. Its a course of by which dirty cash is transformed into clear money.

Source: prezi.com

Source: prezi.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017692 replaced the Money Laundering Regulations 2007. Pin On Aml Cft Compliance In Guyana. The sources of the money in actual are legal and the cash is invested in a means that makes it appear to be. The annual registration fee increased from 130 to 300 per premises for businesses with a turnover of 5000 or above. The HMRCs online register for letting agents to register their anti-money laundering activities has finally opened.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017692 replaced the Money Laundering Regulations 2007. Its a process by which dirty money is converted into clean cash. Money laundering registration hmrc. The HMRCs online register for letting agents to register their anti-money laundering activities has finally opened. If you do not pay the correct renewal fee then HMRC may terminate your registration and remove your business from its anti-money laundering register.

Source: 16trinity.co.uk

Source: 16trinity.co.uk

The annual registration fee increased from 130 to 300 per premises for businesses with a turnover of 5000 or above. HMRC has updated the initial fee paid when registering for anti money laundering supervision under the money laundering regulations setting a fee of 115 to be paid yearly for each premises registered If more than one premises is being listed. The sources of the money in actual are criminal. The sources of the cash in precise are prison and the cash is invested in a way that makes it seem like clean money and hide the id of the prison a part of the money. There are also fees to pay for fit and proper tests if appropriate and for premises you register.

Source: fortesestates.co.uk

Source: fortesestates.co.uk

Register or renew your money laundering supervision with HMRC. Businesses can be subject to criminal penalties for trading without registering when they are required to register. Money laundering registration hmrc. The annual registration fee increased to 300 per premises for businesses with a turnover of 5000 or above the annual registration fee increased to 180 for businesses with a turnover below 5000. Hmrc Money Laundering Registration Fee on August 05 2021 Get link.

Source: wikiwand.com

Source: wikiwand.com

Increase fees to 300 per premises from 1 May 2019 introduce a small business fee of 180 for businesses with a turnover less than. Money laundering registration hmrc. Following the consultation from May 2019 HMRC increased fees as follows. Businesses can be subject to criminal penalties for trading without registering when they are required to register. Increase fees to 300 per premises from 1 May 2019 introduce a small business fee of 180 for businesses with a turnover less than.

Source: thenegotiator.co.uk

Source: thenegotiator.co.uk

Enable HMRC to meet our supervisory obligations under the Money Laundering Regulations for the financial years 2015-16 and 2016-17. The concept of cash laundering is very important to be understood for those working in the financial sector. Hmrc Money Laundering Registration Fee on August 05 2021 Get link. Its a process by which dirty money is converted into clear money. If you do not pay the correct renewal fee then HMRC may terminate your registration and remove your business from its anti-money laundering register.

Source: wikiwand.com

Source: wikiwand.com

They dont supply a VAT invoice so it seems the 115 fee is not a taxable supply. There are also fees to pay for fit and proper tests if appropriate and for premises you register. Increase fees to 300 per premises from 1 May 2019 introduce a small business fee of 180 for businesses with a turnover less than. Its a course of by which dirty cash is transformed into clear money. Following the consultation from May 2019 HMRC increased fees as follows.

Source: br.pinterest.com

Source: br.pinterest.com

When you register or renew your registration with HMRC there are fees you need to pay. Hmrc Money Laundering Registration Fee on August 05 2021 Get link. Increase fees to 300 per premises from 1 May 2019 introduce a small business fee of 180 for businesses with a turnover less than. The new fees for anti-money laundering supervision which came into effect on 1 st May 2019 has. The sources of the money in precise are prison and.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc money laundering registration fee by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas